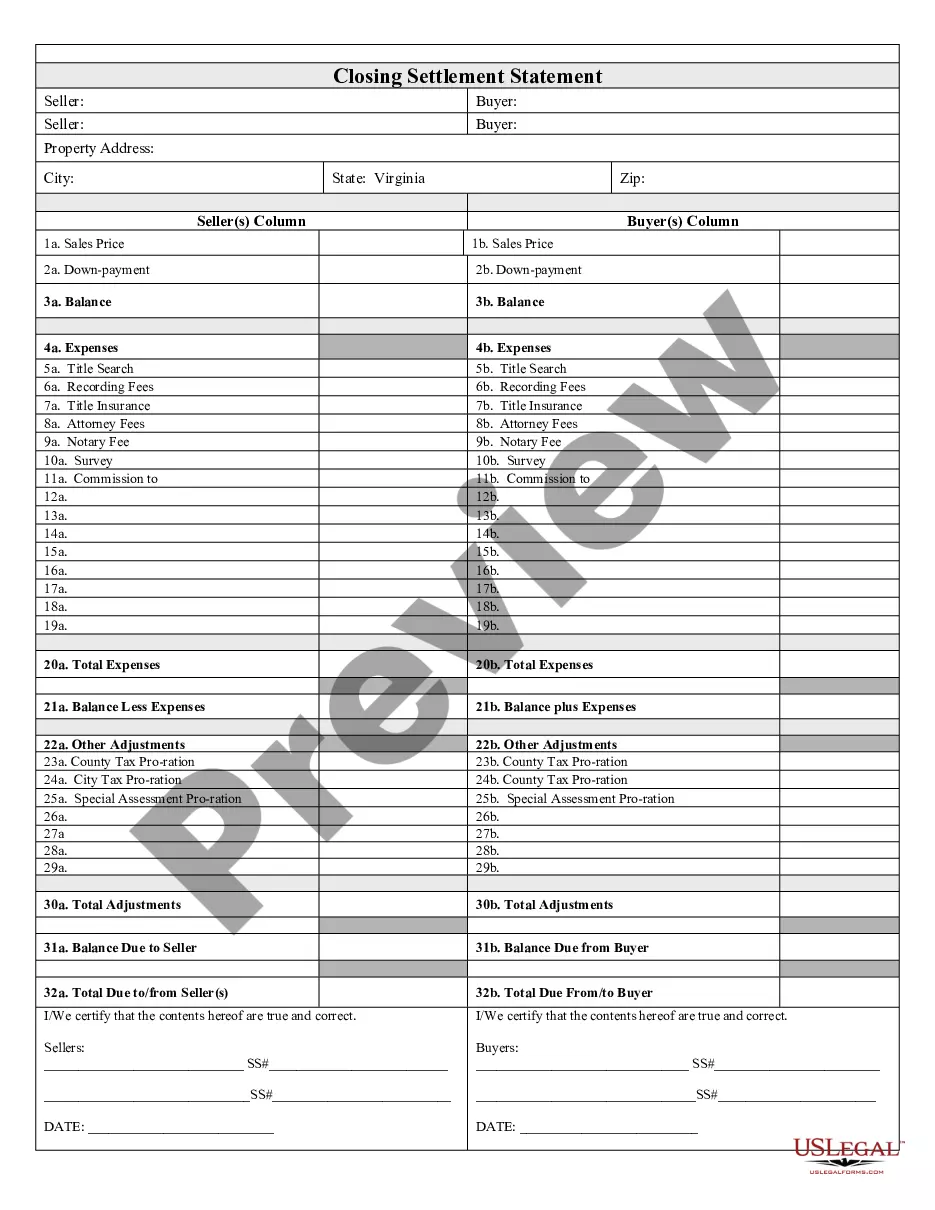

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Virginia Closing Statement

Description

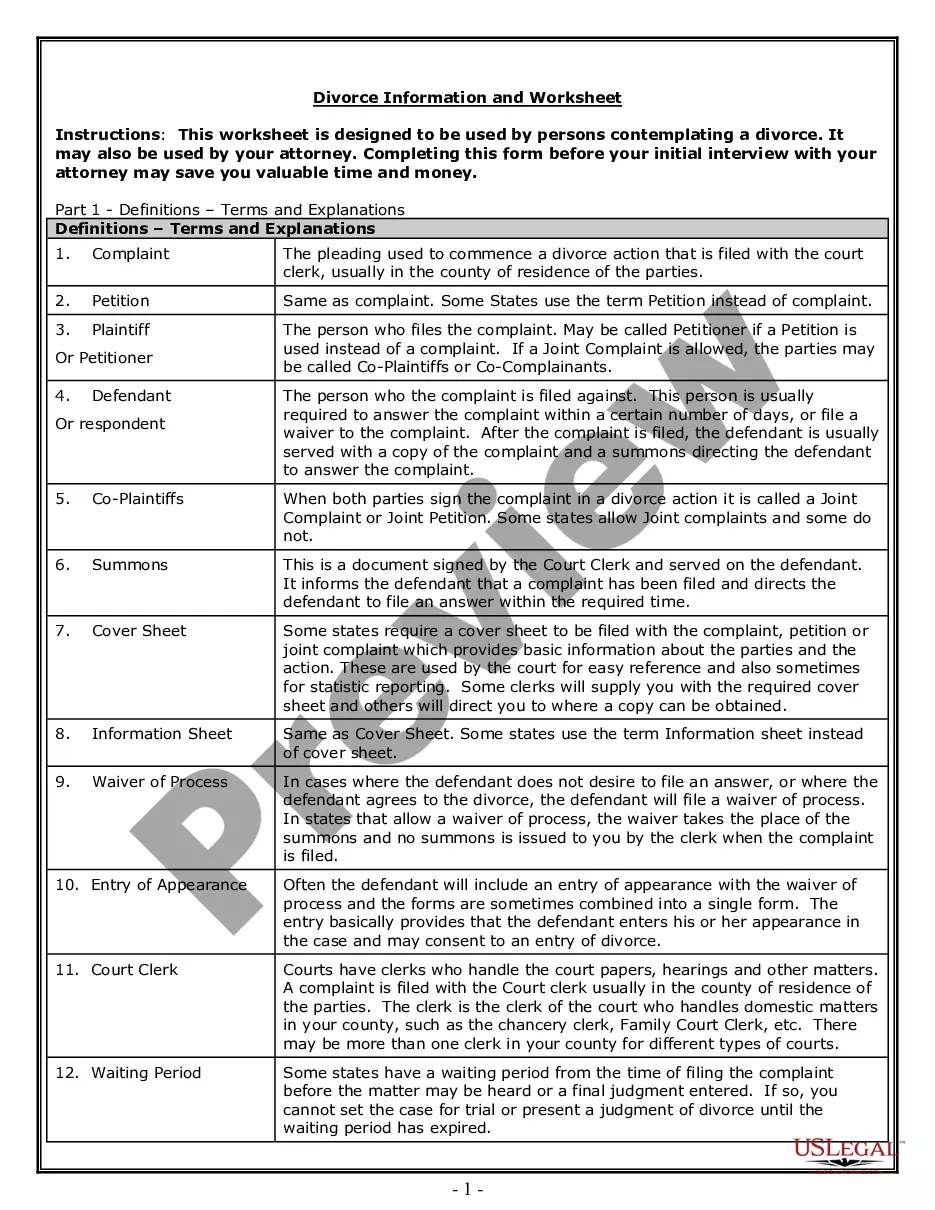

How to fill out Virginia Closing Statement?

Searching for a Virginia Closing Statement online might be stressful. All too often, you find papers that you just think are fine to use, but find out later they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional attorneys in accordance with state requirements. Have any form you are looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included to the My Forms section. If you don’t have an account, you must sign-up and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Virginia Closing Statement from our website:

- See the form description and hit Preview (if available) to check if the template meets your expectations or not.

- In case the form is not what you need, find others using the Search engine or the listed recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the document in a preferable format.

- After getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted samples, users will also be supported with step-by-step instructions regarding how to find, download, and fill out forms.

Form popularity

FAQ

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

Page 1: Information, loan terms, projected payments costs at closing. Page 2: Closing cost details including loan costs and other costs. Page 3: Cash needed to close and a summary of the transaction. Page 4: Additional information about your loan. Page 5: Loan calculations, disclosure information and contact information.

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exceptionreverse mortgages.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1.

Does Closing Disclosure mean clear to close? If the Closing Disclosure meets your expectations, you are clear to close. However, the loan doesn't become official until you sign all the paperwork at closing. And things can change in the three business days before loan settlement.

The HUD-1 form is used in purchase transactions, and it includes lines for both borrower charges/fees and seller charges/fees.The HUD-1A is an option, instead of using the HUD-1, for loan transactions that do not include a seller (refinance). The HUD-1 is three pages, while the HUD-1A is only two pages.

Check the spelling of your name. Check that loan term, purpose, product, and loan type match your most recent Loan Estimate. Check that the loan amount matches your most recent Loan Estimate. Check your interest rate. Monthly Principal & Interest. Does your loan have a prepayment penalty?