Utah Clauses Relating to Initial Capital Contributions: A Detailed Description In the state of Utah, the clauses relating to initial capital contributions hold significant importance for businesses, partnerships, and limited liability companies (LCS) that require an infusion of funds to establish their operations. These clauses are designed to outline the rights, obligations, and requirements pertaining to the initial capital contributions made by members or partners in establishing the entity. The specific details concerning initial capital contributions are generally covered in the entity's governing documents such as the operating agreement for an LLC or partnership agreement for a partnership. These clauses play a vital role in the formation of the business and determining the financial obligations of the owners involved. Various types of Utah Clauses Relating to Initial Capital Contributions include: 1. Mandatory Capital Contributions Clause: This clause specifies the mandatory initial capital contribution amount that each member or partner must make at the time of formation. It delineates the financial obligation each participant has towards the entity and ensures a fair distribution of contributions among the owners. 2. Percentage-Based Capital Contributions Clause: In some cases, the initial capital contributions may be determined based on the percentage of ownership interest held by each member or partner. This clause outlines the proportional share each owner contributes based on their ownership stake. 3. Timeframe for Capital Contributions Clause: To ensure timely funding of the entity, this clause establishes specific deadlines or timeframes within which members or partners must make their initial capital contributions. It prevents delays in the establishment of the business and enforces financial commitment from the owners. 4. Additional Capital Contributions Clause: This clause addresses the scenario when the business requires additional funding beyond the initial capital contributions. It outlines the rights and obligations of the owners to contribute more capital when needed, ensuring the entity's continued operations and growth. 5. Consequences for Non-Compliance Clause: This clause discusses the consequences that may occur if a member or partner fails to make their required initial capital contribution within the stipulated timeframe. It may include penalties, reduced ownership rights, or even expulsion from the entity, ensuring accountability and adherence to financial obligations. Utah's clauses relating to initial capital contributions serve as a framework to establish clear guidelines for the financial aspects of an entity's formation. These clauses protect the interests of participants, ensure equitable distribution of financial responsibilities, and contribute to the overall success of the business. Keywords: Utah, clauses, initial capital contributions, mandatory capital contributions, percentage-based capital contributions, timeframe for capital contributions, additional capital contributions, consequences for non-compliance, governing documents, operating agreement, partnership agreement, financial obligations, owners, ownership interest, funding, partnership, LLC.

