Utah Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

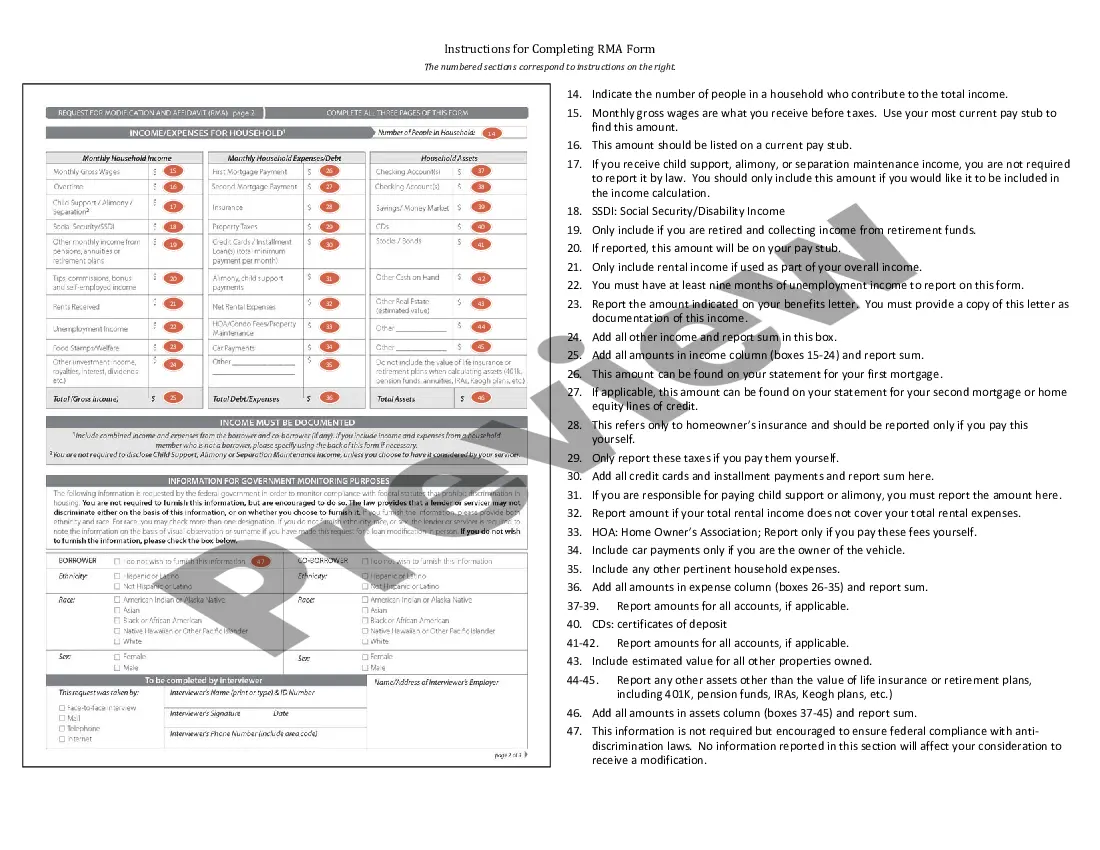

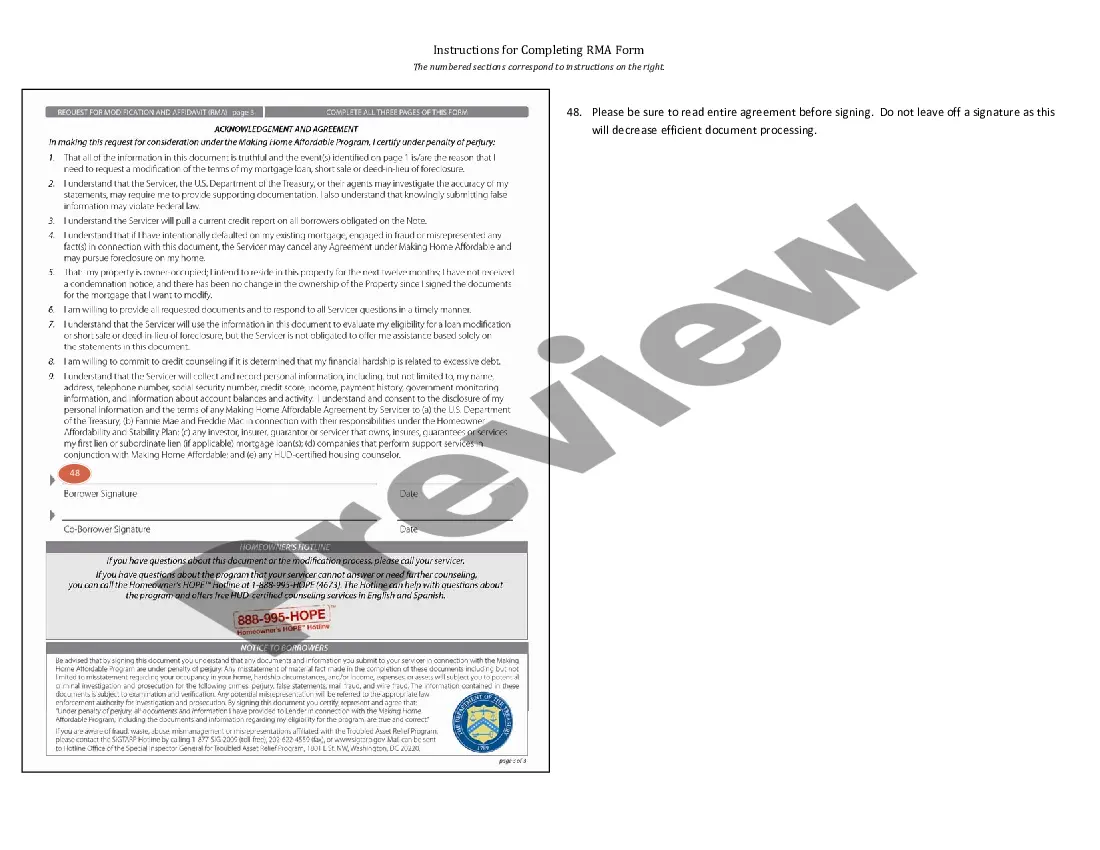

How to fill out Utah Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

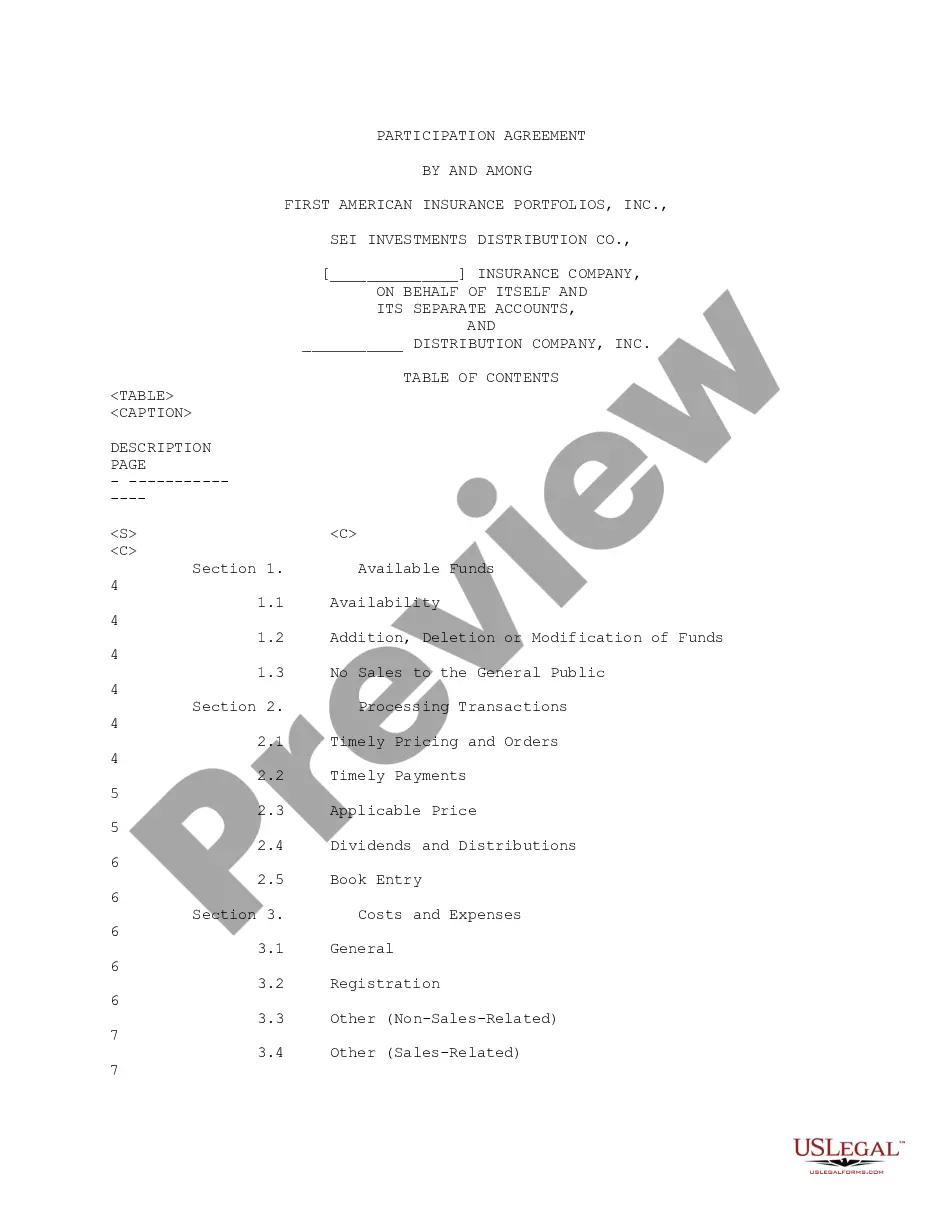

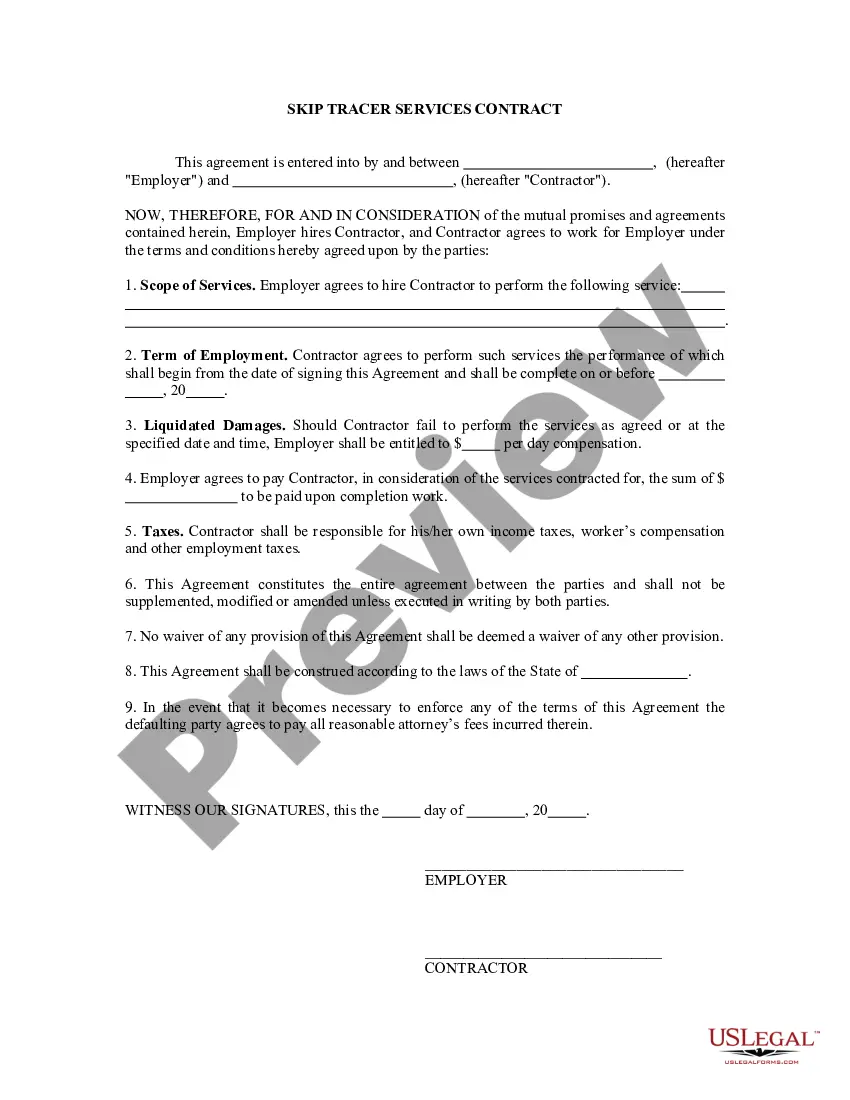

Have you been in the place in which you need to have files for sometimes business or specific uses virtually every day? There are tons of legitimate document themes available online, but discovering versions you can rely on isn`t easy. US Legal Forms delivers a large number of kind themes, such as the Utah Instructions for Completing Request for Loan Modification and Affidavit RMA Form, that are written to satisfy state and federal specifications.

If you are presently acquainted with US Legal Forms website and also have a merchant account, basically log in. Following that, it is possible to download the Utah Instructions for Completing Request for Loan Modification and Affidavit RMA Form design.

