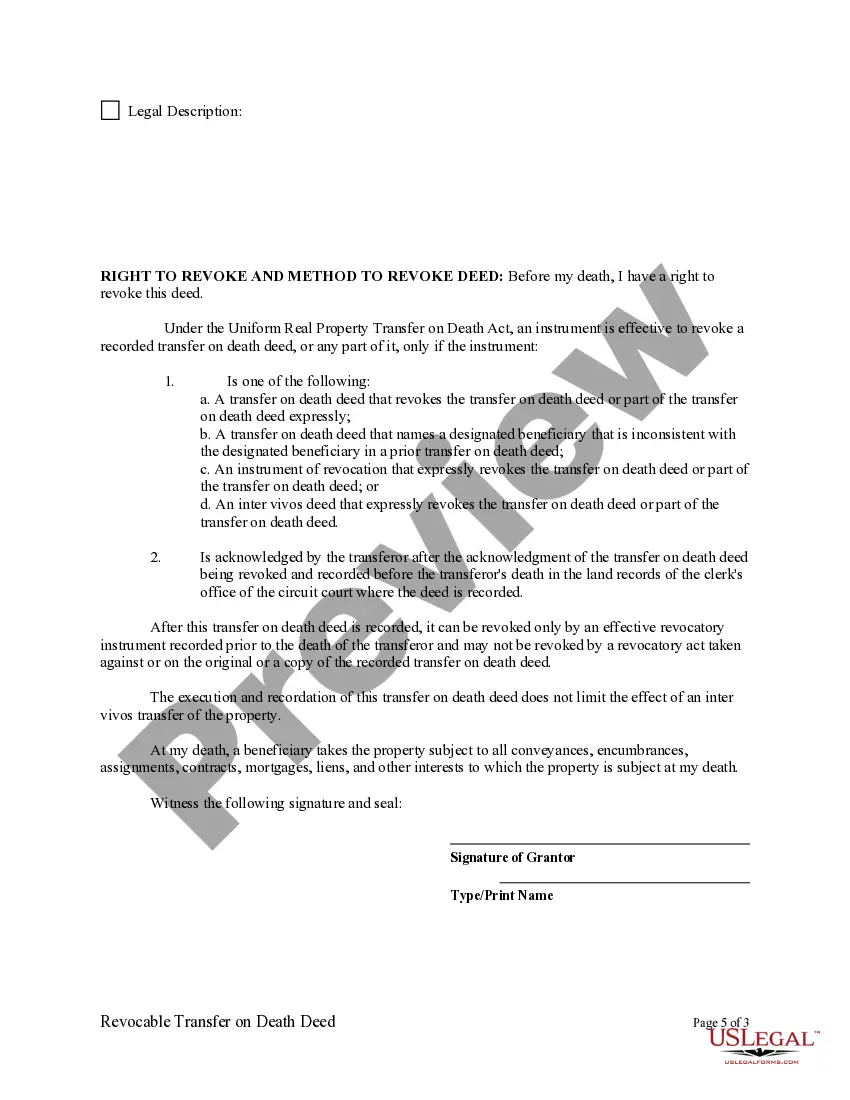

This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the primary beneficiary is an individual. Form contains an optional provision for designating an alternative beneficiary in the event the Primary Beneficiary does not survive the Transferor. This transfer is revocable by Grantor until Grantor's death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Virginia Revocable Transfer on Death Deed from Individual to Individual

