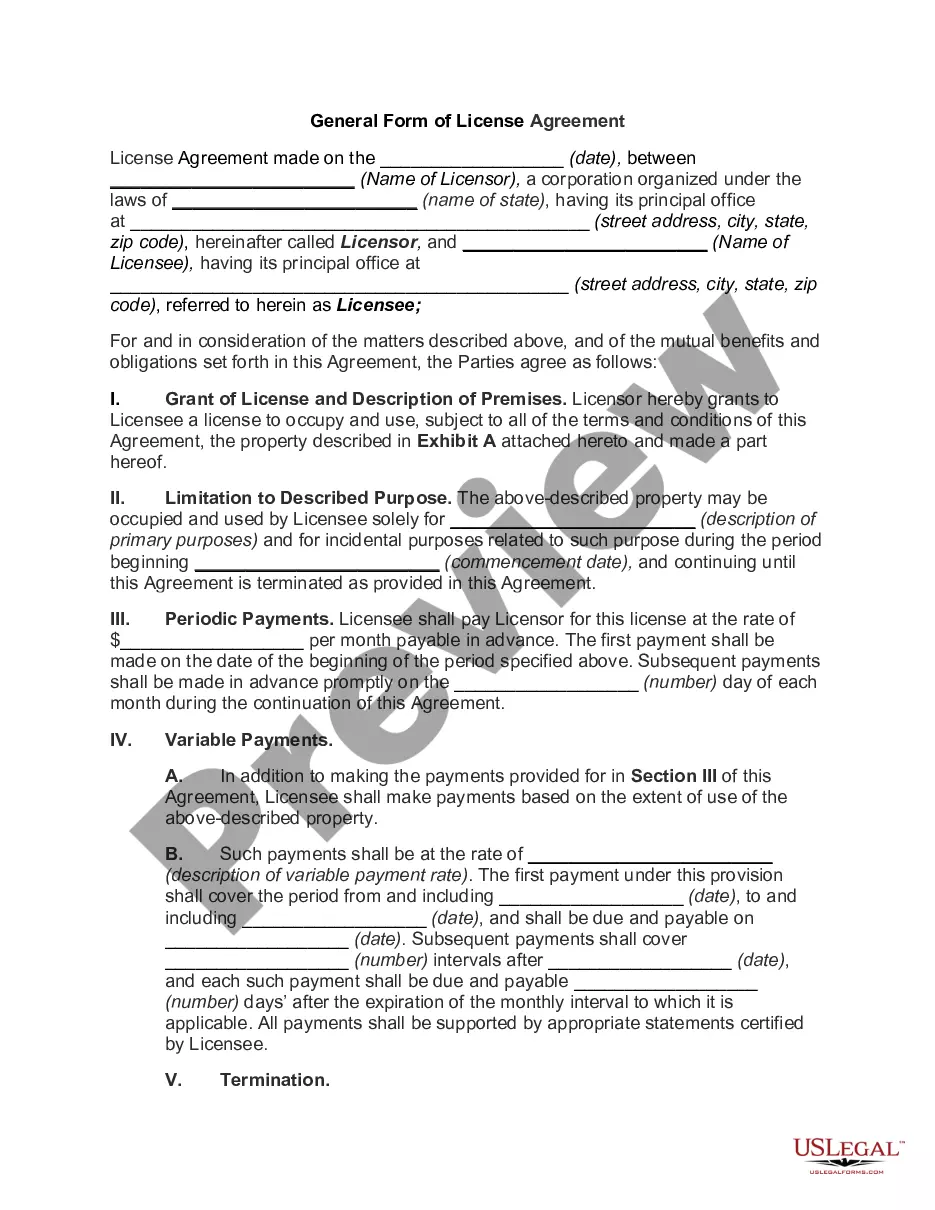

This is a Child Support Guidelines Worksheet, to be used in the State of Virginia. This form is used to calculate the correct amount of child support to be paid by the parties in a divorce action. Attached to this form is the statutory Schedule of Monthly Child Support Guidelines.

Virginia Child Support Guidelines Worksheet

Description Va Child Support Worksheet

How to fill out Virginia Child Support Guidelines Worksheet?

Among countless free and paid templates which you find on the internet, you can't be certain about their reliability. For example, who created them or if they’re qualified enough to deal with what you require these people to. Always keep calm and utilize US Legal Forms! Get Virginia Child Support Guidelines Worksheet with Schedule of Monthly Child Support Obligations templates developed by professional lawyers and prevent the expensive and time-consuming process of looking for an lawyer and then paying them to draft a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access all your previously acquired templates in the My Forms menu.

If you’re utilizing our service for the first time, follow the guidelines listed below to get your Virginia Child Support Guidelines Worksheet with Schedule of Monthly Child Support Obligations quick:

- Make certain that the file you discover is valid in your state.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another sample utilizing the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you have signed up and purchased your subscription, you may use your Virginia Child Support Guidelines Worksheet with Schedule of Monthly Child Support Obligations as often as you need or for as long as it continues to be valid where you live. Change it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

So if you were ordered to pay child support to benefit your two-year-old, let's say, twenty years later (yes, your child would be 22), if your ex-wife has not pursued you, you can be relieved of the debt under Code of Virginia § 8.01-251: A.

This figure should not exceed 5% of the parents' combined gross income. (Virginia Code § 20-108.2(F)) Insert actual cost or the amount required to provide quality child care, whichever is less.

The only situation where a parent can waive child support might be if a custodial parent chooses to waive child support arrears.Another situation may be that the parent paying support has made an offer to pay a portion of the past due support in exchange for the custodial parent waiving the remaining arrearage.

Virginia's laws are so strict that parents cannot even waive or limit a child's right to child support.Child support arrears cannot be waived nor can the Court modify the child support arrears that have already accrued.

As each payment has a determined due date, the Supreme Court held that Virginia Code 8.01-251 (A) applies a 20-year statute of limitations to each child support payment from the date that each payment is due as expressed by the court order.

If the combined family income is $35,000 or greater per month, it falls outside the table and support is based on a percentage of income from 2.6% for one child to 5% for six children. Items that are added to the support obligation include the cost of health insurance and any work-related childcare expenses.

In Virginia, both parentswhether married to one another or notare obligated to support their children. Child support payments are based on the combined incomes of both parents. This gives the child (or children) the benefit of what the parents could have provided in a single household.

Child support debt does not disappear when the original support obligation terminates.If you are paying for arrears accrued while your son was a minor, you will have to continue to pay those support arrearage payments until the debt is paid off.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.