Should you not provide an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is for your proper city/state.

- Utilize the Preview option to review the shape.

- Read the outline to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you`re seeking, use the Research industry to get the kind that suits you and specifications.

- Whenever you obtain the proper kind, click Purchase now.

- Choose the rates program you desire, complete the necessary information to create your account, and purchase your order utilizing your PayPal or charge card.

- Pick a hassle-free data file format and download your copy.

Get all of the document themes you have bought in the My Forms menus. You can obtain a extra copy of Utah Instructions for Completing Request for Loan Modification and Affidavit RMA Form anytime, if possible. Just select the necessary kind to download or printing the document design.

Use US Legal Forms, by far the most extensive selection of legitimate varieties, in order to save time as well as stay away from faults. The support delivers expertly produced legitimate document themes that you can use for a range of uses. Produce a merchant account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

What is a Loan Modification Letter? A Loan Modification Letter is written to your mortgage or loan provider to request a permanent change in your loan payments.

A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

Qualifying for a Loan ModificationYou have to be suffering a financial hardship.You have to show you cannot afford your current mortgage payments.You have to be able to show that you can stay current on a modified payment schedule.The property has to be your primary residence to qualify for a HAMP modification.

Whether the mortgage loan modification agreement will need to be recorded in the public records after it is executed, and. an address to which the executed mortgage loan modification agreement should be returned.

The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay. Using an updated appraisal report the modification underwriter will confirm the current market value of the property as security for the loan.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

In most instances, a recorded modification will not be necessary. However, in some circumstances, a recorded modification may be required to ensure that the lender is protected.

Mortgage Modification OptionsForbearance. A forbearance happens when a lender temporarily suspends or reduces payments for the borrower.Rate Reduction.Loan Extension.Repayment Plan.

Under federal law, some but not all mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.

Lenders will often report a loan modification to credit bureaus as a type of settlement or adjustment to the terms of the loan. If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.