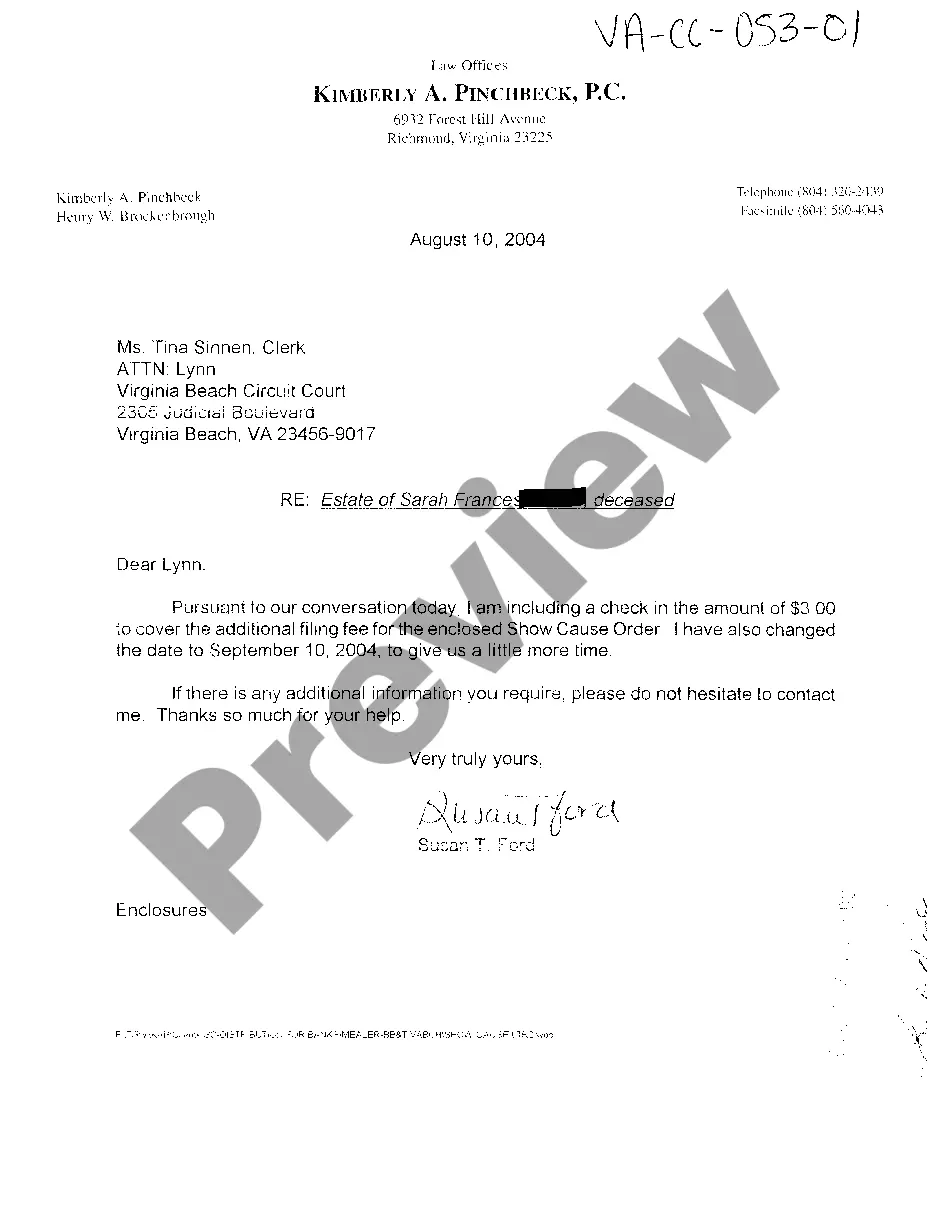

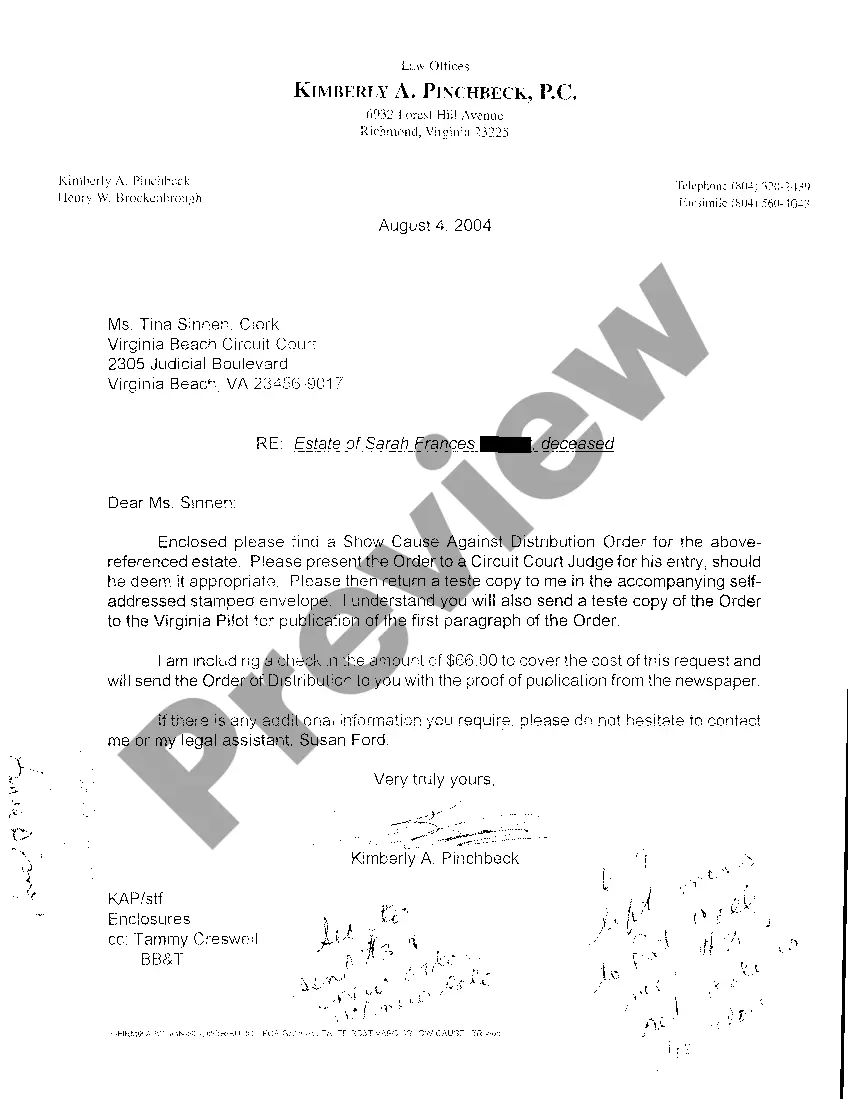

