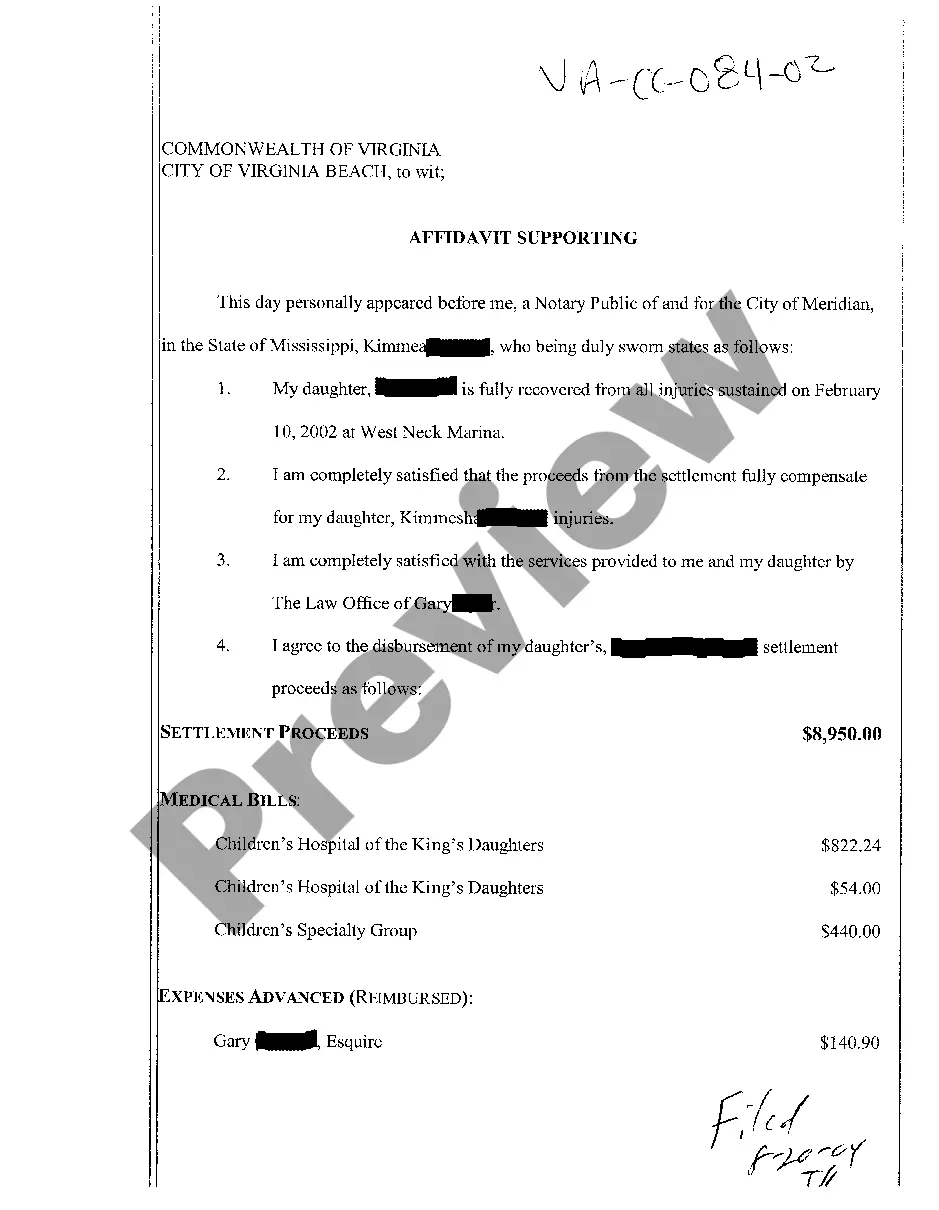

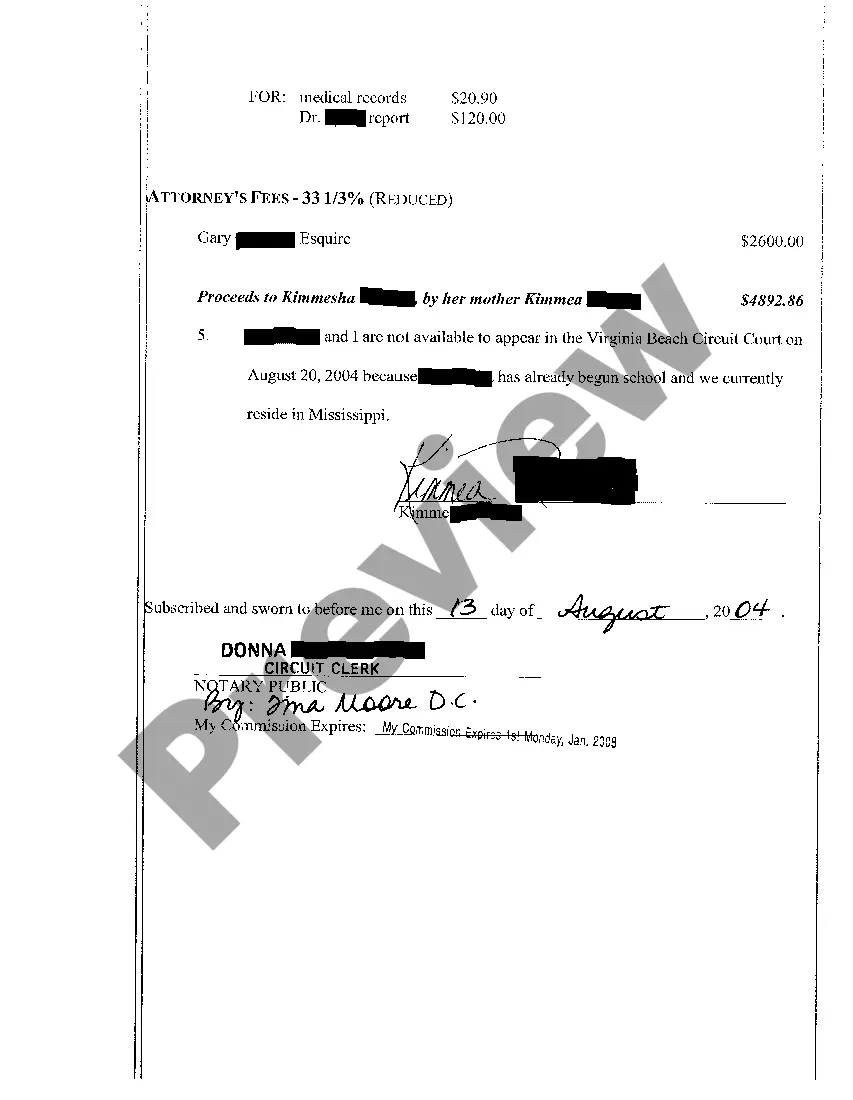

Virginia Affidavit Supporting

Description

How to fill out Virginia Affidavit Supporting?

Looking for a Virginia Affidavit Supporting online can be stressful. All too often, you find files that you simply believe are alright to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Have any form you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added to the My Forms section. If you don’t have an account, you must sign-up and select a subscription plan first.

Follow the step-by-step instructions below to download Virginia Affidavit Supporting from the website:

- See the document description and press Preview (if available) to verify if the template meets your expectations or not.

- If the form is not what you need, get others with the help of Search engine or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted templates, users can also be supported with step-by-step instructions regarding how to get, download, and complete templates.

Form popularity

FAQ

Step 1 Write in your name as the successor in interest. Step 2 In Section 1, enter in decedent's name and the date of death. Step 3 Check the box that indicates the type of asset. Step 4 In Section 7, check the box which indicates your relationship to the decedent.

In Virginia, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Length and Commitment of Process. A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Virginia has no separate probate court. The will should be probated in the circuit court in the county or city where the decedent resided at the time of death.Usually the Clerk of the Circuit Court or a deputy clerk handles the probate of wills and the circuit court judge is not involved.

Assets of an estate when the total value of the entire personal probate estate as of the decedent's death does not exceed, under current law, $50,000, if certain requirements are met, including an affidavit stating certain facts.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Next of kin under Virginia law generally means the closest living relatives of the decedent. The Virginia Supreme Court has stated that the term next of kin is a nontechnical term whose commonly accepted meaning is 'nearest in blood. ' Elmore v. Virginia Nat'l Bank, 232 Va.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.