Utah, also known as the Beehive State, is a scenic and diverse state located in the western United States. It is famous for its stunning landscapes, including the iconic red rock formations in national parks like Zion and Arches. As home to significant religious and historical sites such as Salt Lake City and Temple Square, Utah attracts visitors from around the world. Its rich cultural heritage, outdoor recreational opportunities, and thriving economy make Utah an enticing destination for residents and tourists alike. Now, let's dive into the concept of the FACT Red Flags Rule, specifically as it pertains to Utah. The FACT Red Flags Rule is a federal regulation established under the Fair and Accurate Credit Transactions Act of 2003 (FACT). This rule mandates that certain businesses and organizations in Utah and across the nation must have identity theft prevention programs in place to protect consumers and mitigate the risks associated with identity theft. The primary objective of the FACT Red Flags Rule in Utah is to identify and respond to "red flags" or warning signs of potential identity theft. These red flags include unauthorized account access, suspicious identity document verification, unusual account activity, alerts from credit reporting agencies, and more. By implementing a comprehensive identity theft prevention program, businesses and organizations in Utah can effectively monitor, detect, and respond to these red flags, ultimately safeguarding their consumers' personal information. Different types of businesses and organizations in Utah that may be subject to the FACT Red Flags Rule can include financial institutions such as banks, credit unions, and mortgage lenders. Moreover, healthcare providers, telecommunications companies, utility service providers, and even higher education institutions may also fall within the scope of this rule. Regardless of the industry, any entity that offers or maintains covered accounts, which involve the potential for identity theft, must adhere to the requirements set forth by the FACT Red Flags Rule. To comply with the FACT Red Flags Rule, businesses and organizations in Utah must develop and implement a written identity theft prevention program tailored to their specific operations. This program must include the identification of relevant red flags, procedures for detecting these red flags, appropriate responses to detected red flags, and periodic updates to the program to account for new risks and emerging threats. Designated staff members are responsible for overseeing and administering the identity theft prevention program within Utah organizations, ensuring its effectiveness and ongoing compliance. In summary, Utah's diverse landscape and cultural significance make it a captivating state for residents and visitors alike. However, amidst such beauty and rich history, it is crucial for businesses and organizations in Utah to prioritize the implementation of the FACT Red Flags Rule. By doing so, they can protect consumers, mitigate the risks of identity theft, and contribute to a secure and trustworthy environment in the Beehive State.

