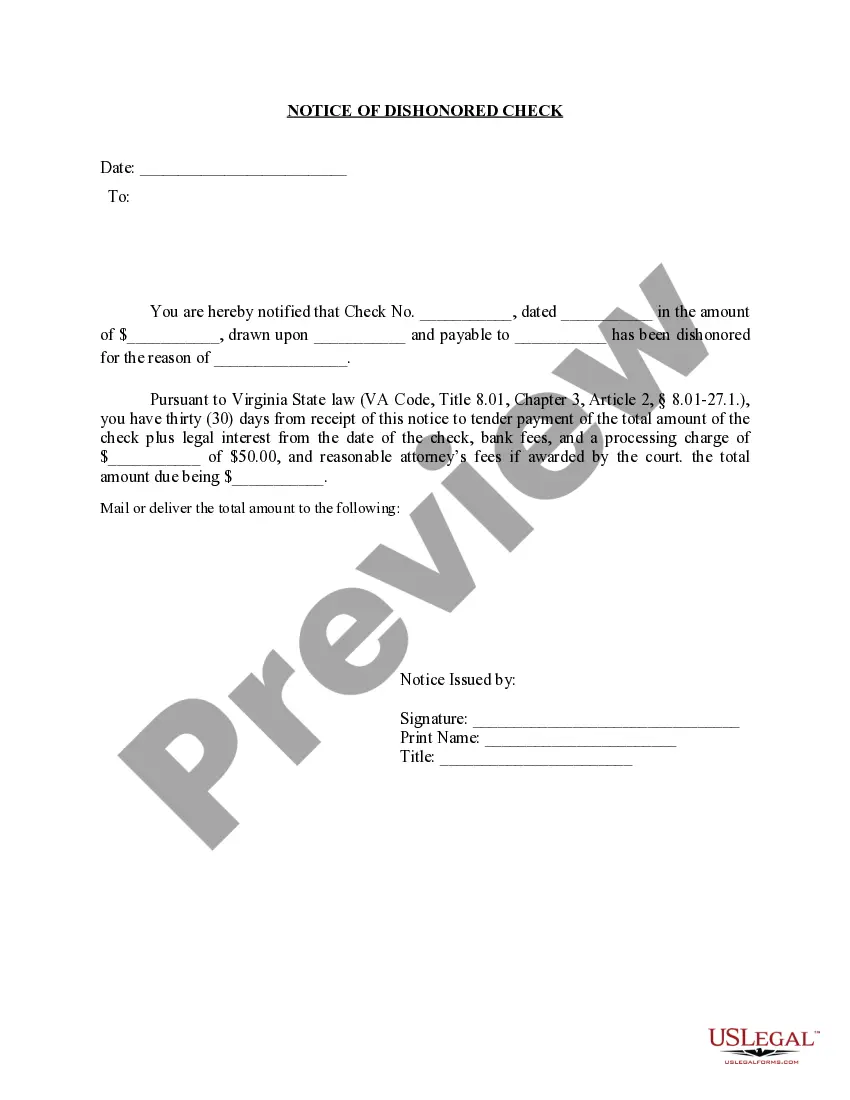

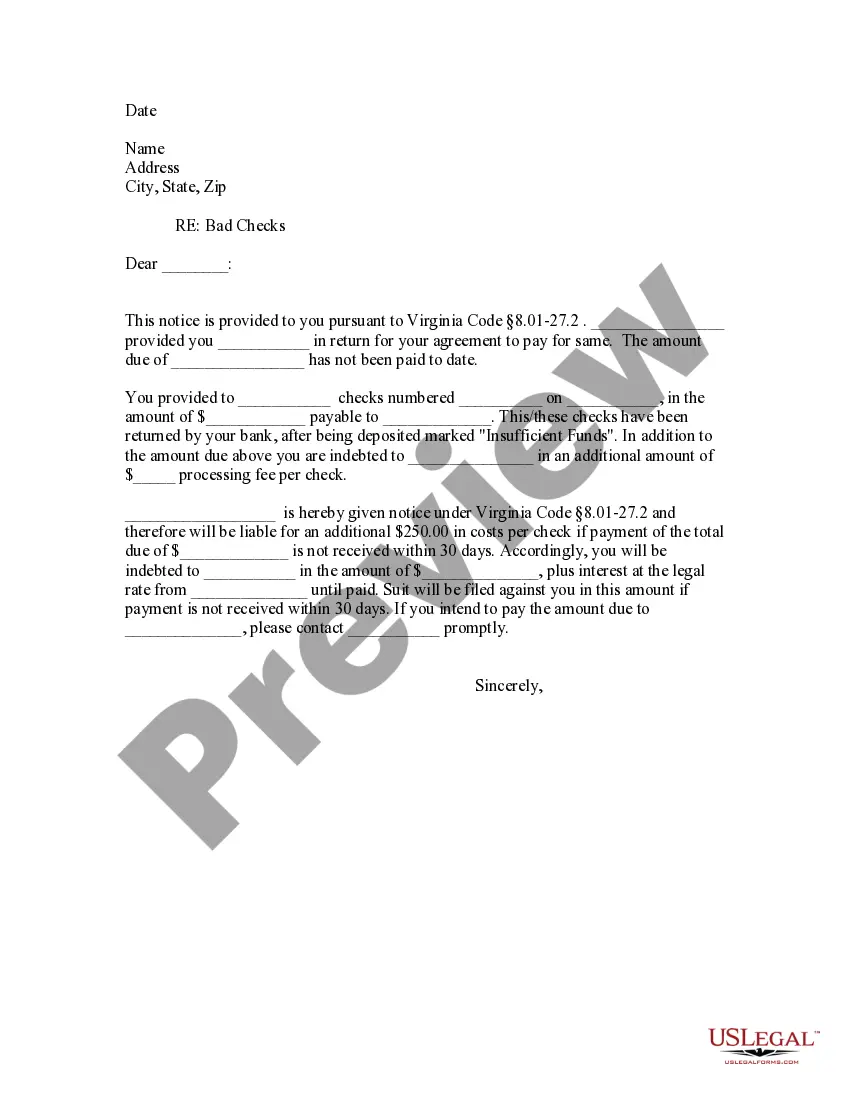

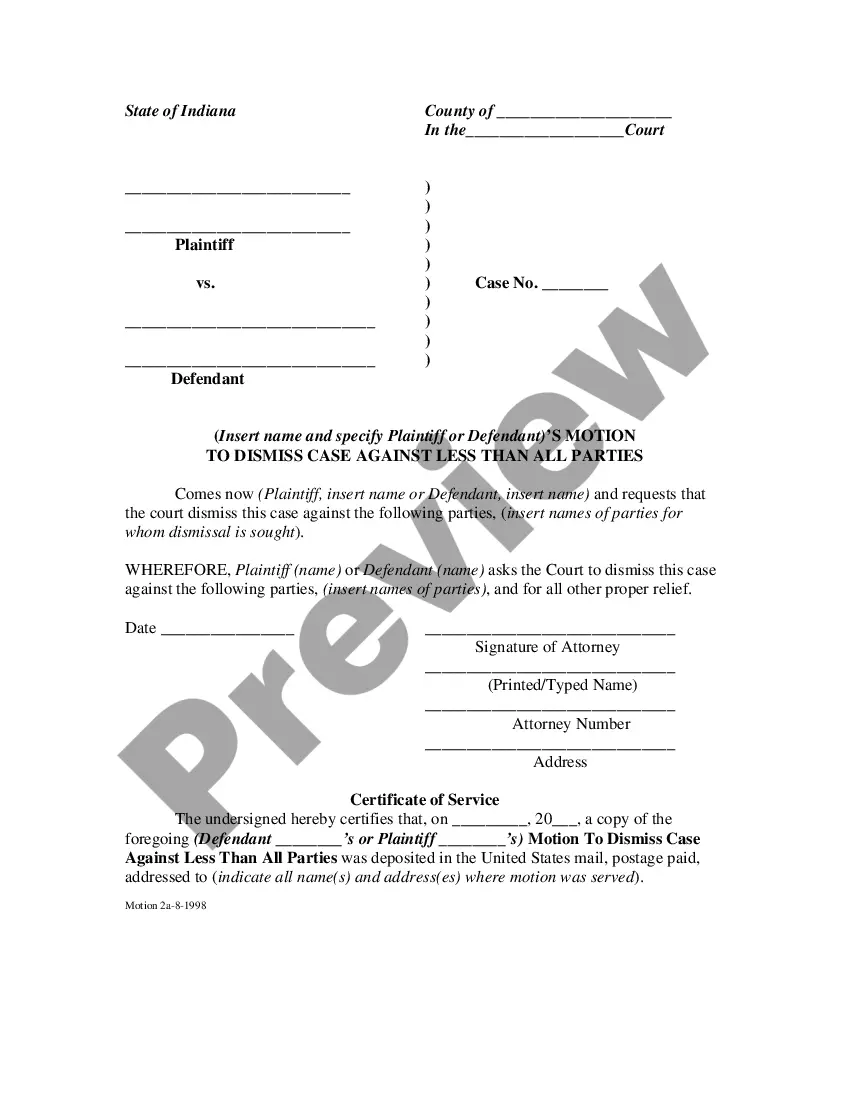

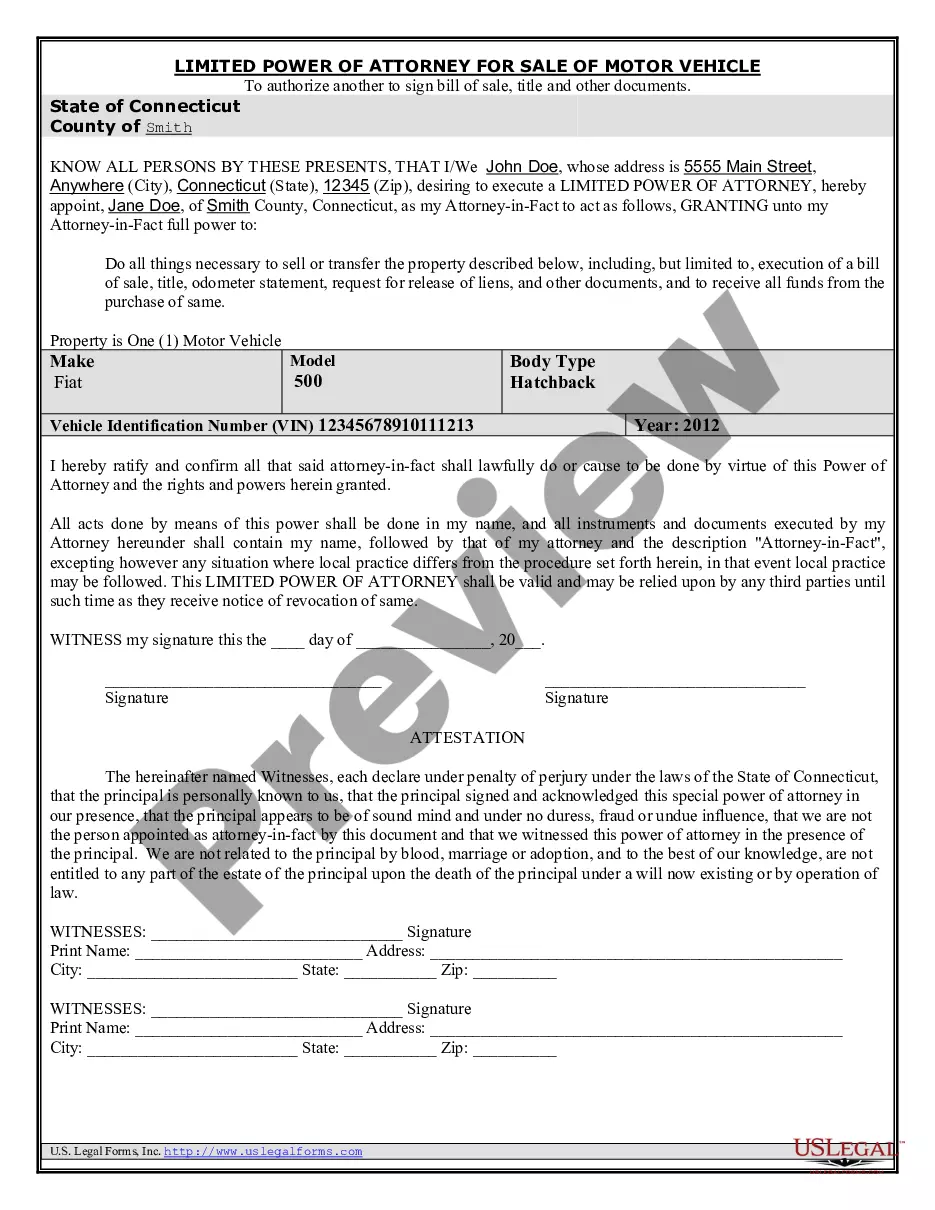

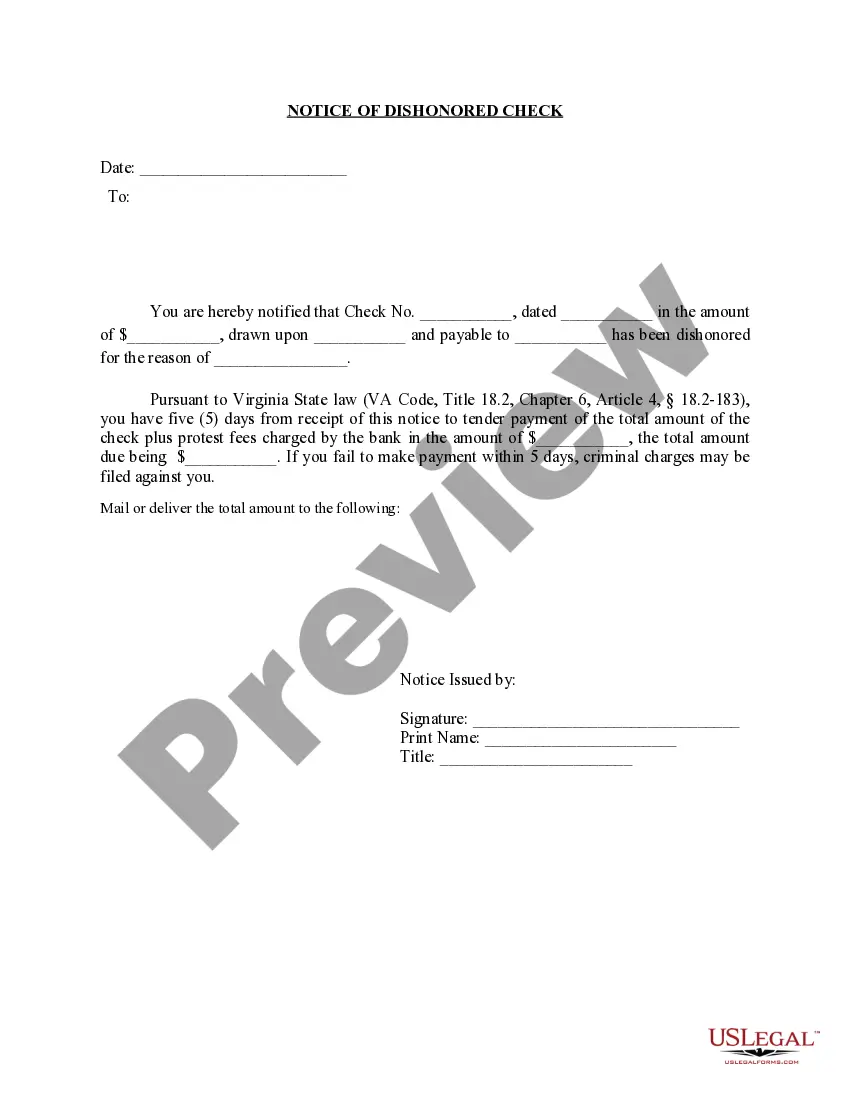

This is a Complaint - Warrant for Dishonored Check - Criminal. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Virginia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description Va Dishonored Criminal

How to fill out Notice Bad Form?

Looking for a Virginia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check on the internet might be stressful. All too often, you find documents which you think are fine to use, but discover afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any form you are searching for in minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included to the My Forms section. If you do not have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check from the website:

