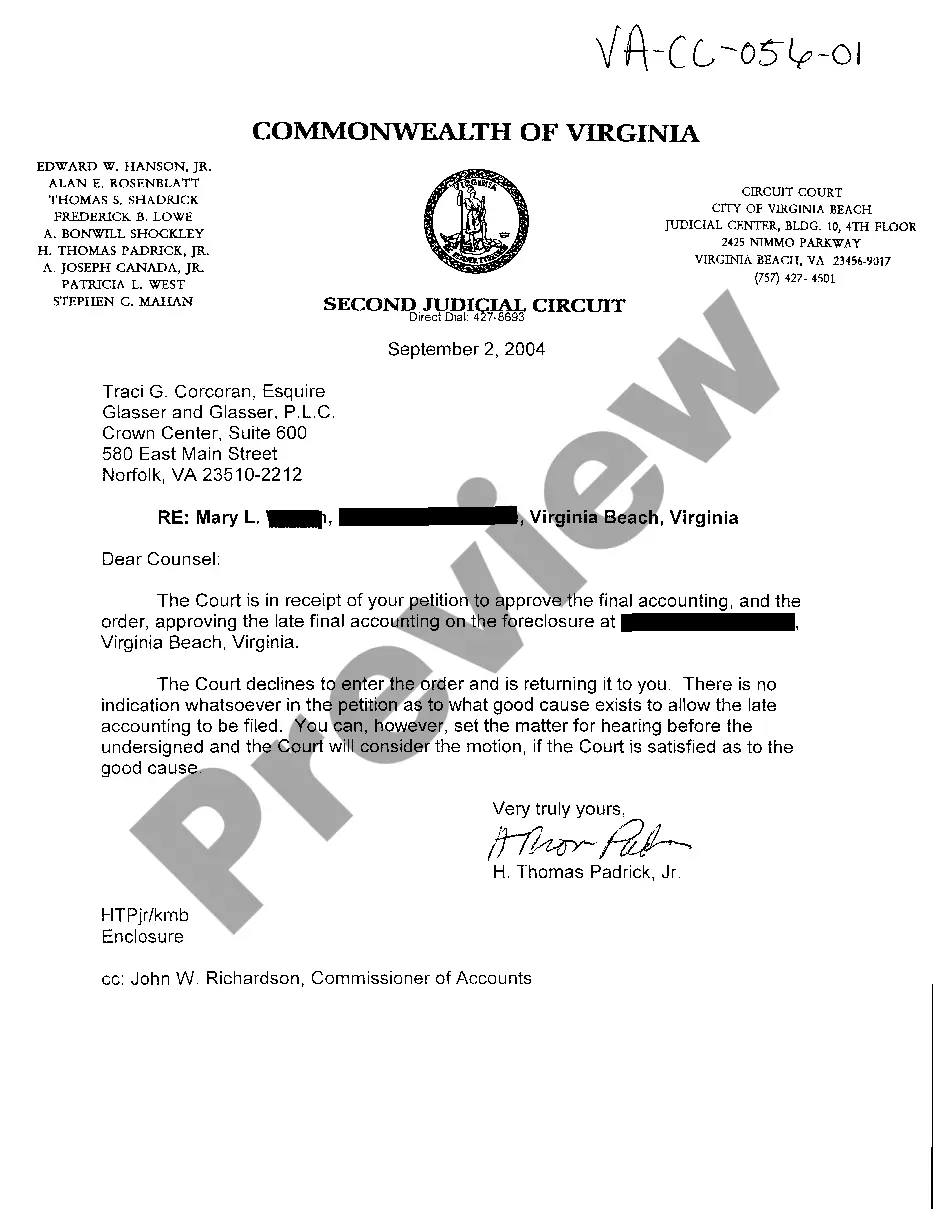

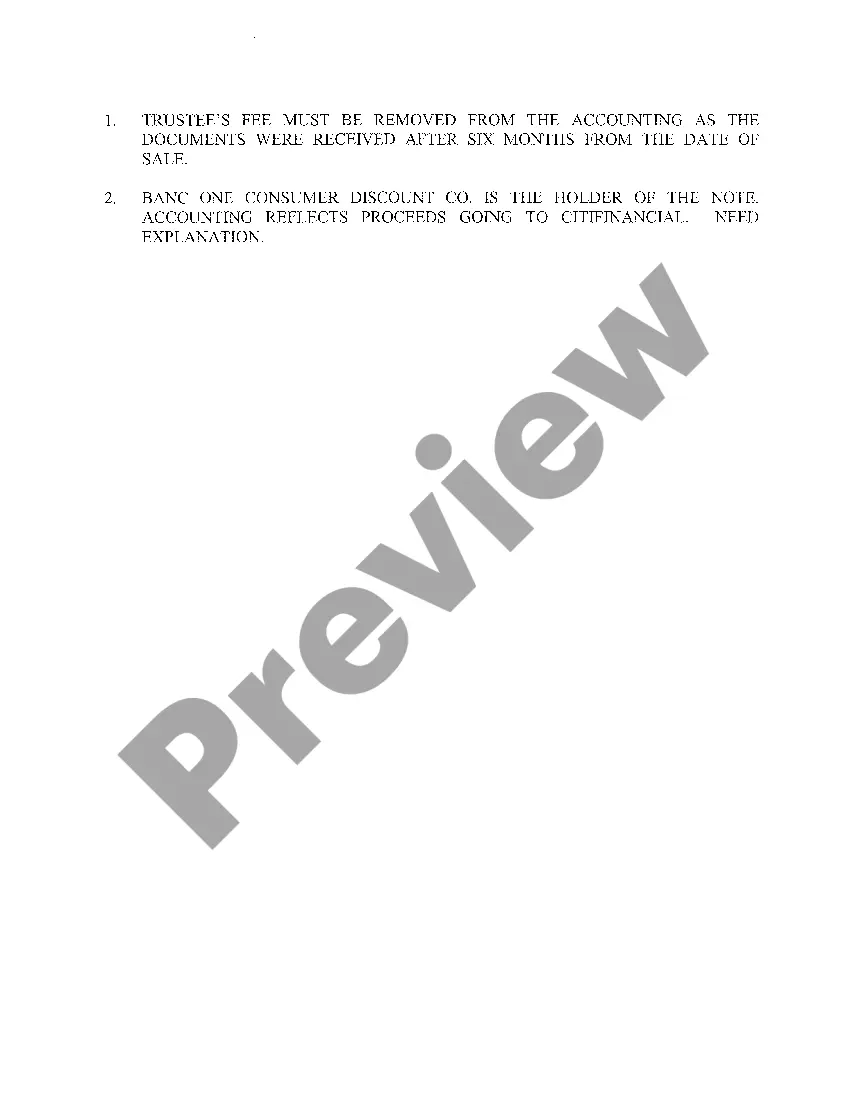

Virginia Letter regarding Petition to Approve Final Accounting

Description

How to fill out Virginia Letter Regarding Petition To Approve Final Accounting?

Looking for a Virginia Letter regarding Petition to Approve Final Accounting online might be stressful. All too often, you see files which you think are alright to use, but discover later they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any document you’re searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will immediately be added in to your My Forms section. If you do not have an account, you must register and pick a subscription plan first.

Follow the step-by-step guidelines below to download Virginia Letter regarding Petition to Approve Final Accounting from the website:

- See the form description and click Preview (if available) to verify if the form meets your requirements or not.

- If the form is not what you need, get others using the Search field or the listed recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- Right after getting it, you can fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted samples, customers may also be supported with step-by-step guidelines on how to get, download, and complete templates.

