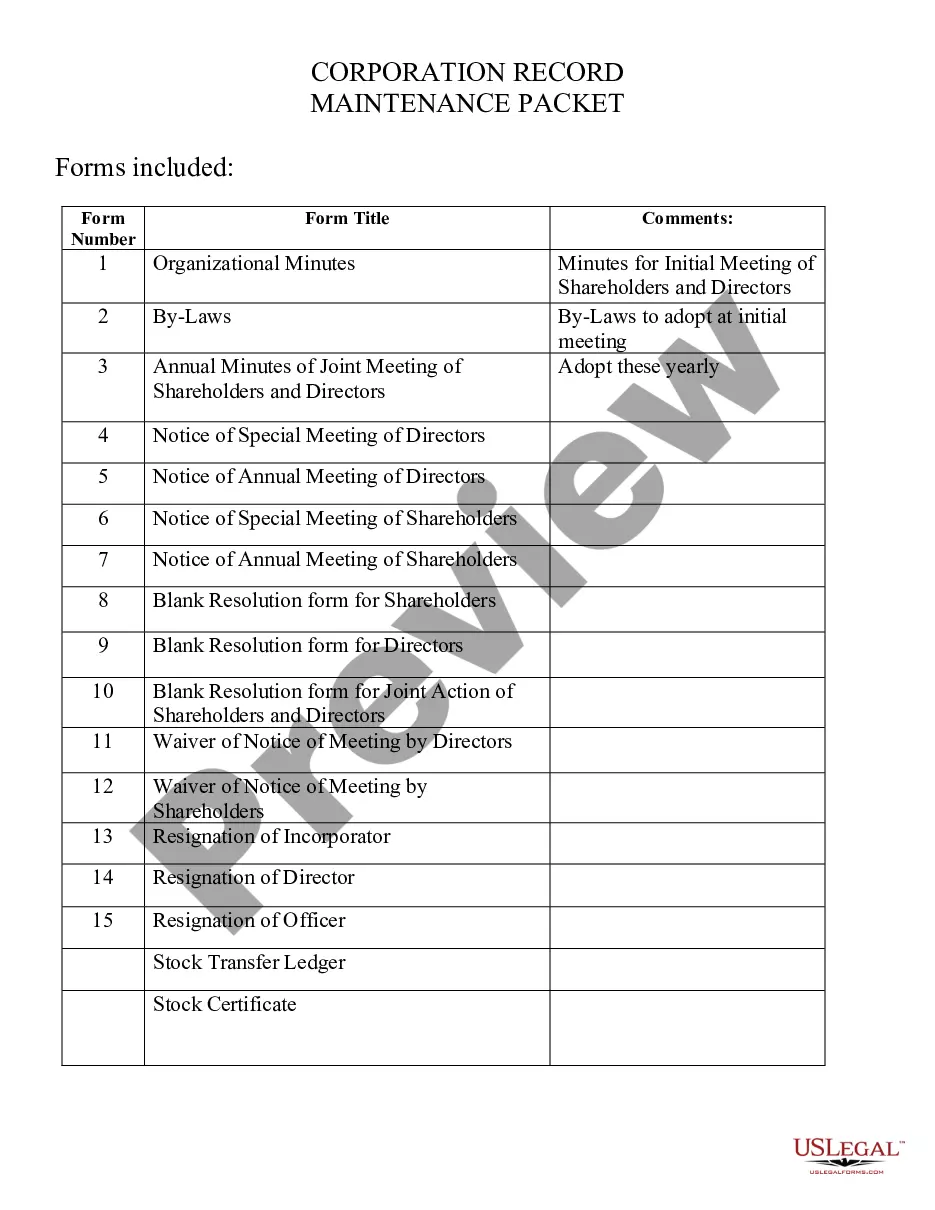

This form package provides the forms necessary to form a professional corporation for the practice of a state-licensed profession in Virginia. You fill in the name of your profession in the blanks where appropriate to customize the documents.