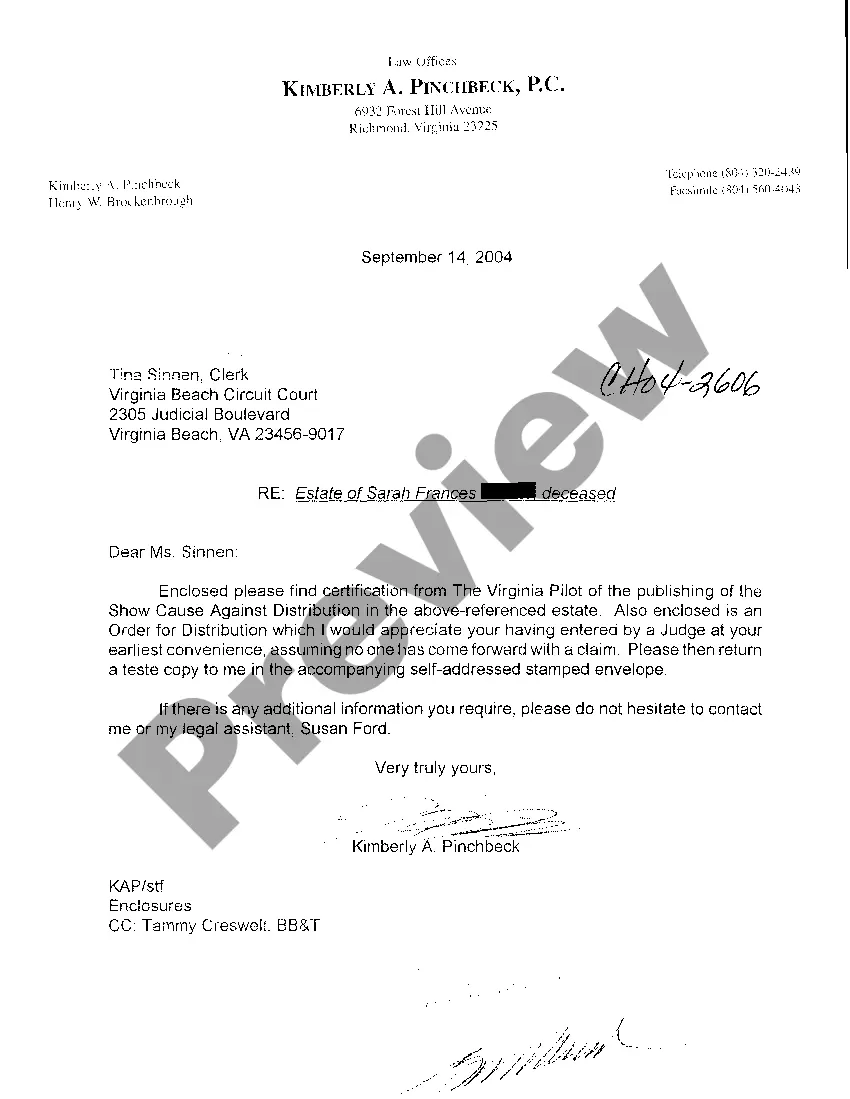

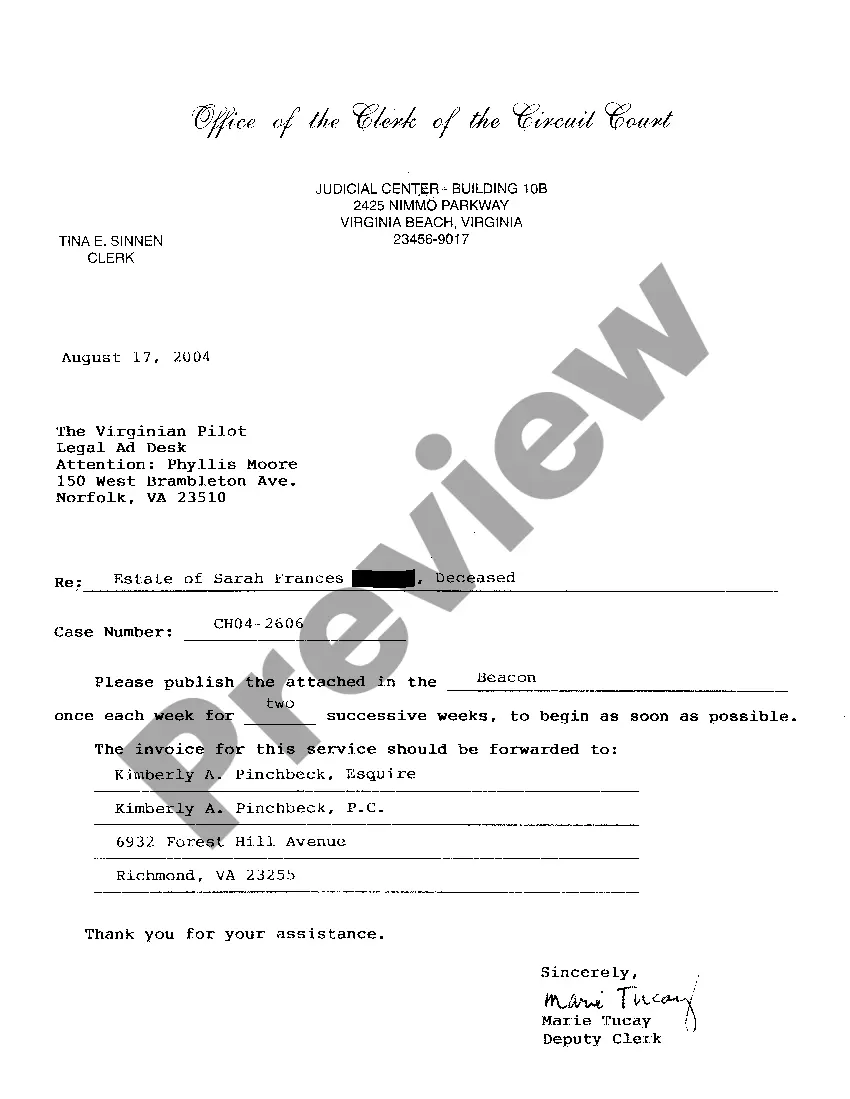

Virginia Letter regarding Distribution of Estate

Description Csprof 48 Letter

How to fill out Show Cost Letter?

