Utah Commingling and Entirety Agreement By Royalty Owners is a legal contract that addresses the consolidation and sharing of royalty interests among multiple owners in lands subject to a lease. It is commonly utilized in the oil and gas industry and plays a crucial role in streamlining operations and simplifying royalty calculations. In cases where royalty ownership varies across different portions of the subject lands, the Utah Commingling and Entirety Agreement provides a mechanism for combining the various interests into a single, cohesive unit. This agreement helps eliminate the complexities associated with managing multiple royalty accounts, accounting issues, and administrative burdens. Various types of Utah Commingling and Entirety Agreements by royalty owners exist, depending on the specific circumstances and agreements between the parties involved. Some common types include: 1. Partial Commingling: In this agreement, only a portion of the royalty interests held by different owners is consolidated into a single unit. The remaining interests may be separately accounted for or commingled differently. 2. Full Commingling: This agreement involves the complete consolidation of all royalty interests held by different owners. All royalty proceeds are pooled together and distributed based on predetermined percentages or other equitable calculations. 3. Proportional Commingling: Here, royalty interests are commingled in proportion to the ownership percentages of the different owners. Each owner maintains a separate account, and their respective shares of revenue are calculated based on their ownership stake. 4. Geographically-defined Commingling: In cases where the lease covers lands in different geographic areas, this agreement allows royalty interests to be commingled separately for each area. This approach ensures precise accounting and distribution of revenues based on the specific locations of the lands involved. The Utah Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease provides a flexible framework for royalty owners to effectively administer their interests, simplifying the process and enhancing operational efficiency. It is an essential instrument for ensuring fair and accurate distribution of proceeds among multiple owners in complex leasing arrangements.

