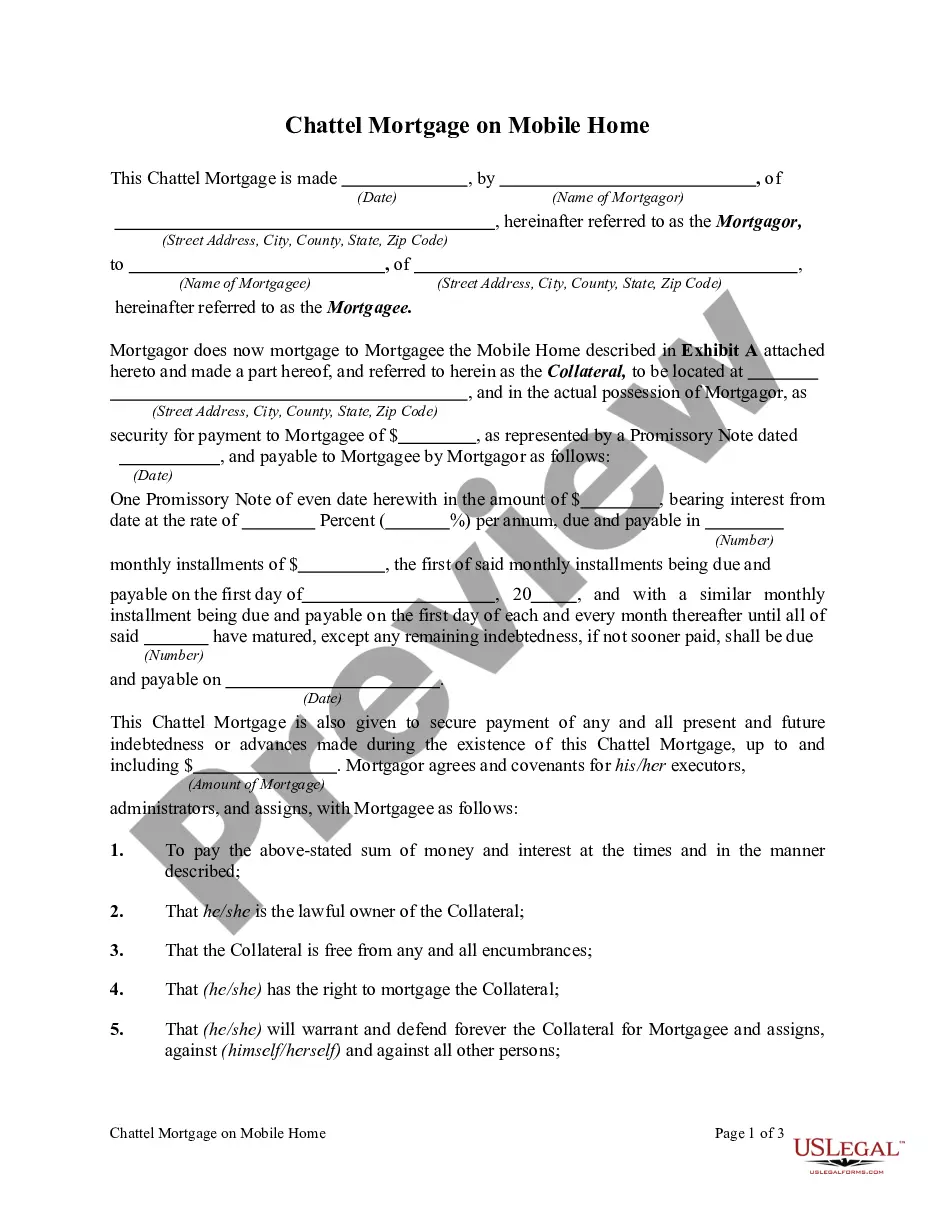

Virginia Chattel Mortgage on Mobile Home

Description

How to fill out Virginia Chattel Mortgage On Mobile Home?

Looking for a Virginia Chattel Mortgage on Mobile Home on the internet might be stressful. All too often, you find files that you simply think are ok to use, but discover afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Get any document you are searching for quickly, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included to your My Forms section. If you don’t have an account, you must register and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Virginia Chattel Mortgage on Mobile Home from our website:

- Read the document description and click Preview (if available) to check whether the template suits your requirements or not.

- If the form is not what you need, find others with the help of Search engine or the provided recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted templates, customers may also be supported with step-by-step guidelines on how to find, download, and complete templates.

Form popularity

FAQ

Financing is challenging for any homeowner, and that's especially true when it comes to mobile homes and some manufactured homes. These loans aren't as plentiful as standard home loans, but they are available from several sources and government-backed loan programs can make it easier to qualify and keep costs low.

If you own a plot of land, you can use a VA loan to buy a mobile home for that lot. You can also use a VA loan to purchase both a mobile home and land at the same time.Veterans who want VA loans for mobile homes will need to submit to a credit check and meet income requirements.

Mobile homes are far cheaper than traditional homes, so you may be able to finance your purchase through a personal loan. Personal loans are flexible loans you can use for almost any purpose. However, personal loan interest rates tend to be higher than those of other types of loans, such as mortgages or auto loans.

If you own a plot of land, you can use a VA loan to buy a mobile home for that lot. You can also use a VA loan to purchase both a mobile home and land at the same time.Veterans who want VA loans for mobile homes will need to submit to a credit check and meet income requirements.

VA Home Loans cannot be used to purchase: A cooperatively (co-op) owned apartment. Financing for these types of shared ownership properties expired in 2011. A farm. If purchasing a farm, there must be a residence on the property which the veteran will occupy.

Chattel Mortgages The movable property, or chattel, guarantees the loan, and the lender holds an interest in it. Mobile homes, as well as airplanes, yachts, houseboats, and certain farm equipment may qualify for chattel mortgages.

Mobile home equity loans have numerous benefits. They include:Access to a lot of Funds: You can get more funds to meet your financial issues by taking out a mobile home equity loan than a credit card or a personal loan.

To qualify for low mobile home interest rates, make sure your credit score is at least 700. You'll need a score of 750 or higher to qualify for the best rates available.

Both businesses and individuals are eligible for a chattel mortgage, as long as the car is being used predominantly for business purposes.A chattel mortgage involves a finance company lending you the money to purchase a vehicle that will be primarily used for business purposes.