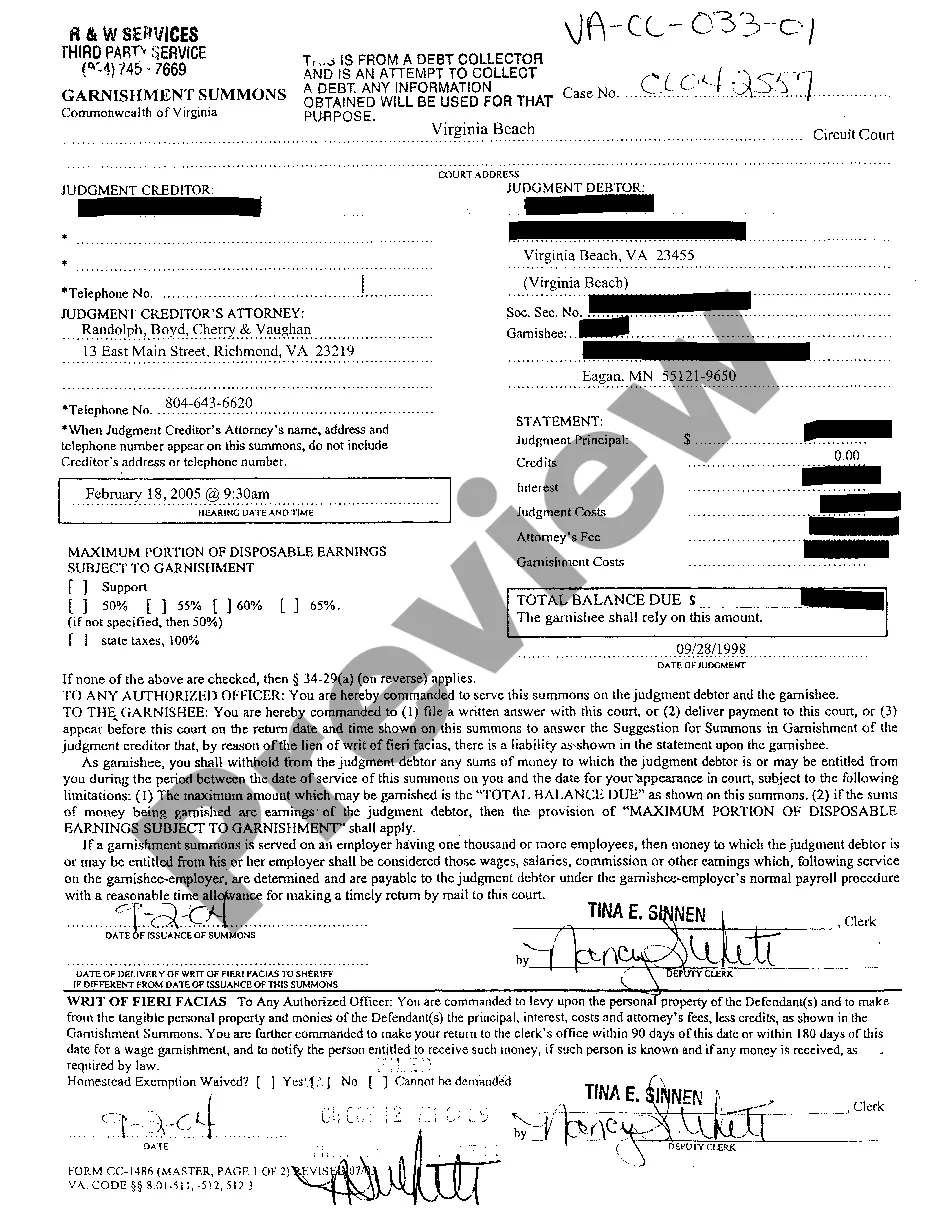

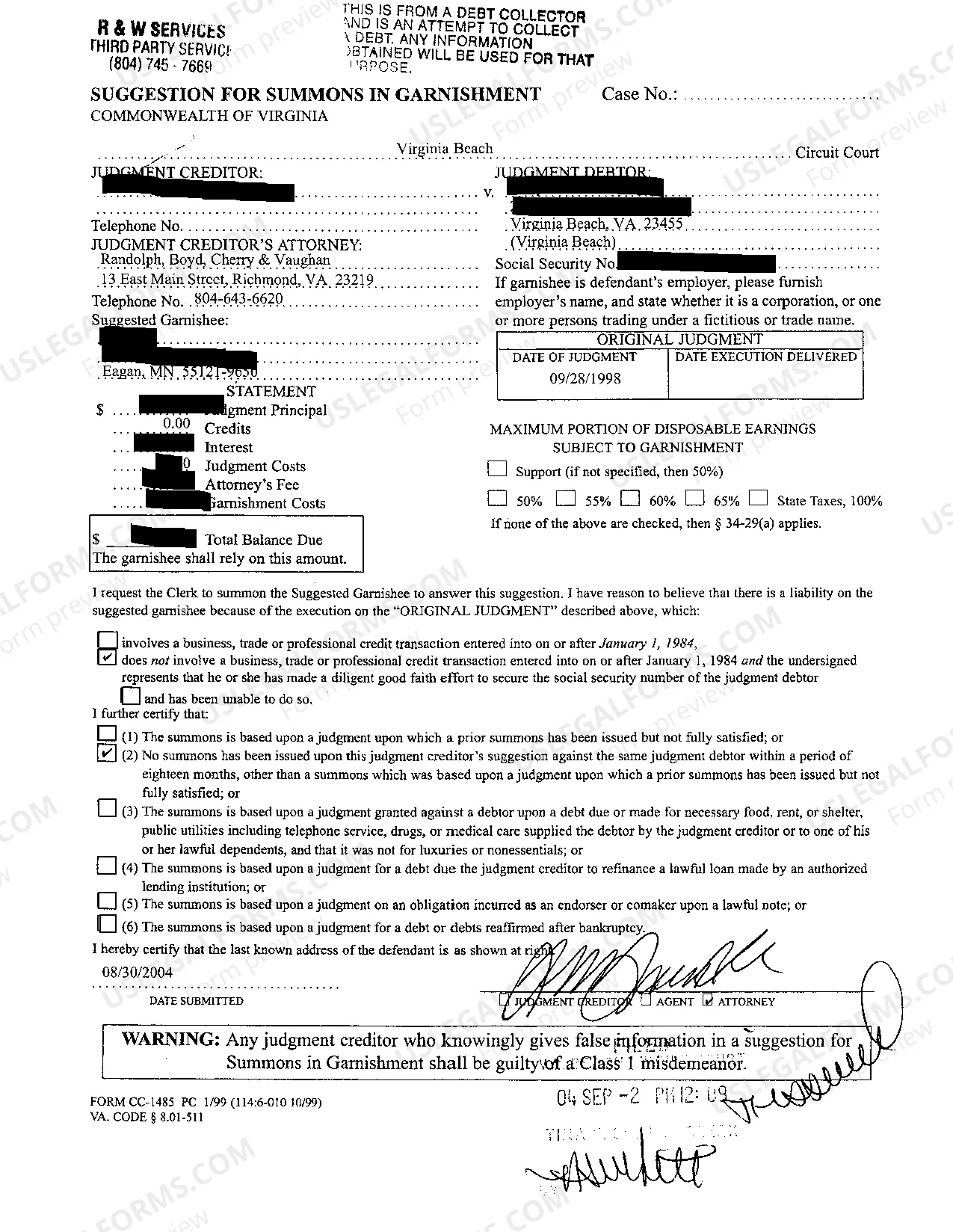

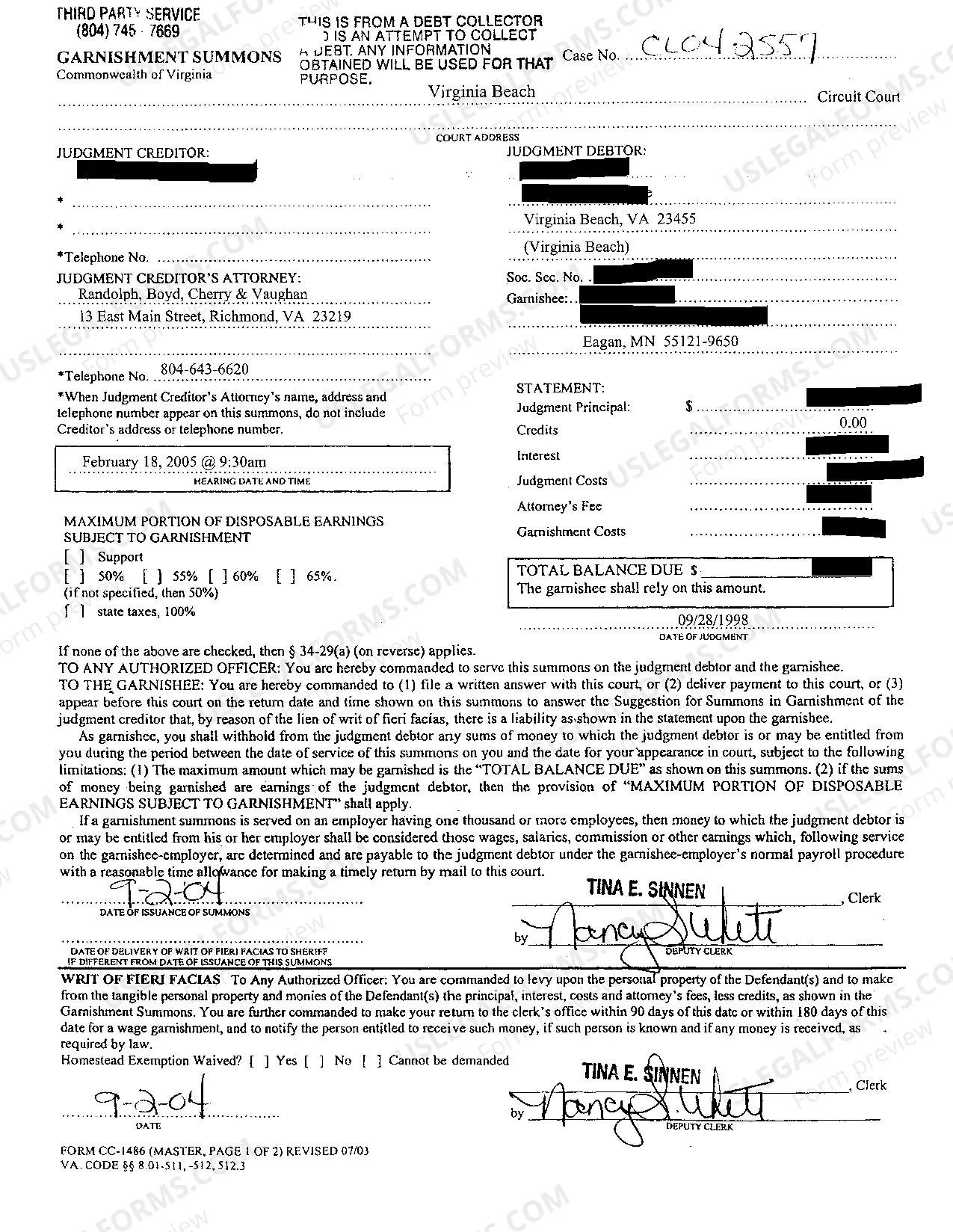

Virginia Garnishment Summons

Description Garnishment Summons

How to fill out Virginia Garnishment Summons?

Looking for a Virginia Garnishment Summons on the internet might be stressful. All too often, you see documents that you think are alright to use, but discover afterwards they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Get any form you’re searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be added in to the My Forms section. In case you do not have an account, you must register and pick a subscription plan first.

