A Utah Promissory Note with Confessed Judgment Provisions is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Utah. This type of promissory note includes a clause known as "Confessed Judgment Provisions," which grants the lender the right to obtain a judgment against the borrower without going through the typical legal process in the event of a default. Confessed Judgment Provisions allow the lender to bypass lengthy court proceedings and quickly obtain a judgment against the borrower, thereby gaining the ability to seize assets or enforce a debt collection. This provision is often favored by lenders as it provides a faster and more straightforward resolution to the loan default. In Utah, there are various types of Promissory Notes with Confessed Judgment Provisions that borrowers and lenders may encounter. These can include: 1. General Utah Promissory Note with Confessed Judgment Provisions: This is the most common type of promissory note that includes the confessed judgment provision. It outlines the essential terms of the loan, such as the principal amount, interest rate, repayment terms, and the confessed judgment provision. 2. Secured Utah Promissory Note with Confessed Judgment Provisions: This type of promissory note includes an additional layer of protection for the lender by incorporating a security interest or collateral for the loan. In the event of default, the lender can not only obtain a confessed judgment but also exercise their rights to the secured property or assets provided as collateral. 3. Commercial Utah Promissory Note with Confessed Judgment Provisions: This specific type of promissory note is designed for commercial loans, such as business financing. It includes provisions that are specific to the unique needs and requirements of commercial lending transactions, while also incorporating the confessed judgment provision. It's important for borrowers in Utah to fully understand the implications of signing a promissory note with confessed judgment provisions. While it can be advantageous for lenders seeking more efficient means of debt recovery, it limits the borrower's legal options and defenses in case of default. Seeking legal advice before signing such a document is highly recommended understanding the potential consequences and explore alternative options available.

Utah Promissory Note with Confessed Judgment Provisions

Description

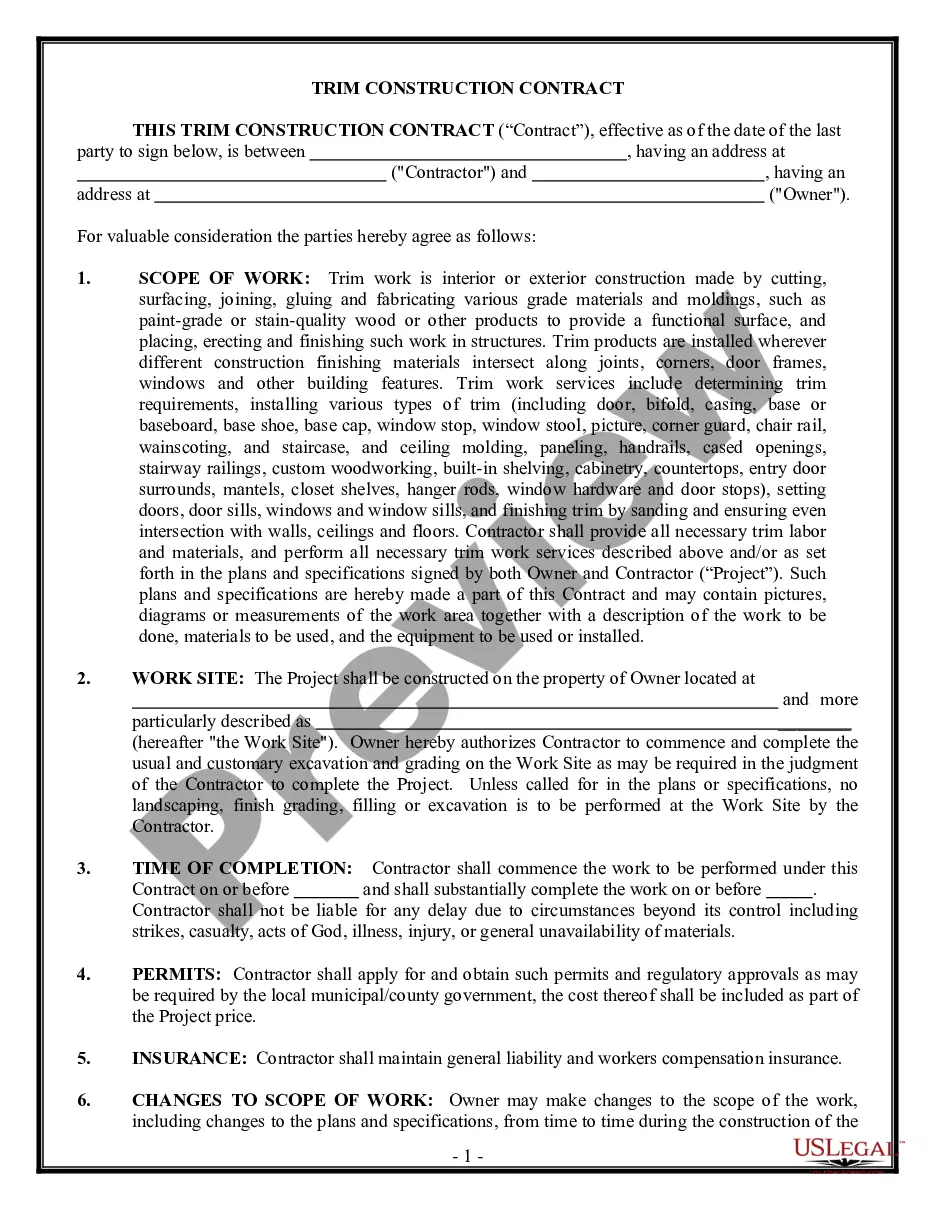

How to fill out Utah Promissory Note With Confessed Judgment Provisions?

Choosing the best legitimate document design can be quite a have difficulties. Obviously, there are plenty of themes available online, but how will you get the legitimate develop you need? Use the US Legal Forms web site. The support offers 1000s of themes, like the Utah Promissory Note with Confessed Judgment Provisions, that you can use for organization and personal needs. All the types are examined by experts and satisfy federal and state requirements.

Should you be previously authorized, log in in your account and then click the Down load key to find the Utah Promissory Note with Confessed Judgment Provisions. Utilize your account to look with the legitimate types you may have acquired earlier. Check out the My Forms tab of your own account and get one more copy in the document you need.

Should you be a whole new user of US Legal Forms, listed here are simple guidelines that you should stick to:

- Initial, make sure you have chosen the correct develop for the area/region. You can check out the shape while using Preview key and look at the shape description to guarantee this is basically the right one for you.

- In the event the develop is not going to satisfy your expectations, use the Seach field to discover the proper develop.

- Once you are positive that the shape is proper, click on the Get now key to find the develop.

- Pick the rates prepare you would like and enter in the essential information and facts. Create your account and purchase your order with your PayPal account or charge card.

- Opt for the data file structure and down load the legitimate document design in your device.

- Total, revise and print out and signal the acquired Utah Promissory Note with Confessed Judgment Provisions.

US Legal Forms will be the largest collection of legitimate types for which you can find different document themes. Use the company to down load professionally-manufactured documents that stick to state requirements.