Utah The FACTA Red Flags Rule: A Primer

Description

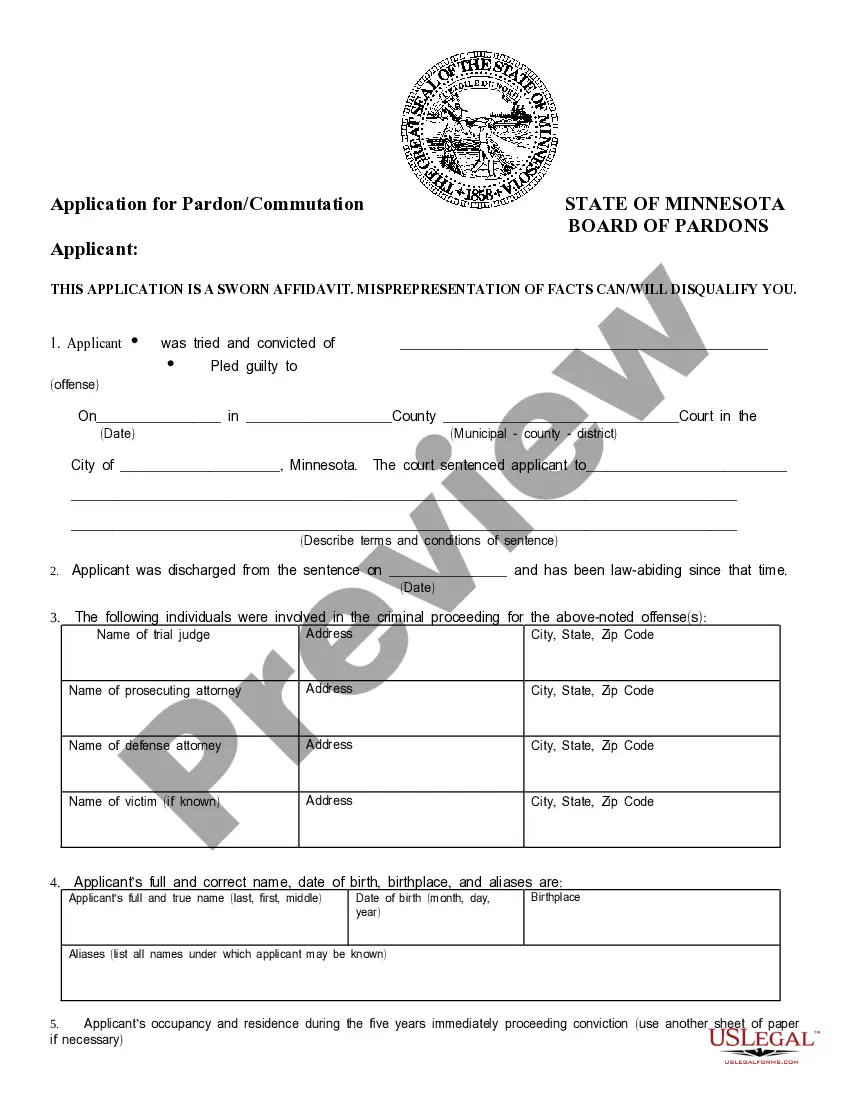

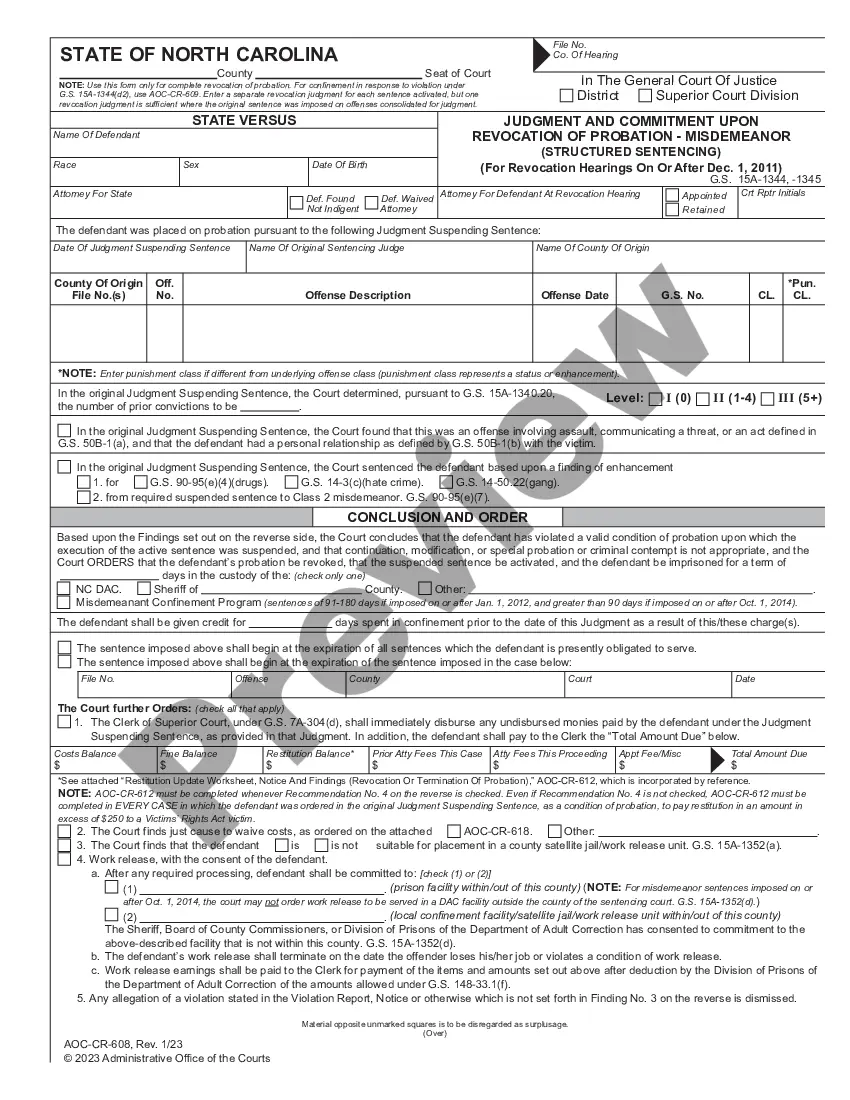

How to fill out Utah The FACTA Red Flags Rule: A Primer?

Are you currently in a place in which you will need paperwork for either business or specific functions virtually every working day? There are plenty of lawful papers layouts available on the net, but getting kinds you can rely on isn`t easy. US Legal Forms gives a large number of kind layouts, like the Utah The FACTA Red Flags Rule: A Primer, which can be composed to satisfy federal and state needs.

In case you are already familiar with US Legal Forms web site and get a merchant account, simply log in. After that, you may down load the Utah The FACTA Red Flags Rule: A Primer web template.

Unless you offer an profile and would like to begin to use US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is to the correct metropolis/area.

- Make use of the Review option to check the shape.

- See the outline to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you`re searching for, utilize the Search discipline to obtain the kind that suits you and needs.

- When you find the correct kind, simply click Acquire now.

- Choose the prices strategy you would like, fill out the necessary information and facts to generate your account, and pay for your order with your PayPal or credit card.

- Select a practical file formatting and down load your backup.

Discover each of the papers layouts you have purchased in the My Forms food selection. You may get a further backup of Utah The FACTA Red Flags Rule: A Primer any time, if possible. Just go through the essential kind to down load or printing the papers web template.

Use US Legal Forms, by far the most comprehensive collection of lawful types, in order to save efforts and steer clear of faults. The support gives skillfully produced lawful papers layouts that you can use for a variety of functions. Make a merchant account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

The Red Flags Rule requires that each "financial institution" or "creditor"?which includes most securities firms?implement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments ...

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

The program has four elements: 1) Identify Relevant Red Flags. 2) Detect Red Flags. 3) Prevent and Mitigate Identity Theft. 4) Update Program.

In Anti-Money Laundering (AML) compliance, a red flag describes a warning sign that indicates the possibility of money laundering or other criminal activity. Red flags can include transactions involving companies in sanctioned jurisdictions, large volumes, or funds being transmitted from unknown or opaque sources.

This ITPP addresses 1) identifying relevant identity theft Red Flags for our firm, 2) detecting those Red Flags, 3) responding appropriately to any that are detected to prevent and mitigate identity theft, and 4) updating our ITPP periodically to reflect changes in risks.

This ITPP addresses 1) identifying relevant identity theft Red Flags for our firm, 2) detecting those Red Flags, 3) responding appropriately to any that are detected to prevent and mitigate identity theft, and 4) updating our ITPP periodically to reflect changes in risks.

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant ?red flags? that indicate identity theft in daily operations. The Rule also offers steps to help prevent the crime and to mitigate its damage.