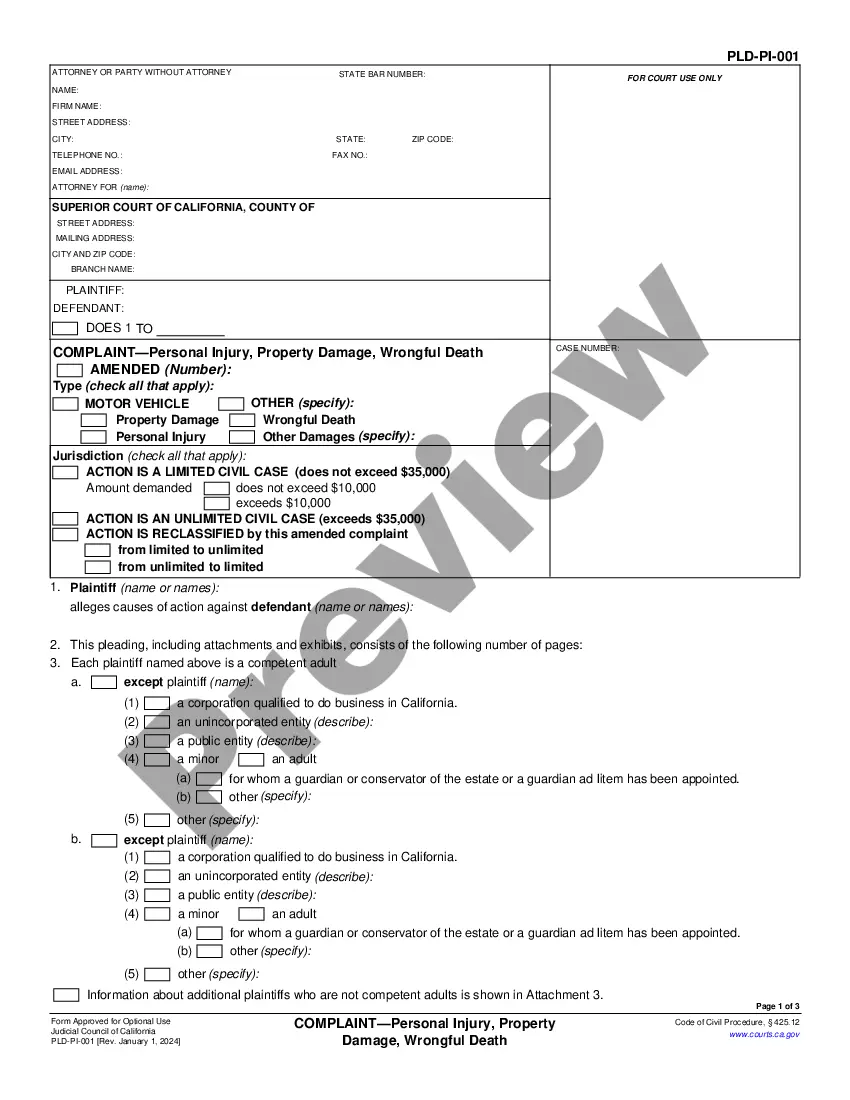

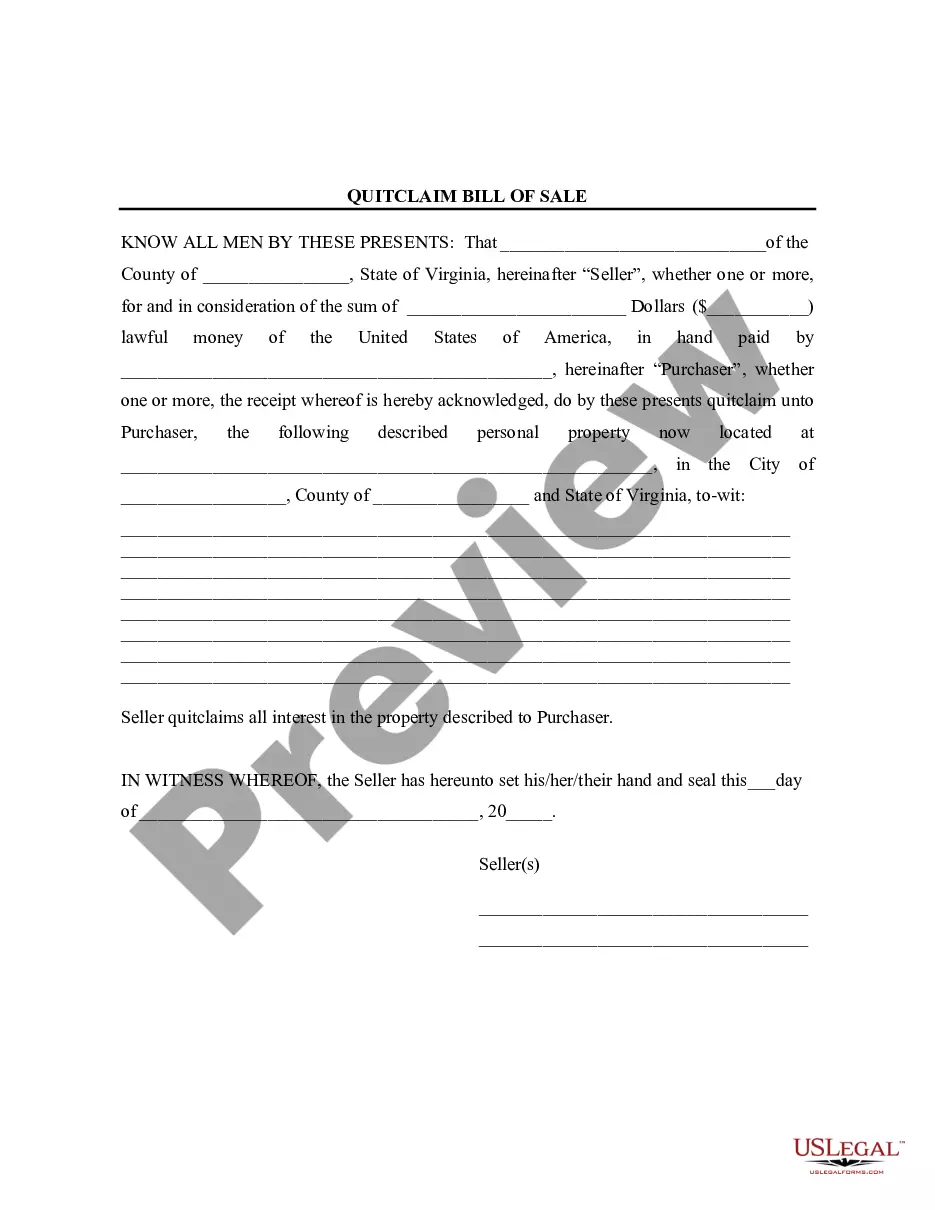

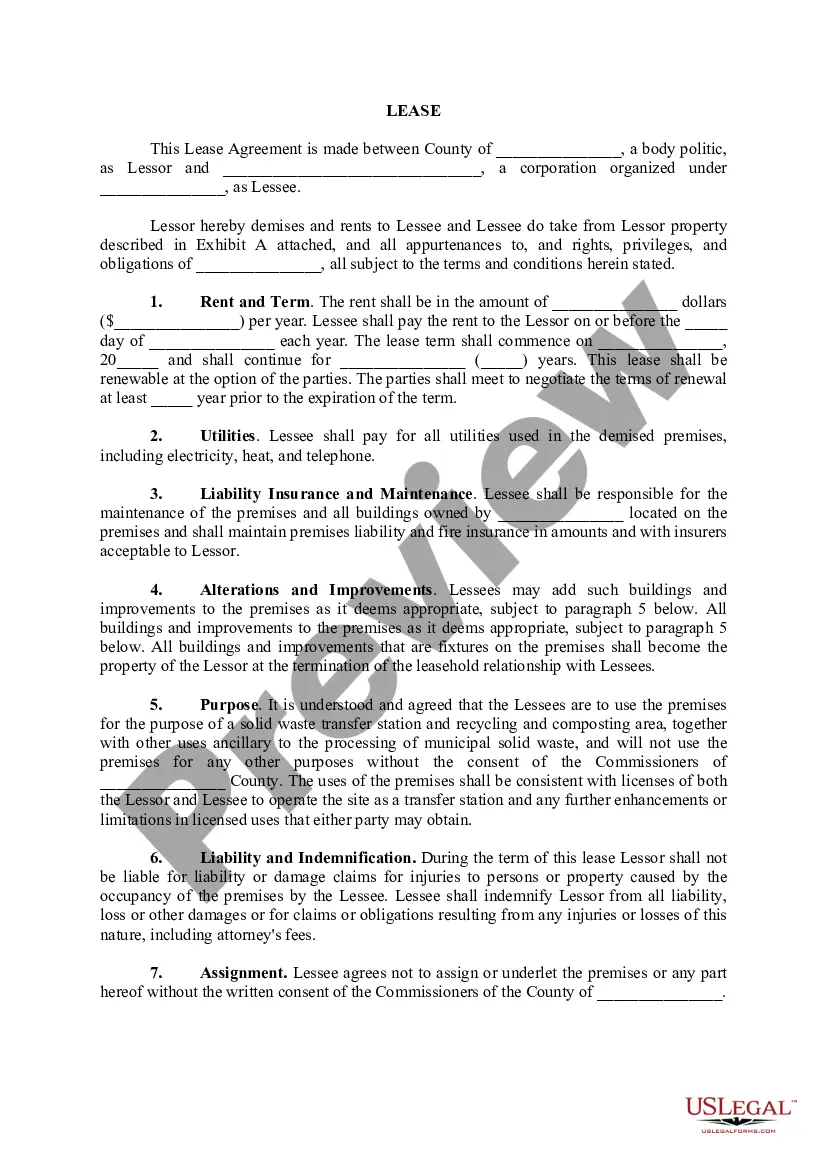

Follow the step-by-step recommendations listed below to download Virginia Garnishment Summons from our website:

- Read the form description and hit Preview (if available) to check whether the form meets your expectations or not.

- If the form is not what you need, find others using the Search field or the provided recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. Besides professionally drafted samples, customers will also be supported with step-by-step instructions regarding how to find, download, and fill out templates.

Form popularity

FAQ

If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

Regular creditors cannot garnish your wages without first suing you in court and obtaining a money judgment. That means that if you owe money to a credit card company, doctor, dentist, furniture company, or the like, you don't have to worry about garnishment unless those creditors sue you in court.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

To get a judgment, you must sue the debtor in civil court or small claims court. If you want to garnish wages for unpaid child support, contact the Virginia Department of Social Services at 1-800-468-8894.

An individual who holds money or property that belongs to a debtor subject to an attachment proceeding by a creditor. For example, when an individual owes money but has for a source of income only a salary, a creditor might initiate Garnishment proceedings.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.