Form popularity

FAQ

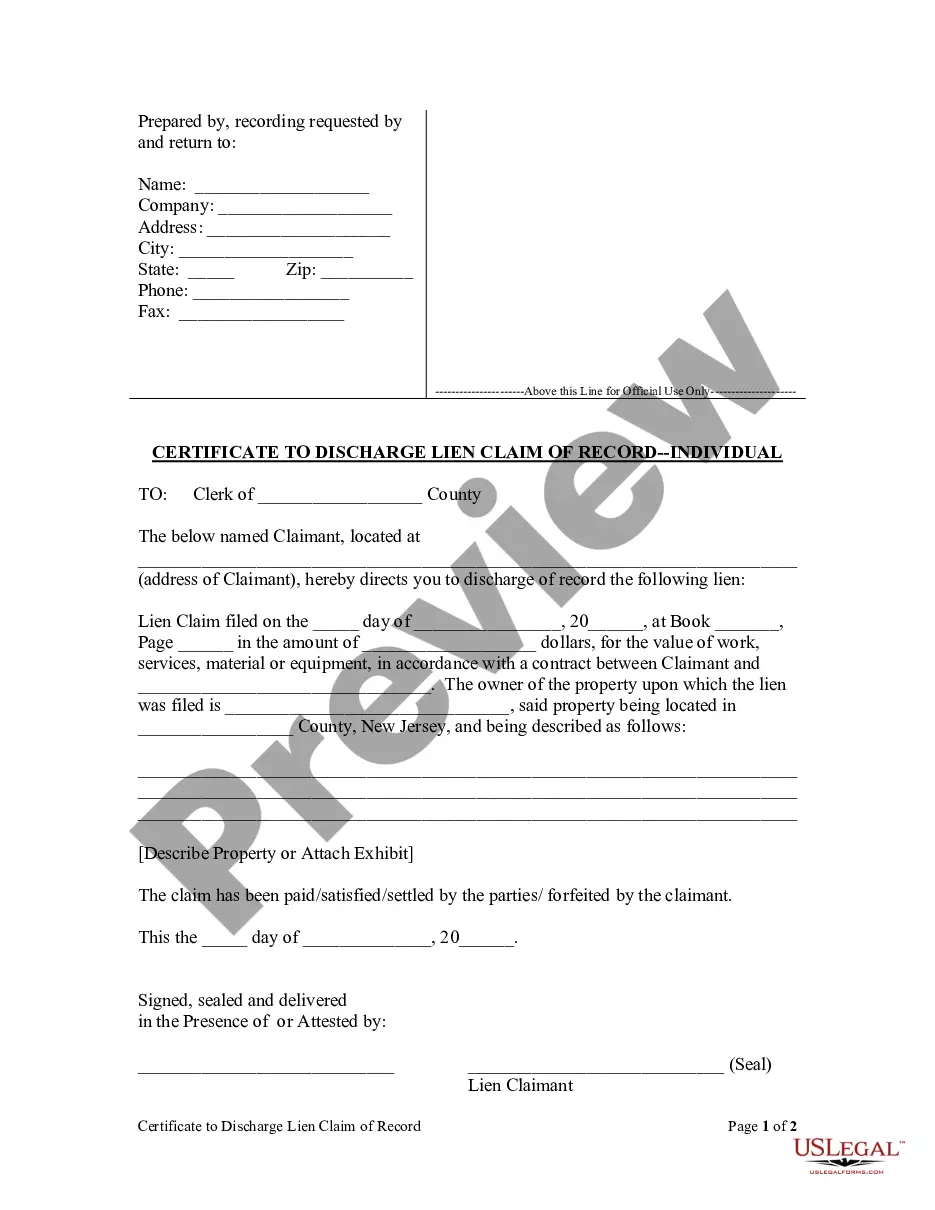

A: The certificate of qualification, sometimes referred to as letters testamentary, is the certificate that the personal representative receives from the Clerk at the time of qualification, which states that the person has qualified as executor or administrator and has authority to act on behalf of the estate.

