Utah Assignment of Production Payment Measured by Quantity of Production

Description

How to fill out Assignment Of Production Payment Measured By Quantity Of Production?

Are you presently inside a place where you will need paperwork for either enterprise or specific reasons almost every day? There are a variety of legal papers themes available on the Internet, but finding versions you can trust isn`t simple. US Legal Forms offers a large number of kind themes, like the Utah Assignment of Production Payment Measured by Quantity of Production, that are created in order to meet state and federal requirements.

When you are previously informed about US Legal Forms site and also have a merchant account, merely log in. After that, it is possible to acquire the Utah Assignment of Production Payment Measured by Quantity of Production template.

Should you not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is for your appropriate town/region.

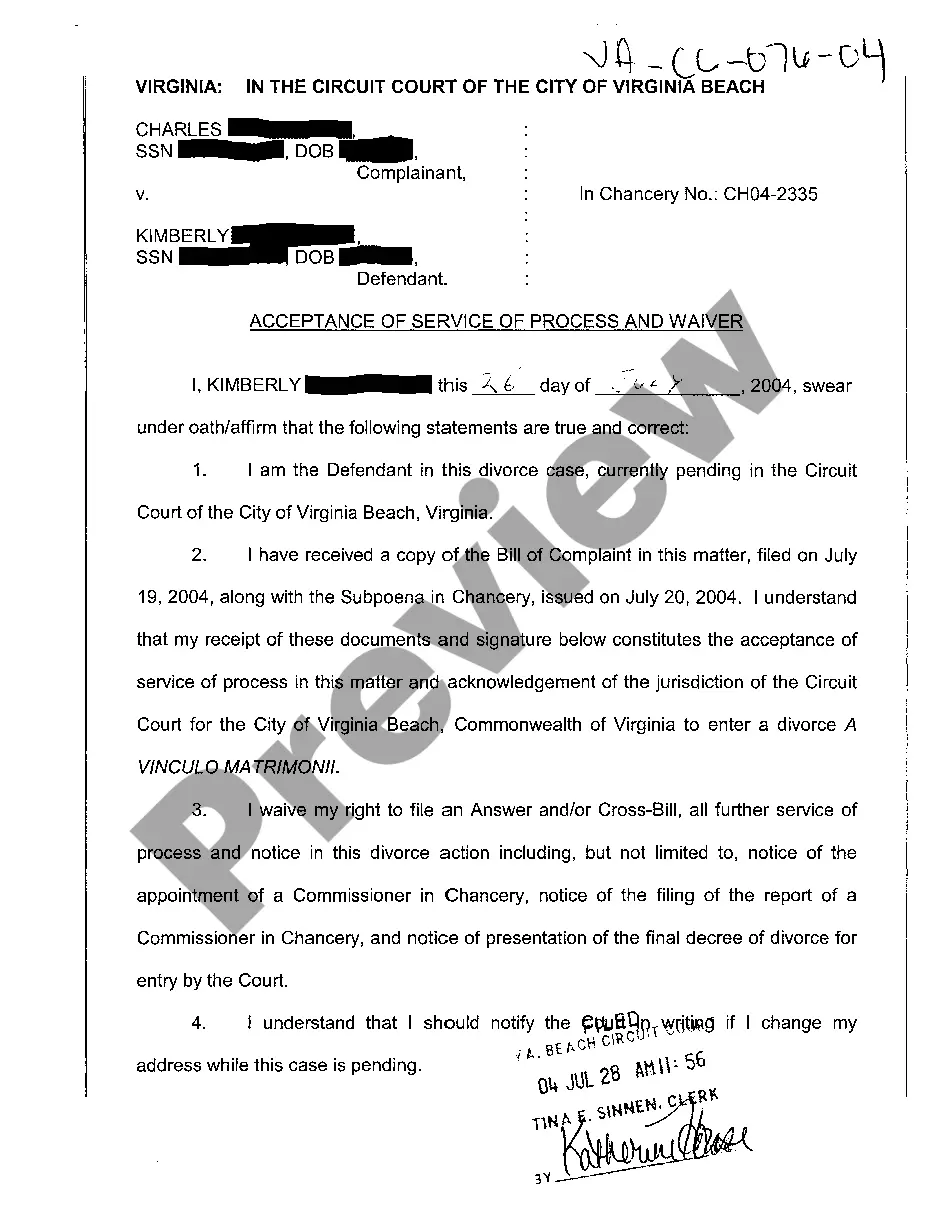

- Utilize the Review switch to analyze the form.

- Look at the description to actually have chosen the proper kind.

- In case the kind isn`t what you`re trying to find, make use of the Lookup field to get the kind that meets your requirements and requirements.

- When you obtain the appropriate kind, simply click Get now.

- Opt for the pricing plan you want, fill in the desired details to generate your bank account, and purchase an order with your PayPal or Visa or Mastercard.

- Decide on a handy file structure and acquire your version.

Locate all of the papers themes you might have bought in the My Forms food list. You can obtain a further version of Utah Assignment of Production Payment Measured by Quantity of Production anytime, if required. Just click the required kind to acquire or printing the papers template.

Use US Legal Forms, the most comprehensive variety of legal types, to save lots of efforts and avoid errors. The assistance offers expertly created legal papers themes that can be used for a selection of reasons. Produce a merchant account on US Legal Forms and start generating your daily life easier.