This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

Virginia Request For Hearing Exemption Claim W-Instructions

Description

How to fill out Virginia Request For Hearing Exemption Claim W-Instructions?

Searching for a Virginia Request for Hearing Exemption Claim on the internet might be stressful. All too often, you find papers which you think are ok to use, but find out later on they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Get any form you are searching for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added in your My Forms section. If you do not have an account, you must register and select a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Request for Hearing Exemption Claim from our website:

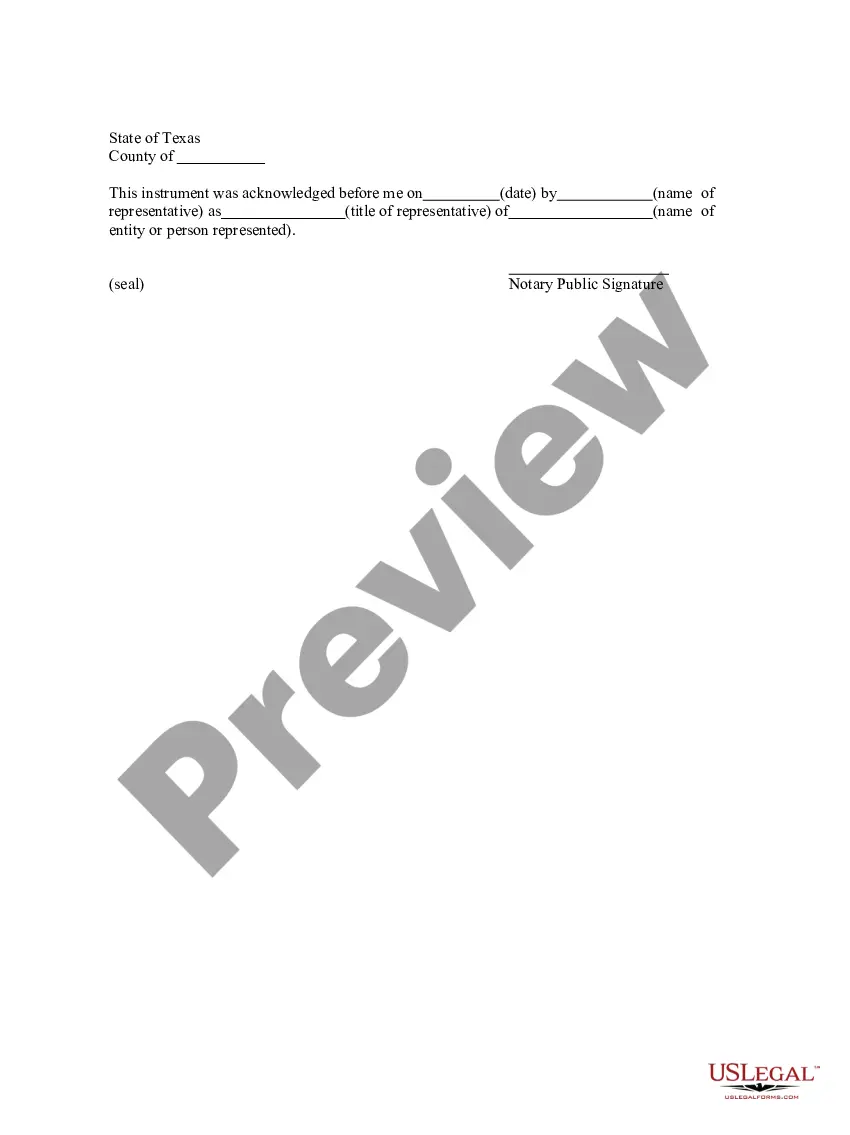

- See the form description and click Preview (if available) to verify whether the form suits your requirements or not.

- In case the document is not what you need, get others using the Search engine or the provided recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms catalogue. Besides professionally drafted templates, customers are also supported with step-by-step instructions on how to get, download, and fill out templates.

Form popularity

FAQ

Funds Exempt from Bank Account Garnishment Social Security, and other government benefit, or payments. Monies received for child support or alimony (spousal support) Workers' compensation payments. Retirement funds, such as those from pensions or annuities.

Section 15062 - Notice of Exemption (a) When a public agency decides that a project is exempt from CEQA pursuant to Section 15061, and the public agency approves or determines to carry out the project, the agency may, file a notice of exemption. The notice shall be filed, if at all, after approval of the project.

The exempt benefits are typically funds received from the government for a specific reason. For example, Veteran's Assistance benefits, Social Security, Workers' Compensation, Unemployment and Disability are benefits that cannot be seized in order to pay off outstanding debts.

Exemption laws allow you to keep a portion of your property away from your creditors when you can't pay a bill.The protected property is known as exempt property. You'll find a listing of exempt property in your state's exemption statutes.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

The court order is called a garnishment. What's important to know is that federal benefits ordinarily are exempt from garnishment. That means you should be able to protect your federal funds from being taken by your creditors, although you might have to go to court to do so.

Notices of Exemption - When a public agency determines that a project is exempt from CEQA, a Notice of Exemption (NOE) is prepared and may be filed by a public agency after it has decided to carry out or approve a project.

A Claim of Exemption is a form a debtor files with the levying officer (like the sheriff or marshal) explaining why the property or money that the creditor wants to take should be exempt (excluded). There are laws and rules that say which types of income or property are exempt.

Virginia law limits the amount that a creditor can garnish (take) from your wages to repay a debt. Most creditors with a money judgment against you can take only 25% of your earnings. However, creditors can take more if you owe taxes or a support obligation, but only 15% on a defaulted student loan.