Description Death Transfer Legal

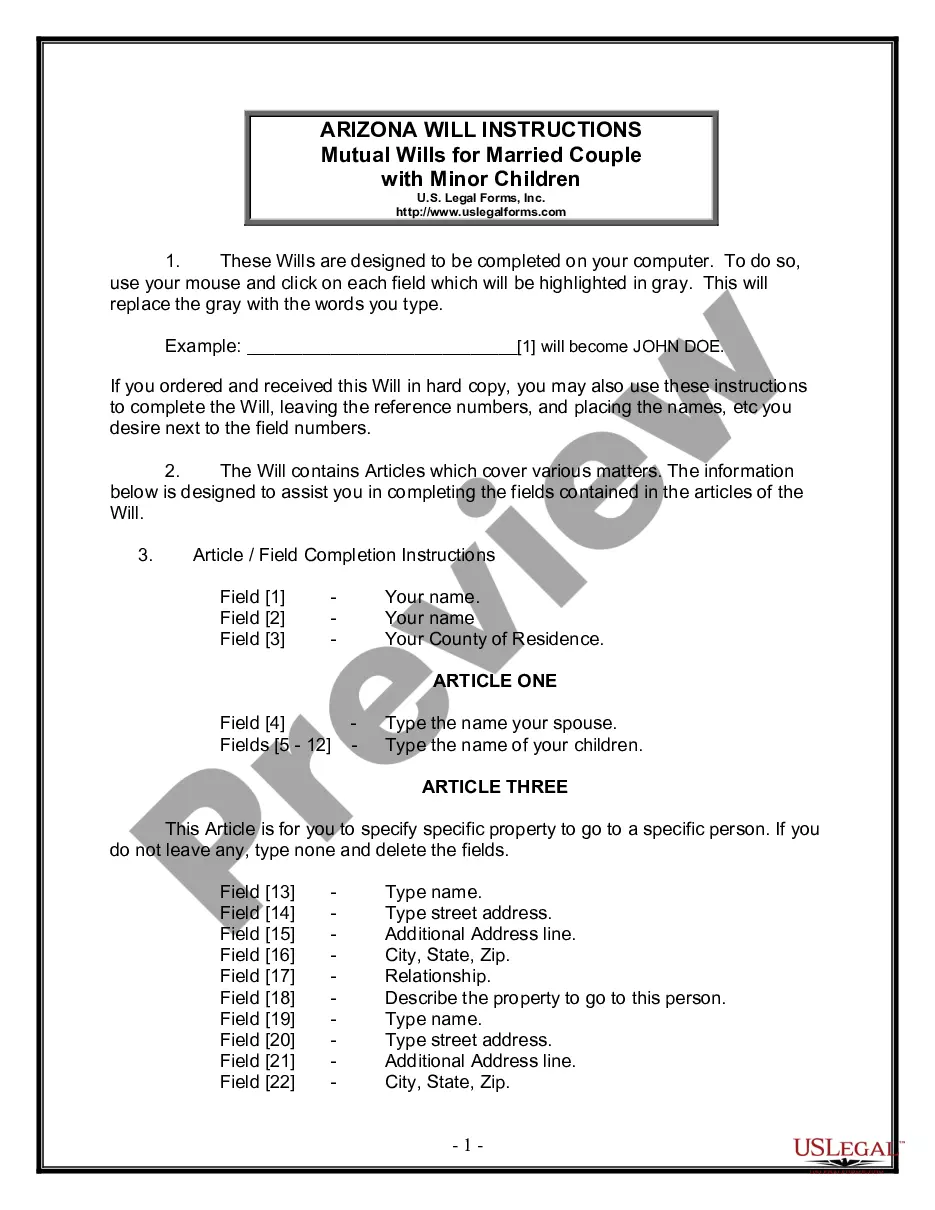

How to fill out Transfer On Death Deed Illinois?

Looking for a Virginia Revocable Transfer on Death Deed from Individual to Individual on the internet might be stressful. All too often, you find documents that you just believe are ok to use, but find out afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Get any document you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will automatically be added in to the My Forms section. In case you do not have an account, you must register and choose a subscription plan first.

Follow the step-by-step recommendations listed below to download Virginia Revocable Transfer on Death Deed from Individual to Individual from the website:

- See the form description and press Preview (if available) to verify whether the template suits your expectations or not.

- In case the document is not what you need, find others using the Search field or the provided recommendations.

- If it is appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After getting it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms catalogue. Besides professionally drafted templates, users are also supported with step-by-step guidelines on how to find, download, and complete templates.

Va Deed Form popularity

How Much Does Executor Of Estate Get Paid Other Form Names

Executor Of Estate Virginia FAQ

Because transfer-on-death beneficiary deeds do not become effective until you pass away, someone can challenge the validity of the deed after you die.Or, beneficiaries and family members can sue each other to take the property entirely. In this case, a court proceeding may be required to resolve the issue.

Do assets in a TOD account receive a step up (or step down) in cost basis when the account owner dies? Yes. Securities held in TOD accounts receive a new cost basis as of the account owner's date of death using the same income tax rules that apply at the death of an individual.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Virginia allows you to leave real estate with transfer-on-death deeds, also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process. A transfer on death deed can be a helpful estate planning tool but it is not permitted in every state.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Virginia's statutory transfer on death deed became effective on July 1, 2013. These deeds are governed by the Uniform Real Property Transfer on Death Act (URPTODA), which is incorporated into the Virginia statutes at 64.2-621 et seq.