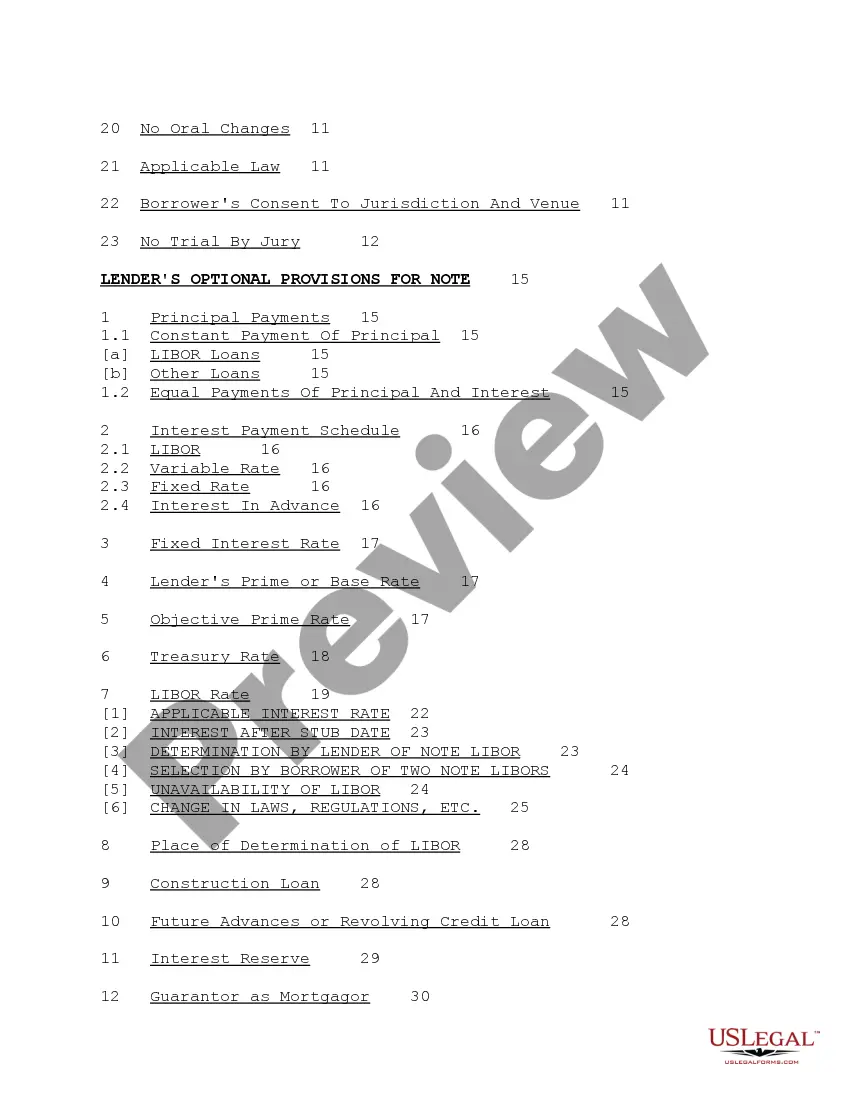

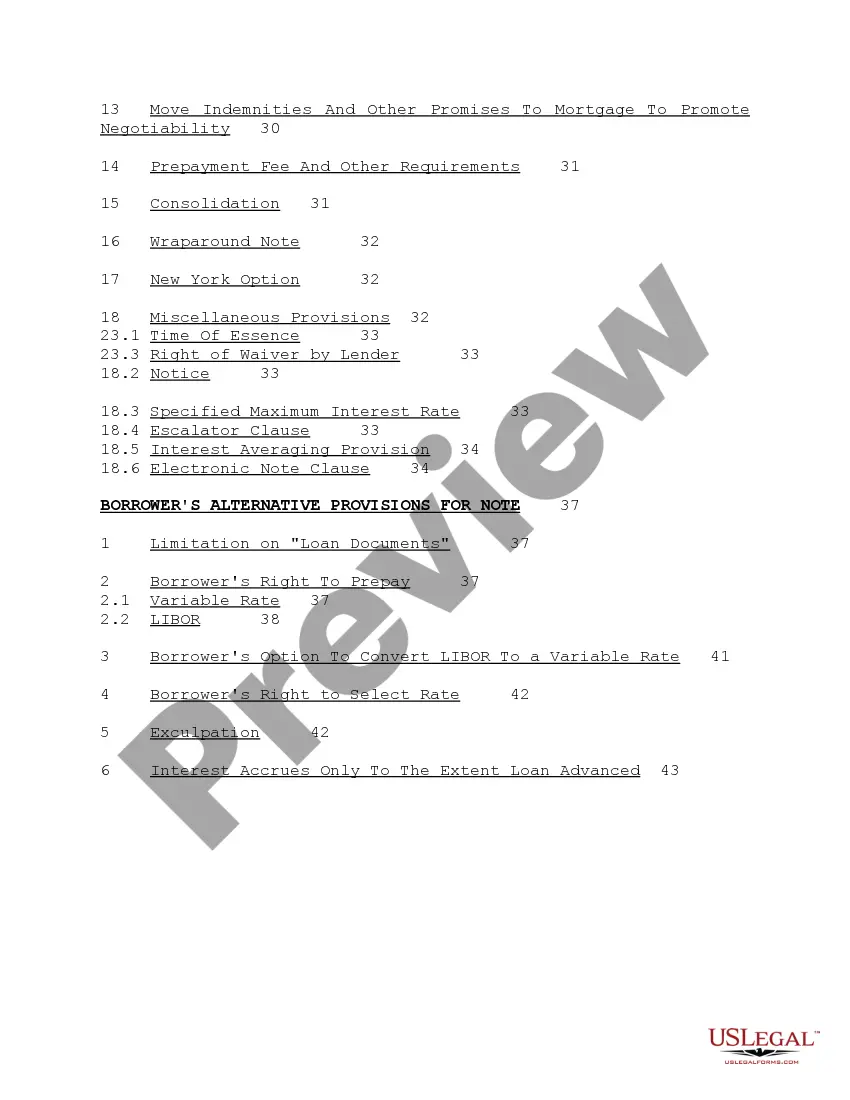

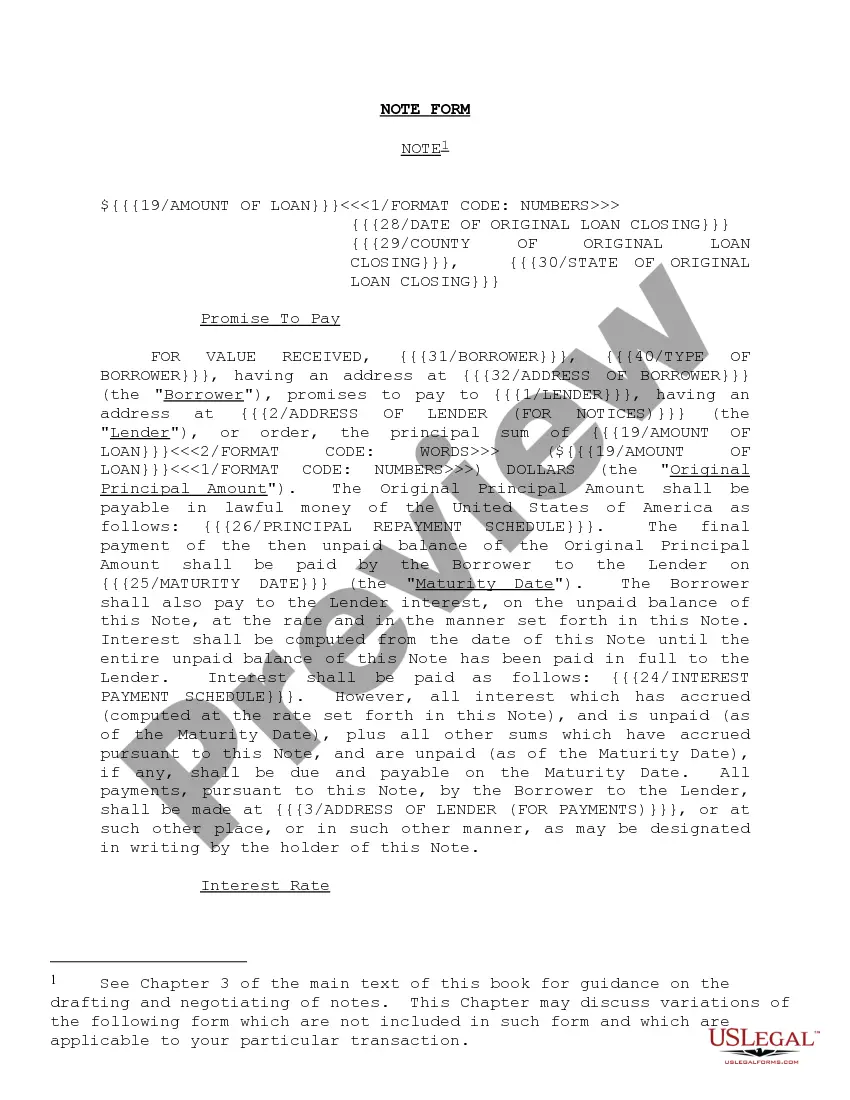

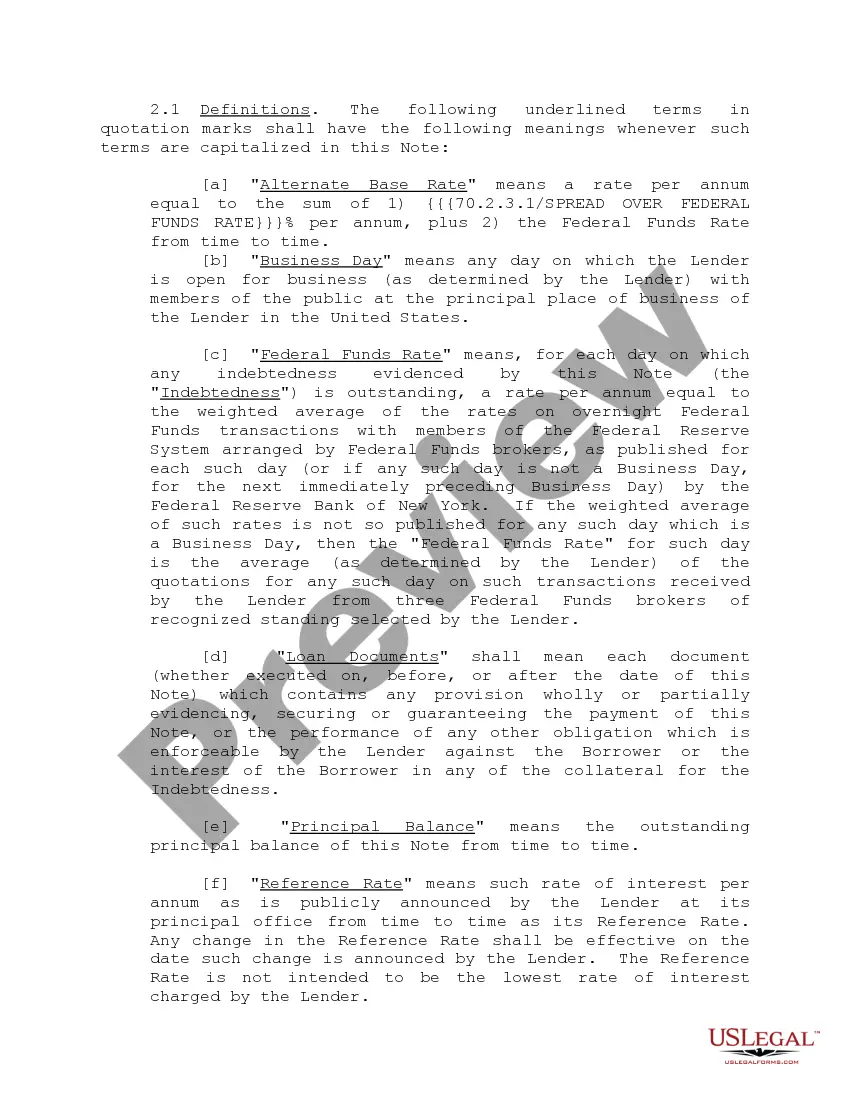

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Utah Note Form and Variations

Description

How to fill out Note Form And Variations?

You can invest hrs on the web attempting to find the lawful papers design that fits the state and federal requirements you require. US Legal Forms gives a large number of lawful varieties which can be reviewed by specialists. It is simple to obtain or printing the Utah Note Form and Variations from the assistance.

If you already possess a US Legal Forms profile, you can log in and then click the Download option. Next, you can complete, edit, printing, or sign the Utah Note Form and Variations. Every lawful papers design you buy is yours forever. To get yet another copy of any bought kind, check out the My Forms tab and then click the corresponding option.

If you use the US Legal Forms site initially, keep to the easy guidelines under:

