This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

Virginia Affidavit of Surety

Description

How to fill out Virginia Affidavit Of Surety?

Searching for a Virginia Affidavit of Surety online might be stressful. All too often, you see documents that you believe are alright to use, but find out later on they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Have any form you’re searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will immediately be added in to the My Forms section. If you do not have an account, you should register and select a subscription plan first.

Follow the step-by-step instructions listed below to download Virginia Affidavit of Surety from our website:

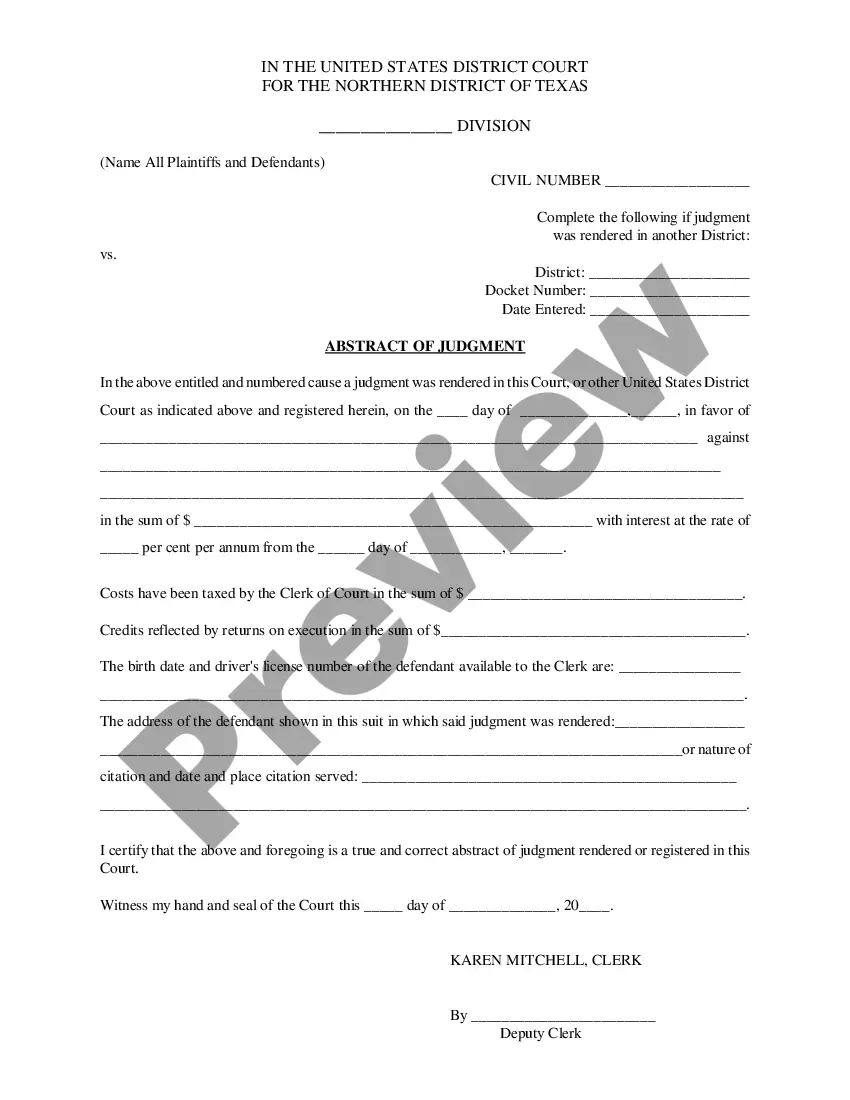

- Read the form description and hit Preview (if available) to check whether the form suits your expectations or not.

- If the form is not what you need, get others with the help of Search engine or the listed recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the document in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted samples, customers will also be supported with step-by-step guidelines concerning how to find, download, and complete forms.

Form popularity

FAQ

What Does a Virginia Surety Bond Cost? Surety bonds generally cost 1-15% of the required bond amount.

Bails Vs Surety Bonds The difference between bail and surety bonds is that bail involving cash bonds only require the involvement of two partiesthe defendant and the court. Surety bonds however, require the involvement of three parties in the bailing processthe court, the defendant and the bail agent.

When it comes to surety bonds, you will not need to pay month-to-month. In fact, when you get a quote for a surety bond, the quote is a one-time payment quote. This means you will only need to pay it one time (not every month).Most bonds are quoted at a 1-year term, but some are quoted at a 2-year or 3-year term.

When it comes to surety bonds, you will not need to pay month-to-month. In fact, when you get a quote for a surety bond, the quote is a one-time payment quote. This means you will only need to pay it one time (not every month).Most bonds are quoted at a 1-year term, but some are quoted at a 2-year or 3-year term.

An individual who undertakes an obligation to pay a sum of money or to perform some duty or promise for another in the event that person fails to act.

A bond for a $100,000 contract will typically cost $500 to $2,000. Get a free Performance Bond quote.

Nevada law requires all Notaries to purchase and maintain a $10,000 Notary surety bond for the duration of their 4-year commission. The Notary bond protects the general public of Nevada against any financial loss due to improper conduct by a Nevada Notary. The bond is NOT insurance protection for Nevada Notaries.