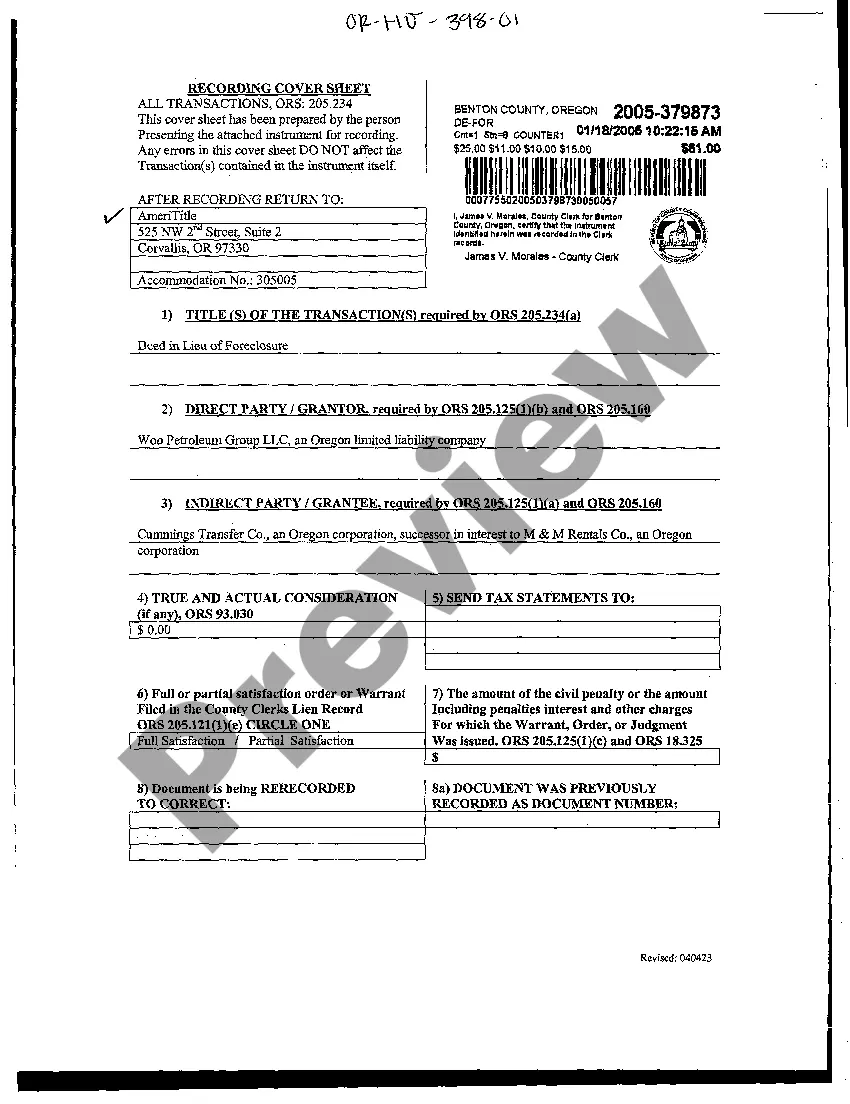

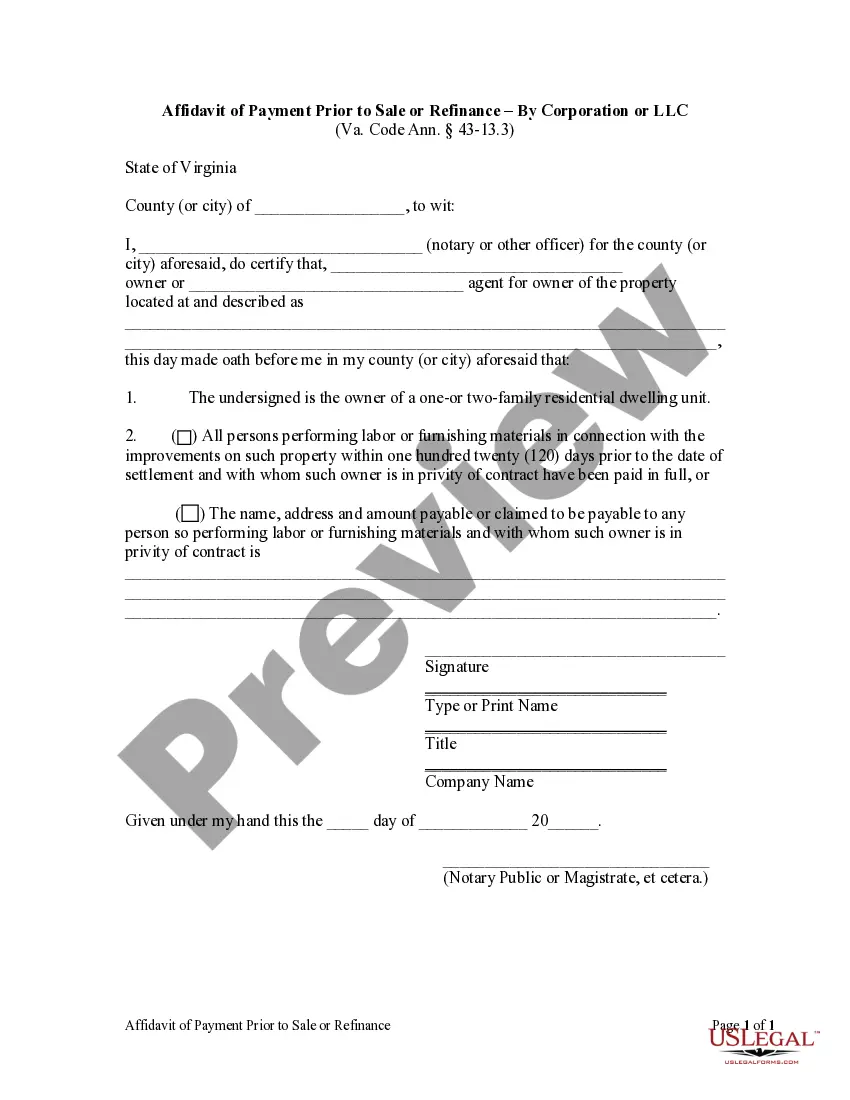

Any person who is the owner of a one-family or two-family residential dwelling unit not included within the scope of § 43-13.2 shall, at the time of settlement on the sale of such property, provide the purchaser, or lender in the case of a permanent loan or refinance, with an affidavit stating either (i) that all persons performing labor or furnishing materials in connection with any improvements on such property within 120 days prior to the date of settlement and with whom such owner is in privity of contract have been paid in full, or (ii) the name, address and amount payable or claimed to be payable to any person so performing labor or furnishing materials and with whom such owner is in privity of contract.