Professional Corporation Package for Virginia

Description

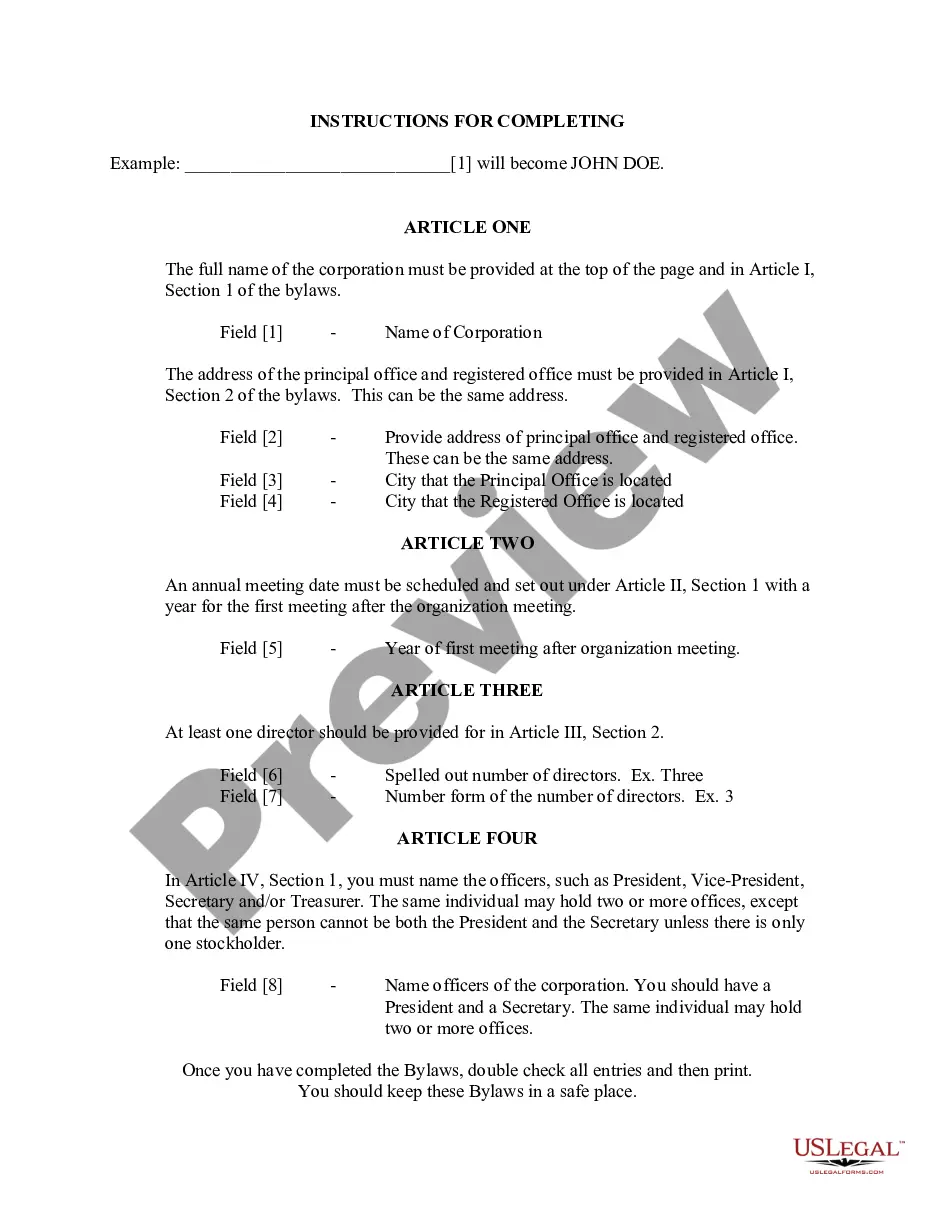

How to fill out Professional Corporation Package For Virginia?

Among countless free and paid samples that you’re able to get on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to deal with what you require these people to. Keep relaxed and make use of US Legal Forms! Find Professional Corporation Package for Virginia samples made by skilled legal representatives and avoid the expensive and time-consuming procedure of looking for an lawyer or attorney and after that paying them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access your earlier acquired samples in the My Forms menu.

If you’re using our service the first time, follow the tips listed below to get your Professional Corporation Package for Virginia with ease:

- Make sure that the document you find applies in your state.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another example utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you’ve signed up and paid for your subscription, you can utilize your Professional Corporation Package for Virginia as often as you need or for as long as it continues to be valid where you live. Revise it in your favored editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100. Note that your corporation will also be responsible for an annual tax of $800 to the California Franchise Tax Board.

