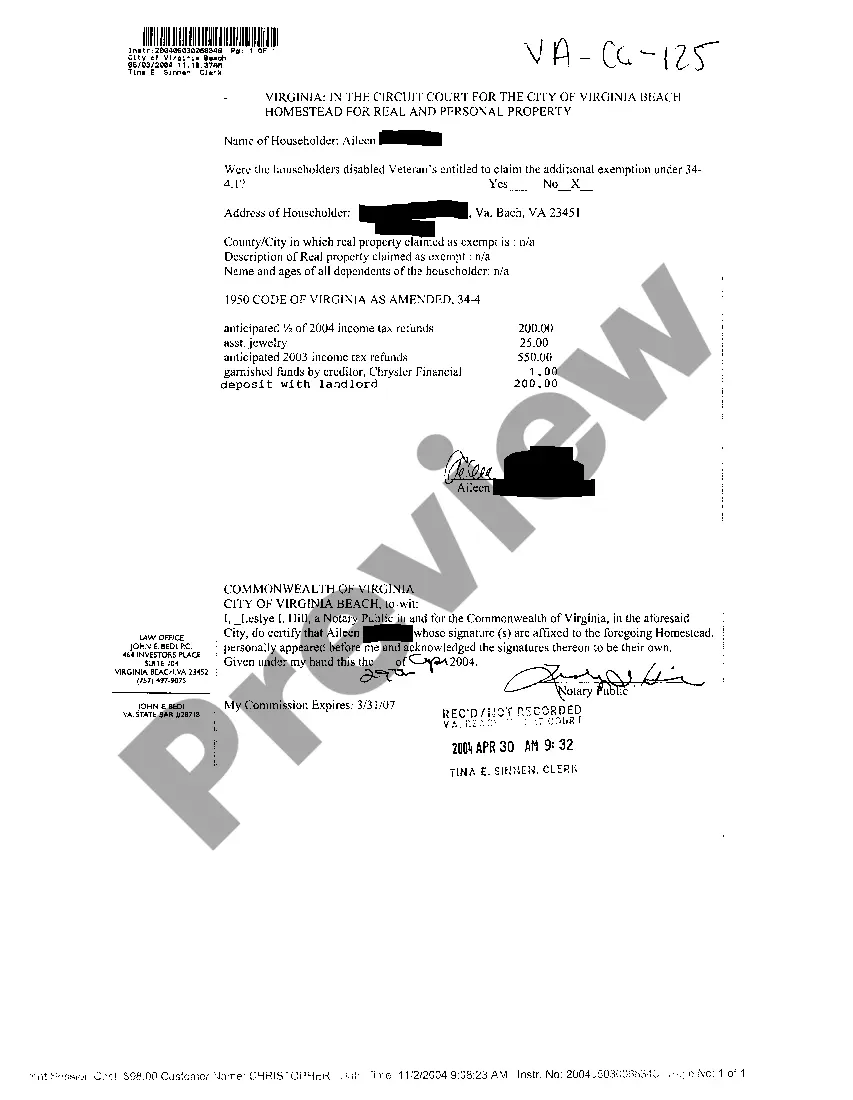

Virginia Tax Assessment Real And Personal Property

Description

How to fill out Virginia Tax Assessment Real And Personal Property?

Looking for a Virginia Tax Assessment Real And Personal Property online might be stressful. All too often, you see files which you think are alright to use, but find out afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Get any document you are looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will automatically be included in your My Forms section. In case you do not have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Virginia Tax Assessment Real And Personal Property from our website:

- Read the form description and hit Preview (if available) to verify if the template suits your requirements or not.

- If the document is not what you need, get others using the Search field or the listed recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- After getting it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted templates, users are also supported with step-by-step instructions concerning how to get, download, and complete forms.

Form popularity

FAQ

The personal property tax rate, set annually by City Council, is $3.45 per $100 of assessed value, or 3.45% except for Aircraft which is taxed at a rate of $1.06 per $100 assessed value, or 1.06% Aircraft 20,000 pounds or more are taxed at a rate of . 45 cents per $100 of assessed value.

Business Tangible Property and Vehicles Tangible personal property, as defined by state code, is all personal property not otherwise classified as intangible personal property, merchants' capital, or as short-term rental property (Code of Virginia, §58.1-3500).

The current tax rate for most all vehicles is $4.20 per $100 of assessed value.The current percentage of personal property tax relief is 35% and is provided only on the first $20,000 of a vehicle's value. For an estimate of the tax on your vehicle, contact the office of the Commissioner of the Revenue.

Online / Phone Visit the e-services portal to view and pay your personal property tax using credit cards, e-checks, or PayPal. You will need your account number, zip code on file with the Treasurer's Office, and the last four digits of your Social Security number or customer number.

Personal Property Taxes are due semi-annually on June 25th and December 5th. Supplement bills are due within 30 days of the bill date. View important dates for current supplements and due dates.

All cities and counties in Virginia have a personal property tax which helps fund local government. For Arlington County residents, the tax is assessed on all motor vehicles that are garaged (regularly parked) overnight in Arlington County per Arlington County Code § 27-11.1 , including: Cars.

The current tax rate for most all vehicles is $4.20 per $100 of assessed value.The current percentage of personal property tax relief is 35% and is provided only on the first $20,000 of a vehicle's value. For an estimate of the tax on your vehicle, contact the office of the Commissioner of the Revenue.

Property taxes in Virginia are calculated by multiplying a home's assessed value by its total property tax rate. Assessed value is determined by local assessors on regular two- to six-year cycles. By state law, cities are required to reassess every two years and counties every four years.