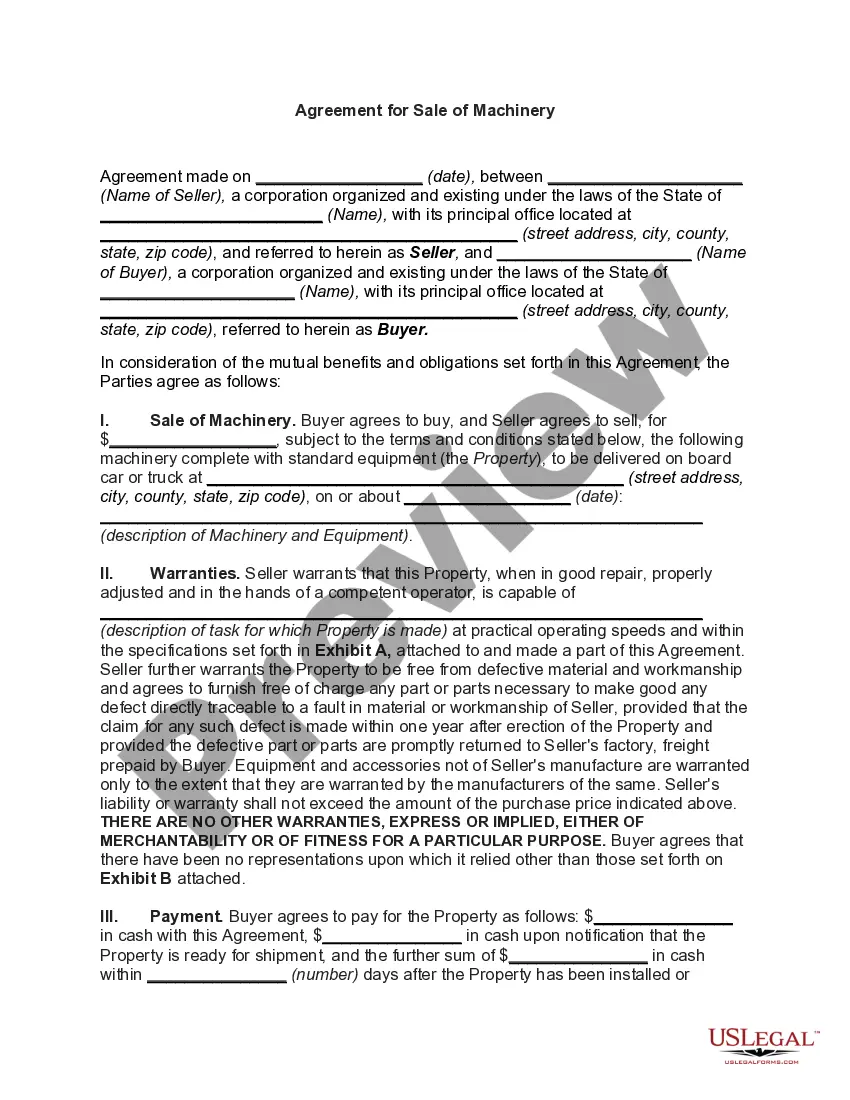

Searching for a Virginia Letter regarding Distribution of Estate online can be stressful. All too often, you see documents that you think are alright to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any form you’re looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in in your My Forms section. In case you do not have an account, you need to sign up and choose a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Letter regarding Distribution of Estate from the website:

- See the form description and click Preview (if available) to verify whether the form suits your expectations or not.

- In case the form is not what you need, get others with the help of Search field or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. Besides professionally drafted samples, users are also supported with step-by-step instructions concerning how to get, download, and complete forms.

