Utah Amendment to Oil and Gas Lease to Change Depository

Description

How to fill out Amendment To Oil And Gas Lease To Change Depository?

Choosing the best lawful document format might be a have a problem. Of course, there are a variety of web templates accessible on the Internet, but how will you discover the lawful develop you will need? Use the US Legal Forms site. The assistance offers a huge number of web templates, for example the Utah Amendment to Oil and Gas Lease to Change Depository, that can be used for business and personal requirements. Each of the kinds are checked out by pros and fulfill federal and state needs.

If you are currently listed, log in to the profile and click on the Obtain switch to get the Utah Amendment to Oil and Gas Lease to Change Depository. Make use of profile to check from the lawful kinds you might have ordered earlier. Check out the My Forms tab of the profile and have another duplicate in the document you will need.

If you are a new customer of US Legal Forms, listed here are basic directions so that you can comply with:

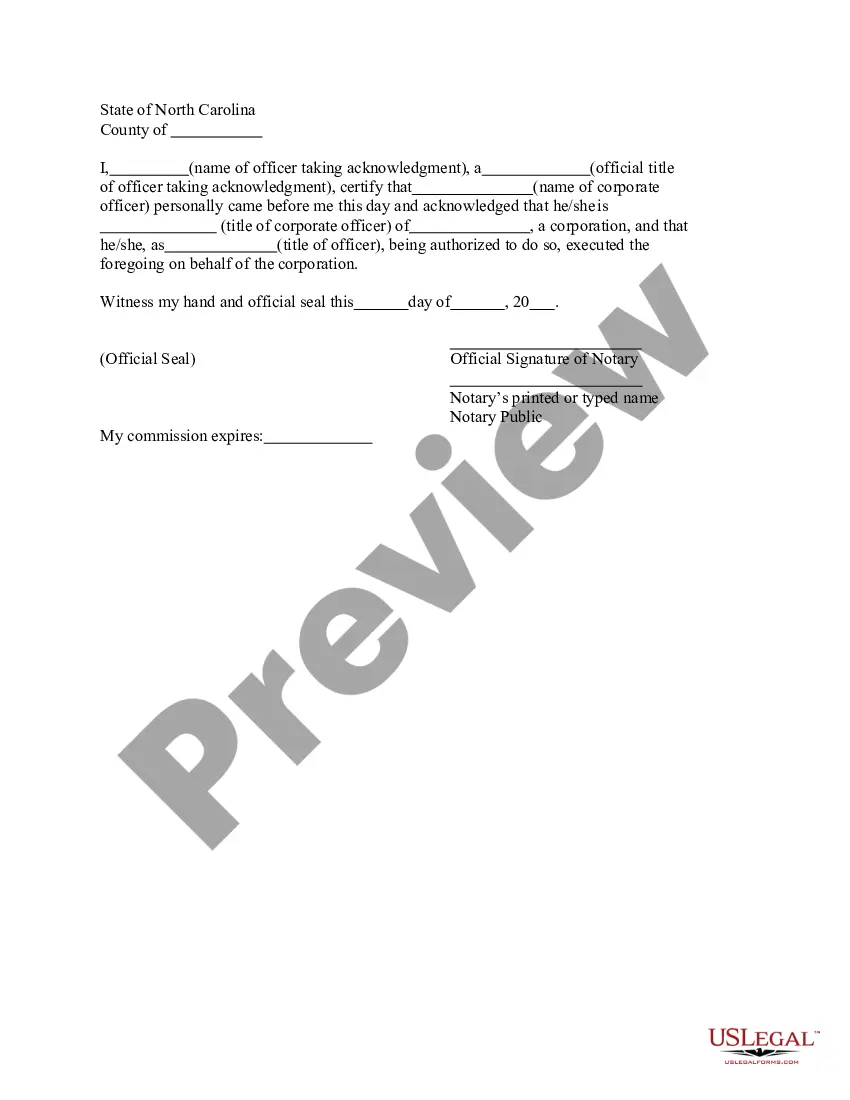

- First, be sure you have chosen the appropriate develop to your city/area. You may look over the shape using the Review switch and look at the shape explanation to make certain it is the best for you.

- In case the develop does not fulfill your requirements, make use of the Seach area to find the proper develop.

- Once you are sure that the shape is proper, click on the Buy now switch to get the develop.

- Pick the pricing program you desire and enter in the required information. Design your profile and pay for the order with your PayPal profile or bank card.

- Choose the data file formatting and down load the lawful document format to the product.

- Complete, edit and produce and sign the acquired Utah Amendment to Oil and Gas Lease to Change Depository.

US Legal Forms may be the most significant catalogue of lawful kinds in which you can see different document web templates. Use the company to down load professionally-produced files that comply with state needs.

Form popularity

FAQ

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.