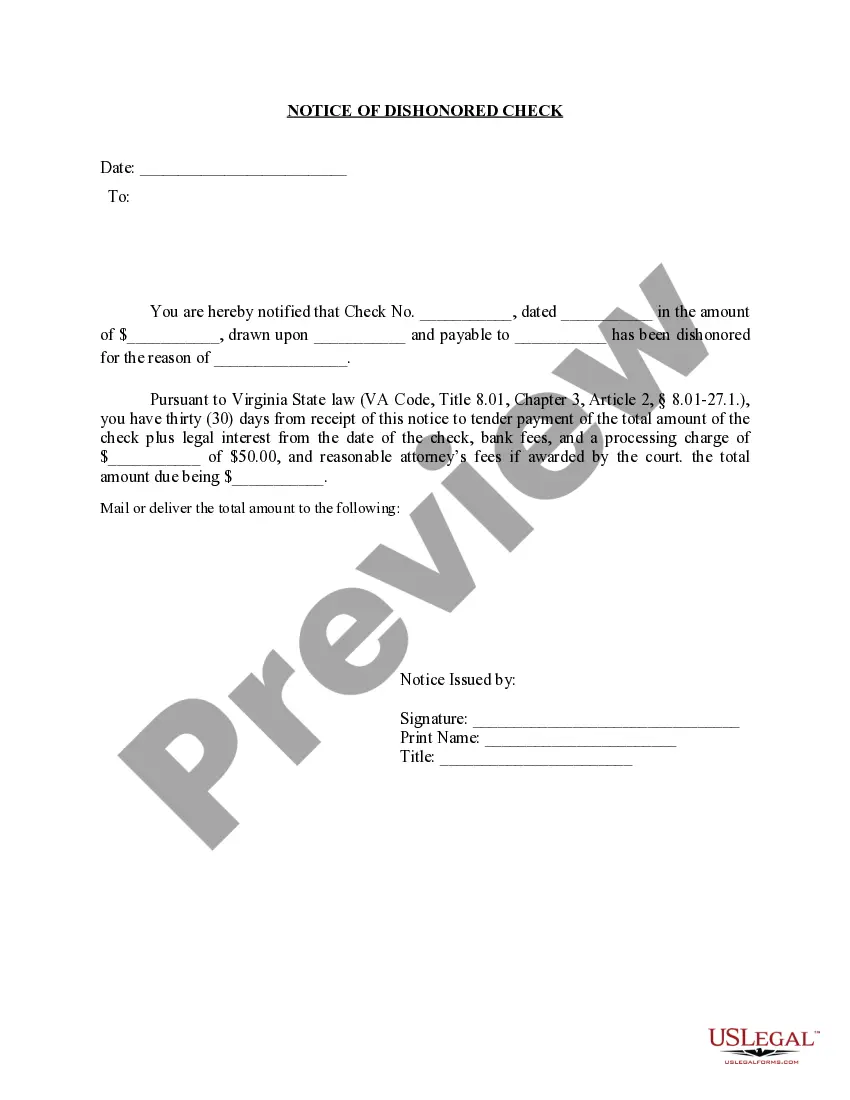

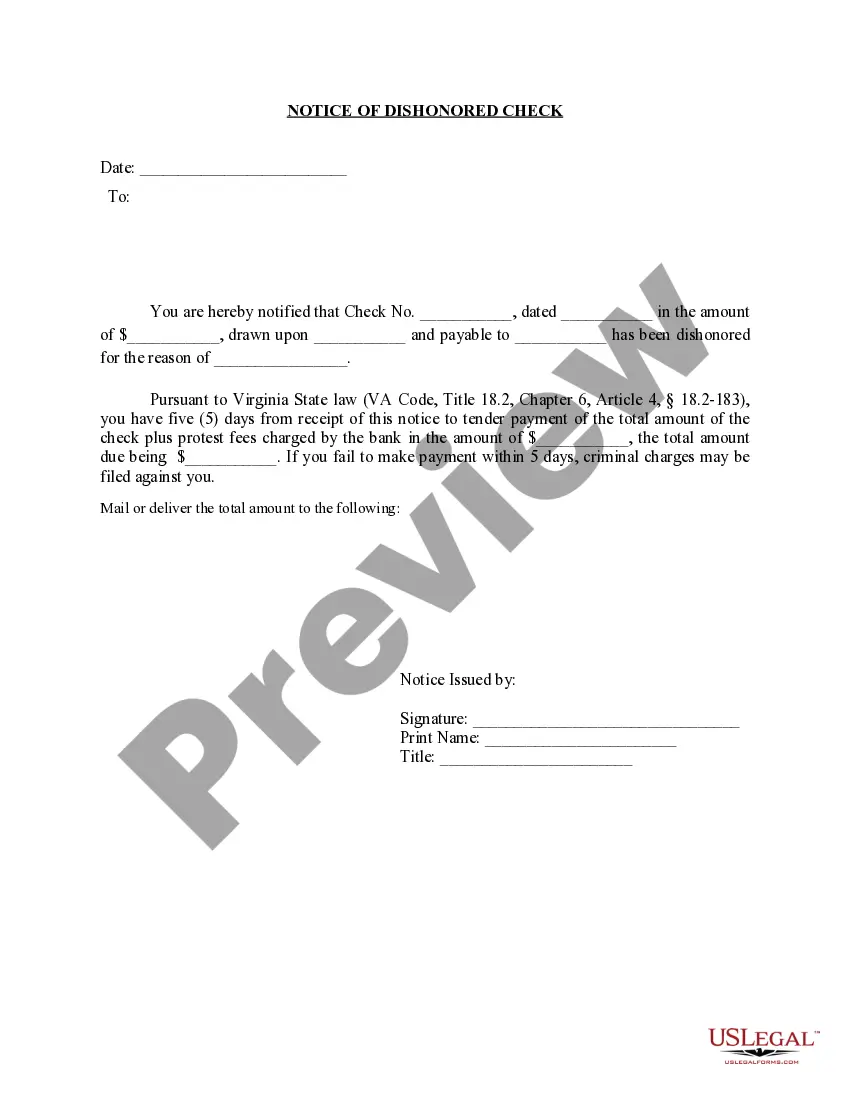

Form of notice for bad check.

Virginia Bad Check Notice

Description

How to fill out Virginia Bad Check Notice?

Searching for a Virginia Bad Check Notice on the internet might be stressful. All too often, you see documents that you simply think are fine to use, but discover afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any form you are searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be included to your My Forms section. In case you do not have an account, you have to sign-up and choose a subscription plan first.

Follow the step-by-step instructions below to download Virginia Bad Check Notice from our website:

- See the document description and press Preview (if available) to verify if the template meets your expectations or not.

- If the document is not what you need, find others using the Search field or the provided recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- After getting it, you may fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms library. In addition to professionally drafted samples, users can also be supported with step-by-step guidelines concerning how to find, download, and fill out forms.

Form popularity

FAQ

Under criminal penalties, you can be prosecuted and even arrested for writing a bad check. A bounced check typically becomes a criminal matter when the person who wrote it did so intending to commit fraud, such as writing several bad checks in a short time frame knowing there is no money to cover them.

As defined under California Penal Code Section 476a, writing a check while knowing that funds are insufficient can be charged as a misdemeanor offense that can result in sentence of up to one year in county jail.

Knowingly writing a bad check is an act of fraud, and is punishable by law. Writing bad checks is a crime. Penalties for people who tender checks knowing there are insufficient funds in their accounts vary by state.But in the majority of states, the crime is considered a misdemeanor.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony.

Contact the bank that placed the negative information on your report. If the information is true, it isn't obligated to change or remove the information. You can, however, write a short explanation of the circumstances surrounding the bad check for inclusion in your report.

Writing bad checks in the Commonwealth of Virginia can be considered a felony offense or a misdemeanor.However, if you wrote a bad check for over $200, then this would be considered a crime and tried as a Class 6 felony offense, with a prison term.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Penal Code 476a PC is the California statute that makes it a crime for a person to write or pass a bad check, knowing there are insufficient funds to cover payment of the check. The offense can be charged as a felony if the value of the bad checks is more than $950.00. Otherwise, the offense is only a misdemeanor.