How To Do A Cc On A Letter Form popularity

Sample Letter Of Claim Against Estate Other Form Names

Cc In Letter FAQ

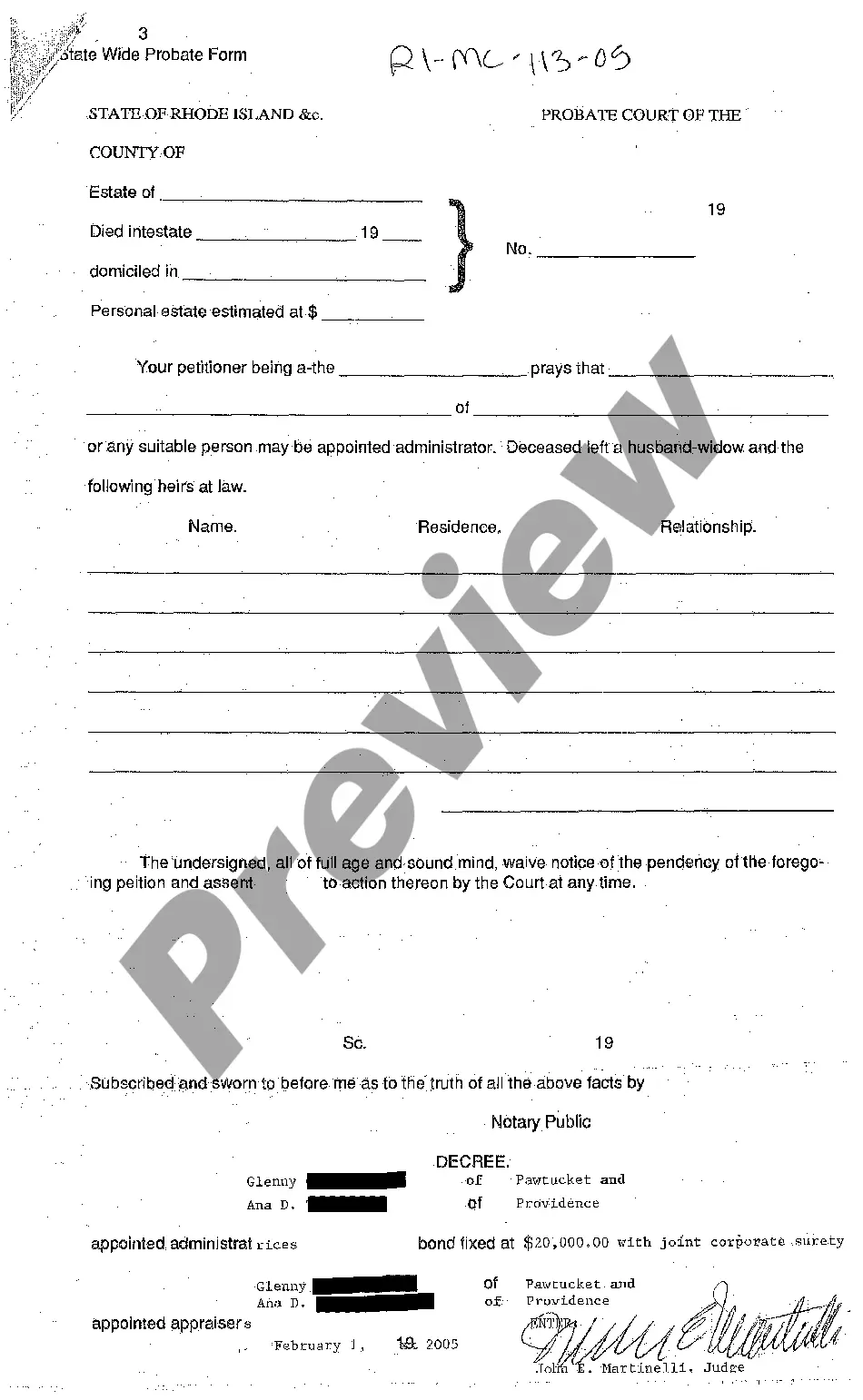

In order for the closing of an estate to occur, a final accounting showing that all estate assets have been distributed to beneficiaries in accordance with the written will or Virginia law if no will exists and a statement by the executor that all taxes have been paid must be filed and approved by the Commissioner of

An estate bank account is opened up by the executor, who also obtains a tax ID number. The various accounts of the deceased person are then transferred to the account. The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Generally speaking, inheritance is not subject to tax in California. If you are a beneficiary, you will not have to pay tax on your inheritance.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Typically, fees such as fiduciary, attorney, executor and estate taxes are paid first, followed by burial and funeral costs. If the deceased member's family was dependent on him or her for living expenses, they will receive a family allowance to cover expenses. The next priority is federal taxes.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

An estate bank account is opened up by the executor, who also obtains a tax ID number.The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent. Finally, he or she distributes the remainder in accordance with the will.