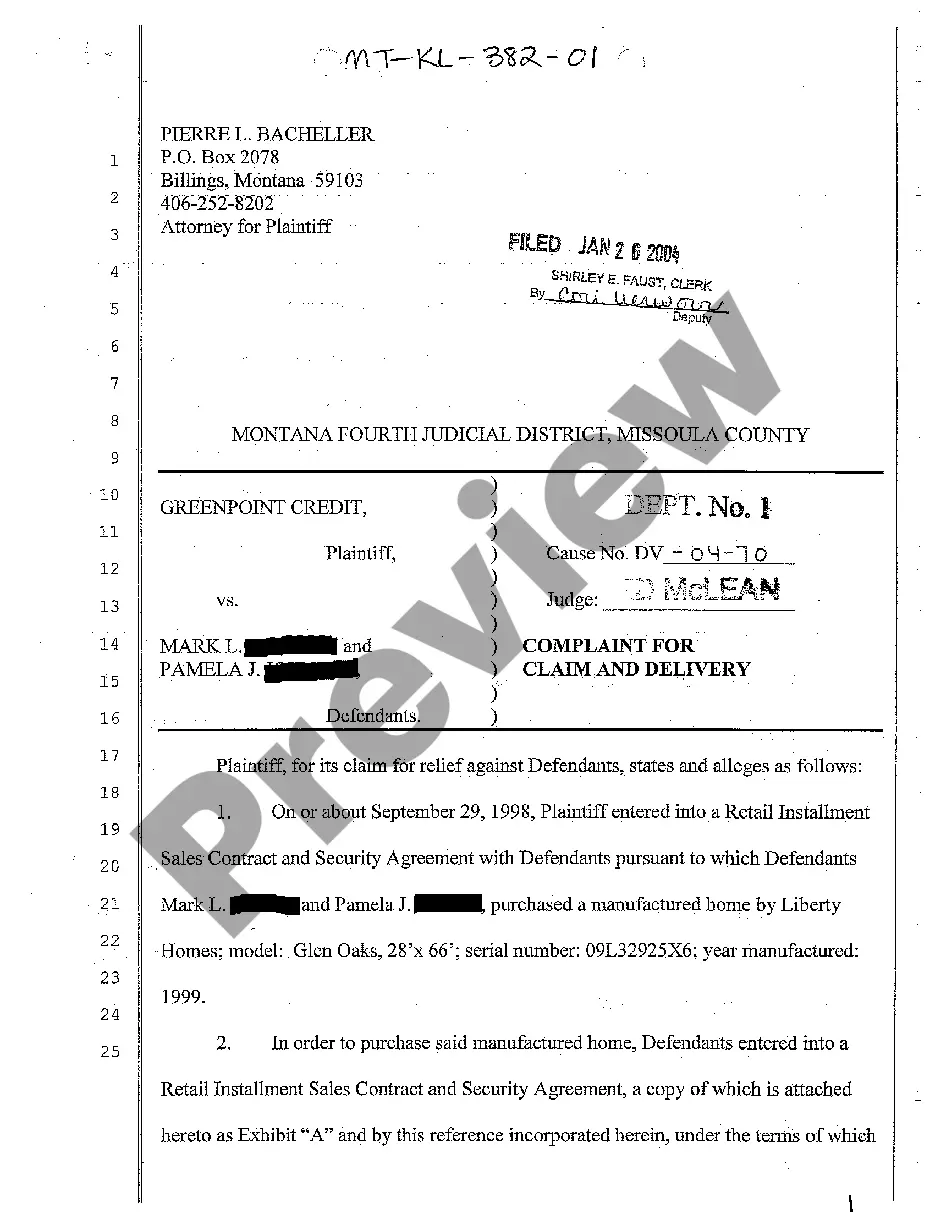

This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

Virginia Certificate of Creditor or Person Other Than a Distributee

Description Virginia Probate Forms

How to fill out Virginia Certificate Of Creditor Or Person Other Than A Distributee?

Looking for a Virginia Certificate of Creditor or Person Other Than Distributee online might be stressful. All too often, you see documents which you believe are fine to use, but find out later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Have any document you are looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be included to your My Forms section. If you don’t have an account, you need to sign-up and choose a subscription plan first.

Follow the step-by-step instructions below to download Virginia Certificate of Creditor or Person Other Than Distributee from our website:

- See the form description and press Preview (if available) to check whether the template suits your requirements or not.

- If the document is not what you need, find others using the Search engine or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. In addition to professionally drafted samples, customers may also be supported with step-by-step guidelines regarding how to find, download, and fill out forms.

Form popularity

FAQ

Virginia law provides that any person desiring to prove any debt or demand against the estate shall file his claim or a written statement thereof with the Commissioner of Accounts. There is filing fee under the uniform Commissioners of Accounts fee schedule of $25 for each claim filed.

To qualify as the executor of an estate in Virginia, the individual must contact the clerk's office in the deceased's county of residence and schedule a meeting with the probate clerk. The potential executor brings all necessary paperwork to the meeting.

Length and Commitment of Process. A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

A: The certificate of qualification, sometimes referred to as letters testamentary, is the certificate that the personal representative receives from the Clerk at the time of qualification, which states that the person has qualified as executor or administrator and has authority to act on behalf of the estate.

Probate in Virginia is a court-supervised legal process that may be required after someone dies. Probate gives someone, usually the surviving spouse or other close family member, authority to gather the deceased person's assets, pay debts and taxes, and eventually transfer assets to the people who inherit them.

Virginia is a common law property state. This means that in cases of intestacy, the estate is automatically inherited by the spouse.Therefore, if there is a surviving spouse, the spouse will receive the deceased's portion of all marital properties.

WHO INHERITS THE PROPERTY OF AN INTESTATE? someone other than the surviving spouse in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children. f0a7 if no surviving spouse, all passes to the children and their descendants.

To qualify as the executor of an estate in Virginia, the individual must contact the clerk's office in the deceased's county of residence and schedule a meeting with the probate clerk. The potential executor brings all necessary paperwork to the meeting.