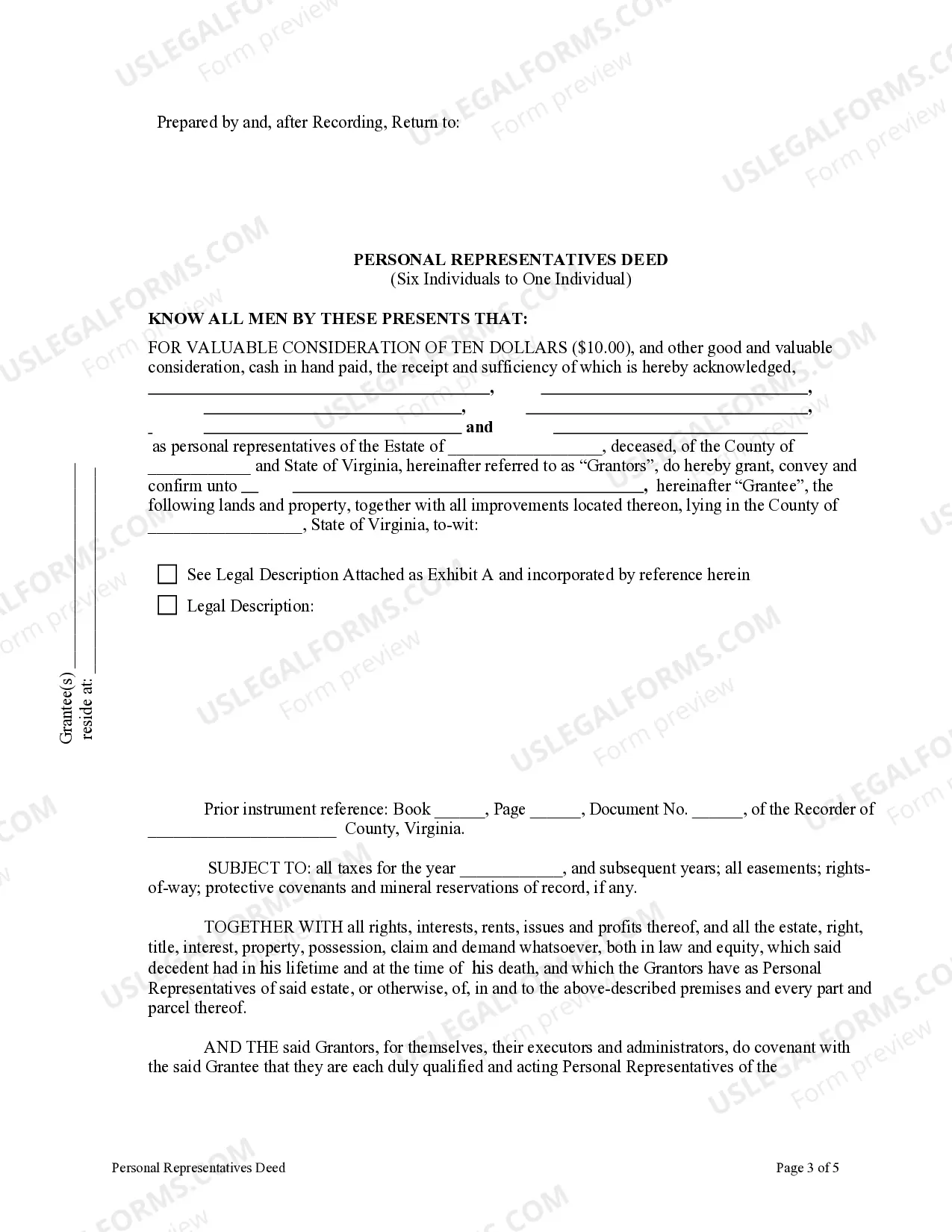

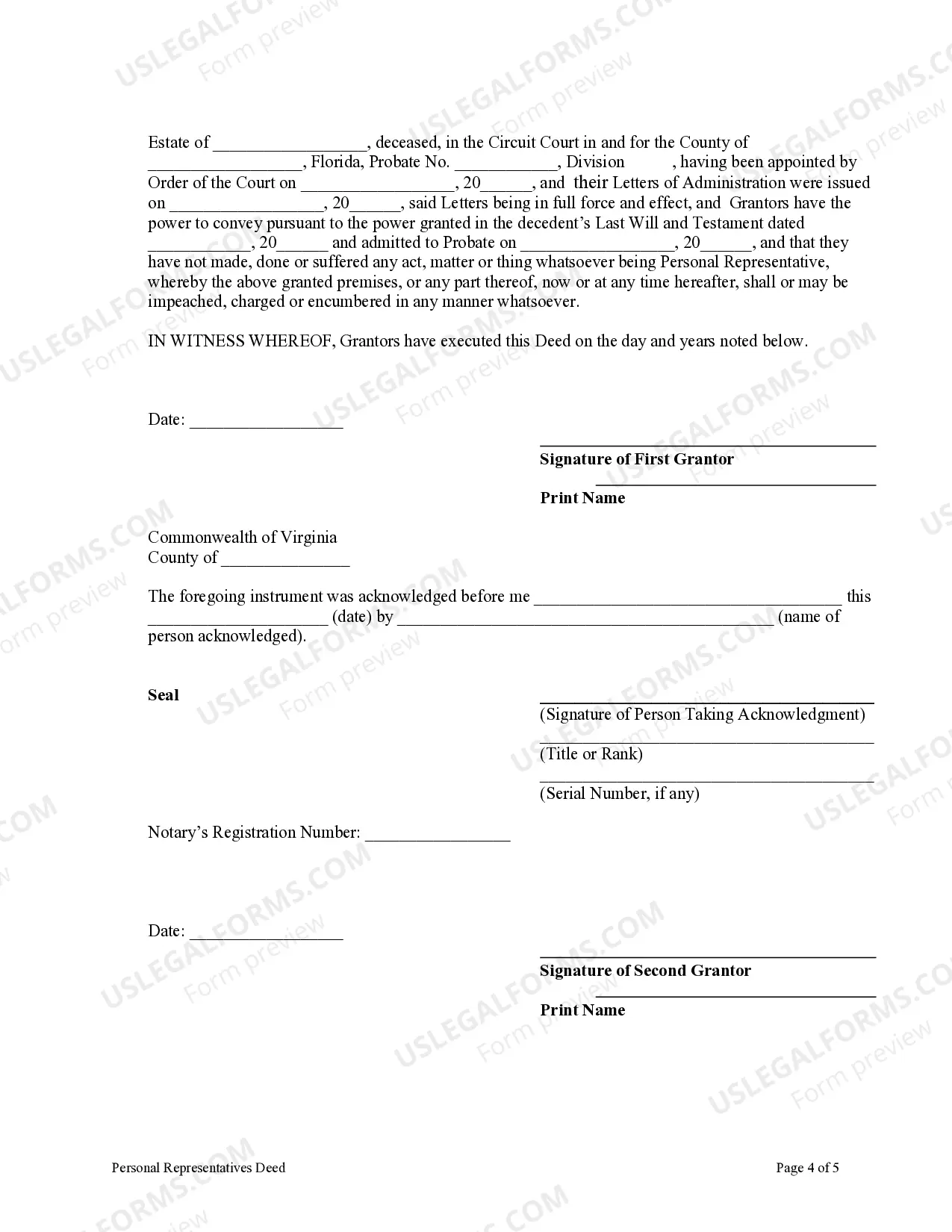

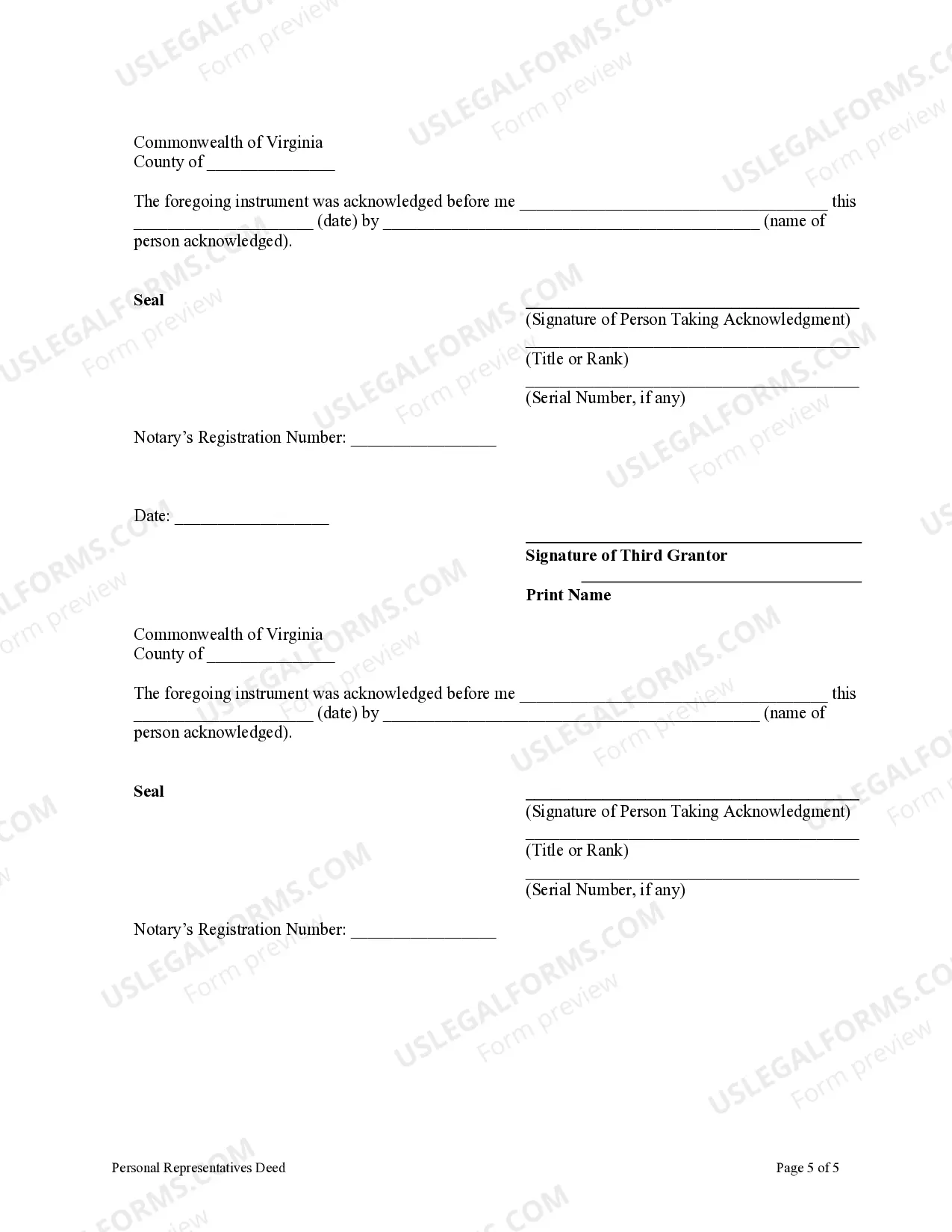

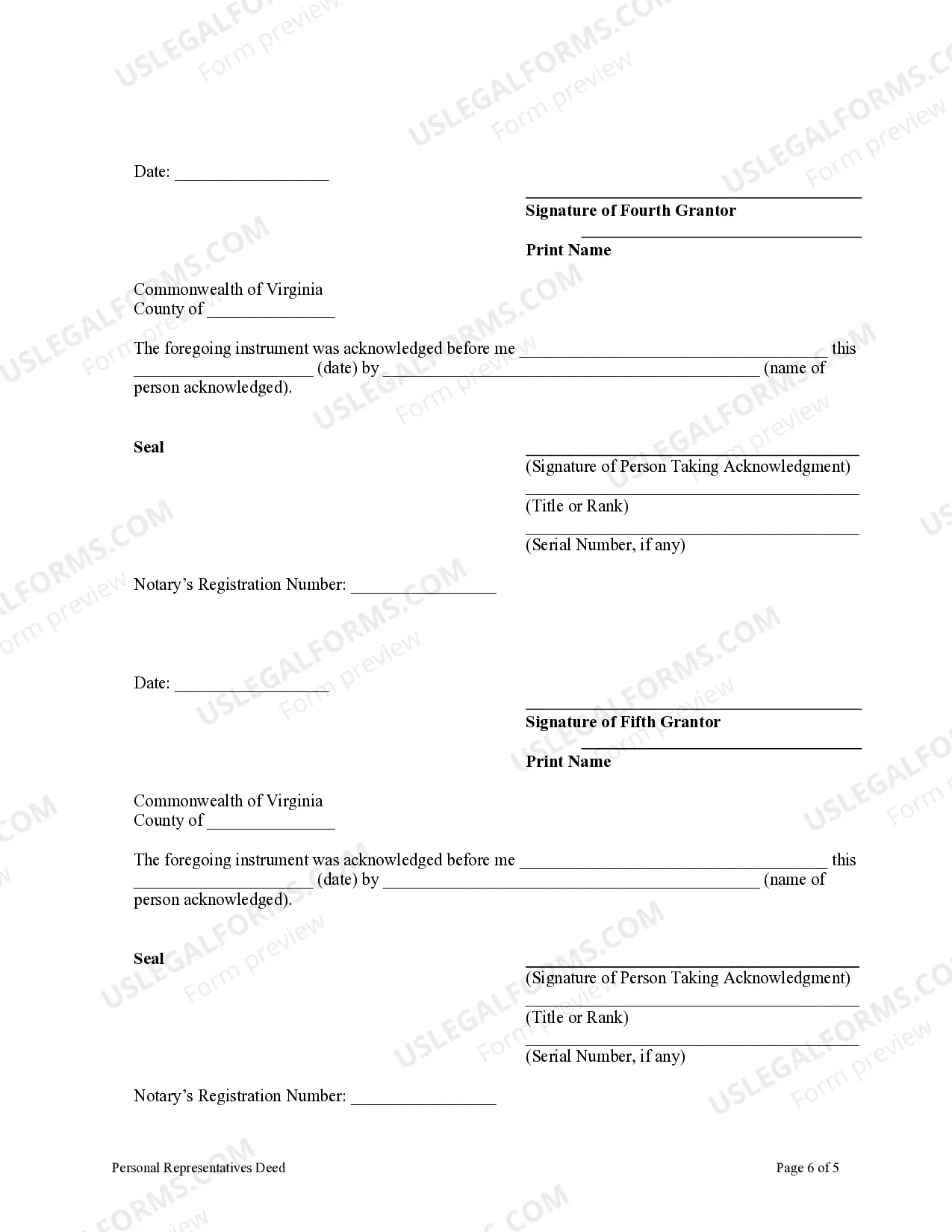

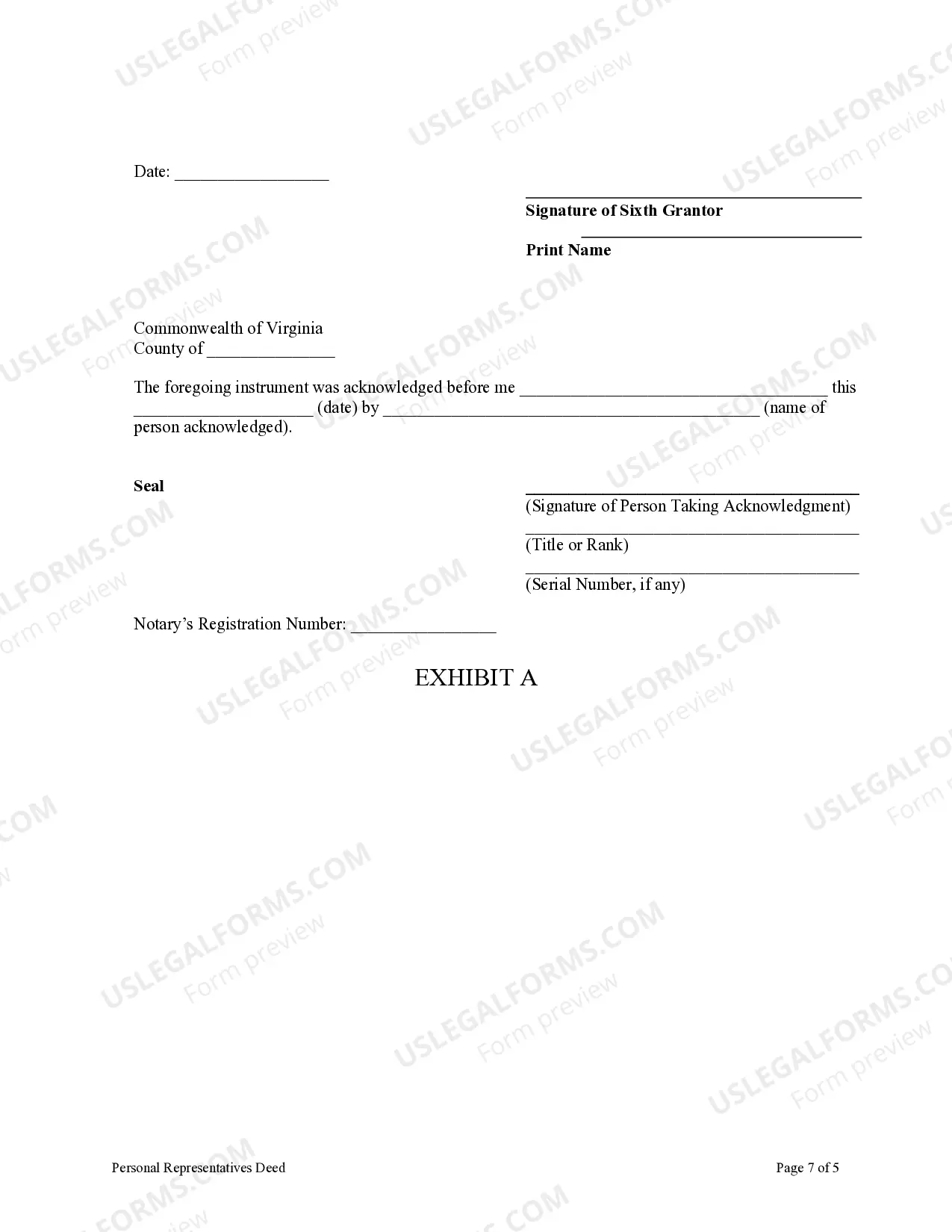

This form is a Personal Representatives Deed where the Grantors are the individuals appointed as Personal Represenatives of the decedent's estate and the Grantee is an individual. Grantors convey the described property to Grantee and covenants that the transfer is authorized by the Court and that the Grantors have done nothing while serving as Personal Represenatives to burden or encumber the real property. This deed complies with all state statutory laws.

Virginia Personal Representatives Deed - Six Individuals to One Individual

Description Personal Representatives Form

How to fill out Va Representatives Form?

Searching for a Virginia Personal Representatives Deed - Six Individuals to One Individual on the internet might be stressful. All too often, you find papers that you think are ok to use, but find out afterwards they’re not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Get any form you are looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be added to your My Forms section. In case you don’t have an account, you should sign up and pick a subscription plan first.

Follow the step-by-step instructions below to download Virginia Personal Representatives Deed - Six Individuals to One Individual from the website:

- See the form description and press Preview (if available) to check if the template suits your requirements or not.

- If the document is not what you need, find others with the help of Search field or the provided recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted samples, users may also be supported with step-by-step instructions regarding how to find, download, and fill out templates.

Personal Representative Deed Form popularity

Personal Deed Form Other Form Names

Virginia Deed Form FAQ

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

The Virginia small estate affidavit may be used when a decedent has $50,000 or less in probatable assets. It provides a quicker way to settle an estate by a successor when the estate is small. This form may not be used until at least 60 days have passed since the date of death of the decedent.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.