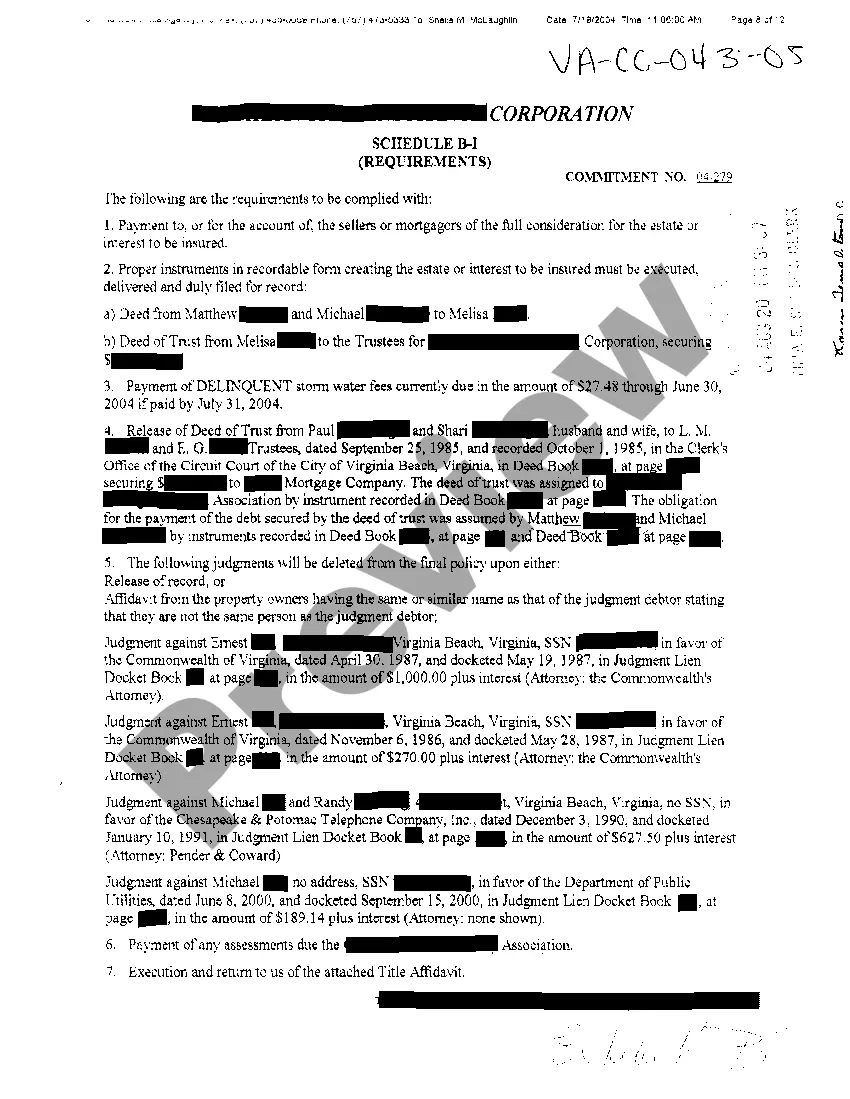

Virginia Schedule B-I Mortgage Compliance Requirements

Description

How to fill out Virginia Schedule B-I Mortgage Compliance Requirements?

Searching for a Virginia Schedule B-I Mortgage Compliance Requirements on the internet might be stressful. All too often, you find papers that you simply believe are fine to use, but discover later they’re not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Get any form you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be added in to your My Forms section. In case you do not have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Virginia Schedule B-I Mortgage Compliance Requirements from the website:

- See the document description and press Preview (if available) to verify whether the form suits your requirements or not.

- If the document is not what you need, find others with the help of Search field or the listed recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- Right after downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. In addition to professionally drafted samples, customers are also supported with step-by-step instructions on how to get, download, and complete templates.

