Utah Sample Identity Theft Policy for FCRA and FACT Compliance In Utah, businesses and organizations need to proactively safeguard personal information and protect individuals from identity theft risks. To comply with the federal Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT), it is crucial for entities to have a well-defined Identity Theft Policy in place. This policy outlines the necessary steps and procedures to prevent, detect, and respond to identity theft incidents effectively. Utah Sample Identity Theft Policy for FCRA and FACT Compliance covers a wide range of essential aspects to ensure compliance and protect personal information. Some key components and considerations include: 1. Purpose: Clearly defining the purpose of the policy to protect individuals from identity theft and maintain compliance with related laws and regulations. 2. Scope: Identifying the entities covered by the policy, including all employees, contractors, and third-party service providers who have access to personal information. 3. Definitions: Providing specific definitions of key terms related to identity theft, such as personally identifiable information (PIN), red flags, unauthorized access, and breach. 4. Risk Assessment: Conducting a thorough risk assessment to identify potential vulnerabilities and evaluate the ongoing risk of identity theft. 5. Responsibilities: Clearly outlining the responsibilities of various individuals within the organization, including management, IT personnel, and employees, in preventing and responding to identity theft incidents. 6. Employee Training: Implementing regular training programs to educate employees about identity theft risks, the identification of red flags, and appropriate response procedures. 7. Red Flags Detection: Establishing a comprehensive system for detecting red flags that could indicate potential identity theft, such as suspicious account activity, the use of incorrect personal information, or unusual financial patterns. 8. Incident Response: Detailing the steps to be taken in the event of an identity theft incident, including reporting, investigation, and notification to affected individuals, as required by applicable laws. 9. Investigations and Remediation: Defining the procedures for investigating identity theft incidents promptly, mitigating potential damages, and restoring the affected individual's credit and reputation. 10. Policy Review and Updates: Establishing a regular review and update process for the policy to ensure its effectiveness and compliance with evolving laws and regulations. Among the different types of Utah Sample Identity Theft Policy for FCRA and FACT Compliance, there might be variations depending on the specific industry or nature of the organization. For instance, healthcare organizations might have additional guidelines in accordance with the Health Insurance Portability and Accountability Act (HIPAA). Ultimately, a well-crafted Utah Sample Identity Theft Policy for FCRA and FACT Compliance provides organizations with a roadmap to effectively prevent, detect, and respond to identity theft incidents. By implementing such a policy, entities in Utah can safeguard personal information, maintain consumer trust, and avoid potential legal and financial repercussions.

Utah Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Utah Sample Identity Theft Policy For FCRA And FACTA Compliance?

