Utah Exhibit to Operating Agreement Escrow Agreement

Description

How to fill out Exhibit To Operating Agreement Escrow Agreement?

If you want to comprehensive, download, or print authorized document templates, use US Legal Forms, the greatest variety of authorized varieties, that can be found on-line. Use the site`s basic and convenient lookup to get the documents you will need. Various templates for organization and person uses are sorted by categories and states, or key phrases. Use US Legal Forms to get the Utah Exhibit to Operating Agreement Escrow Agreement within a number of click throughs.

If you are presently a US Legal Forms customer, log in for your profile and then click the Acquire switch to have the Utah Exhibit to Operating Agreement Escrow Agreement. You may also accessibility varieties you formerly saved from the My Forms tab of the profile.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the form to the correct city/country.

- Step 2. Make use of the Preview option to look over the form`s content. Never neglect to read through the description.

- Step 3. If you are not happy together with the type, take advantage of the Lookup area towards the top of the display screen to find other variations of your authorized type template.

- Step 4. When you have discovered the form you will need, select the Buy now switch. Select the pricing prepare you favor and put your credentials to sign up to have an profile.

- Step 5. Approach the purchase. You can use your charge card or PayPal profile to finish the purchase.

- Step 6. Find the file format of your authorized type and download it on your own system.

- Step 7. Total, modify and print or sign the Utah Exhibit to Operating Agreement Escrow Agreement.

Every single authorized document template you acquire is your own permanently. You might have acces to every type you saved with your acccount. Go through the My Forms segment and choose a type to print or download again.

Contend and download, and print the Utah Exhibit to Operating Agreement Escrow Agreement with US Legal Forms. There are many skilled and state-specific varieties you can use to your organization or person requires.

Form popularity

FAQ

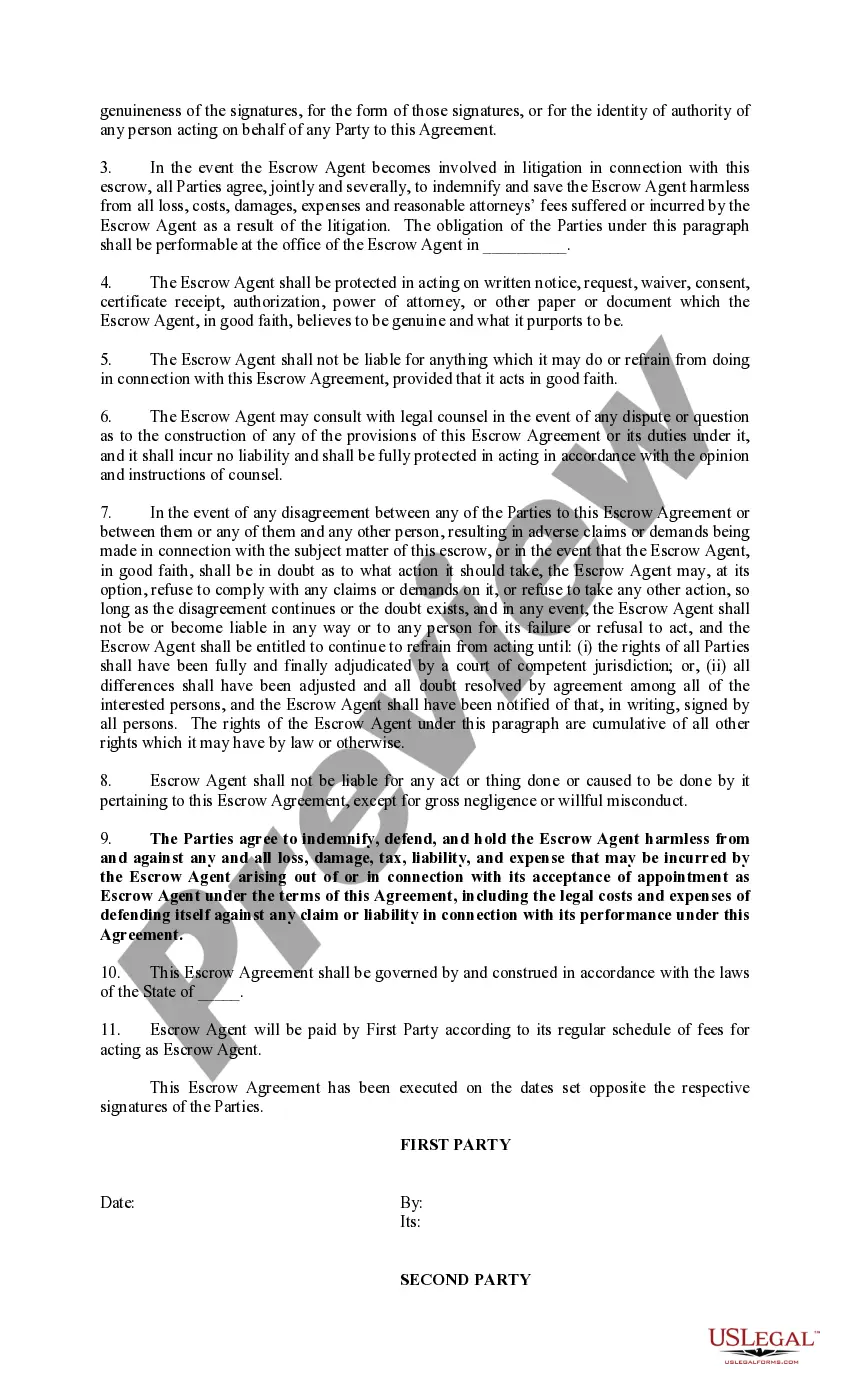

In general terms, the escrow agreement should include: The identity of the escrow agent. The duties of both the escrow agent and the parties to the escrow agreement. The beneficiary of the escrow, which is commonly one of the parties entering the escrow agreement.

?If a home is under contract, it usually means that the seller has accepted an offer from a buyer, and escrow has been opened,? says Tamara Rizzi of The Rizzi Group. ?However, don't be too quick to take it off your list if it is truly a property you are interested in.

To be in escrow means the seller and buyer of a home have agreed to a set of purchase terms, and both the seller and buyer are completing the due diligence process of the home sale. A house under contract meaning can be thought of the same thing.

In the event of a conflict between a purchase agreement and escrow instructions, the escrow instructions will prevail because they are more recent. If the parties are unable to resolve a conflict, the escrow agent should interplead any funds or items that have already been deposited into escrow.

The two essential elements for a valid sale escrow are a binding contract/agreement between buyer and seller and the conditional delivery to a neutral third party of something of value, as defined, which typically includes written instruments of conveyance (grant deed) or encumbrance (deed of trust) and related ...

Who owns the money in an escrow account? The buyer in a transaction owns the money held in escrow. This is because the escrow agent only has the money in trust. The ownership of the money is transferred to the seller once the transaction's obligations are met.

Escrows are useful for transactions where a large amount of money is involved, and several obligations must be fulfilled before payment is released. For example, escrow is used in real estate for the sale and purchase of a property. It is also often used in mergers and acquisitions and other corporate transactions.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.