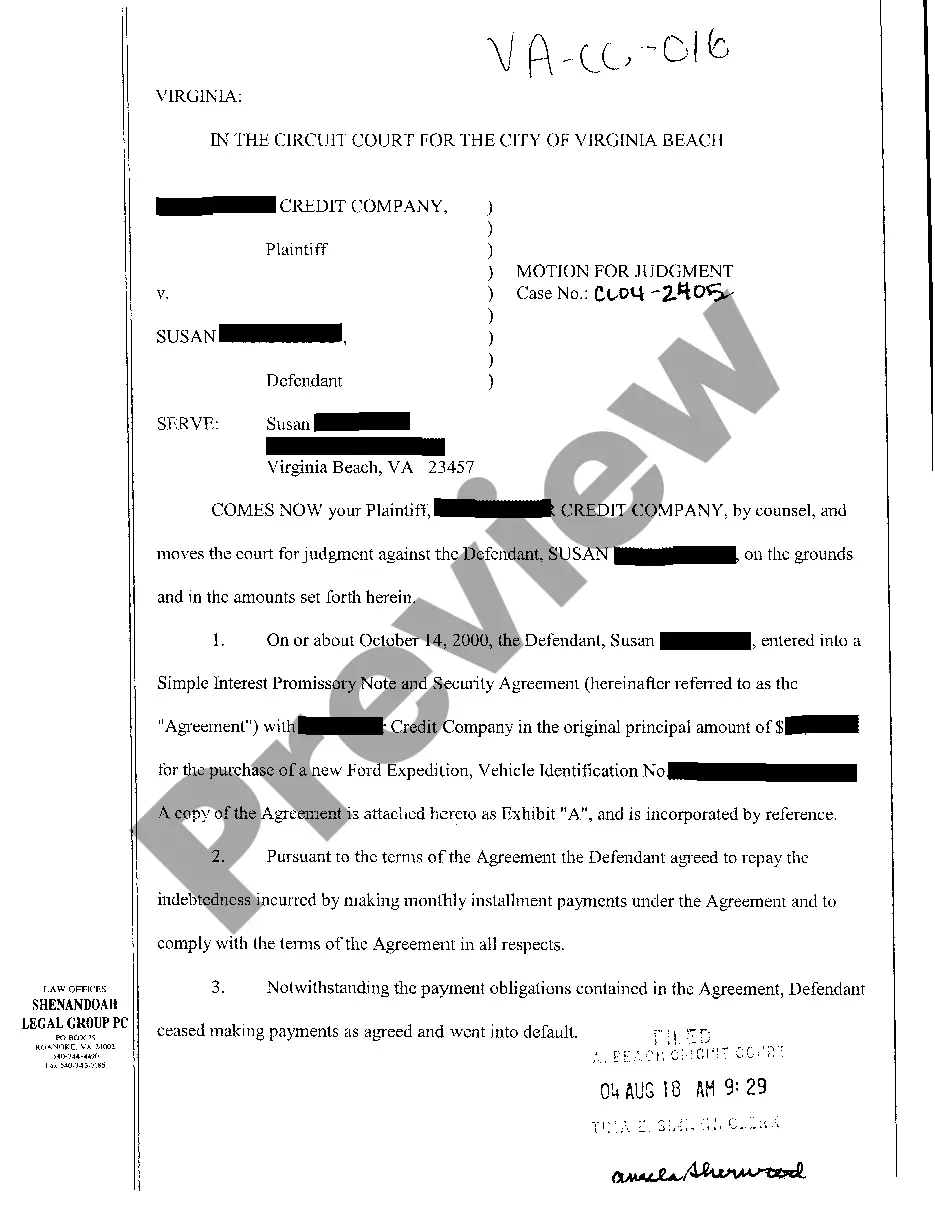

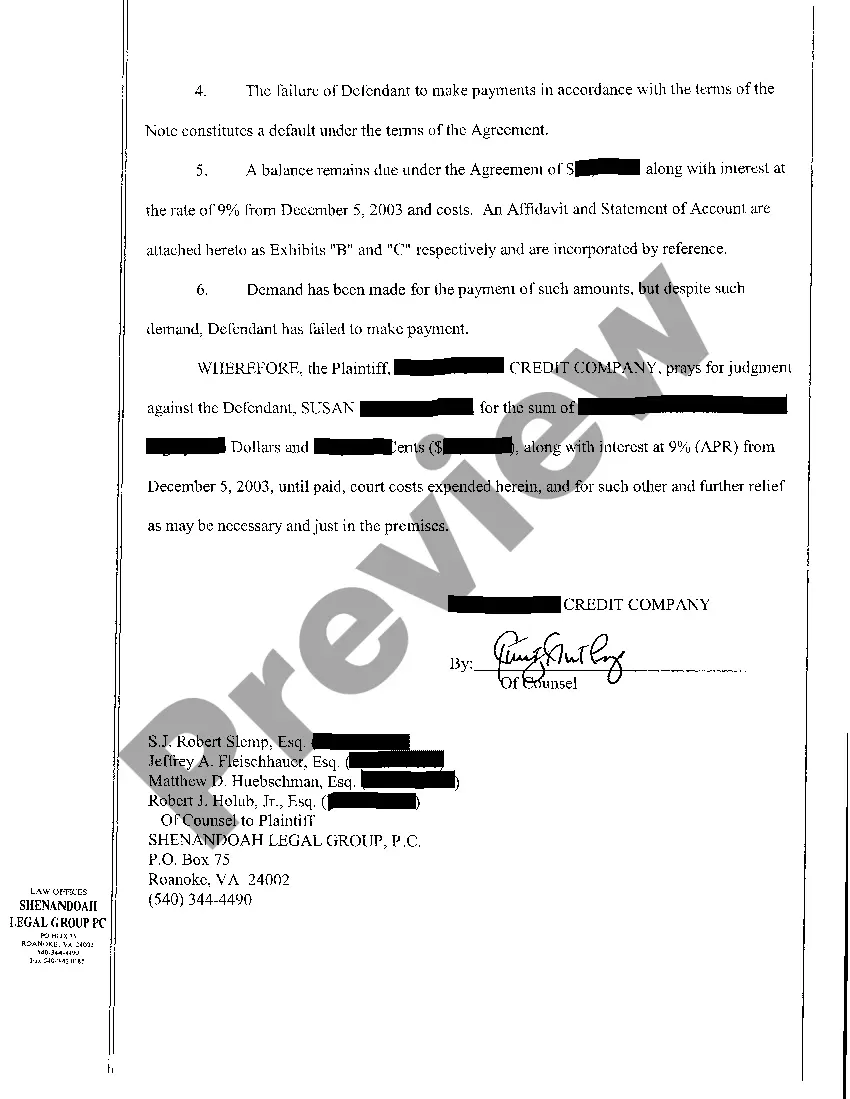

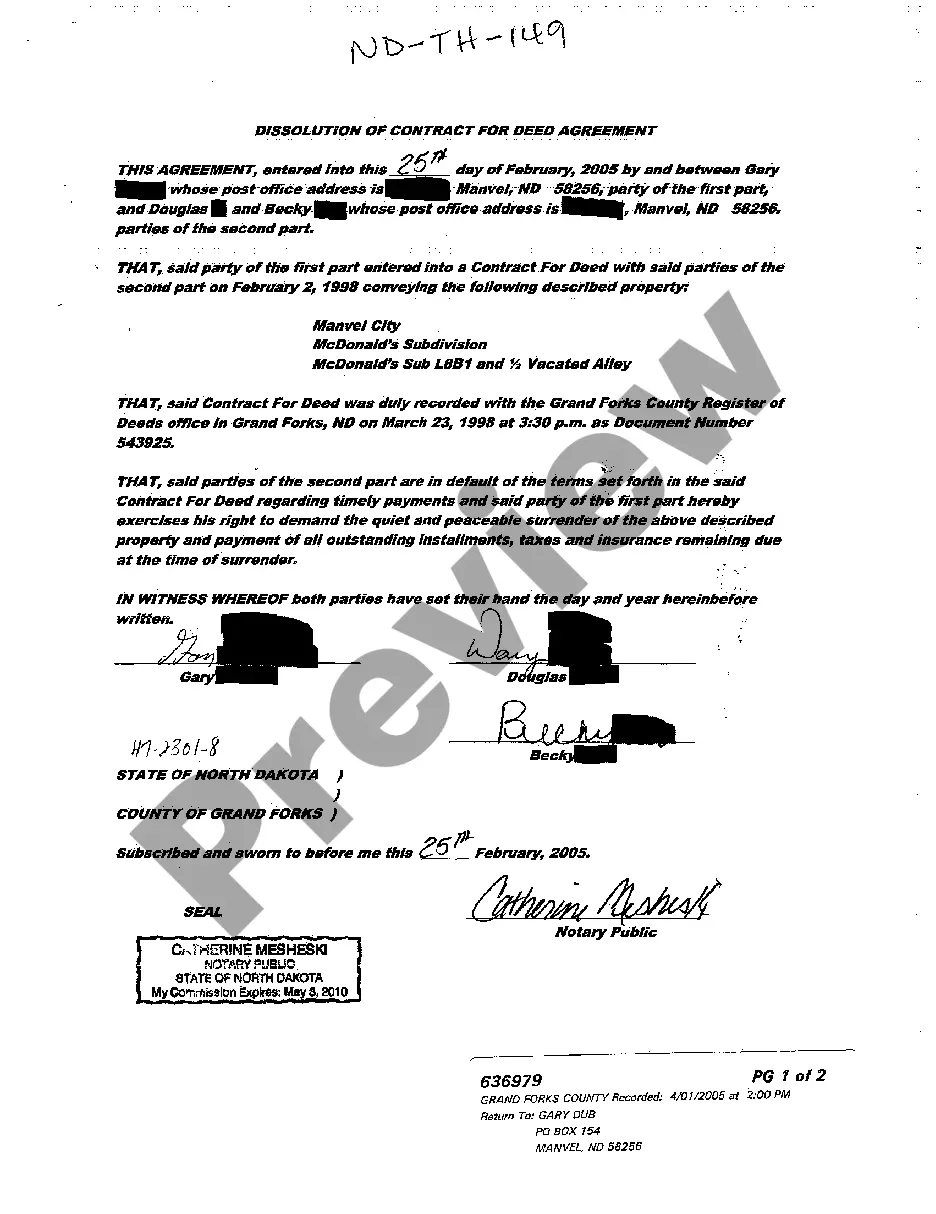

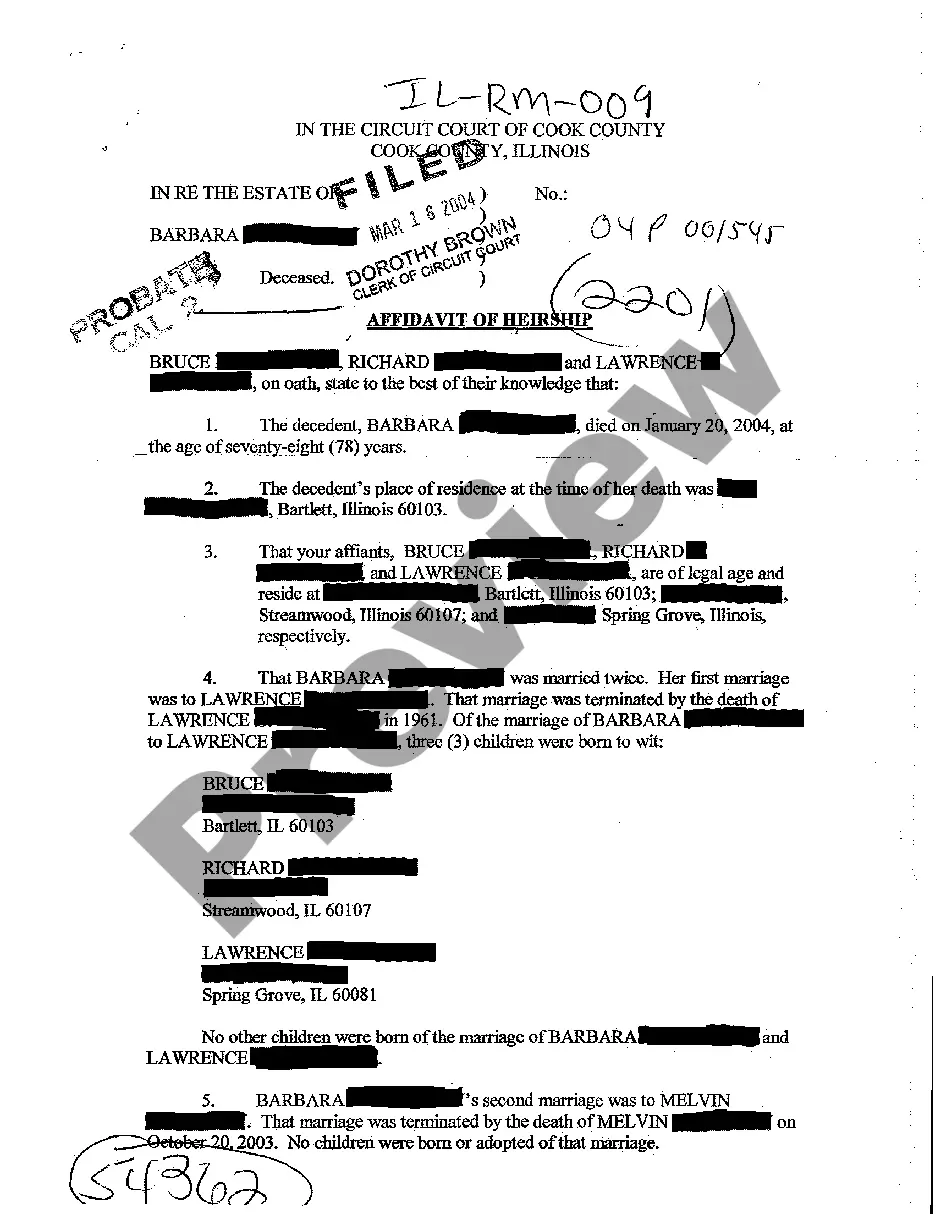

Virginia Motion for Judgment regarding Debt Collection

Description

How to fill out Virginia Motion For Judgment Regarding Debt Collection?

Looking for a Virginia Motion for Judgment regarding Debt Collection on the internet might be stressful. All too often, you find files that you think are alright to use, but discover afterwards they are not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Have any form you are looking for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be included to the My Forms section. If you don’t have an account, you should register and pick a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Motion for Judgment regarding Debt Collection from the website:

