Utah Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease

Description

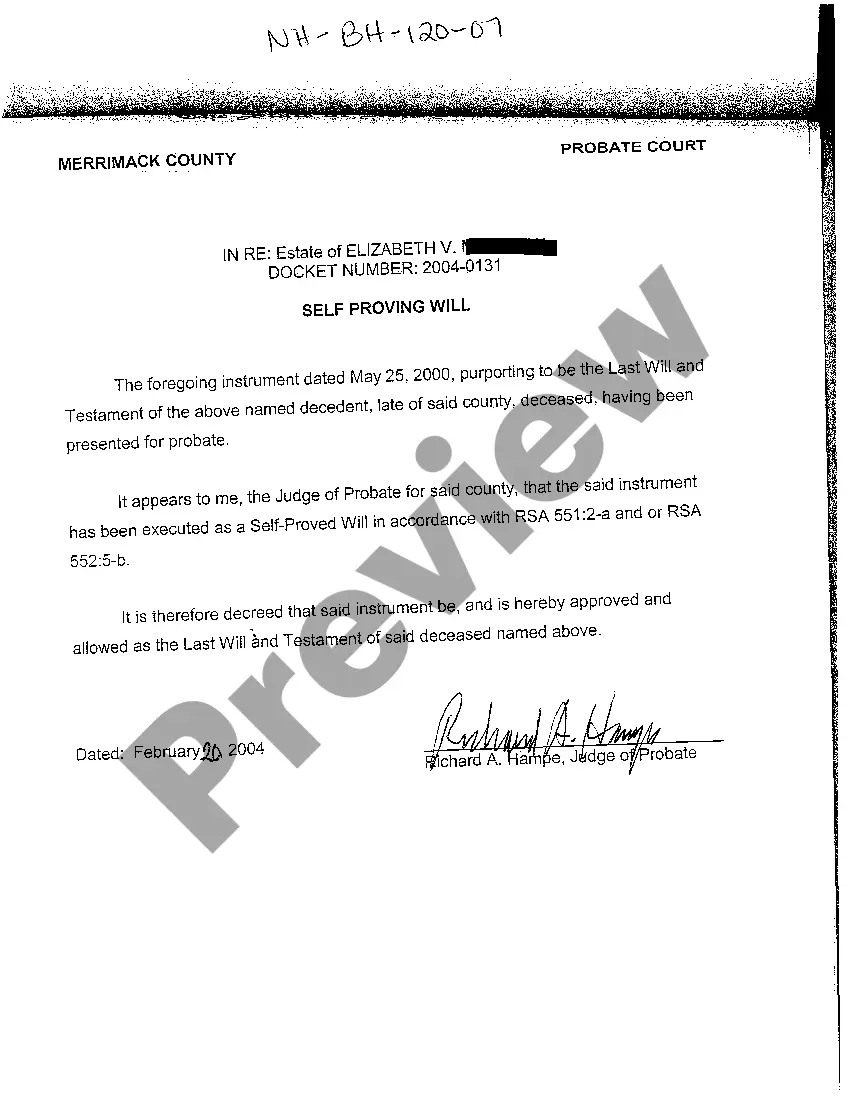

How to fill out Conveyance Of Right To Make Free Use Of Gas Provided For In An Oil And Gas Lease?

US Legal Forms - one of many biggest libraries of lawful varieties in the USA - offers a variety of lawful document templates it is possible to acquire or print out. Making use of the site, you can find a large number of varieties for company and personal functions, sorted by groups, states, or search phrases.You can get the newest versions of varieties much like the Utah Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease in seconds.

If you currently have a monthly subscription, log in and acquire Utah Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease through the US Legal Forms library. The Obtain button can look on every single kind you view. You gain access to all formerly downloaded varieties within the My Forms tab of the profile.

If you wish to use US Legal Forms initially, listed below are straightforward instructions to help you get started out:

- Be sure to have picked out the correct kind to your city/region. Go through the Review button to examine the form`s content material. Look at the kind information to actually have chosen the proper kind.

- If the kind does not suit your demands, take advantage of the Search industry at the top of the display screen to discover the the one that does.

- If you are content with the shape, affirm your choice by simply clicking the Acquire now button. Then, select the costs plan you like and offer your accreditations to sign up to have an profile.

- Method the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Pick the structure and acquire the shape on the system.

- Make modifications. Fill up, revise and print out and sign the downloaded Utah Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease.

Every design you included in your account lacks an expiration particular date which is yours eternally. So, if you would like acquire or print out yet another duplicate, just visit the My Forms section and click on the kind you require.

Obtain access to the Utah Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease with US Legal Forms, by far the most considerable library of lawful document templates. Use a large number of expert and state-distinct templates that meet your business or personal requires and demands.

Form popularity

FAQ

Many oil and gas leases contain what is commonly known as a ?free gas? clause. Such clauses typically entitle the landowner to ?use? 250,000 to 400,000 cubic feet of gas per year from any wells developed on their property.

1. n. [Geology, Shale Gas] The gaseous phase present in a reservoir or other contained area.

Oil and gas rights extend vertically downward from the property line. Unless explicitly separated by a deed, oil and gas rights are owned by the surface landowner. Oil and gas rights offshore are owned by either the state or federal government and leased to oil companies for development.

In such circumstances where a gas well has been completed but no market exists for the gas, the shut-in clause enables a lessee to keep the non-producing lease in force by the payment of the shut-in royalty.

?Unless? Lease An oil and gas lease with a delay- rental clause structured as a special limitation to the primary term. The lease automatically terminates, though the lessee has no liability for its failure to perform, ?unless? the lessee pays delay rentals or commences drilling operations.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Aggravated burglary. Terms defined in Sections 76-1-101.5 and 76-6-201 apply to this section. possesses or attempts to use any explosive or dangerous weapon.

By way of background, a ?free use? clause is a provision in an oil/gas lease which gives the lessee the right to use gas produced from the leasehold.

If enough lessors (mineral owners) insist on a strict "NO-deductions" clause in their lease, it may discourage the lessee from working hard to find the best market they can, since a strict no-deductions clause will require them to pay not only for making the gas marketable at the well, but also will require them to pay ...

Oil and gas royalties refer to the payments made to the owner of the mineral rights, which are the rights to extract oil and gas from the land. These royalties are typically a percentage of the revenue generated from the production and sale of the oil and gas extracted from the land.