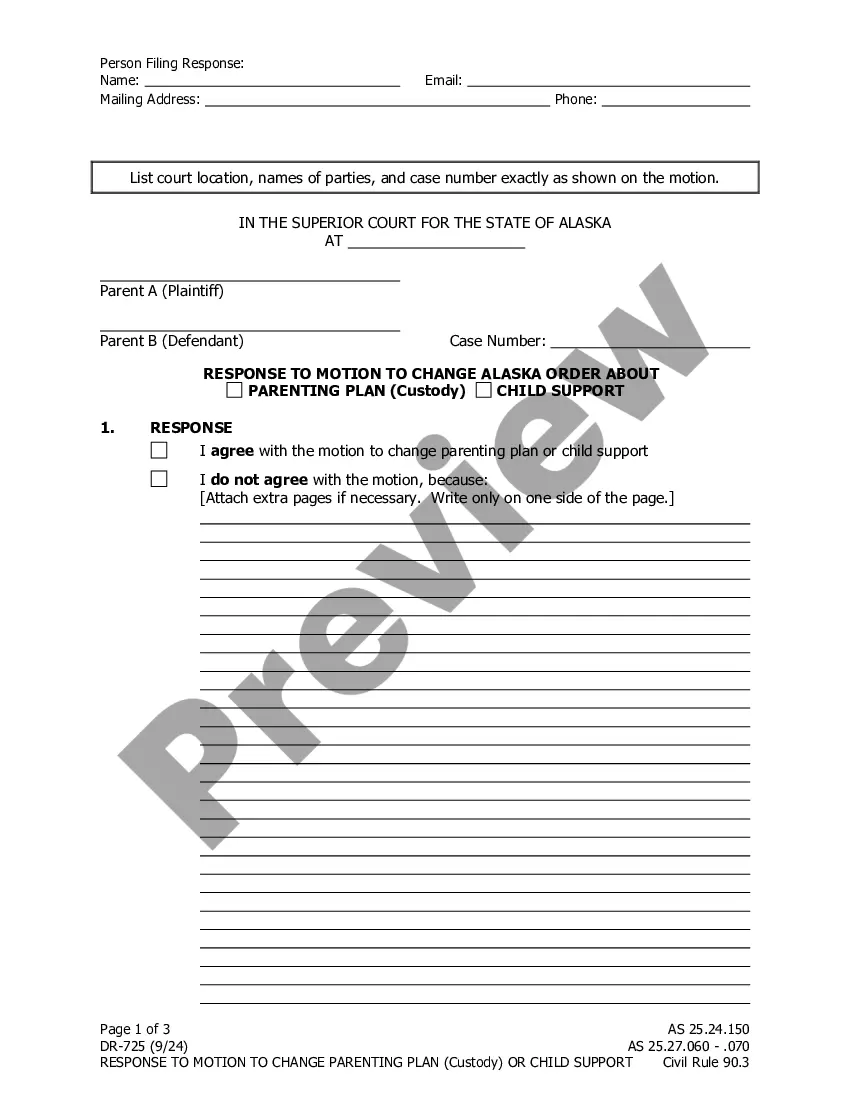

Virginia Affidavit of Payment Prior to Sale or Refinance - Corporation

Description Affidavit Refinance

How to fill out Virginia Affidavit Of Payment Prior To Sale Or Refinance - Corporation?