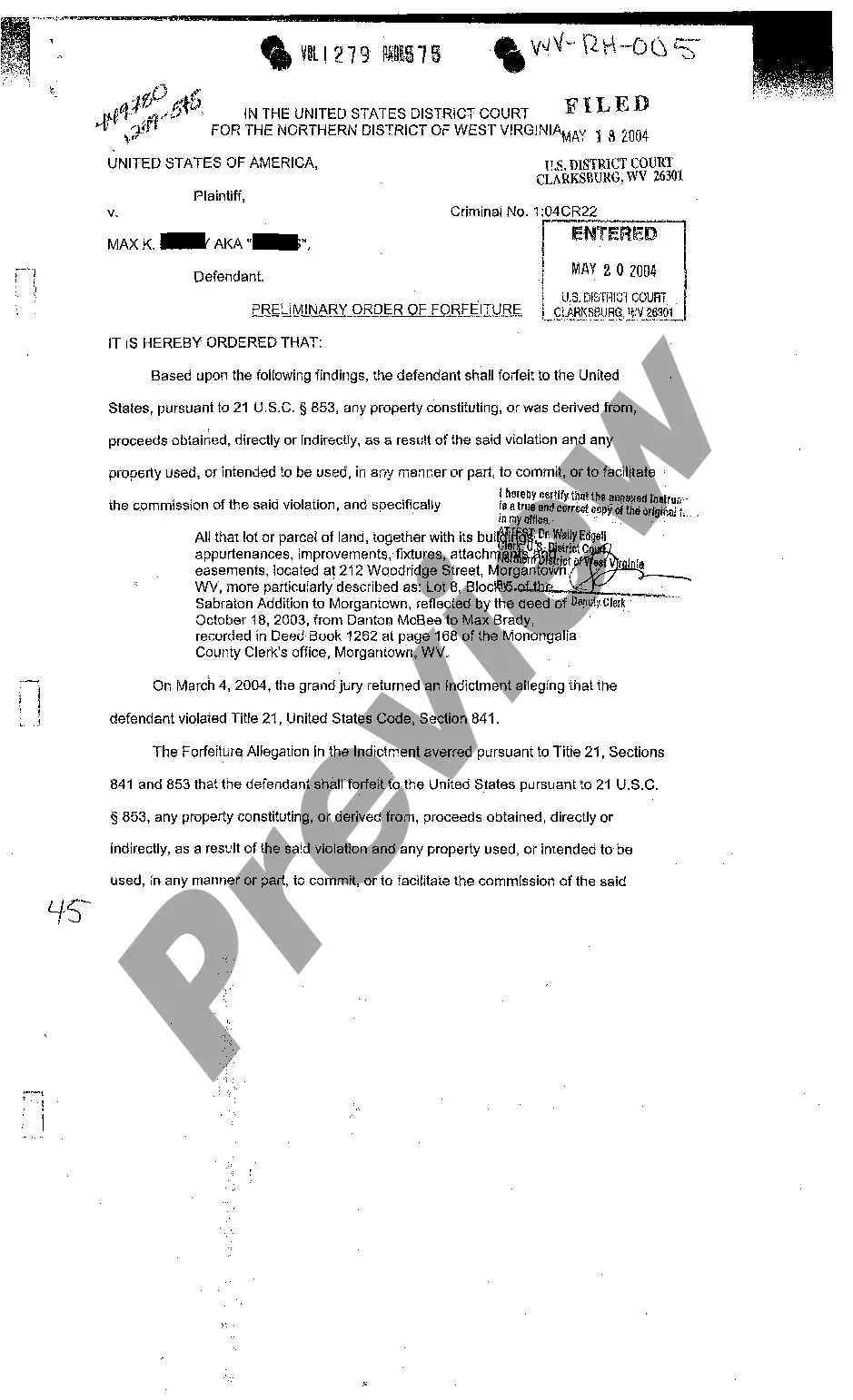

Are you in a placement the place you require files for either enterprise or specific reasons virtually every time? There are a lot of authorized record layouts available on the Internet, but locating types you can trust is not straightforward. US Legal Forms offers thousands of type layouts, such as the Utah Sample Identity Theft Policy for FCRA and FACTA Compliance, that happen to be composed to meet federal and state demands.

In case you are previously familiar with US Legal Forms site and also have a free account, merely log in. Next, it is possible to down load the Utah Sample Identity Theft Policy for FCRA and FACTA Compliance web template.

Should you not come with an account and wish to begin using US Legal Forms, follow these steps:

- Discover the type you require and ensure it is for your appropriate town/state.

- Use the Preview switch to review the form.

- Browse the description to ensure that you have selected the correct type.

- If the type is not what you are searching for, use the Look for area to obtain the type that meets your needs and demands.

- Whenever you get the appropriate type, simply click Acquire now.

- Opt for the costs plan you would like, complete the specified information and facts to generate your account, and purchase the order using your PayPal or Visa or Mastercard.

- Choose a convenient file file format and down load your duplicate.

Find every one of the record layouts you may have purchased in the My Forms food list. You can aquire a extra duplicate of Utah Sample Identity Theft Policy for FCRA and FACTA Compliance at any time, if possible. Just go through the essential type to down load or printing the record web template.

Use US Legal Forms, the most substantial selection of authorized varieties, to conserve efforts and avoid errors. The support offers professionally manufactured authorized record layouts which you can use for a selection of reasons. Create a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

Your name, address and date of birth provide enough information to create another 'you'. An identity thief can use a number of methods to find out your personal information and will then use it to open bank accounts, take out credit cards and apply for state benefits in your name.

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc. Criminal Division | Identity Theft - Department of Justice justice.gov ? identity-theft-and-identity-fraud justice.gov ? identity-theft-and-identity-fraud

Types of Identity Theft The victim usually doesn't realize their identity is being used until they receive a court summons or employers uncover the infraction on their background check. Even once it's discovered, criminal identity theft is often hard and complicated to prove.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft. FTC FACT Act Red Flags Rule Template - finra finra ? default ? files ? Industry finra ? default ? files ? Industry PDF

If you're not sure of the victim's identity, the FCRA allows you to ask for proof of identity, such as a copy of a government-issued identification. You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report.

Unusual credit activity, such as an increased number of new accounts or inquiries and spending appear in the credit reports. Identification documents provided by the customer appears altered or forged. Photograph on ID card is inconsistent with the appearance of the customer present. 26 Red Flags for Preventing Identity Theft identitymanagementinstitute.org ? 26-red-flags-fo... identitymanagementinstitute.org ? 26-red-flags-fo...

Complying with the FCRA Tell the applicant or employee that you might use information in their consumer report for decisions related to their employment. ... Get written permission from the applicant or employee. ... Certify compliance to the company from which you are getting the applicant or employee's information. Using Consumer Reports: What Employers Need to Know Federal Trade Commission (.gov) ? business-guidance ? resources Federal Trade Commission (.gov) ? business-guidance ? resources