Utah Public Relations Agreement - Self-Employed Independent Contractor

Description

How to fill out Utah Public Relations Agreement - Self-Employed Independent Contractor?

You can spend several hours on-line looking for the authorized file format which fits the federal and state requirements you require. US Legal Forms provides thousands of authorized kinds which are analyzed by experts. You can easily obtain or printing the Utah Public Relations Agreement - Self-Employed Independent Contractor from the service.

If you currently have a US Legal Forms account, you can log in and click the Obtain switch. Following that, you can total, modify, printing, or signal the Utah Public Relations Agreement - Self-Employed Independent Contractor. Every authorized file format you get is the one you have eternally. To get one more version of any bought develop, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms internet site the very first time, keep to the simple directions beneath:

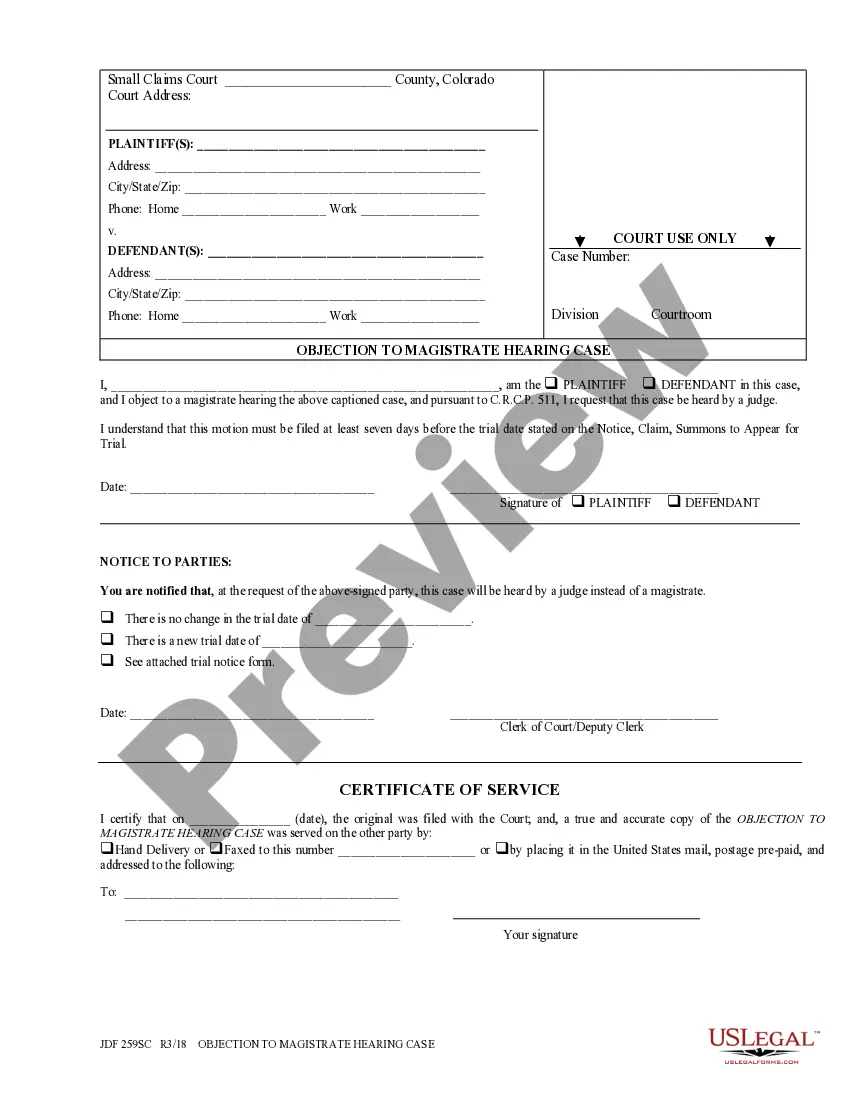

- Very first, make sure that you have chosen the correct file format to the state/city of your liking. Look at the develop explanation to ensure you have chosen the appropriate develop. If accessible, make use of the Review switch to look from the file format at the same time.

- If you wish to find one more version from the develop, make use of the Research industry to get the format that meets your requirements and requirements.

- After you have discovered the format you would like, just click Acquire now to move forward.

- Find the rates plan you would like, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You should use your bank card or PayPal account to fund the authorized develop.

- Find the structure from the file and obtain it for your product.

- Make adjustments for your file if necessary. You can total, modify and signal and printing Utah Public Relations Agreement - Self-Employed Independent Contractor.

Obtain and printing thousands of file web templates making use of the US Legal Forms site, that provides the biggest variety of authorized kinds. Use expert and condition-specific web templates to take on your organization or specific requirements.

Form popularity

FAQ

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.