Utah Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

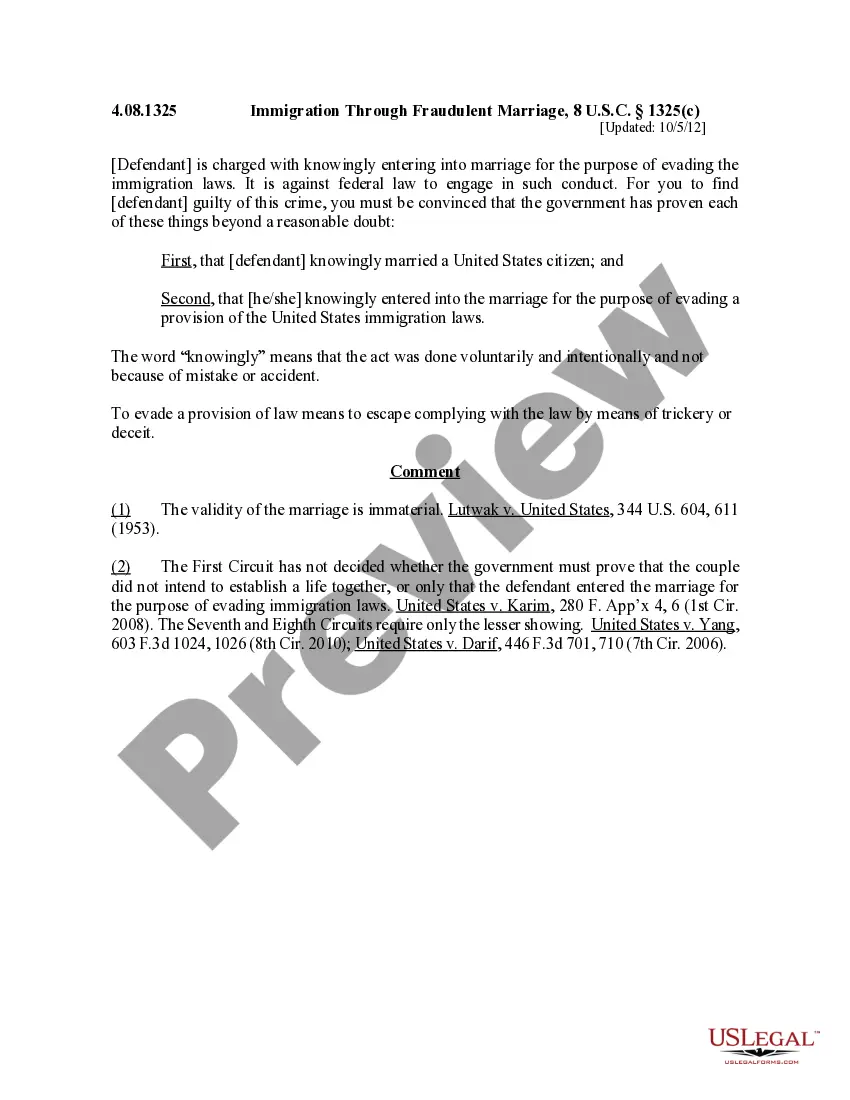

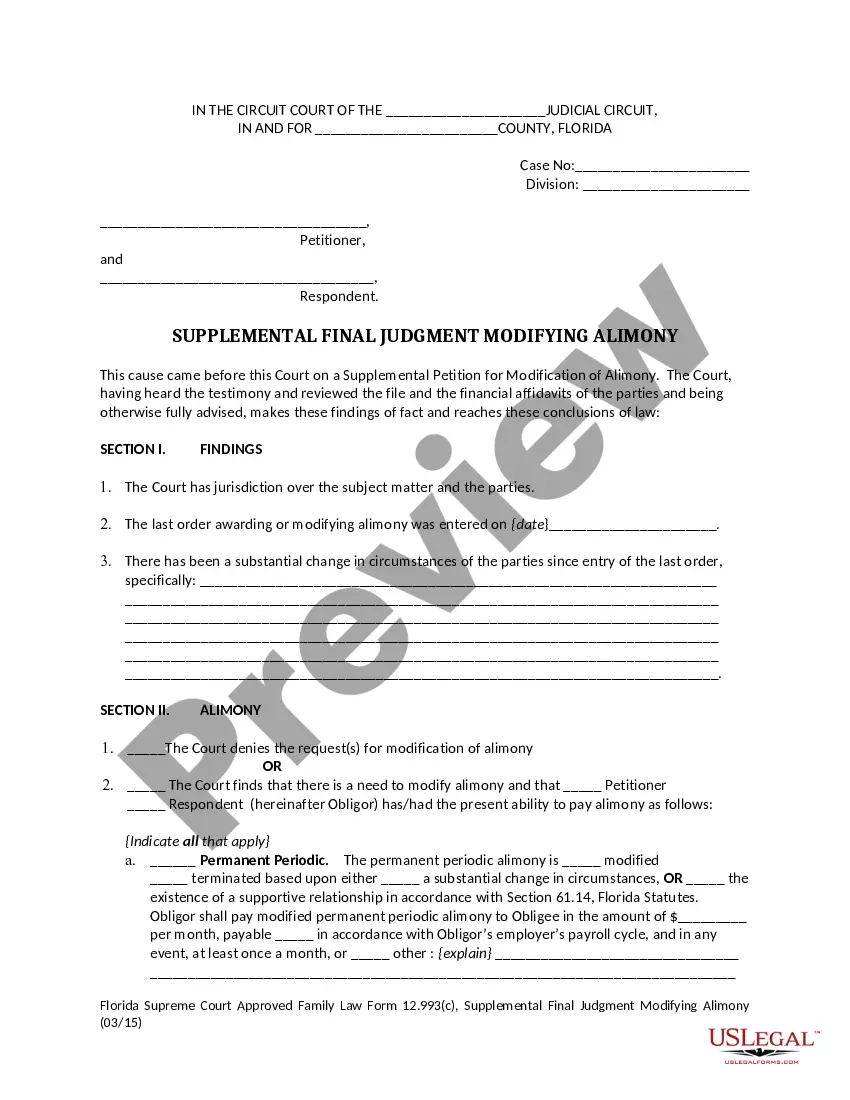

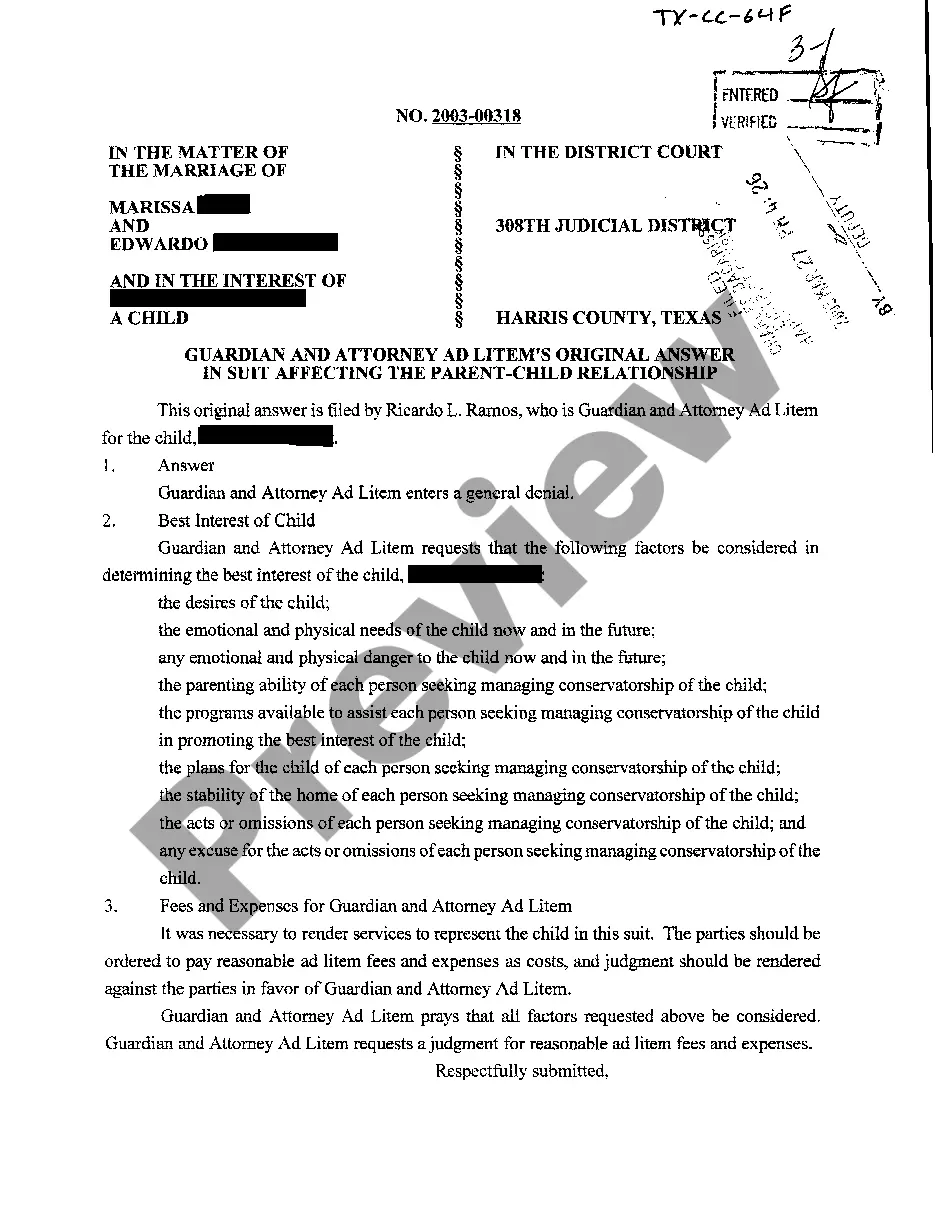

How to fill out Utah Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

Choosing the right legitimate file template can be quite a have difficulties. Of course, there are a lot of layouts available on the Internet, but how can you obtain the legitimate type you need? Make use of the US Legal Forms web site. The support gives 1000s of layouts, like the Utah Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease, that can be used for organization and private needs. All of the varieties are inspected by professionals and fulfill federal and state requirements.

If you are currently signed up, log in to the account and click on the Obtain switch to get the Utah Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease. Make use of account to search through the legitimate varieties you might have acquired in the past. Proceed to the My Forms tab of your respective account and obtain another duplicate from the file you need.

If you are a whole new user of US Legal Forms, here are straightforward guidelines that you can stick to:

- Initial, make certain you have chosen the appropriate type to your town/region. You may look through the shape making use of the Review switch and read the shape description to guarantee this is the right one for you.

- If the type is not going to fulfill your requirements, make use of the Seach area to discover the appropriate type.

- Once you are positive that the shape is suitable, click on the Purchase now switch to get the type.

- Pick the rates strategy you desire and type in the required info. Build your account and purchase your order with your PayPal account or bank card.

- Choose the file format and down load the legitimate file template to the product.

- Complete, revise and produce and sign the acquired Utah Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease.