- Read the document description and press Preview (if available) to verify if the form meets your expectations or not.

- In case the document is not what you need, get others using the Search engine or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms from our US Legal Forms library. Besides professionally drafted samples, customers may also be supported with step-by-step instructions on how to get, download, and fill out templates.

Form popularity

FAQ

Once the judge rules in your favor, you still don't have a judgment. The clerk of the court needs to issue the judgment. This typically takes 2 to 4 weeks, but with governmental budget cuts, there have been a few occasions where this has taken 4 to 6 months.

Welcome to Warrant In Debt Info A warrant in debt is the paper you get when a bill collector is suing you in the Virginia General District Court. Warrant might sound like it's a criminal law problem. It's not: you can't go to jail; but if you ignore it, your pay and bank account can get garnished.

Domestic judgments, or those obtained in a Virginia court of law have a collection period of 10 years and may be extended for a long as 20 years. While foreign judgments, or any judgments of a court where the debt did not originally occur, also have a collection period of 10 years but may not be renewed or extended.

A general rule of thumb is that if you owe less than $1,000 the odds that you will be sued are very low, particularly if you're creditor is a large corporation. In fact, many big creditors won't sue over amounts much larger than $1,000.

Virginia has a statute of limitations of six years for nearly all debts, including written contracts, oral contracts and open-ended accounts such as credit cards. That means that once such a debt is six years overdue, creditors can no longer attempt to collect the owed money.

When a creditor sues you and wins, the court issues a money judgment against you. Once the creditor has a money judgment, it can use various methods to collect on that judgment. It can garnish your wages, place a levy on your bank account, or place a lien against any real estate that you own.

The court enters a judgment against you if your creditor wins their claim or you fail to show up to court.The judgment creditor can then use that court judgment to try to collect money from you. Common methods include wage garnishment, property attachments and property liens.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Virginia has a statute of limitations of six years for nearly all debts, including written contracts, oral contracts and open-ended accounts such as credit cards. That means that once such a debt is six years overdue, creditors can no longer attempt to collect the owed money.