Utah Reservation of Production Payment

Description

How to fill out Reservation Of Production Payment?

If you have to full, acquire, or print out authorized document layouts, use US Legal Forms, the most important variety of authorized types, which can be found on the Internet. Utilize the site`s easy and handy lookup to get the paperwork you need. A variety of layouts for company and specific functions are categorized by categories and suggests, or search phrases. Use US Legal Forms to get the Utah Reservation of Production Payment in a handful of clicks.

In case you are already a US Legal Forms buyer, log in to your account and click on the Download key to obtain the Utah Reservation of Production Payment. You can even accessibility types you formerly downloaded in the My Forms tab of your respective account.

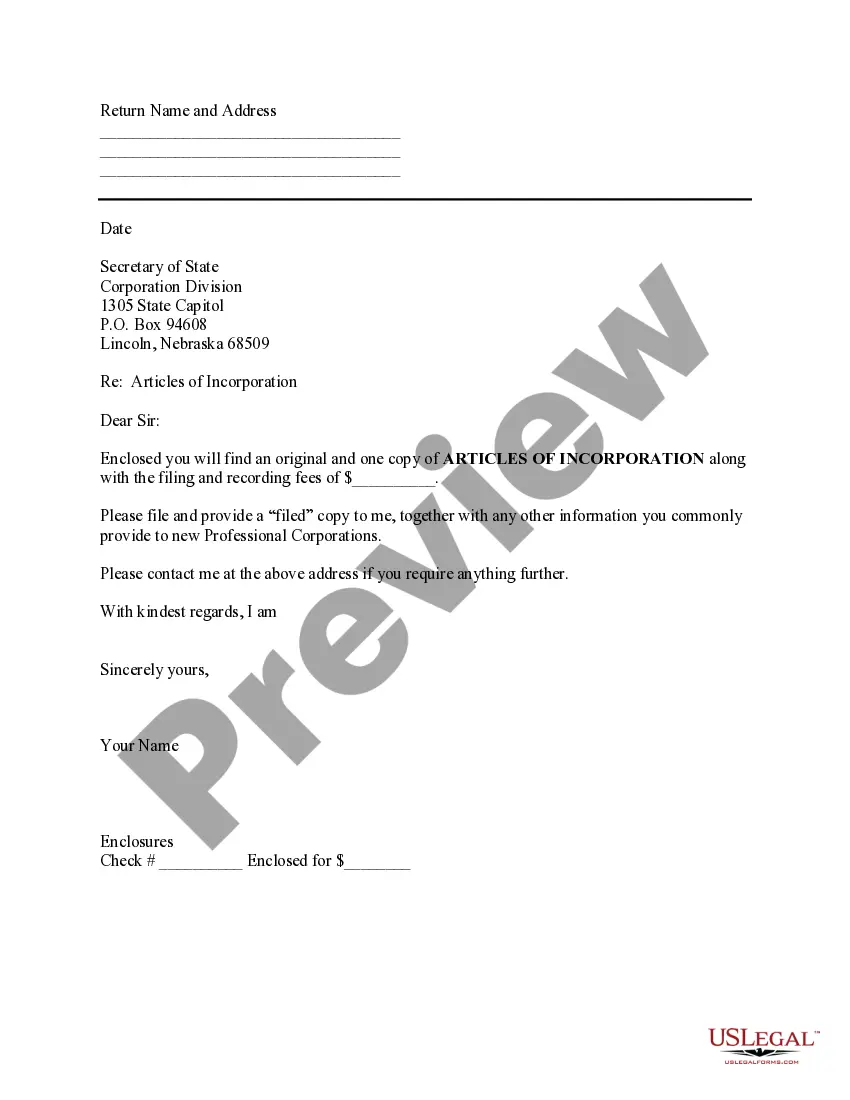

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape to the right town/country.

- Step 2. Make use of the Review method to check out the form`s articles. Never neglect to learn the outline.

- Step 3. In case you are not satisfied using the form, utilize the Search industry near the top of the screen to find other versions from the authorized form template.

- Step 4. Once you have located the shape you need, click on the Buy now key. Opt for the prices plan you favor and add your references to register for the account.

- Step 5. Method the transaction. You may use your bank card or PayPal account to accomplish the transaction.

- Step 6. Pick the structure from the authorized form and acquire it on the device.

- Step 7. Comprehensive, modify and print out or indicator the Utah Reservation of Production Payment.

Each and every authorized document template you buy is your own property permanently. You may have acces to every single form you downloaded in your acccount. Go through the My Forms portion and choose a form to print out or acquire again.

Be competitive and acquire, and print out the Utah Reservation of Production Payment with US Legal Forms. There are thousands of skilled and condition-certain types you can utilize for the company or specific needs.

Form popularity

FAQ

About Oil and Gas The Rocky Mountain Region holds large reserves of conventional and unconventional onshore oil and gas deposits. Utah's natural gas fuels not only homes and businesses in Utah; it also is used by surrounding states.

Utah is an energy-rich state. The state has reserves of natural gas and coal, as well as the potential to generate renewable energy supplies from solar, wind, and geothermal sources.

The oil and gas industry supports millions of American jobs, provides lower energy costs for consumers, and ensures our energy security.

A new report released on Friday says that pollution from the oil and gas industry in Utah exacerbates air quality concerns, especially in Uintah and Duchesne counties, which are home to 85% of the state's oil and gas wells.

Severance Tax - Based on the price received from the sale of oil and gas. Recipients: State of Utah on Sliding Scale* ? Oil is taxed at 3% of the first $13/barrel (bo) of oil value and 5% of the value in excess of $13.01/bo.

Using data from the U.S. Energy Information Administration researchers found that out of all U.S. states with at least one million barrels, Utah has the 12th most crude oil proved reserves. Utah has 275 million barrels of crude oil proved reserves, with five operating refineries.