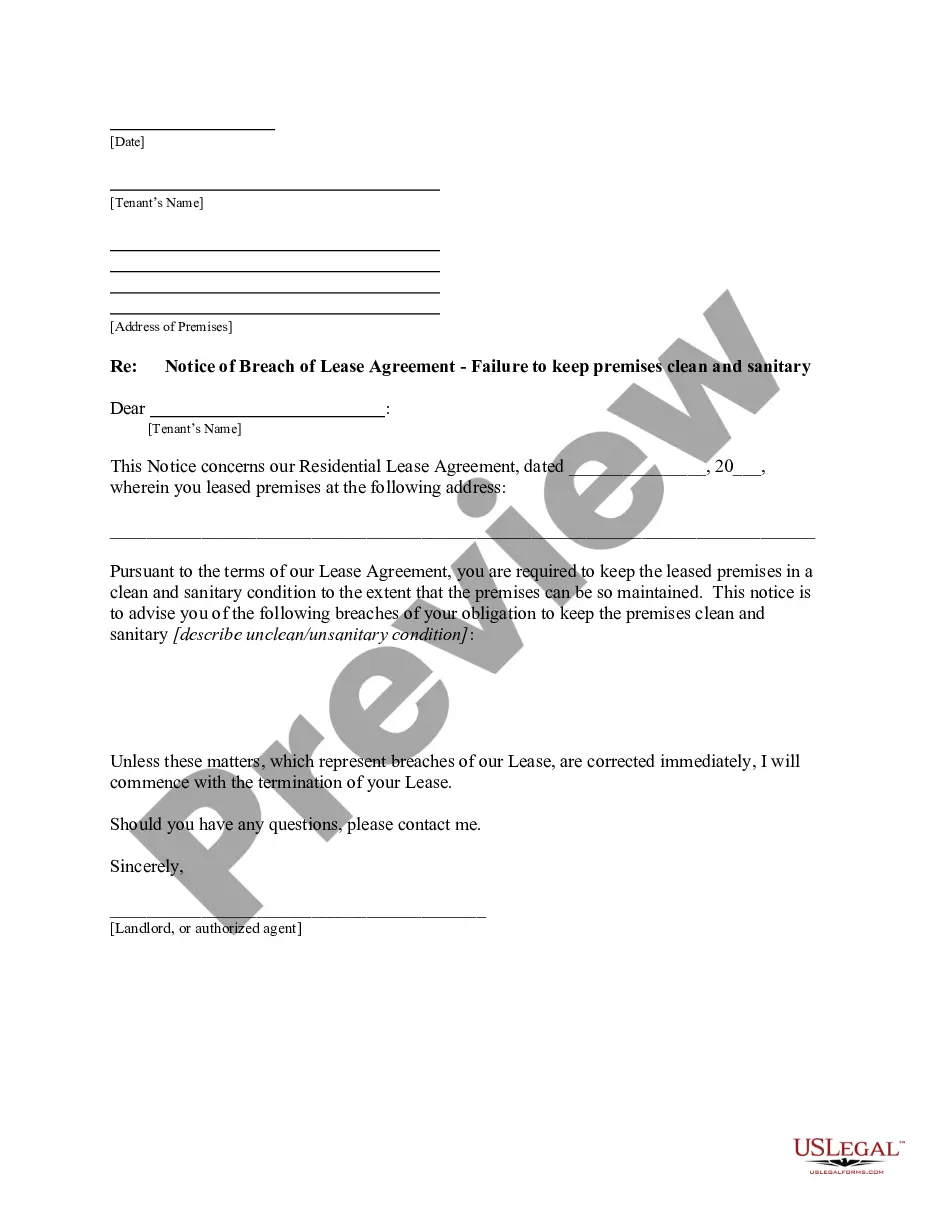

Searching for a Virginia Affidavit of Payment Prior to Sale or Refinance - Corporation or LLC on the internet might be stressful. All too often, you find documents that you just believe are fine to use, but find out later on they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Get any document you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be included in your My Forms section. If you don’t have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Affidavit of Payment Prior to Sale or Refinance - Corporation or LLC from our website:

