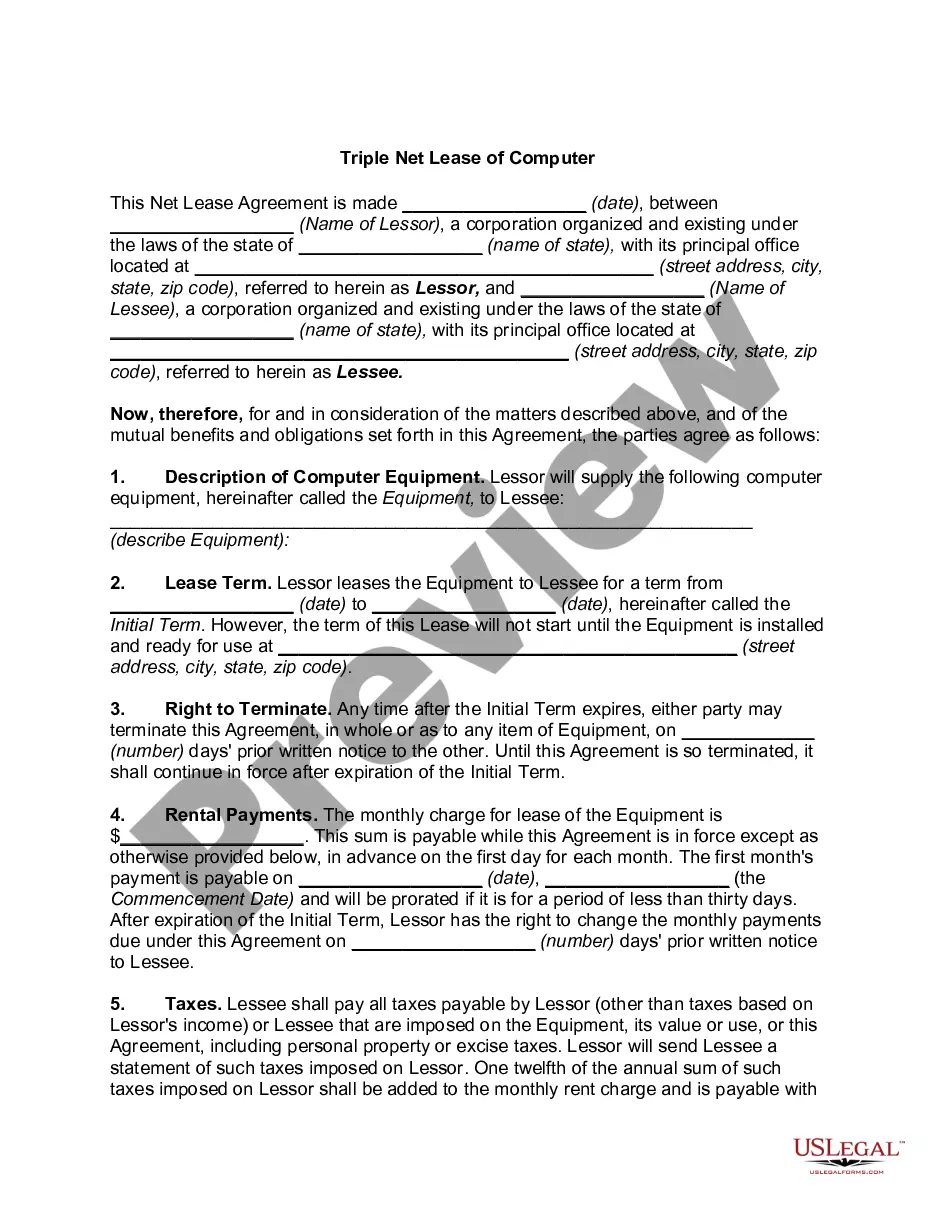

Utah Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

Are you in a situation where you need to have paperwork for both business or personal purposes almost every day.

There are numerous legitimate document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Utah Agreement for Sales of Data Processing Equipment, which are designed to meet federal and state requirements.

Choose the pricing plan you need, complete the required information to create your account, and pay for the order using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Utah Agreement for Sales of Data Processing Equipment at any time, if needed. Just select the desired form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Agreement for Sales of Data Processing Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

- Use the Preview button to review the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you're looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

Form popularity

FAQ

In Utah, software licenses are typically subject to sales tax, as they are considered tangible personal property. However, there are specific circumstances under which certain types of software can be exempt from tax. When purchasing under the Utah Agreement for Sales of Data Processing Equipment, it's crucial to be aware of these nuances to ensure compliance. For comprehensive guidance and to simplify the process, uslegalforms offers valuable resources tailored to your needs.

The current sales tax on electronics in Utah generally stands at 6.85%. This rate can vary based on local taxes, which may be applicable in certain areas. Understanding the implications of the Utah Agreement for Sales of Data Processing Equipment can help you plan your purchases effectively and avoid unexpected costs. For further assistance, uslegalforms provides tools and resources to clarify any queries regarding tax obligations.

In Utah, sales tax exemptions apply to specific products, which include items like groceries and certain medical supplies. Additionally, many raw materials used in manufacturing can also qualify for tax exemptions. When it comes to data processing equipment, keep in mind the Utah Agreement for Sales of Data Processing Equipment may play a role in defining eligibility for these exemptions. For tailored guidance, visiting uslegalforms can help you navigate these complexities.

In Utah, the sales tax on equipment typically includes both state and local taxes, which can vary by location. Generally, the combined rate reaches around 6.1% on most equipment, including data processing devices. If you are entering a Utah Agreement for Sales of Data Processing Equipment, understanding the applicable sales tax will help you budget effectively.

Yes, you can create a bill of sale without a notary in Utah, including for the Utah Agreement for Sales of Data Processing Equipment. While notarization may add an extra layer of verification, it is not a legal requirement for the document to be valid. However, make sure both parties sign the document for it to serve its purpose effectively. Using platforms like US Legal Forms can guide you through this process, ensuring your bill of sale meets all necessary requirements.

In Utah, a bill of sale is not legally required for all transactions, but it is highly recommended for certain types of sales, including the Utah Agreement for Sales of Data Processing Equipment. This document provides a written record of the transaction, which can protect both the buyer and seller. Having a bill of sale can also assist in resolving disputes in the future. It serves as proof of ownership transfer, making it a smart choice for any sale.

In Utah, if you plan to resell the data processing equipment and not use it yourself, you will need to provide a resale certificate. This certificate confirms that you intend to buy the equipment for resale, which may help you avoid sales tax. For those involved in the Utah Agreement for Sales of Data Processing Equipment, having proper documentation is key. You can find resale certificate templates through UsLegalForms to simplify the process.