Utah Clauses Relating to Initial Capital contributions

Description

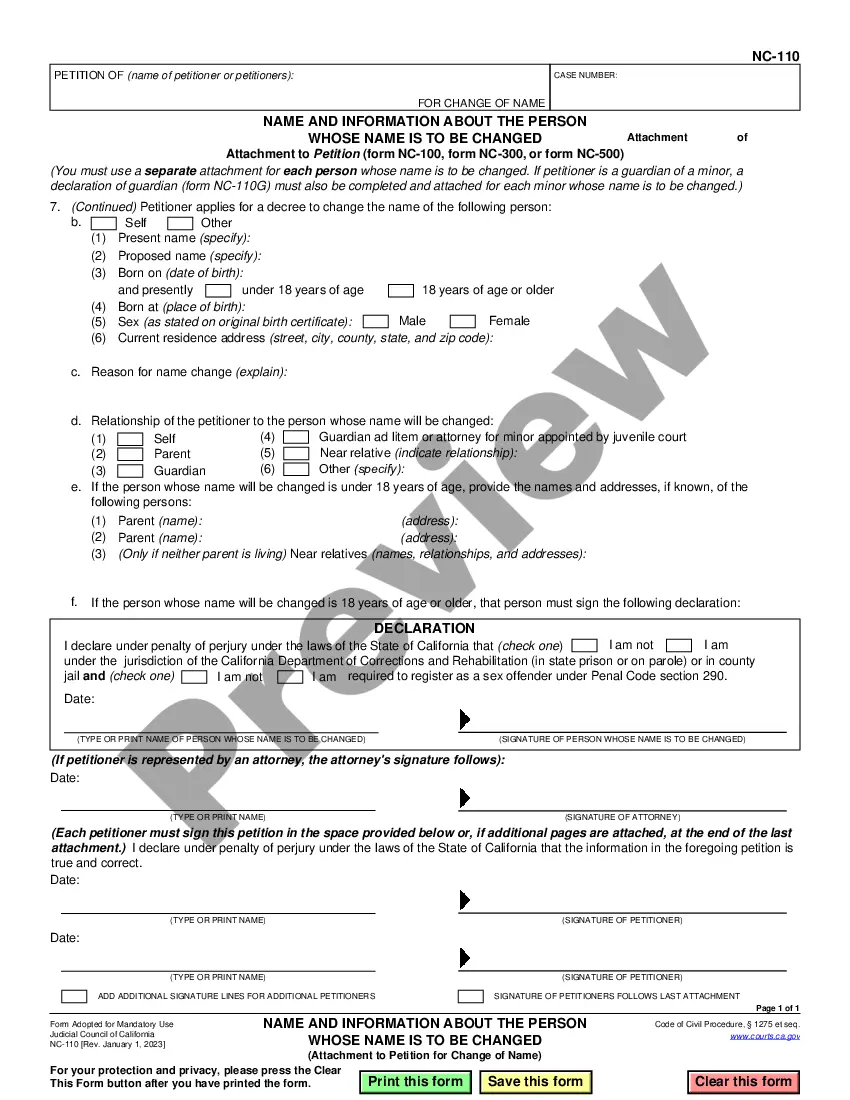

How to fill out Utah Clauses Relating To Initial Capital Contributions?

Are you currently in a placement in which you need files for either organization or specific functions virtually every working day? There are plenty of lawful file templates accessible on the Internet, but getting types you can depend on isn`t easy. US Legal Forms gives a huge number of type templates, such as the Utah Clauses Relating to Initial Capital contributions, which are composed to meet state and federal requirements.

Should you be already knowledgeable about US Legal Forms internet site and possess an account, just log in. Following that, you may acquire the Utah Clauses Relating to Initial Capital contributions web template.

Should you not provide an bank account and need to start using US Legal Forms, adopt these measures:

- Discover the type you require and make sure it is for the correct metropolis/state.

- Take advantage of the Review option to analyze the form.

- Browse the description to actually have selected the proper type.

- If the type isn`t what you are seeking, use the Research area to find the type that meets your needs and requirements.

- If you find the correct type, click on Purchase now.

- Pick the prices program you would like, fill out the necessary info to make your bank account, and purchase an order with your PayPal or credit card.

- Choose a hassle-free file formatting and acquire your copy.

Locate every one of the file templates you have purchased in the My Forms menu. You can obtain a extra copy of Utah Clauses Relating to Initial Capital contributions anytime, if needed. Just go through the essential type to acquire or printing the file web template.

Use US Legal Forms, the most considerable selection of lawful kinds, in order to save time as well as prevent faults. The services gives skillfully produced lawful file templates which can be used for a selection of functions. Make an account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions?these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on.

This can either be from a secondary issuance of stock or from an initial public offering. The accounting entry for the contributed capital are to debit cash or asset and credit Shareholders' Equity, reflecting the increase in assets and balance owed to shareholders.

An Initial Capital Stock Contribution is a specific amount of money you noted on your Operating Agreement that you as a shareholder in your LLC with S Corp tax formation would 'contribute' to get the business up and running.

How do I add capital to my LLC? You should make capital contributions in ance with your operating agreement. The agreement might require regular contributions or ?as-needed? contributions. Either way, a capital contribution often entails making a check out to the LLC.

After you have made your capital contributions to the business, each member's contribution should be recorded on the balance sheet as an equity account. You should have a capital contribution account for each member's contributions and record their initial contribution as well as additional contributions there.

After you have made your capital contributions to the business, each member's contribution should be recorded on the balance sheet as an equity account. You should have a capital contribution account for each member's contributions and record their initial contribution as well as additional contributions there.

Is Capital Contribution Taxable? Our tax laws say that most capital contributions are not taxable for the LLC owner or the LLC.

Unfortunately, capital contributions are not tax deductible when it comes to contributions toward an LLC.