Virginia Notice of Order for Garnishment

Description

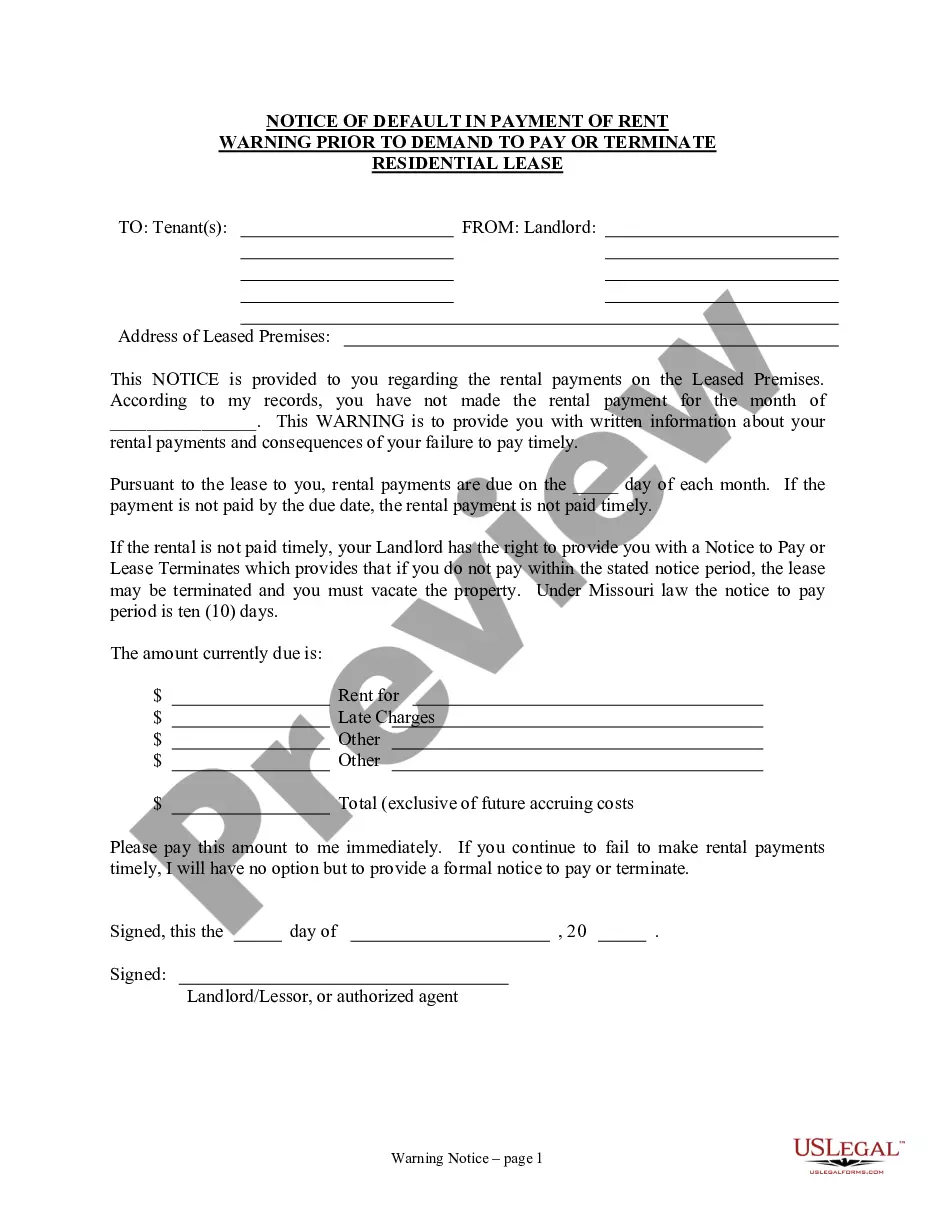

How to fill out Virginia Notice Of Order For Garnishment?

Searching for a Virginia Notice of Order for Garnishment online can be stressful. All too often, you see files that you simply believe are ok to use, but find out later they are not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you’re looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added to your My Forms section. If you don’t have an account, you must register and choose a subscription plan first.

Follow the step-by-step instructions below to download Virginia Notice of Order for Garnishment from the website:

- See the document description and hit Preview (if available) to check if the template suits your requirements or not.

- In case the document is not what you need, find others using the Search engine or the listed recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- After getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. Besides professionally drafted samples, users may also be supported with step-by-step instructions on how to find, download, and fill out templates.