An S corporation is a special form of corporation, named after the relevant section of the Internal Revenue Code. It is taxed on a pass-through basis, meaning it doesn't pay taxes in its own right. In principle, an S corporation can have no employees.

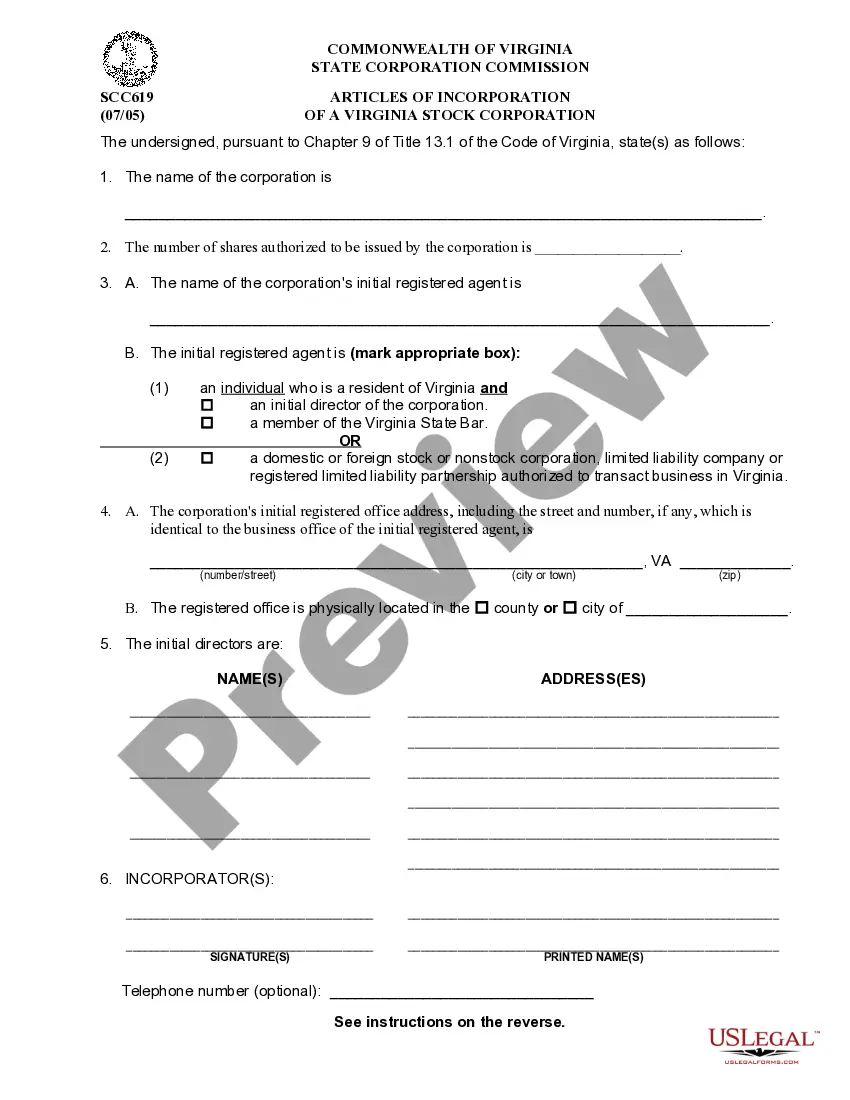

Virginia Formation Documents Use the Clerk's Information System (CIS) or complete Articles of Incorporation (Form SCC 619) and file it with the State Corporation Commission. Use CIS or complete Articles of Incorporation (Form SCC 819) and file it with the State Corporation Commission.

Articles of incorporation are filed with the Commonwealth of Virginia State Corporation Commission (SCC). Preparing and filing articles of incorporation is the first step in starting your business or nonprofit corporation.

Virginia requires companies incorporating to pay a filing fee of $25 and a charter fee.

Key takeaway: Having your LLC taxed as an S corporation can save you money on self-employment taxes. However, you will have to file an individual S-corp tax return, which means paying your CPA to file an additional form. An S-corp is also less structurally flexible than an LLC.

Virginia charges a minimum of $75 ($25 filing fee and $50 for up to 25,000 authorized shares) to file the Articles of Incorporation. Add another $50 for up to 25,000 shares (add $50 for each additional 25K of shares).