Utah Self-Employed Seasonal Picker Services Contract

Description

How to fill out Utah Self-Employed Seasonal Picker Services Contract?

US Legal Forms - one of the largest libraries of legitimate varieties in the States - delivers an array of legitimate papers web templates you can download or printing. While using web site, you will get a large number of varieties for organization and specific purposes, categorized by types, claims, or keywords.You will find the newest variations of varieties such as the Utah Self-Employed Seasonal Picker Services Contract in seconds.

If you currently have a membership, log in and download Utah Self-Employed Seasonal Picker Services Contract in the US Legal Forms collection. The Down load switch will appear on every single form you view. You have access to all earlier acquired varieties within the My Forms tab of the bank account.

If you wish to use US Legal Forms for the first time, allow me to share easy recommendations to help you started out:

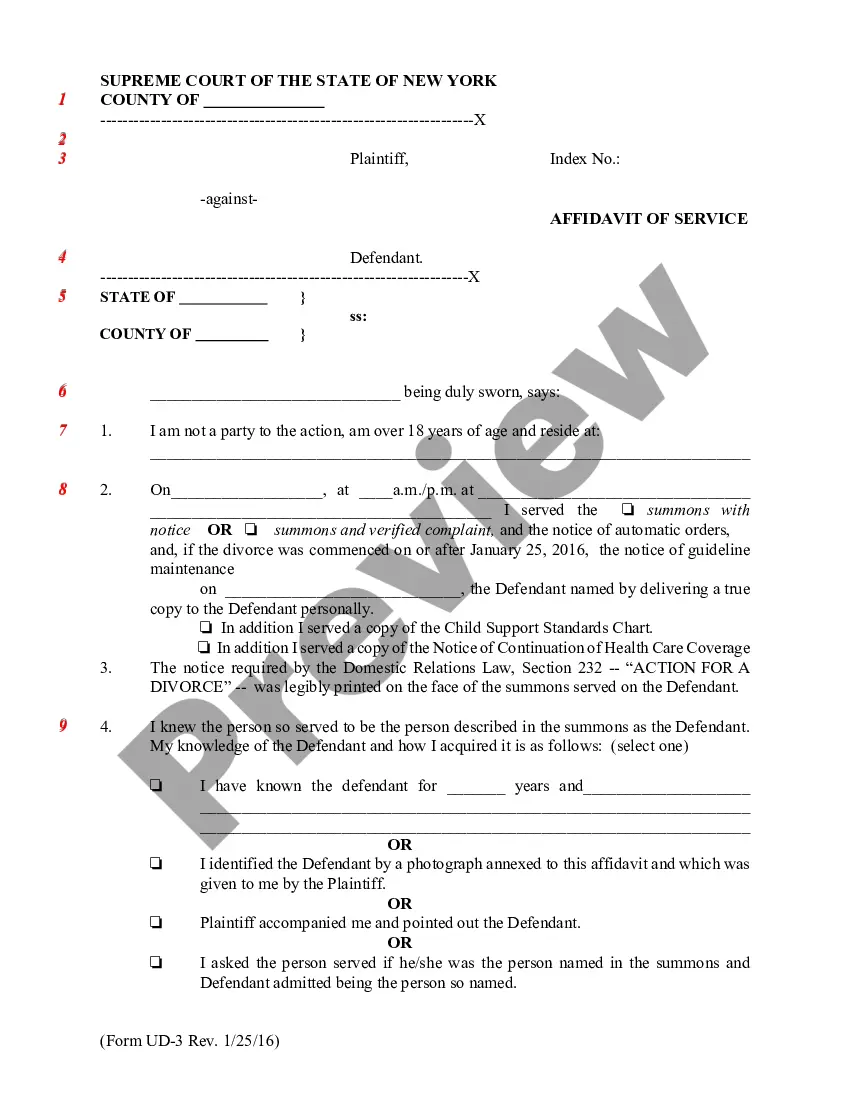

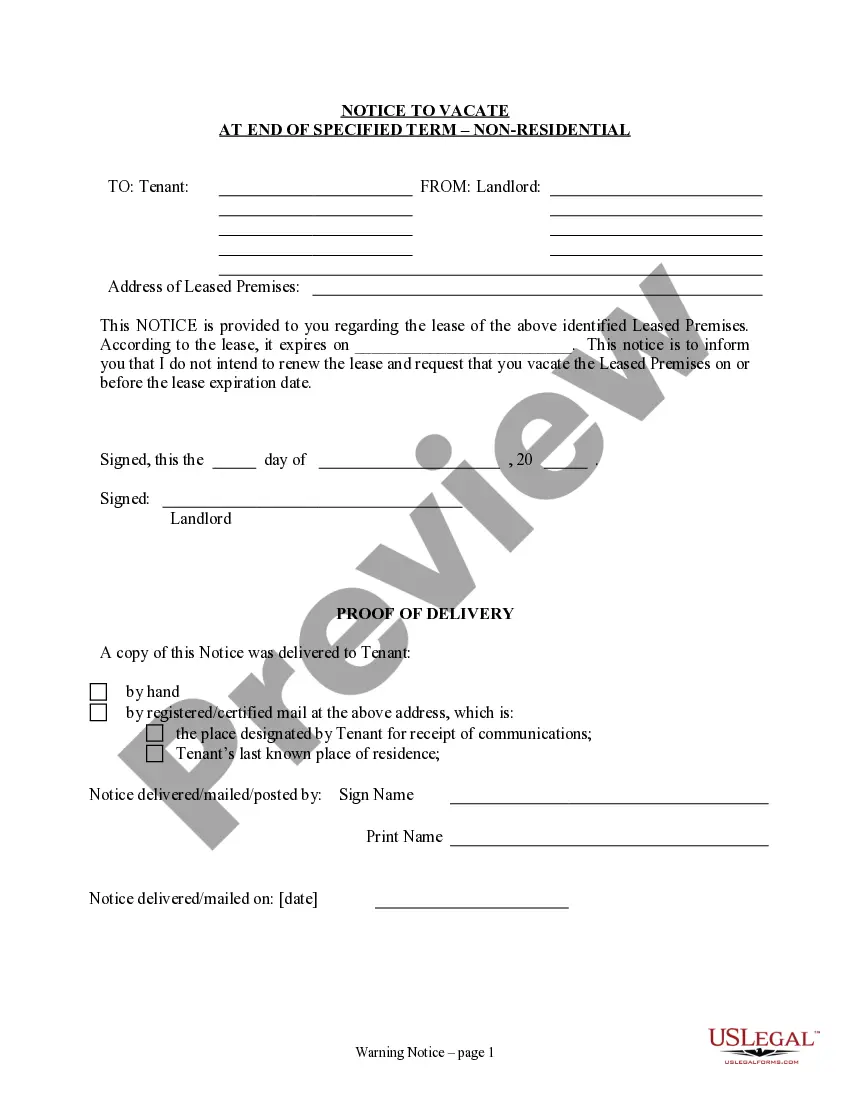

- Be sure to have picked out the best form for your personal metropolis/state. Click on the Review switch to review the form`s content material. Look at the form explanation to actually have selected the right form.

- When the form doesn`t match your specifications, utilize the Look for discipline towards the top of the screen to discover the one that does.

- If you are content with the form, verify your choice by visiting the Purchase now switch. Then, select the pricing strategy you want and provide your accreditations to register for the bank account.

- Process the deal. Utilize your charge card or PayPal bank account to perform the deal.

- Choose the file format and download the form on your gadget.

- Make changes. Fill up, revise and printing and signal the acquired Utah Self-Employed Seasonal Picker Services Contract.

Each and every design you put into your money does not have an expiry day and is your own property permanently. So, in order to download or printing yet another copy, just check out the My Forms section and then click on the form you need.

Get access to the Utah Self-Employed Seasonal Picker Services Contract with US Legal Forms, probably the most extensive collection of legitimate papers web templates. Use a large number of expert and status-specific web templates that meet up with your business or specific requires and specifications.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

You set your own schedule One of the best parts of being an independent contractor is that you can choose your own work hours. Most employees get schedules telling them when and how long they have to work. For hourly workers, schedules often change from week to week.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.