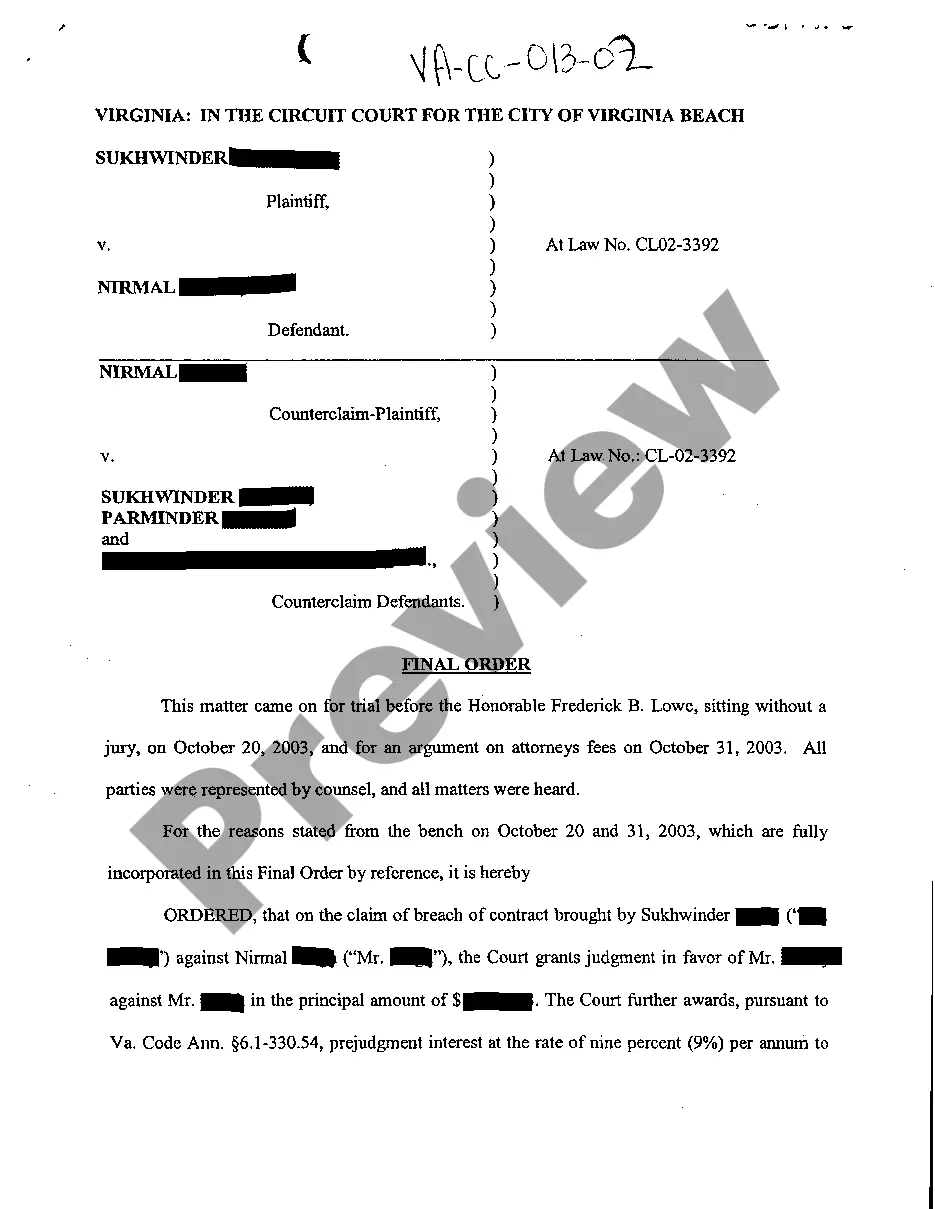

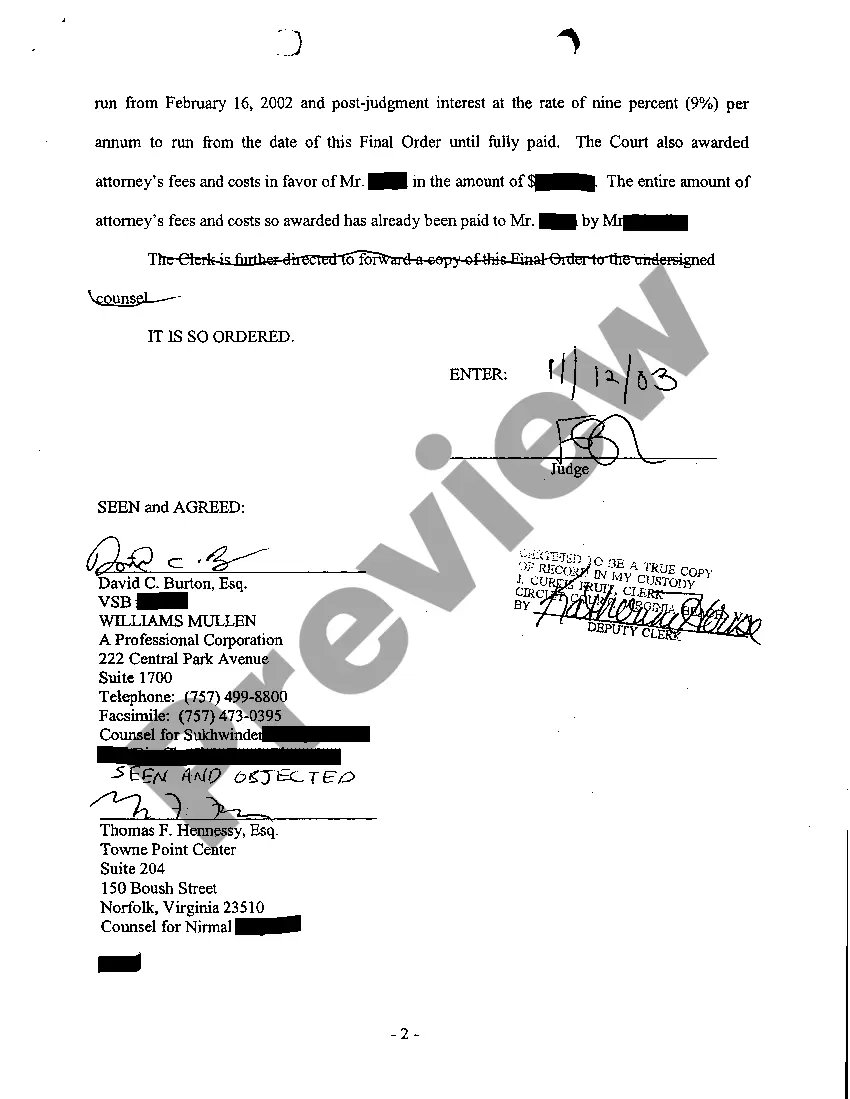

Virginia Final Order for Garnishment

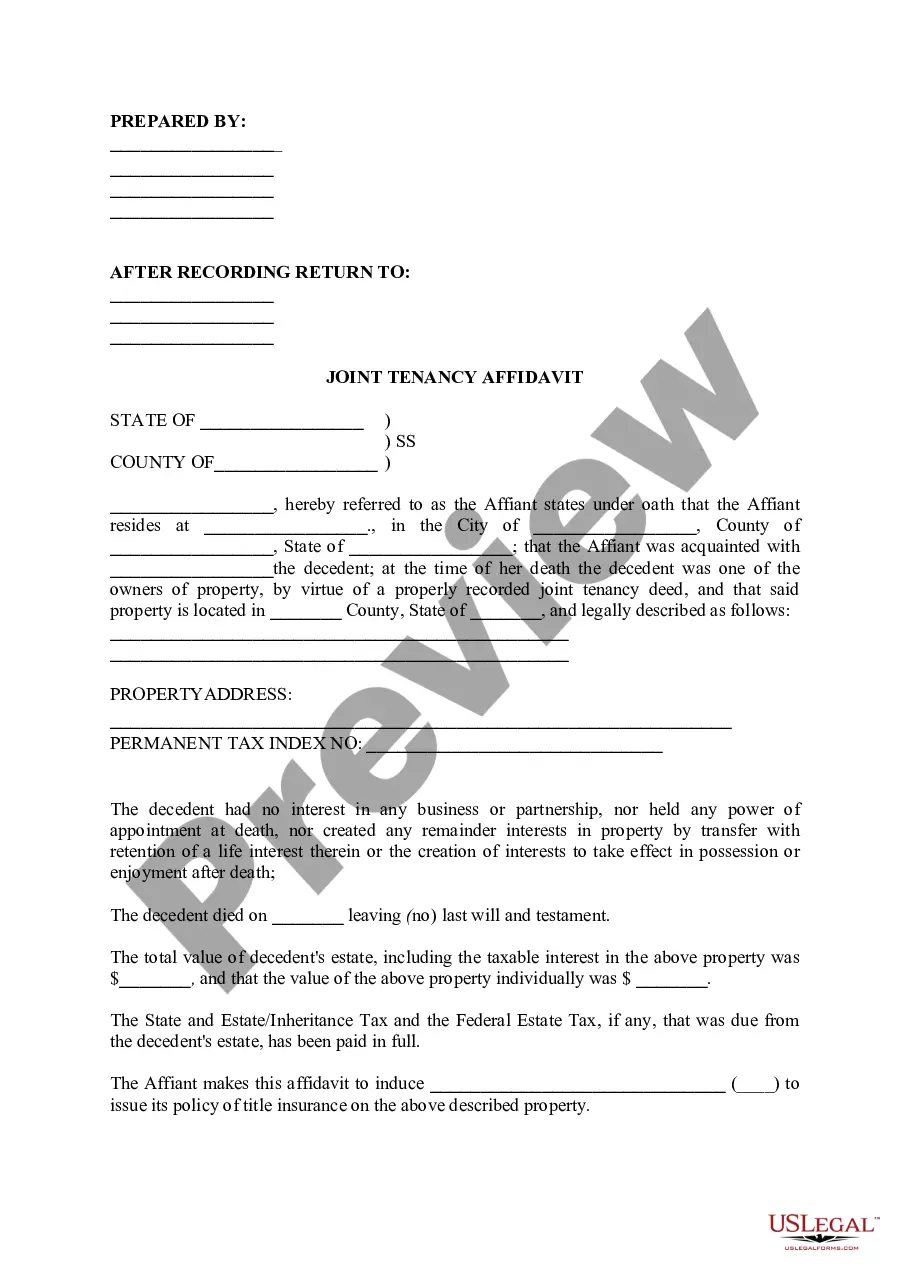

Description

How to fill out Virginia Final Order For Garnishment?

Searching for a Virginia Final Order for Garnishment on the internet might be stressful. All too often, you find files that you just believe are alright to use, but find out later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional attorneys in accordance with state requirements. Get any document you are looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be included in your My Forms section. If you do not have an account, you must register and pick a subscription plan first.

Follow the step-by-step instructions listed below to download Virginia Final Order for Garnishment from the website:

- See the document description and hit Preview (if available) to check if the template meets your expectations or not.

- If the document is not what you need, find others using the Search field or the listed recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms catalogue. In addition to professionally drafted templates, users can also be supported with step-by-step instructions on how to find, download, and fill out forms.

Form popularity

FAQ

In Virginia, garnishments last for 90 or 180 days with exceptions for taxes and child support. The creditor has to file a garnishment summons. The summons will have a court date.

A simple way to collect a judgment is by deducting money out of the debtor's paycheck using a wage garnishment. The debtor must have a decent income because both the federal government and states cap the amount you can take, and certain types of income, like Social Security, are off-limits.

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Collecting a Judgment.Collecting a judgment can be just as challenging as winning the lawsuit in some cases. If the defendant has stable finances, they should pay the judgment uneventfully. If the defendant is going through financial difficulties, on the other hand, you may need to force them to pay you.

Do not use illegal ways to collect your money. Encourage the debtor to pay you voluntarily. Be organized. Ask a lawyer or collection agency for help. Make sure you renew your judgment. Ask the court for help.

Settling a debt requires that you have some leverage.Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.