Utah Accounting Procedures

Description

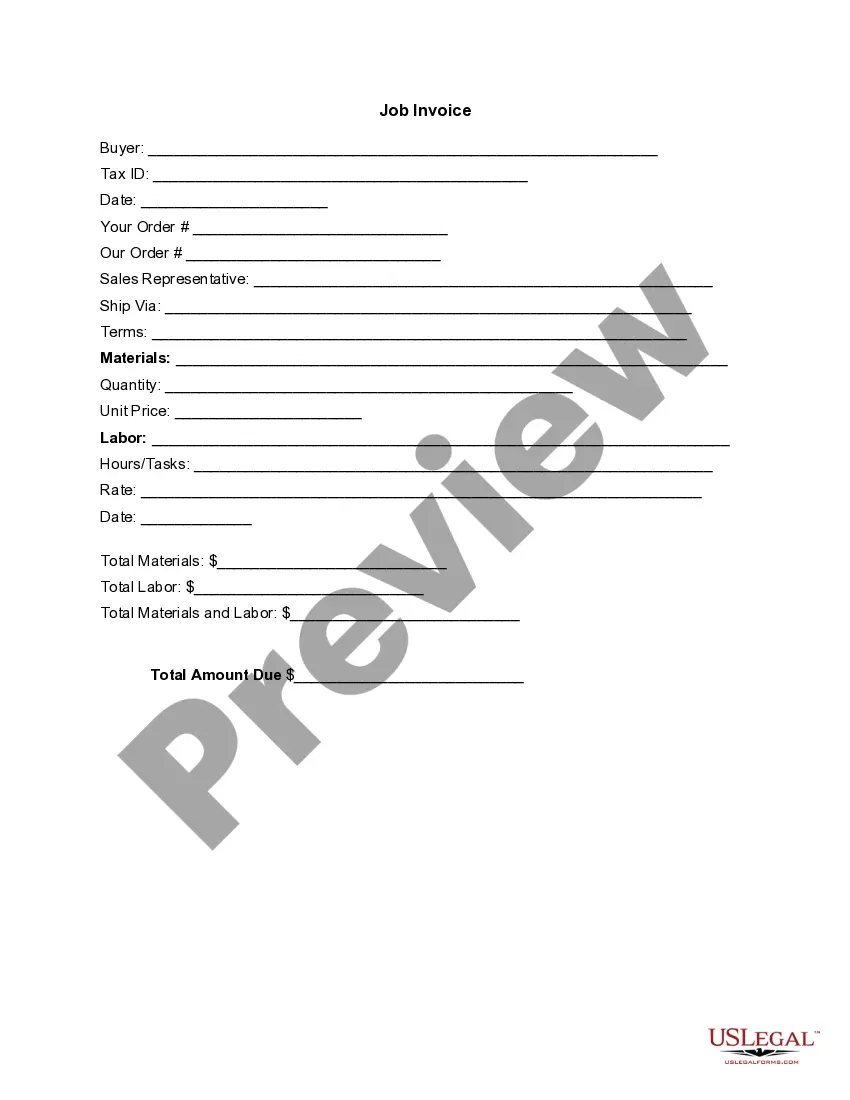

How to fill out Accounting Procedures?

If you want to comprehensive, acquire, or print out authorized document themes, use US Legal Forms, the most important collection of authorized forms, which can be found on-line. Take advantage of the site`s simple and convenient search to obtain the files you want. Different themes for organization and specific functions are sorted by types and claims, or key phrases. Use US Legal Forms to obtain the Utah Accounting Procedures in just a number of mouse clicks.

If you are presently a US Legal Forms buyer, log in in your accounts and click on the Acquire option to get the Utah Accounting Procedures. Also you can gain access to forms you earlier delivered electronically within the My Forms tab of the accounts.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the form for the right area/country.

- Step 2. Take advantage of the Review option to examine the form`s information. Do not forget about to read through the information.

- Step 3. If you are unsatisfied using the form, use the Search discipline near the top of the screen to locate other types from the authorized form format.

- Step 4. After you have discovered the form you want, click on the Buy now option. Opt for the prices plan you favor and put your references to sign up on an accounts.

- Step 5. Process the purchase. You can utilize your bank card or PayPal accounts to finish the purchase.

- Step 6. Choose the file format from the authorized form and acquire it in your system.

- Step 7. Complete, revise and print out or indication the Utah Accounting Procedures.

Each authorized document format you acquire is the one you have eternally. You possess acces to each form you delivered electronically with your acccount. Select the My Forms segment and choose a form to print out or acquire once again.

Remain competitive and acquire, and print out the Utah Accounting Procedures with US Legal Forms. There are thousands of skilled and condition-specific forms you may use for your personal organization or specific needs.

Form popularity

FAQ

Have a separate section for each accounting process, such as accounts payable, accounts receivable and fixed assets. Give each policy and procedure (P&P) a number and use the numbering system to organize the documentation. For example, all accounts receivable P&Ps could start with a 1, accounts payable with a 2. How to Write Accounting Policies & Procedures Small Business - Chron.com ? write-accounting-po... Small Business - Chron.com ? write-accounting-po...

The steps in the accounting cycle are identifying transactions, recording transactions in a journal, posting the transactions, preparing the unadjusted trial balance, analyzing the worksheet, adjusting journal entry discrepancies, preparing a financial statement, and closing the books. The 8 Important Steps in the Accounting Cycle - Investopedia investopedia.com ? ask ? answers ? what-are... investopedia.com ? ask ? answers ? what-are...

The Uniform Accounting Manual (UAM) assists local government entities (cities, towns, metro townships, counties, local and special districts, and interlocal entities) in the accounting, budgeting, and reporting of public funds.

How Do You Write Accounting Policies and Procedures? Title. This is the name of the policy or procedure. ... Prepared by and Effective Date. ... Policy. ... Purpose. ... Scope. ... Responsibilities. ... Procedures.