- Very first, be sure that you have chosen the proper papers design for your county/metropolis of your choosing. See the kind description to make sure you have chosen the correct kind. If accessible, make use of the Review option to look with the papers design too.

- In order to find yet another model of the kind, make use of the Search field to obtain the design that fits your needs and requirements.

- Once you have discovered the design you need, click on Buy now to proceed.

- Choose the pricing strategy you need, key in your references, and register for a free account on US Legal Forms.

- Total the purchase. You may use your bank card or PayPal profile to pay for the lawful kind.

- Choose the formatting of the papers and obtain it to the gadget.

- Make alterations to the papers if possible. You can complete, edit and sign and printing Utah Note Form and Variations.

Download and printing a large number of papers templates using the US Legal Forms site, that provides the biggest collection of lawful varieties. Use professional and condition-certain templates to tackle your small business or personal needs.

Form popularity

FAQ

You can pay electronically* by: Electronic Funds Transfer (EFT) ACH credit ? You initiate this payment through your financial institution. ... ACH debit request ? You authorize the Tax Commission to initiate this payment. ... eCheck or Credit Card ?Pay through your online Taxpayer Access Point (TAP)* account at tap.utah.gov.

You can pay electronically* by: Electronic Funds Transfer (EFT) ACH credit ? You initiate this payment through your financial institution. ... ACH debit request ? You authorize the Tax Commission to initiate this payment. ... eCheck or Credit Card ?Pay through your online Taxpayer Access Point (TAP)* account at tap.utah.gov.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc.

Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. The Utah State Tax Commission has updated Publication 14, Withholding Tax Guide to reflect a reduction in the income tax withholding rate from 4.85% to 4.65%.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records ? we may ask you to provide the documents at a later time.

Find Your Utah Tax ID Numbers and Rates You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.