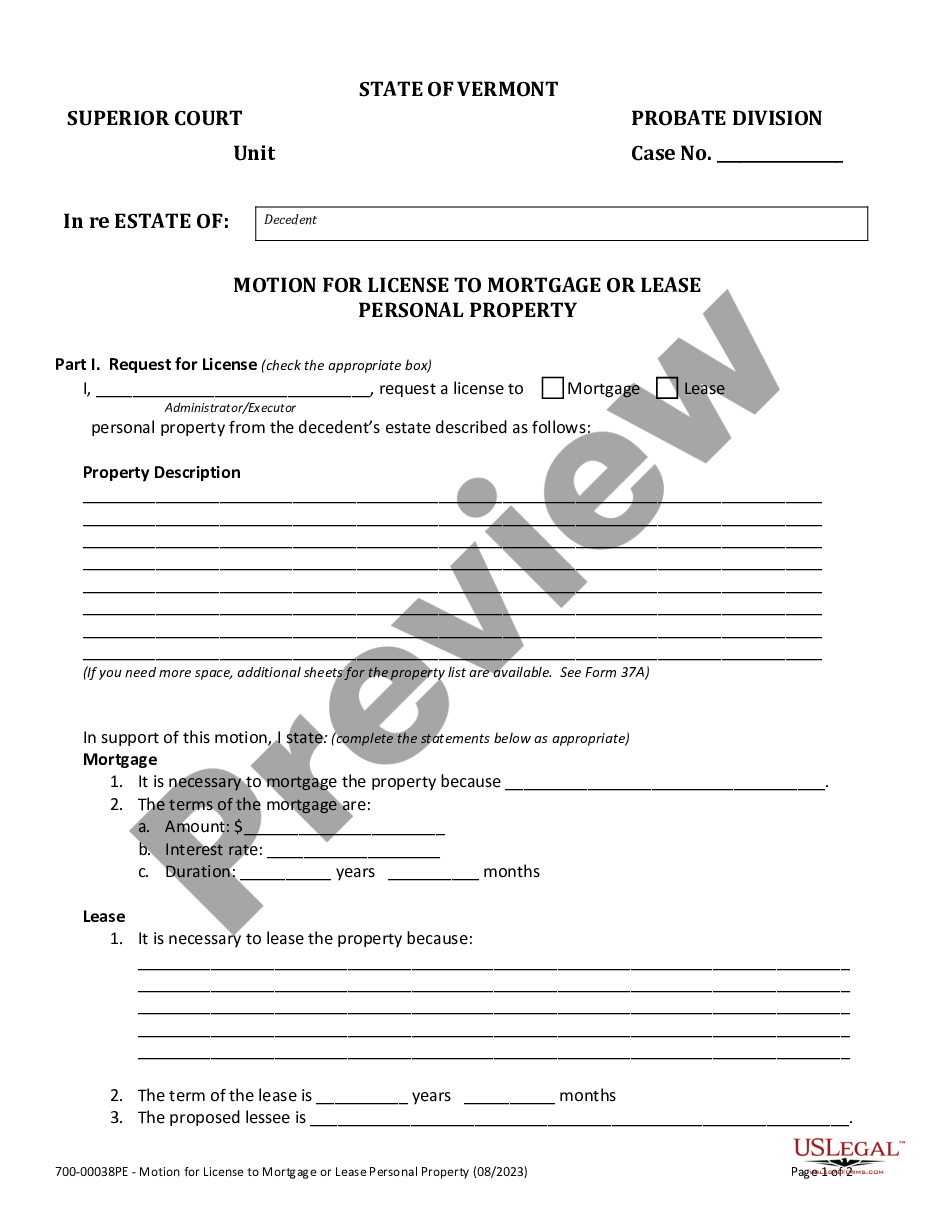

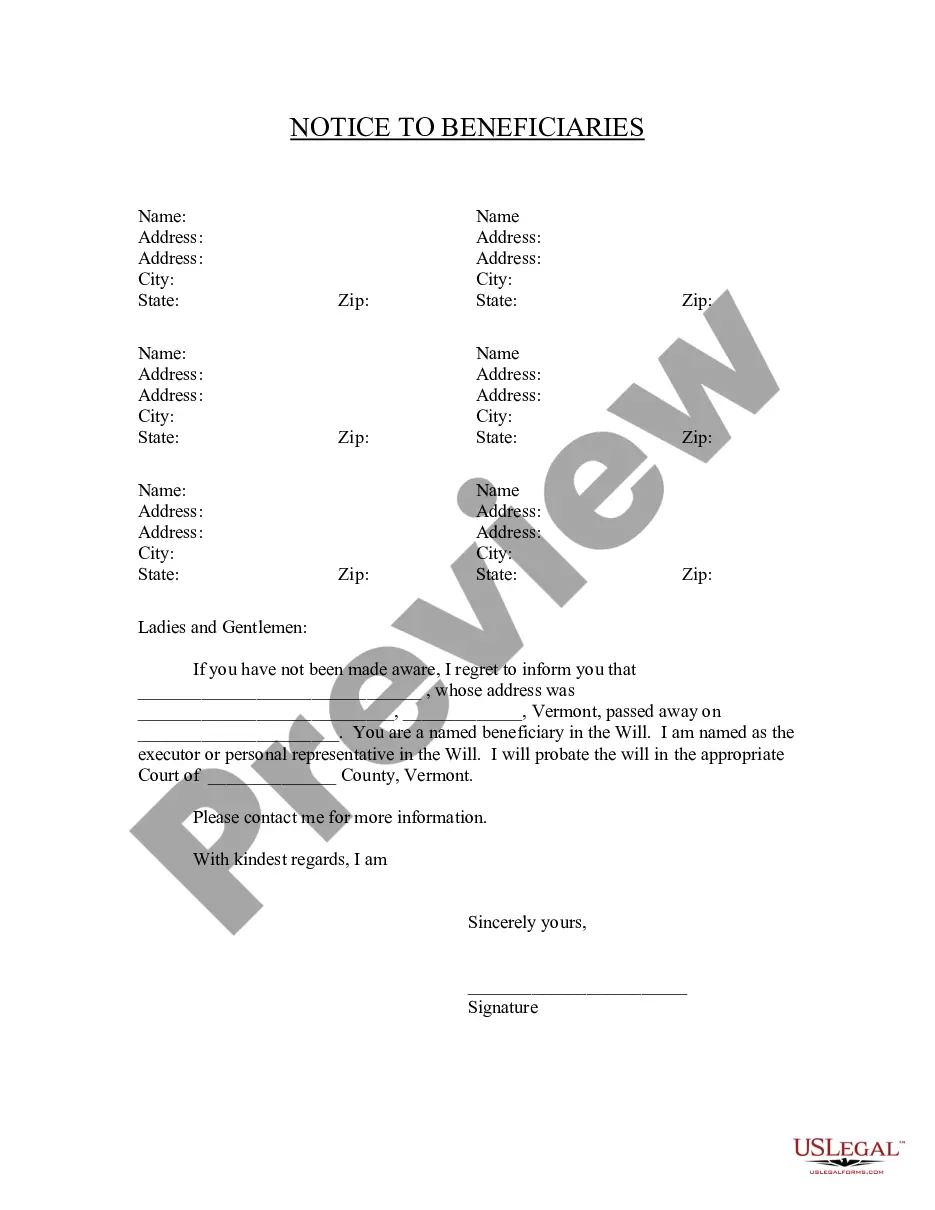

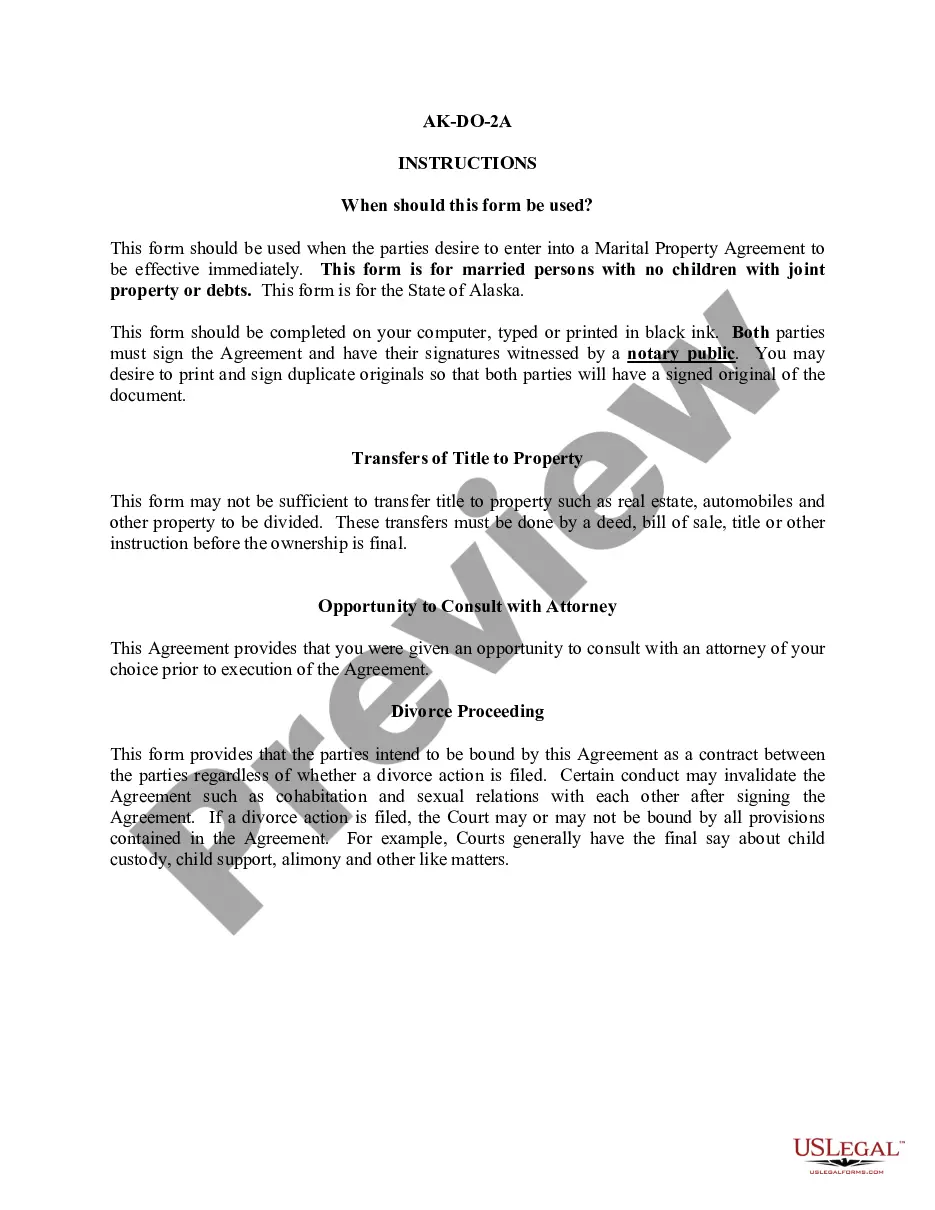

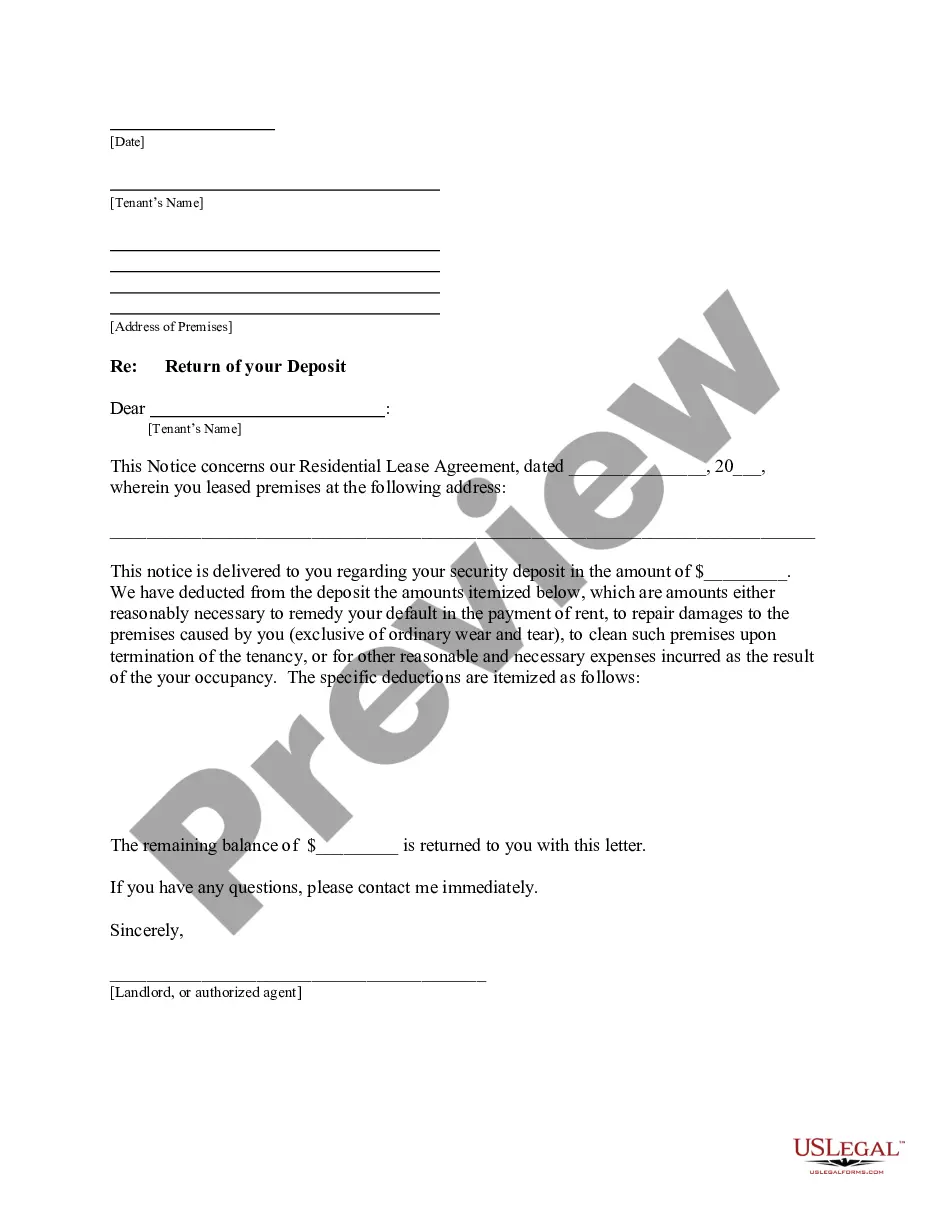

- See the document description and hit Preview (if available) to check whether the form meets your requirements or not.

- In case the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal forms from our US Legal Forms library. Besides professionally drafted templates, customers can also be supported with step-by-step instructions on how to get, download, and fill out forms.

Virginia Payment Sale Form popularity

Va Sale Form Other Form Names

FAQ