Form popularity

FAQ

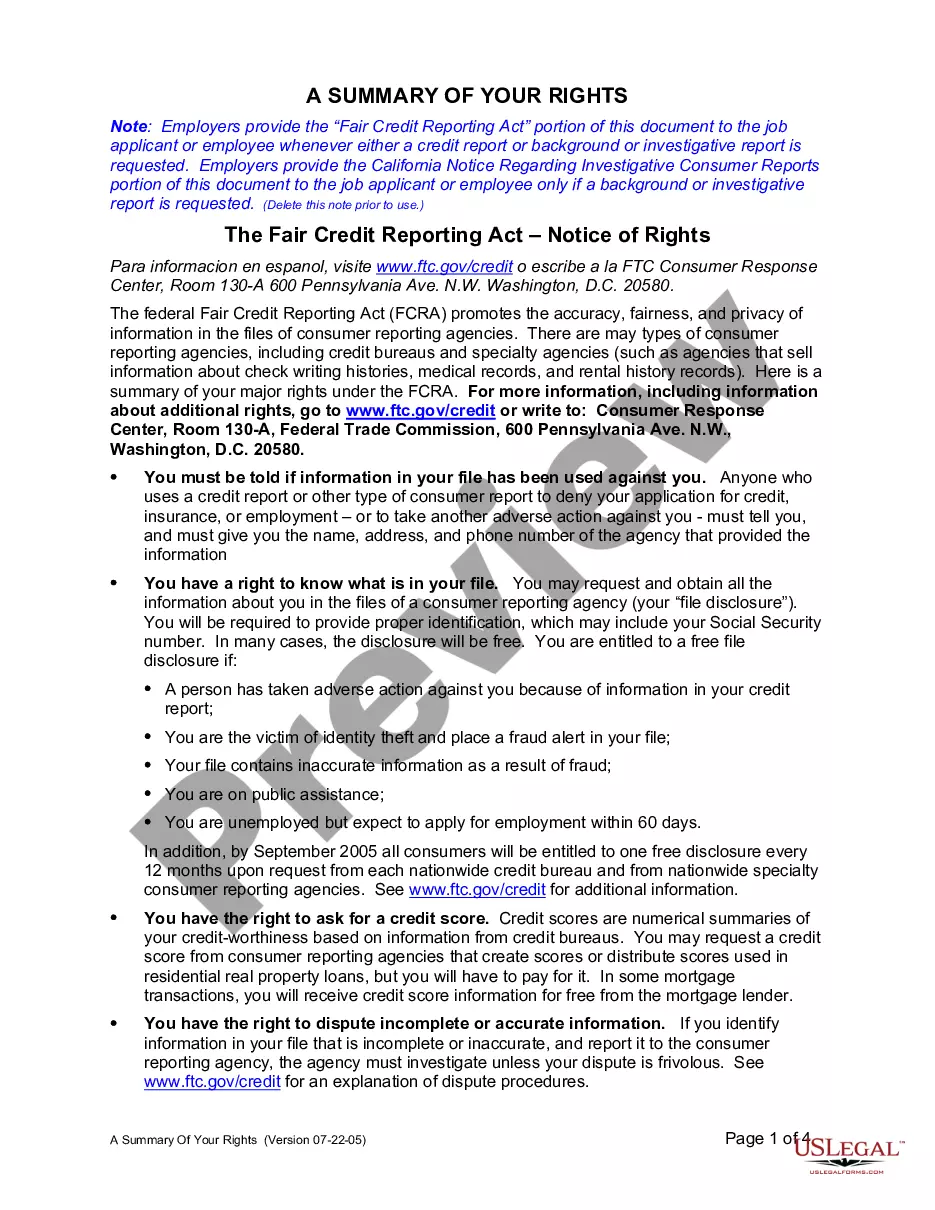

The Truth in Lending Act (TILA) protects consumers in their dealings with lenders and creditors. The TILA applies to most kinds of consumer credit, including both closed-end credit and open-end credit. The TILA regulates what information lenders must make known to consumers about their products and services.

The Truth in Lending Act and Regulation Z are almost identical. TILA is a law, while Regulation Z is a Federal Reserve regulation. They both require full disclosure of the costs and terms associated with credit financing. RESPA is a law which requires full disclosure of settlement costs.

Regulation Z, which is part of the Truth in Lending Act, is a consumer-protection law intended to ensure lenders clearly disclose certain credit terms in a clear way for borrowers.

Regulation Z requires mortgage issuers, credit card companies and other lenders to provide written disclosure of important credit terms, such as interest rate and other financing charges, abstain from certain unfair practices and to respond to borrower complaints about errors in periodic billings.

Regulation Z prohibits certain practices relating to payments made to compensate mortgage brokers and other loan originators. The goal of the amendments is to protect consumers in the mortgage market from unfair practices involving compensation paid to loan originators.

Clearly and conspicuously In meaningful sequence, In writing, and. In a form the consumer may keep.

Regulation Z is part of the Truth in Lending Act of 1968 and applies to home mortgages, home equity lines of credit, reverse mortgages, credit cards, installment loans and certain student loans.

Regulation Z protects consumers from misleading practices by the credit industry and provides them with reliable information about the costs of credit. It applies to home mortgages, home equity lines of credit, reverse mortgages, credit cards, installment loans, and certain kinds of student loans.

Some examples of violations are the improper disclosure of the amount financed, finance charge, payment schedule, total of payments, annual percentage rate, and security interest disclosures. Under TILA, a creditor can be strictly liable for any violations, meaning that the creditor's intent is not relevant.