Virginia Exhibit B to Bill of Complaint, Title Insurance Requirements

Description

How to fill out Virginia Exhibit B To Bill Of Complaint, Title Insurance Requirements?

Looking for a Virginia Exhibit B to Bill of Complaint, Title Insurance Requirements on the internet might be stressful. All too often, you see documents that you think are ok to use, but discover afterwards they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you’re looking for quickly, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be included to your My Forms section. In case you don’t have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Virginia Exhibit B to Bill of Complaint, Title Insurance Requirements from our website:

- See the form description and hit Preview (if available) to verify whether the template suits your expectations or not.

- In case the form is not what you need, get others using the Search field or the listed recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted templates, users are also supported with step-by-step instructions on how to get, download, and complete forms.

Form popularity

FAQ

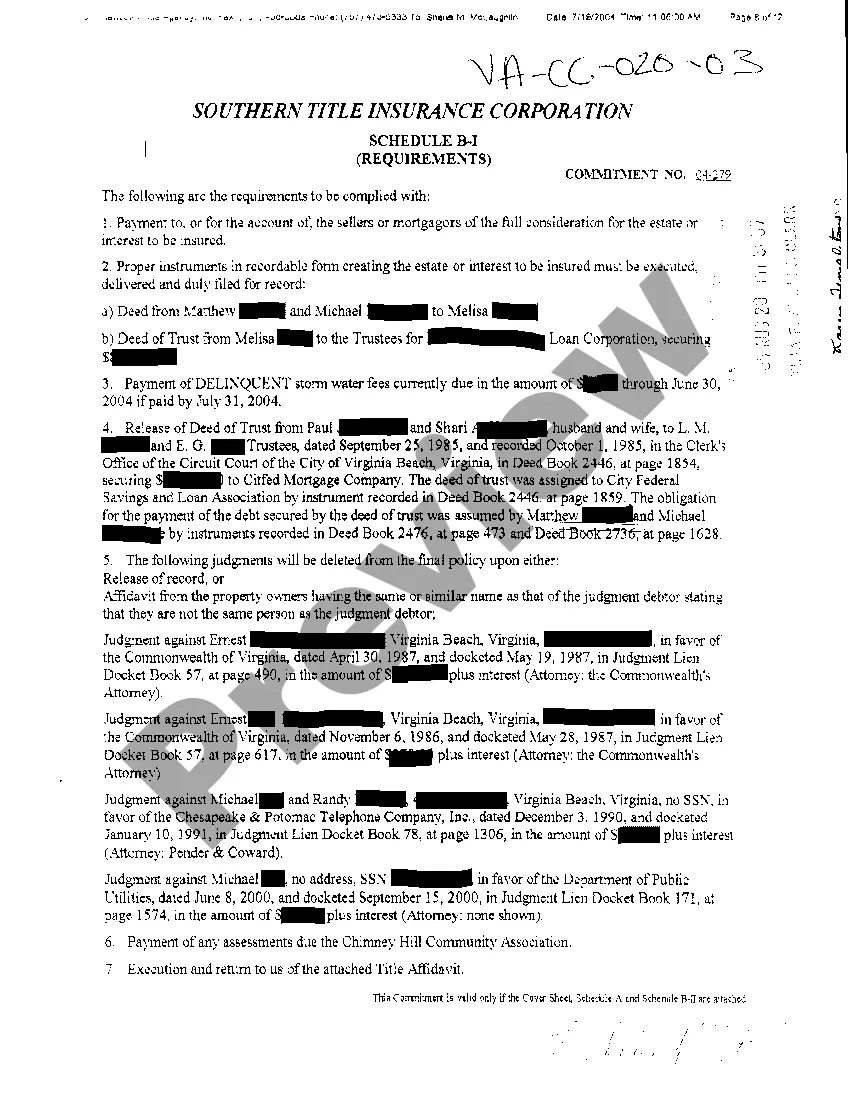

Schedule B-2 in a title commitment lists all matters that constitute an encumbrance on the title to the property. If these matters are not disposed of in some manner (such as the release of an existing deed of trust), they will appear in Schedule B of the final title policy.

Title insurance is a one-time charge assessed at settlement that protects a homebuyer in the event that the property title, which proves ownership, is flawed.In fact, title insurance is not required by law.

Schedule B contains the requirements, exceptions, and exclusions. Schedule B is the most important part of the title commitment. Buyers should pay close attention to it. Requirements: this section lists the things that must be completed/adhered to in order for title insurance to be issued.

Schedule B-2 in a title commitment lists all matters that constitute an encumbrance on the title to the property. If these matters are not disposed of in some manner (such as the release of an existing deed of trust), they will appear in Schedule B of the final title policy.

A title commitment (or whatever name yours goes by) is basically the title company's promise to issue a title insurance policy for the property after closing.Almost every purchase and sale agreement contains language requiring the seller to provide the buyer with title insurance.

Schedule B The Schedule B exceptions are items which are tied to the subject property. These include Covenants, Conditions and Restrictions (CC&Rs), easements, homeowner's association by-laws, leases and other items which will remain of record and transfer with the property.

Ten states don't regulate title insurance rates at all. Some states have rating bureaus that influence rates, but the big four title insurers are often members of these rating bureaus. In other states, those companies control rates just by the sheer force of their market dominance.

The title commitment is the document a title company or real estate law firm creates as a promise to issue a title insurance policy. It's basically a road map that the title agent uses to cure any defects in order to transfer the title free and clear.

In California, title insurers and title agents have filed rates for sub-escrow fees, and laws mandate supervision of an underwritten title company's sub-escrow accounts. The jurisdictions that do not conduct settlements under the pure escrow system are called table closing states.