Generally, the lender sends the documents to be recorded after the closing. The recording fees are included in your closing costs. Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded.

Do You Get a New Title When You Refinance?Usually, you will not be issued a new title at the end of the process. An owner's policy is only brought at the original closing. For each separate loan transaction, only a loan policy is purchased.

Mortgage refinancing is not always the best idea, even when mortgage rates are low and friends and colleagues are talking about who snagged the lowest interest rate. This is because refinancing a mortgage can be time-consuming, expensive at closing, and will result in the lender pulling your credit score.

The refinancing lender provides a new deed of trust containing the terms of the new loan. A new trustee also is designated.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

Can I refinance a property without being on the title/deed? You can NOT refinance a property you don't own. you will need to be on the note or deed to refinance and show that you have been the person making the mortgage payment, but if you are not on the deed or the note then no you are not able to refinance a home.

Title Insurance and Refinancing Your Home For homeowners considering a refinance, you'll need to purchase lender's title insurance, as lenders won't fund your mortgage without it. Choosing to purchase an owner's title insurance policy is optional.

Yes, you can get a mortgage in your name only even if you are married. Your married partner may still have a claim on the property even if their name is not in the mortgage or title deeds.

1. Pay Stubs. When applying for a home loan refinance, your lender will need proof of income. Lenders want to ensure that you have the financial means to pay off your new mortgage, as well as any other long-term debts (such as car loans) or other living expenses.