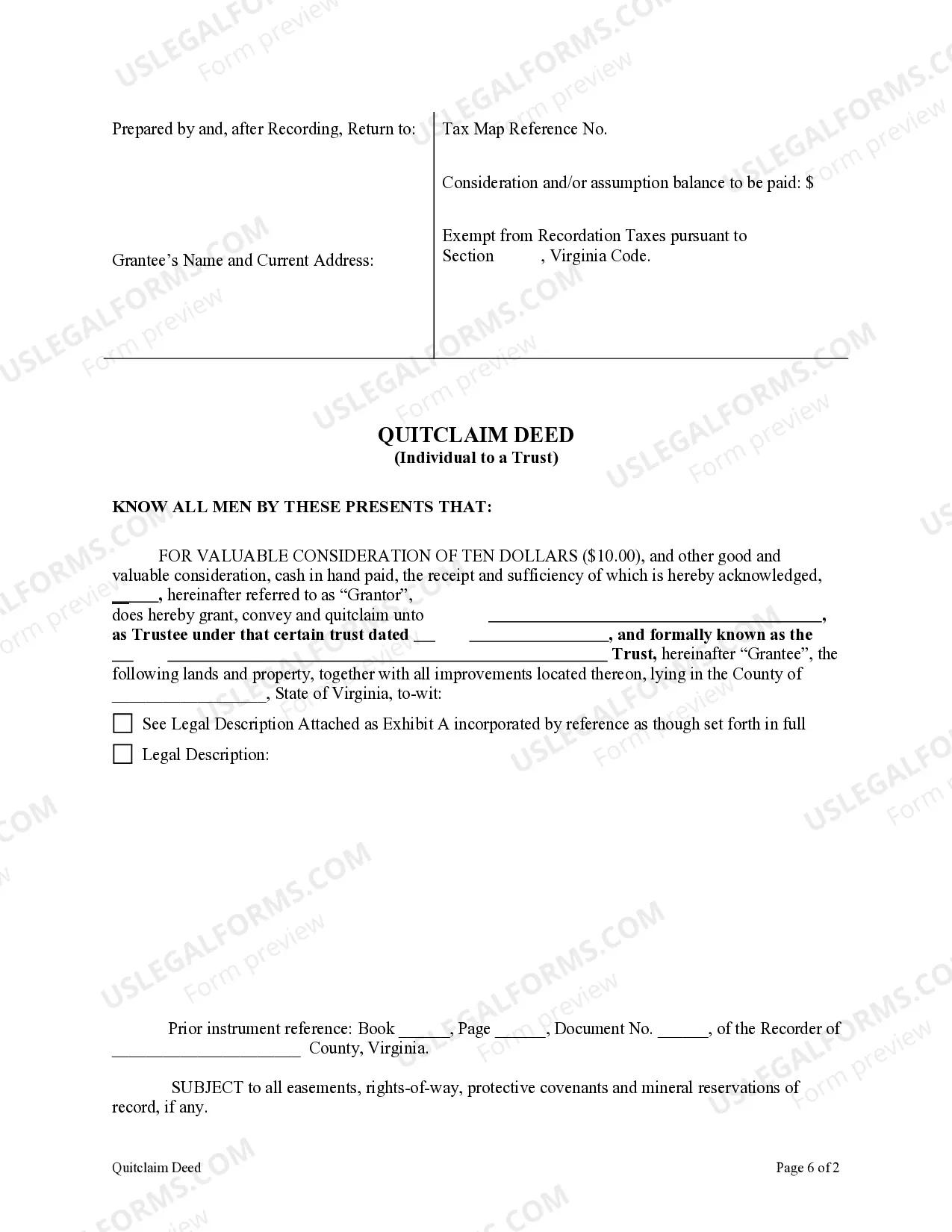

Virginia Quitclaim Deed - Individual to a Trust

What this document covers

The Quitclaim Deed - Individual to a Trust is a legal document that allows an individual (the Grantor) to transfer their interest in real property to a trust (the Grantee). Unlike other types of deeds, a quitclaim deed does not guarantee that the property title is clear, but it effectively transfers whatever interest the Grantor has. This form is commonly used for estate planning purposes and simplifies the process of placing property within a trust, allowing for easier management and distribution of assets after death.

What’s included in this form

- Identifying details of the Grantor and Grantee, including full names and addresses.

- Description of the property being conveyed, including its legal description and address.

- Statement of the intent to convey that specifies the terms of the quitclaim transfer.

