Utah Convertible Secured Promissory Note is a legal document used in financial transactions to outline the terms and conditions of a loan between a lender and a borrower, where the borrower provides collateral for the loan. This type of promissory note offers added security to the lender, as it allows them to seize the specified collateral in case of default. Moreover, the Utah convertible secured promissory note also includes a conversion feature, which allows the lender to convert the outstanding debt into equity shares of the borrower's business. In Utah, there are different types of Convertible Secured Promissory Notes that can be used based on specific requirements: 1. Traditional Utah Convertible Secured Promissory Note: This type of note secures the loan by utilizing a specific asset or property as collateral. The borrower guarantees the repayment to the lender, or else the lender can seize the collateral according to the agreed-upon terms. 2. Utah Real Estate Convertible Secured Promissory Note: Specifically designed for real estate transactions, this note secures the loan using a property as collateral. In case of default, the lender has the right to foreclose on the property and recover the debt. 3. Utah Convertible Secured Promissory Note with a Stock Conversion Option: This note includes a conversion feature, wherein if the borrower fails to repay the loan, the lender has the option to convert the outstanding debt into equity shares of the borrower's company. 4. Utah Convertible Secured Promissory Note with a Debt Conversion Option: This note allows the lender to convert the debt into a different form of debt, such as a different loan or a different type of security, rather than converting it into equity. 5. Utah Convertible Secured Promissory Note with a Time Condition: This note includes a time-based condition that triggers the conversion feature. For example, if the borrower fails to repay the loan within a specified period, the lender can convert the debt into equity. When using any type of Utah Convertible Secured Promissory Note, it is crucial for both parties to clearly define the terms of the loan, including the interest rate, repayment schedule, conversion terms, collateral details, and any penalties or late fees. It is highly recommended consulting with a legal professional to ensure compliance with Utah state laws and to draft a thorough and enforceable promissory note.

Utah Convertible Secured Promissory Note

Description

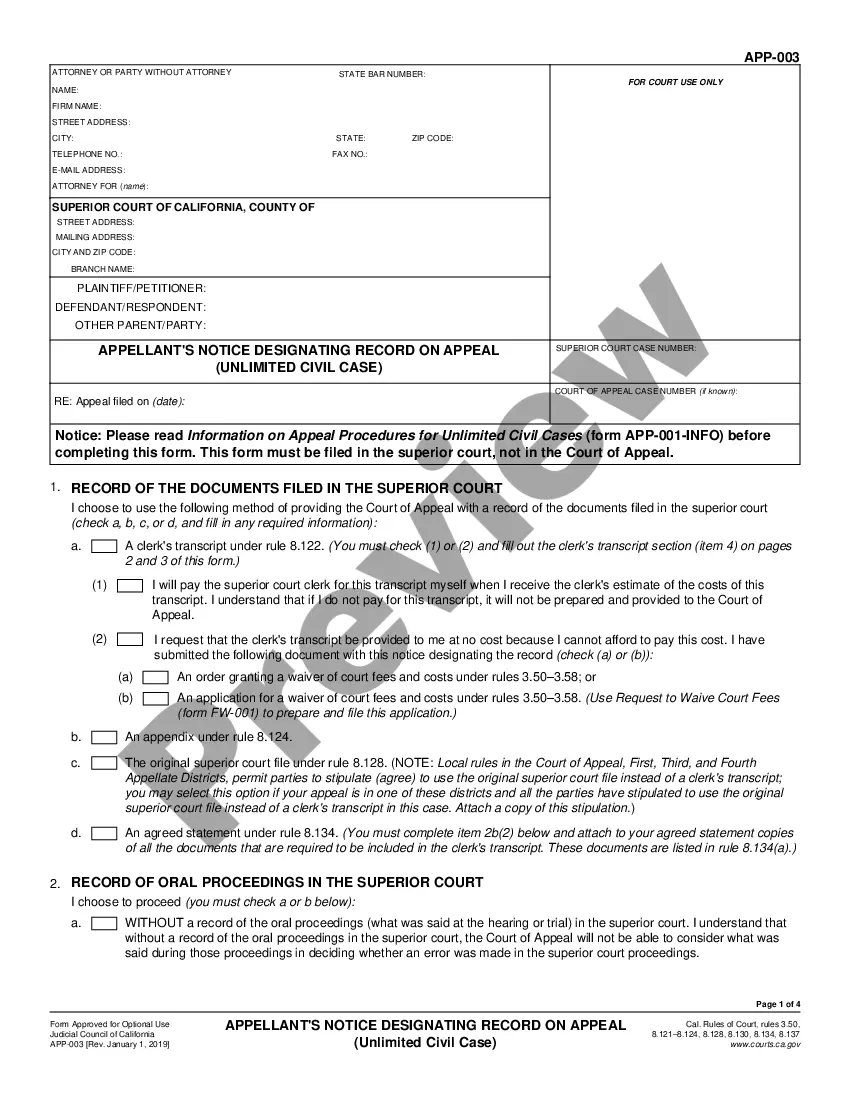

How to fill out Utah Convertible Secured Promissory Note?

Are you currently within a place the place you need to have paperwork for sometimes business or person reasons virtually every day? There are plenty of legal document themes available on the net, but discovering types you can rely isn`t effortless. US Legal Forms offers 1000s of form themes, much like the Utah Convertible Secured Promissory Note, which can be composed to satisfy state and federal specifications.

Should you be already knowledgeable about US Legal Forms website and get a free account, basically log in. Following that, you may down load the Utah Convertible Secured Promissory Note design.

If you do not come with an profile and would like to begin to use US Legal Forms, abide by these steps:

- Get the form you want and make sure it is for your right city/state.

- Utilize the Review key to analyze the shape.

- Look at the information to actually have selected the proper form.

- If the form isn`t what you`re trying to find, use the Lookup discipline to get the form that meets your needs and specifications.

- If you get the right form, just click Acquire now.

- Pick the prices program you would like, submit the required information to produce your bank account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a convenient file structure and down load your duplicate.

Discover all of the document themes you possess bought in the My Forms food selection. You can get a extra duplicate of Utah Convertible Secured Promissory Note anytime, if possible. Just click the necessary form to down load or produce the document design.

Use US Legal Forms, probably the most substantial assortment of legal varieties, to conserve time and steer clear of errors. The support offers professionally created legal document themes which you can use for a range of reasons. Produce a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

Secured Promissory Notes A secured promissory note requires the borrower to safeguard the loan by putting up items of hard value, such as the home, condominium or rental property you're purchasing, as collateral to ensure the mortgage is repaid.

Borrower's promise to pay is secured by a mortgage, deed of trust or similar security instrument that is dated the same date as this Note and called the ?Security Instrument.? The Security Instrument protects the Lender from losses, which might result if Borrower defaults under this Note.

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.

Secured promissory notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.