Executor compensation for VA estates is primarily calculated as a percentage of the qualified estate gross value (see limitations below): 5.0% on the first $400K. 4.0% on the next $300K. 3.0% on the next $300K.

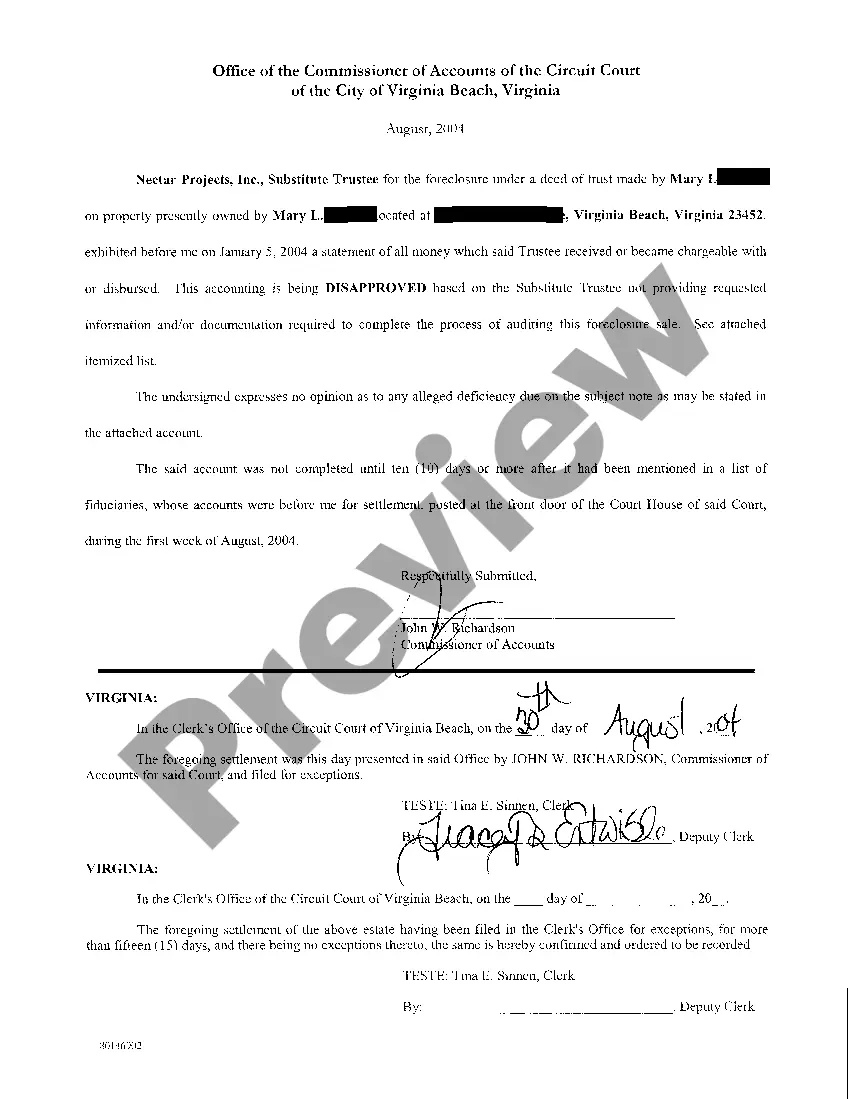

Within 60 days after the hearing, the Commissioner of Accounts will file a report of sufficiently proven debts and demands with the court. Creditors have 15 days from the filing to file exceptions. There is no particular form or formality.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

WHO INHERITS THE PROPERTY OF AN INTESTATE? someone other than the surviving spouse in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children. f0a7 if no surviving spouse, all passes to the children and their descendants.

To qualify as the executor of an estate in Virginia, the individual must contact the clerk's office in the deceased's county of residence and schedule a meeting with the probate clerk. The potential executor brings all necessary paperwork to the meeting.

Length and Commitment of Process. A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Obtain a tax ID number for the estate account. Bring all required documents to the bank. Open the estate account.