US Legal Forms may be the biggest catalogue of legitimate varieties for which you can find numerous file layouts. Make use of the service to down load professionally-created paperwork that stick to state requirements.

Form popularity

FAQ

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

The definition of assignment in real estate is the sale, transfer, or conveyance of a whole property ownership/rights or part of it to another party. The term in the oil and gas industry is used for sale, transfer, or conveyance of working interest, lease, royalty, overriding royalty interest, or net profit interest.

What is an NPRI? A non-participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals. Types of Mineral Ownership - Mineral, Surface & Royalty momentumminerals.com ? what-rights-do-y... momentumminerals.com ? what-rights-do-y...

Oil and gas interests are interests in real property and thereby have the same attributes as other real property such as a home or a ranch. Although the ownership of oil and gas interests can take many forms, courts commonly analogize the ownership of oil and gas interests to a bundle of sticks.

Net Revenue Interest is the portion of an oil and gas leaseholder's interest in production that they are entitled to receive as part of their lease. The amount is calculated after deducting all royalty payments, production costs, and other fees.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property. Assignment Of Oil And Gas Lease: Definition & Sample contractscounsel.com ? assignment-of-oil-an... contractscounsel.com ? assignment-of-oil-an...

Utah mineral rights include crude oil and natural gas. Utah ranks 13th in the nation for crude oil production and 8th in the nation for natural gas production. Utah currently has approximately 8,600 wells producing oil and natural gas. Utah Mineral Rights | Learn Basics of Mineral Rights in UT - MineralWise mineralwise.com ? mineral-rights-by-state ? utah-... mineralwise.com ? mineral-rights-by-state ? utah-...