Virginia Procedure for Release of Funds Held Under Garnishment (2 Exhibits) is a state law that specifies how to process the release of funds that have been held under garnishment. This procedure applies to any garnishment of wages, salaries, or other remuneration paid by a Virginia employer or by the Commonwealth of Virginia, its departments, agencies, and political subdivisions. The procedure involves two exhibits: Exhibit A and Exhibit B. Exhibit A outlines the requirements for the release of funds under garnishment. It includes information on the filing of the release form with the court, the amount of money to be released, the way the funds should be released, the time frame for the release of funds, and the requirements for the employer to provide notice to the employee of the release. Exhibit B outlines the requirements for the garnishee to provide notice to the court, the defendant, and the garnish or regarding the release of funds. It also includes information on the garnishee's duties in issuing the release, the time frame for providing the release, and the requirements for the garnishee to provide the court with proof of service. The Virginia Procedure for Release of Funds Held Under Garnishment (2 Exhibits) is a necessary step for Virginia employers and garnishees to ensure that the garnishment process is conducted legally and in compliance with state law.

Virginia Procedure for Release of Funds Held Under Garnishment (2 Exhibits)

Description

How to fill out Virginia Procedure For Release Of Funds Held Under Garnishment (2 Exhibits)?

If you’re looking for a way to appropriately complete the Virginia Procedure for Release of Funds Held Under Garnishment (2 Exhibits) without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of documentation you find on our web service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Follow these simple instructions on how to get the ready-to-use Virginia Procedure for Release of Funds Held Under Garnishment (2 Exhibits):

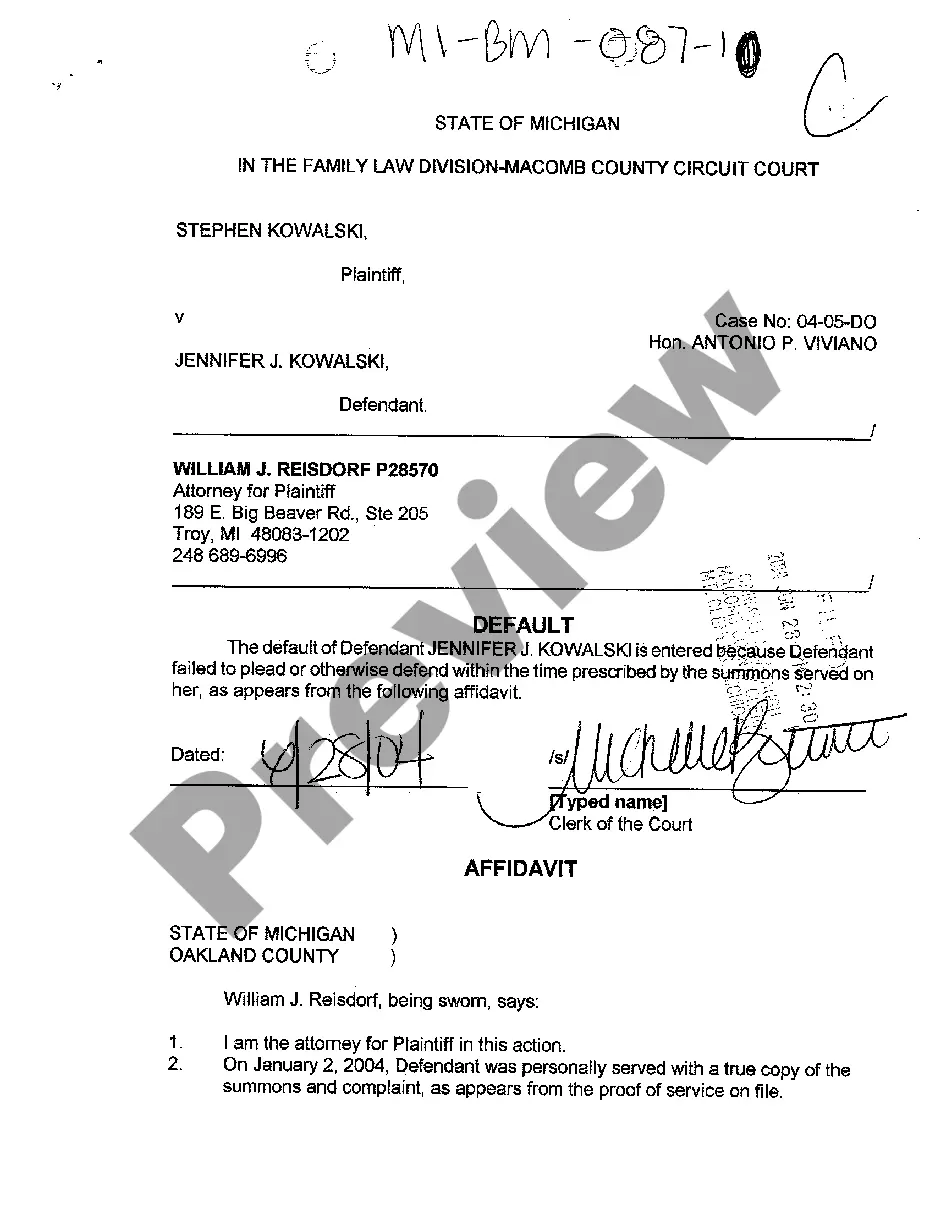

- Ensure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and choose your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Virginia Procedure for Release of Funds Held Under Garnishment (2 Exhibits) and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

No more than 25% of disposable earnings in any pay period may be garnished to satisfy an ordinary debt.

Your employer can't fire you the first time your wages are garnished. A garnishment is good for 30, 60, 90 or 180 days, at the choice of the judgment-creditor. The garnished money is under the control of the court until the garnishment period is over.

A garnishment is good for 30, 60, 90 or 180 days, at the choice of the judgment-creditor. The garnished money is under the control of the court until the garnishment period is over.

Limits on Wage Garnishment in Virginia Again, under Virginia law, garnishment limits are the lesser of: 25% of your disposable earnings, or. the amount by which your disposable earnings exceed 40 times the federal minimum hourly wage or the Virginia minimum hourly wage, whichever is greater.

A garnishment is a legal process that allows creditors to collect money from the debtor's wages, bank account, or other assets. The creditor must first obtain a court order before they can garnish the debtor's assets. The court order will specify how much of the debtor's wages can be garnished and for how long.

Limits on Wage Garnishment in Virginia Again, under Virginia law, garnishment limits are the lesser of: 25% of your disposable earnings, or. the amount by which your disposable earnings exceed 40 times the federal minimum hourly wage or the Virginia minimum hourly wage, whichever is greater.

In Virginia, you have 21 days to file an answer, or respond to the lawsuit, if it's filed in a circuit court. If the suit is filed in a district court, you need to show up at the time on your summons prepared to prove your case. If you fail to answer or appear as directed, a default judgment may be entered against you.