Form popularity

FAQ

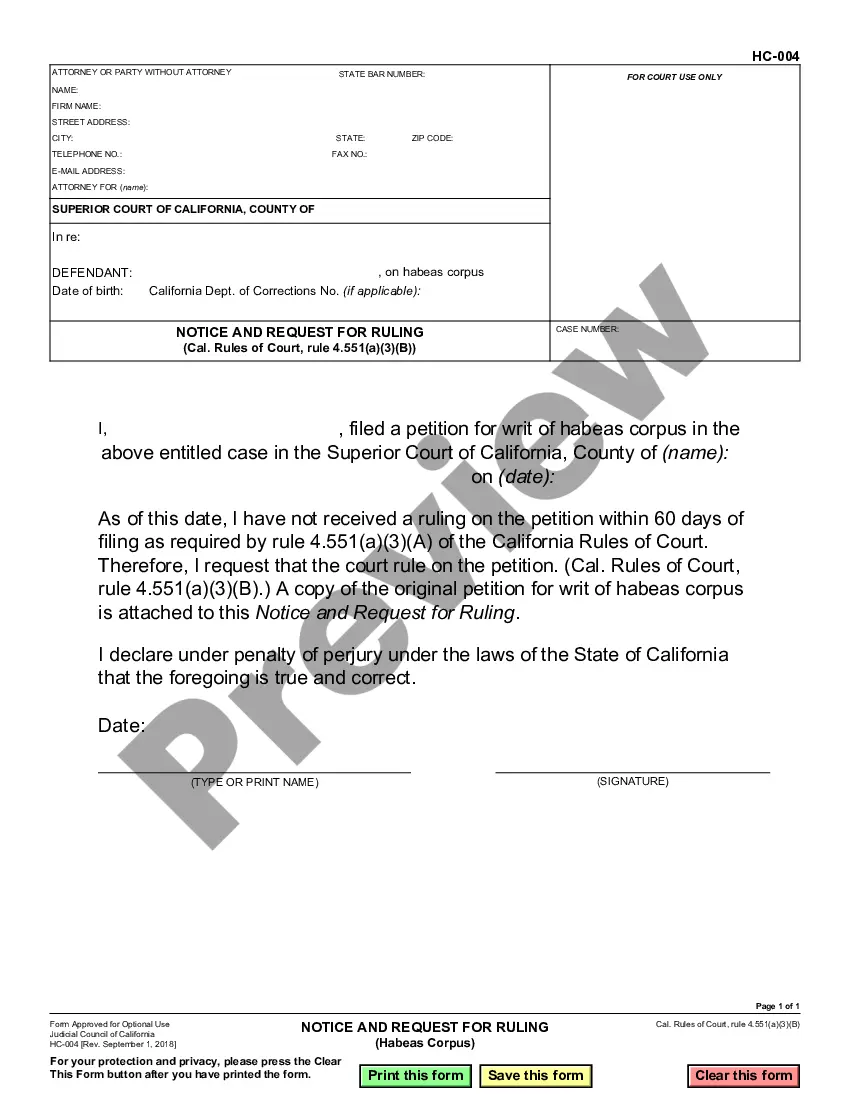

A creditor starts the garnishment process by serving a legal documentcalled a garnishment summonson the third party (called the garnishee) who the creditor believes to have money or property belonging to the debtor.

Unpaid income taxes. court-ordered child support. owed child support (arrears) defaulted student loans.

You can easily find the debtor's bank and account number if you have a copy of a check written by the debtor, which may be the case if you had a business relationship. You may also have this information on a credit application or other form the debtor completed.

Virginia wage garnishment law limits the amount that judgment creditors can garnish (take( from your paycheck.Most creditors with a money judgment against you can take only 25% of your earnings. However, creditors can take more if you owe taxes or a support obligation, but only 15% on a defaulted student loan.

Once a garnishment is approved in court, the creditor will notify you before contacting your bank to begin the actual garnishment. However, the bank itself has no legal obligation to inform you when money is withdrawn due to an account garnishment.

Don't Ignore Debt Collectors. Have Government Assistance Funds Direct Deposited. Don't Transfer Your Social Security Funds to Different Accounts. Know Your State's Exemptions and Use Non-Exempt Funds First.

Other than a court order or getting you to volunteer that information over the phone, creditors can look at your credit report to see if you have listed a current employer on a recent credit application, This means that if you have applied for any new credit in the last year or so, then they may be able to set up a

Your bank isn't required to notify you of an account garnishment unless the withdrawal overdraws your balance. Depending on where you live, you may have certain rights and protections against having your bank account garnished.

In Virginia, garnishments last for 90 or 180 days with exceptions for taxes and child support. The creditor has to file a garnishment summons. The summons will have a court date.