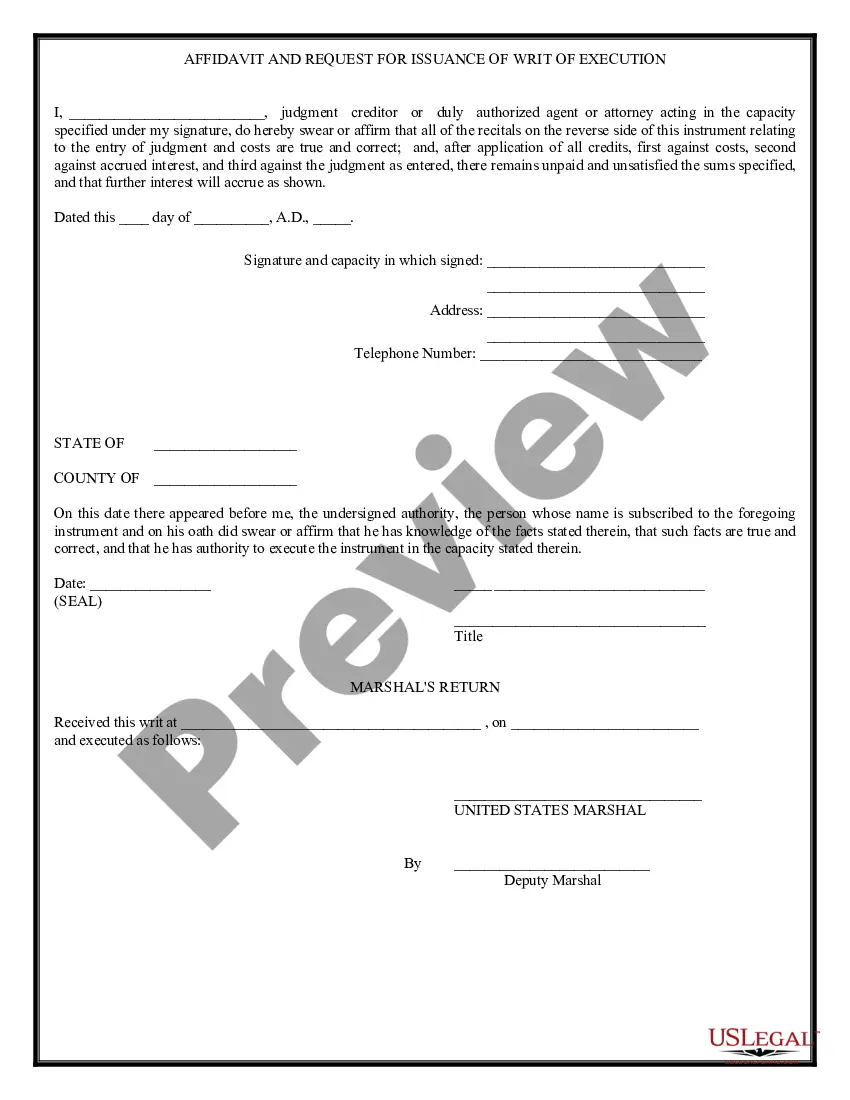

Utah Writ of Execution is a legal document that grants a judgment creditor the authority to execute or enforce a judgment against a debtor's assets to recover a debt. It is a useful tool in the debt collection process, ensuring that creditors have a means to satisfy their judgments. When a judgment creditor obtains a Utah Writ of Execution, it enables them to seize and sell a debtor's personal or real property to satisfy the debt owed. The execution of the writ is carried out by a sheriff or constable who ensures that the assets are appraised and sold to generate funds to pay off the debt. There are a few different types of Utah Writs of Execution, each serving a specific purpose depending on the nature of the debt and the assets available for seizure: 1. General Writ of Execution: This is the most common type of writ, used to enforce monetary judgments against a debtor's non-exempt assets, such as vehicles, bank accounts, or personal belongings. 2. Writ of Garnishment: Issued to seize a portion of a debtor's wages or bank accounts regularly, allowing for regular payments towards the judgment debt until it is satisfied. 3. Writ of Restitution: This specific type of execution is used in eviction cases, allowing a landlord to recover possession of a property from a tenant who has failed to pay rent or violated the terms of the lease agreement. 4. Writ of Execution on Real Property: This writ is utilized when a judgment creditor identifies real estate owned by the debtor. It authorizes the sheriff or constable to seize and sell the property, with the proceeds applied towards the judgment debt. It is important to note that certain assets may be exempt from execution under Utah law, such as a primary residence or specific personal belongings. These exemptions aim to protect debtors from losing everything and ensure they have the means to maintain a basic standard of living. Utah Writs of Execution play a vital role in the debt recovery process, ensuring that creditors have a fair chance to collect what they are owed. The different types of writs available cater to various scenarios, providing flexibility to creditors and protecting the rights of debtors.

Utah Writ of Execution

Description

How to fill out Utah Writ Of Execution?

Are you in a place the place you need paperwork for either business or personal functions virtually every time? There are tons of lawful file templates accessible on the Internet, but discovering types you can rely on isn`t easy. US Legal Forms gives 1000s of form templates, such as the Utah Writ of Execution, which are published in order to meet state and federal demands.

Should you be currently acquainted with US Legal Forms website and have a free account, simply log in. Next, you may acquire the Utah Writ of Execution design.

Unless you provide an account and need to begin to use US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for the correct town/state.

- Use the Review key to analyze the shape.

- Browse the information to actually have selected the correct form.

- If the form isn`t what you are searching for, use the Lookup field to discover the form that suits you and demands.

- Whenever you discover the correct form, click on Purchase now.

- Opt for the costs program you desire, complete the specified information and facts to create your money, and buy the order utilizing your PayPal or credit card.

- Decide on a practical paper structure and acquire your backup.

Discover all of the file templates you possess bought in the My Forms menu. You can aquire a further backup of Utah Writ of Execution any time, if needed. Just select the required form to acquire or print the file design.

Use US Legal Forms, the most considerable collection of lawful forms, to conserve efforts and stay away from errors. The assistance gives professionally manufactured lawful file templates which can be used for a range of functions. Make a free account on US Legal Forms and commence creating your daily life a little easier.