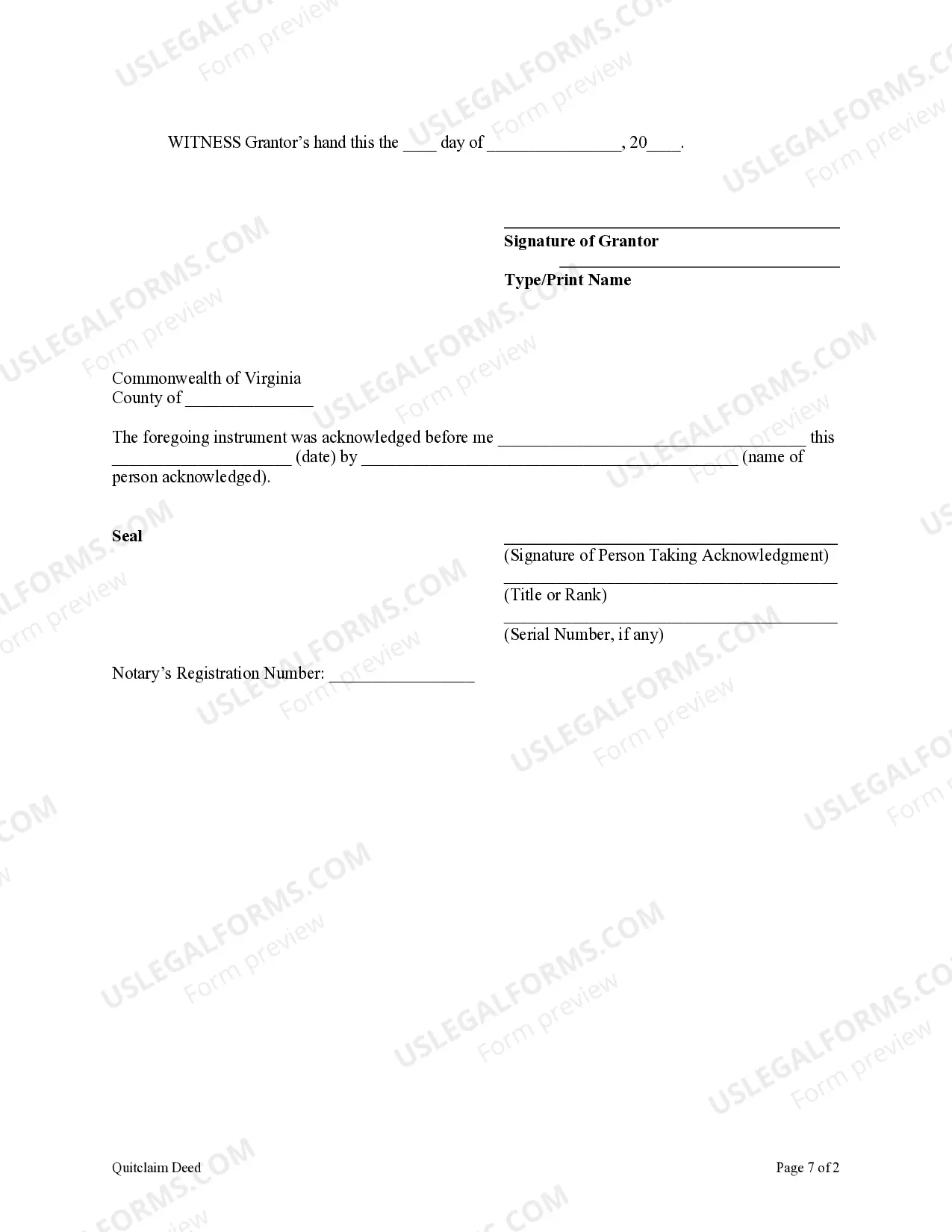

- Signature lines for the Grantor and a notary public for validation.

- Space for indicating the date of the transaction and any pertinent attachments.

Situations where this form applies

This form is appropriate when an individual wishes to transfer real property into a trust, especially for estate planning purposes. It is beneficial in situations where the Grantor wants to ensure that the trust holds title to the property, simplifying inheritance issues and providing for clearer management during the Grantor's lifetime. Additionally, it may be used for transferring property to a trust upon the Grantor's passing to avoid probate.

Who can use this document

- Individuals looking to place their property into a trust for estate planning.

- Grantors who wish to simplify the transfer of property to their heirs.

- Trustees who are managing an estate and require a clear title to trust assets.

- Anyone wishing to legally document the transfer of property to a trust without needing a warranty deed.

How to prepare this document

- Identify the parties involved by entering the full names and addresses of the Grantor and Grantee.

- Specify the property being transferred by including a detailed legal description and the property address.

- State the intent to convey, ensuring clarity around the transfer of interest.

- Have the Grantor sign and date the document in the appropriate sections.

- Provide a space for notarization to confirm the validity of the signatures.

Notarization guidance

Yes, this form must be notarized to be legally valid. Notarization provides an assurance that the signatures on the document have been verified by a neutral third party. Using US Legal Forms' integrated online notarization service, you can complete this step easily through a secure video call, available 24/7, without the need for in-person visits.

Mistakes to watch out for

- Failing to include a complete legal description of the property.

- Not properly signing the form or neglecting to have it notarized.

- Using incorrect or outdated information regarding the Grantor or Grantee.

- Overlooking state-specific recording requirements after completing the form.

Benefits of completing this form online

- Quick and convenient access to legal forms tailored to your needs.

- Editability allows for easy customization to fit specific legal situations.

- Reliability of professionally drafted templates ensures compliance with applicable laws.

Form popularity

FAQ

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Virginia Requirements for Quit Claim Deeds A legal description of the property must be included, and there should be a statement regarding how the grantor came to be in possession of the property. The deed should be notarized both parties must sign the deed in the presence of a notary public, who will also sign it.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.