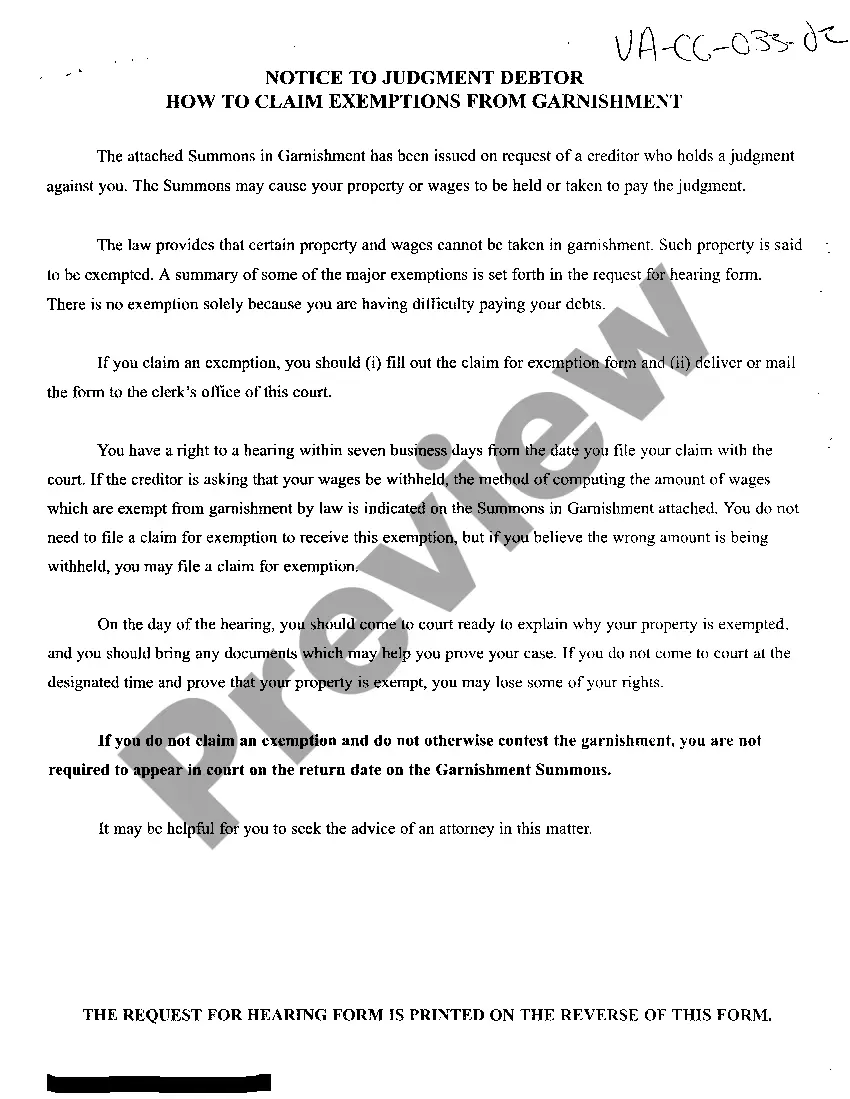

Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment

Description

How to fill out Virginia Notice Of Judgment Debtor How To Claim Exemptions From Garnishment?

Searching for a Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment on the internet can be stressful. All too often, you find papers that you think are fine to use, but discover later they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any document you are looking for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be added in your My Forms section. In case you don’t have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step guidelines listed below to download Virginia Notice of Judgment Debtor How To Claim Exemptions From Garnishment from our website:

- Read the document description and hit Preview (if available) to verify if the form suits your requirements or not.

- In case the form is not what you need, get others using the Search engine or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the document in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted samples, users can also be supported with step-by-step instructions regarding how to find, download, and complete templates.

Form popularity

FAQ

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

The court order is called a garnishment. What's important to know is that federal benefits ordinarily are exempt from garnishment. That means you should be able to protect your federal funds from being taken by your creditors, although you might have to go to court to do so.

Section 15062 - Notice of Exemption (a) When a public agency decides that a project is exempt from CEQA pursuant to Section 15061, and the public agency approves or determines to carry out the project, the agency may, file a notice of exemption. The notice shall be filed, if at all, after approval of the project.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Unpaid income taxes. court-ordered child support. owed child support (arrears) defaulted student loans.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.