- See the document description and hit Preview (if available) to verify if the template meets your expectations or not.

- In case the form is not what you need, get others with the help of Search engine or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms library. Besides professionally drafted templates, users can also be supported with step-by-step guidelines concerning how to find, download, and fill out forms.

Notice Civil Form Form popularity

Va Notice Issuer Other Form Names

Va Dishonored Issuer FAQ

A stop payment on a check is when you ask your bank to cancel a check before it is processed. After you request a stop payment, the bank will flag the check you specified, and if anyone tries to cash it or deposit it, they'll be rejected.

A stop payment on a check is when you ask your bank to cancel a check before it is processed. After you request a stop payment, the bank will flag the check you specified, and if anyone tries to cash it or deposit it, they'll be rejected.

Give your bank a "stop payment order" Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Some merchants may need to have the transaction go through and refund you, anyway. Failing that, you'll need to wait for the transaction to go through and try to lodge a dispute - if you're able to - in order to reclaim the funds. You can not stop the pending debit card transaction.

Payment history is the most important ingredient in credit scoring, and even one missed payment can have a negative impact on your score.Payment history accounts for 35% of your FICO®Score2609 , the credit score used by most lenders.

A stop payment is a request for a bank to stop a check or recurring debit payment that's waiting to be processed. Stop payment requests can only be made by the account holder who sent the original payment, and must be made before the check or payment has been processed.

The first is that stopping payments on your account only makes things worse. It starts a process that can put you deeper in debt, wreck your credit, cause you more stress and negatively affect you for years to come.

Depending on the bank, stop payment orders typically expire after six to 12 months, although many banks allow you to renew a stop payment order if the check is still outstanding. If your bank charges a stopped check fee, they may also charge a fee to renew the stop payment order.

A pending transaction can only be cancelled if the merchant provides us with a pre-authorisation release confirming they have no intention to debit the restricted funds.If you believe a pending transaction is unauthorised, once the funds have debited from your account, we can help you dispute the transaction.