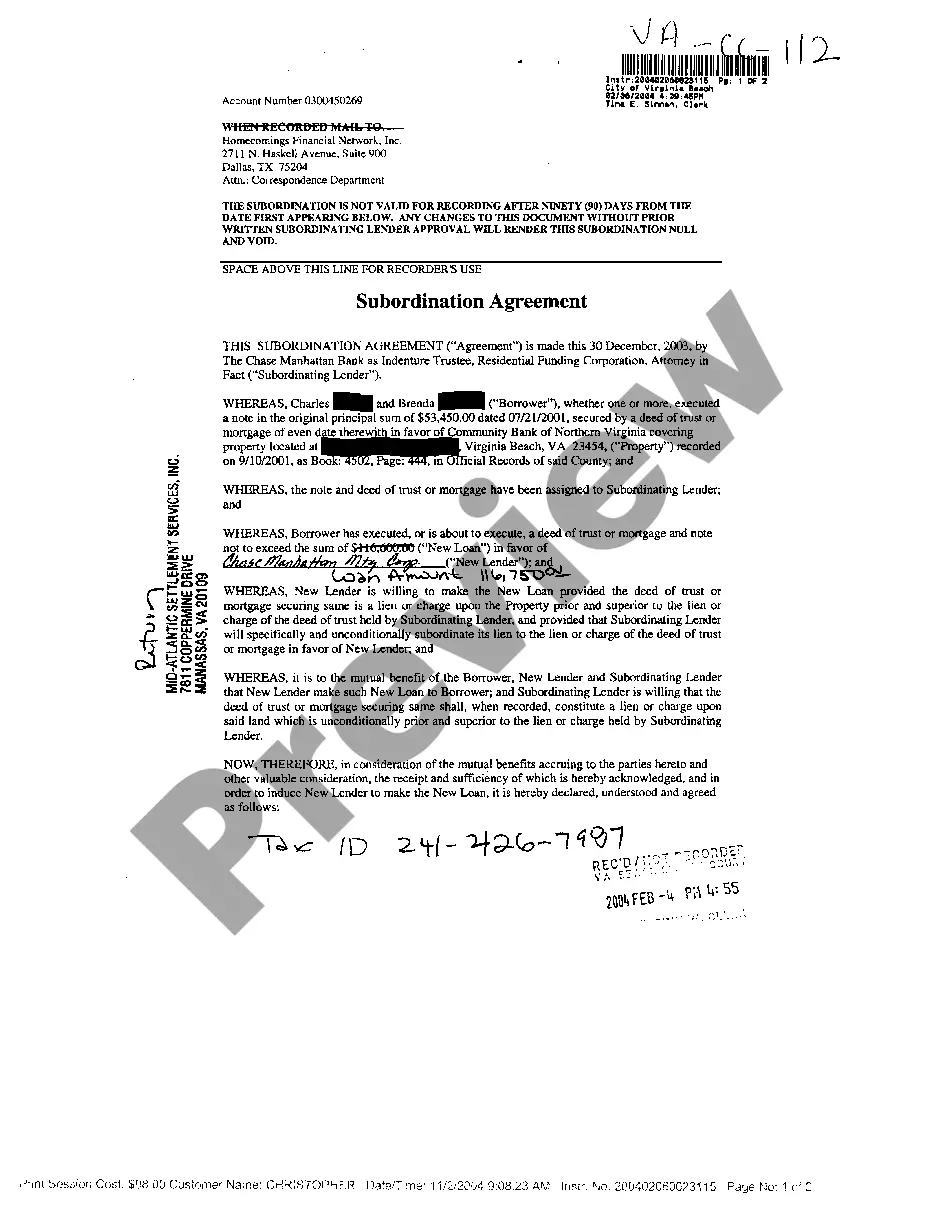

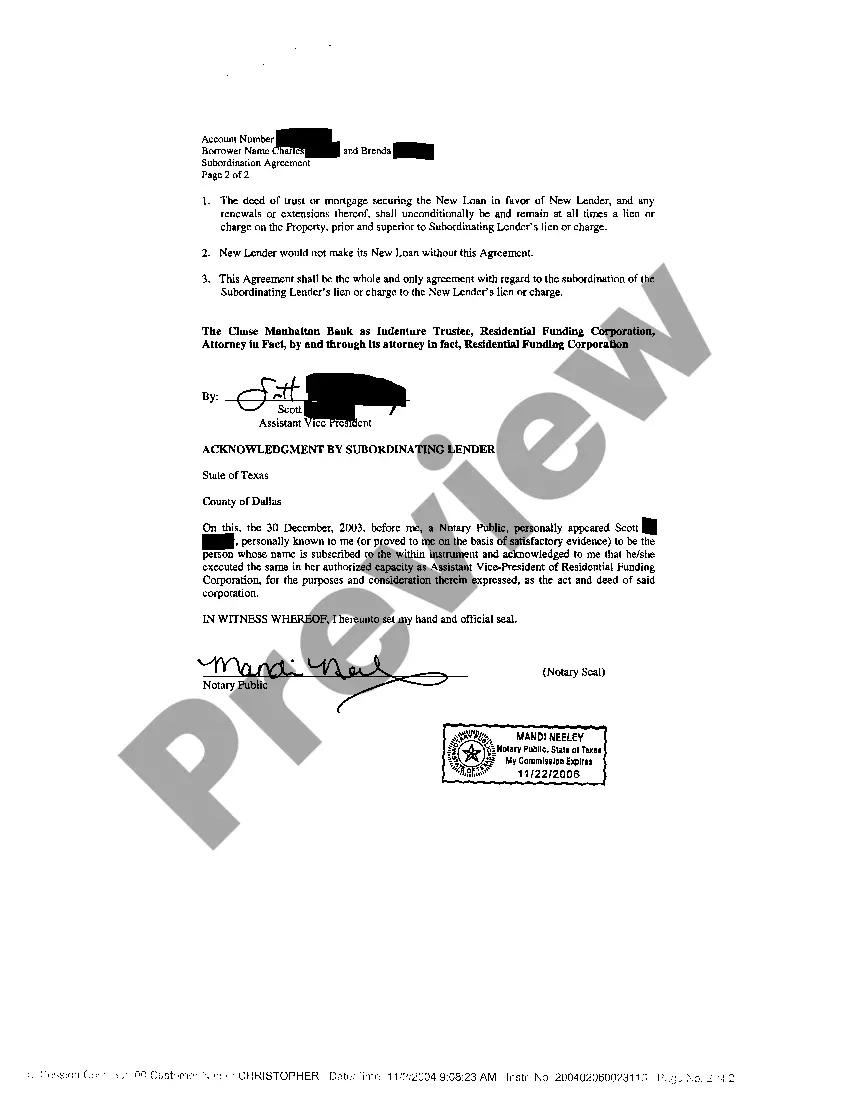

Virginia Subordination Agreement

Description

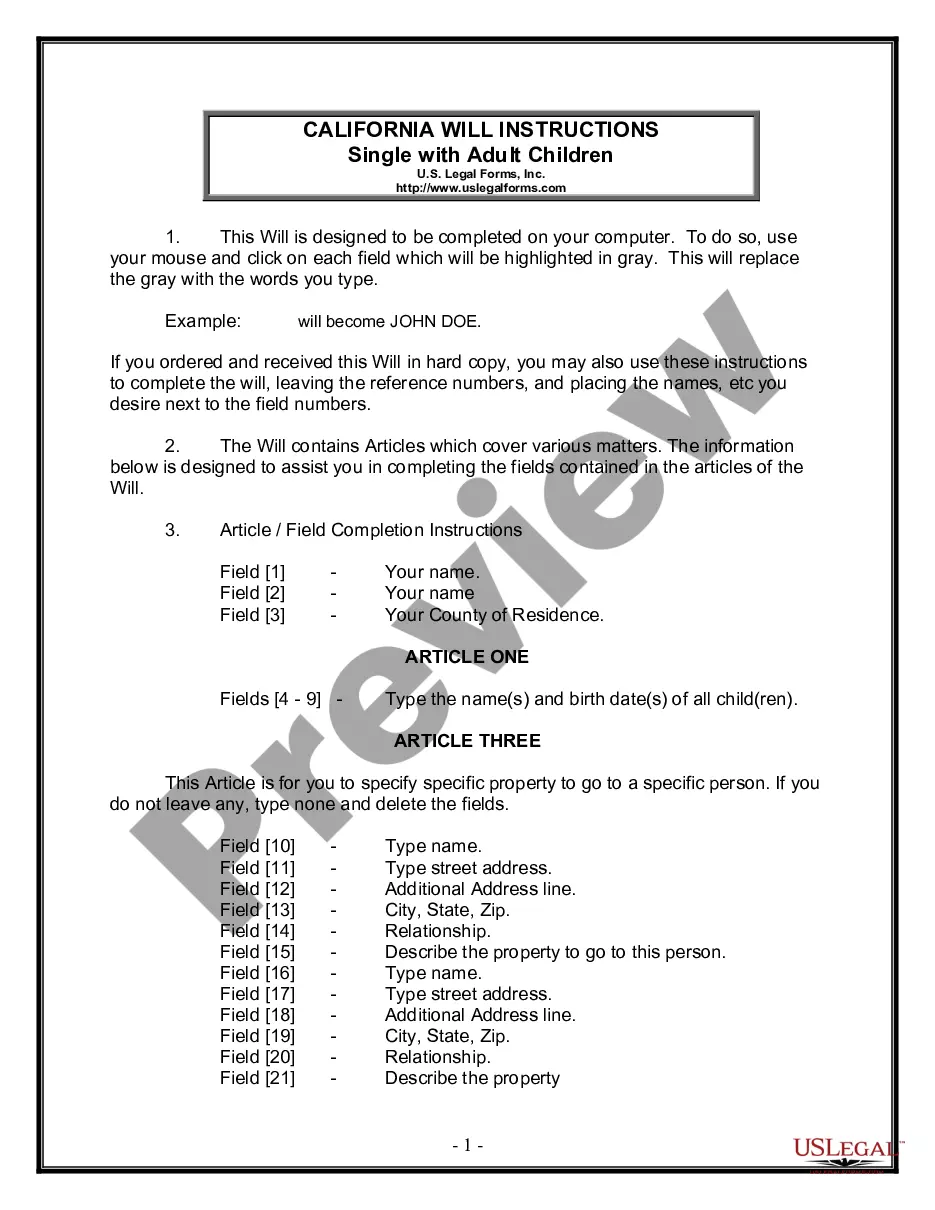

How to fill out Virginia Subordination Agreement?

Looking for a Virginia Subordination Agreement online might be stressful. All too often, you see files that you think are alright to use, but discover afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Get any form you’re searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will immediately be added in to your My Forms section. In case you do not have an account, you should sign up and pick a subscription plan first.

Follow the step-by-step guidelines listed below to download Virginia Subordination Agreement from our website:

- Read the form description and hit Preview (if available) to check whether the form suits your requirements or not.

- If the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it’s appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- Right after downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms catalogue. Besides professionally drafted templates, users can also be supported with step-by-step guidelines on how to get, download, and fill out forms.

Form popularity

FAQ

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

What is Automatic Subordination? Automatic Subordination of junior mortgages takes place when the junior mortgage is subordinated to a new first mortgage pursuant to the auto subordination statute, without a subordination agreement.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

A subordination agreement acknowledges that one party's claim or interest is superior to that of another party in the event that the borrower's assets must be liquidated to repay the debts.

The process by which a creditor holding a priority debt agrees to accept a lower priority for the collection of its debt in a deference to a new debt. ( See also: subordination agreement)

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.