Utah Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Utah Carpentry Services Contract - Self-Employed Independent Contractor?

Have you been in the position where you need to have files for possibly organization or individual purposes nearly every day time? There are tons of lawful document web templates accessible on the Internet, but discovering ones you can rely isn`t simple. US Legal Forms gives a huge number of develop web templates, like the Utah Carpentry Services Contract - Self-Employed Independent Contractor, that are created to meet state and federal needs.

In case you are currently informed about US Legal Forms site and also have an account, merely log in. After that, you can down load the Utah Carpentry Services Contract - Self-Employed Independent Contractor template.

Unless you offer an profile and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you want and make sure it is to the right area/state.

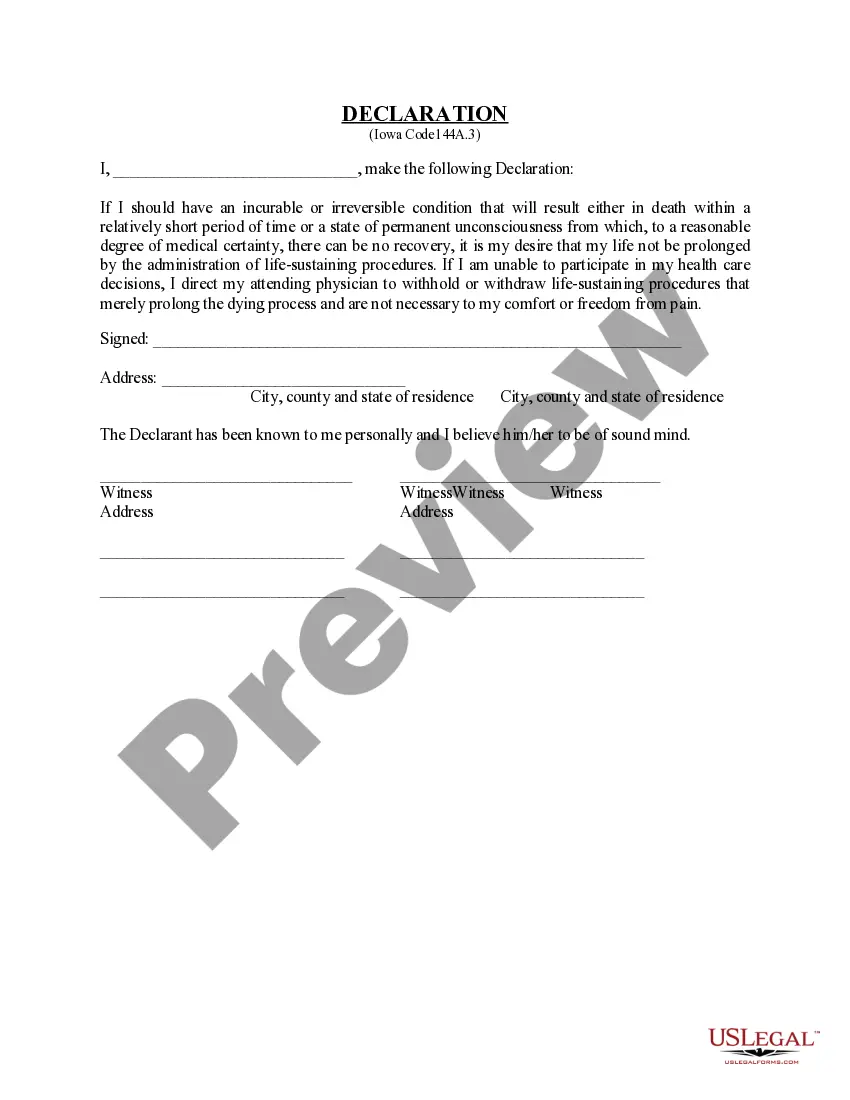

- Use the Preview option to examine the shape.

- See the description to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re trying to find, utilize the Lookup area to get the develop that suits you and needs.

- If you find the right develop, simply click Purchase now.

- Select the costs prepare you would like, complete the specified information and facts to produce your account, and pay money for the transaction with your PayPal or bank card.

- Pick a handy data file file format and down load your version.

Discover all of the document web templates you may have purchased in the My Forms food list. You may get a further version of Utah Carpentry Services Contract - Self-Employed Independent Contractor at any time, if needed. Just click the needed develop to down load or print the document template.

Use US Legal Forms, probably the most considerable selection of lawful types, to conserve time as well as steer clear of faults. The support gives expertly manufactured lawful document web templates that can be used for a range of purposes. Generate an account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.