This Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Virginia Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Virginia Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

Looking for a Virginia Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children on the internet can be stressful. All too often, you see files which you think are alright to use, but discover later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers according to state requirements. Have any document you are looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be included in your My Forms section. In case you don’t have an account, you must sign-up and choose a subscription plan first.

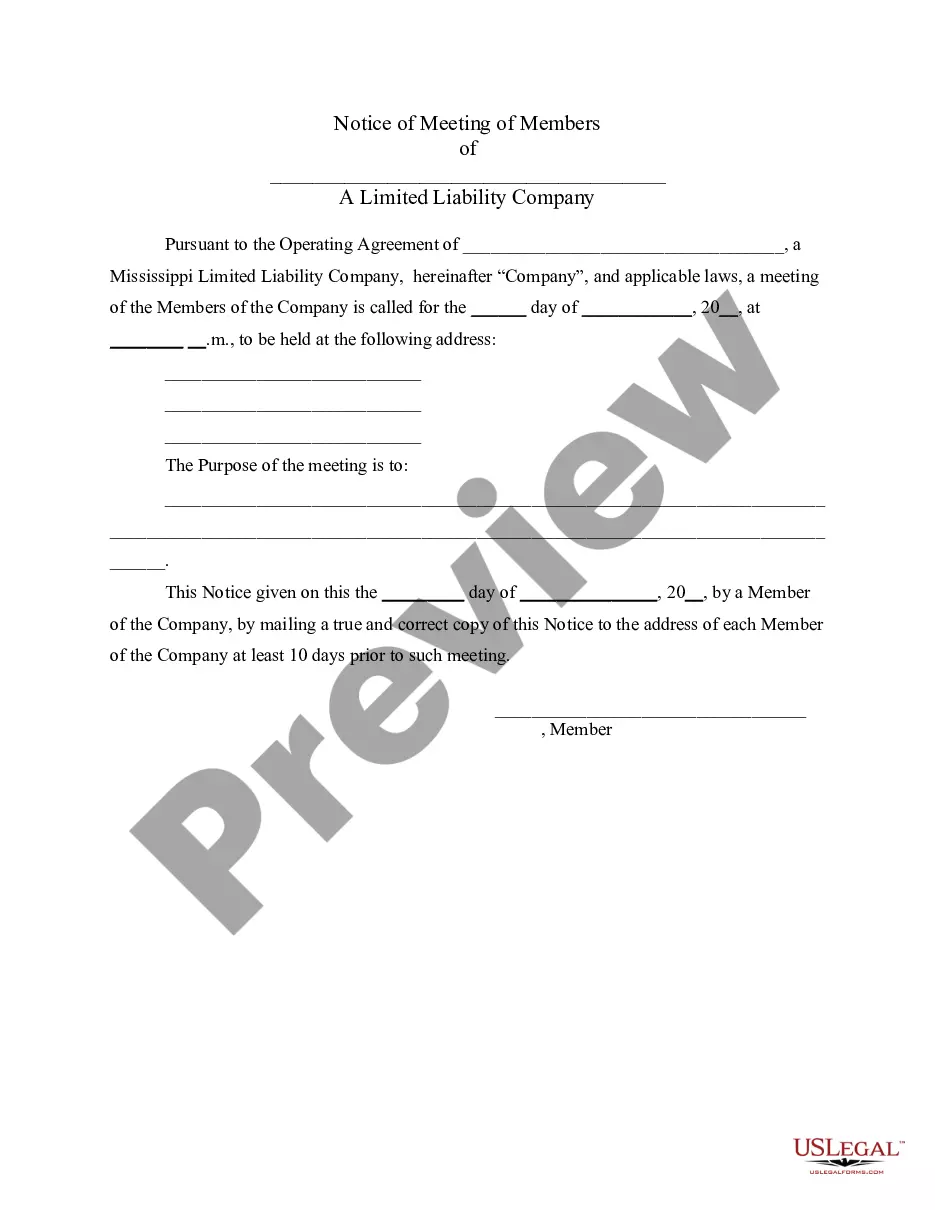

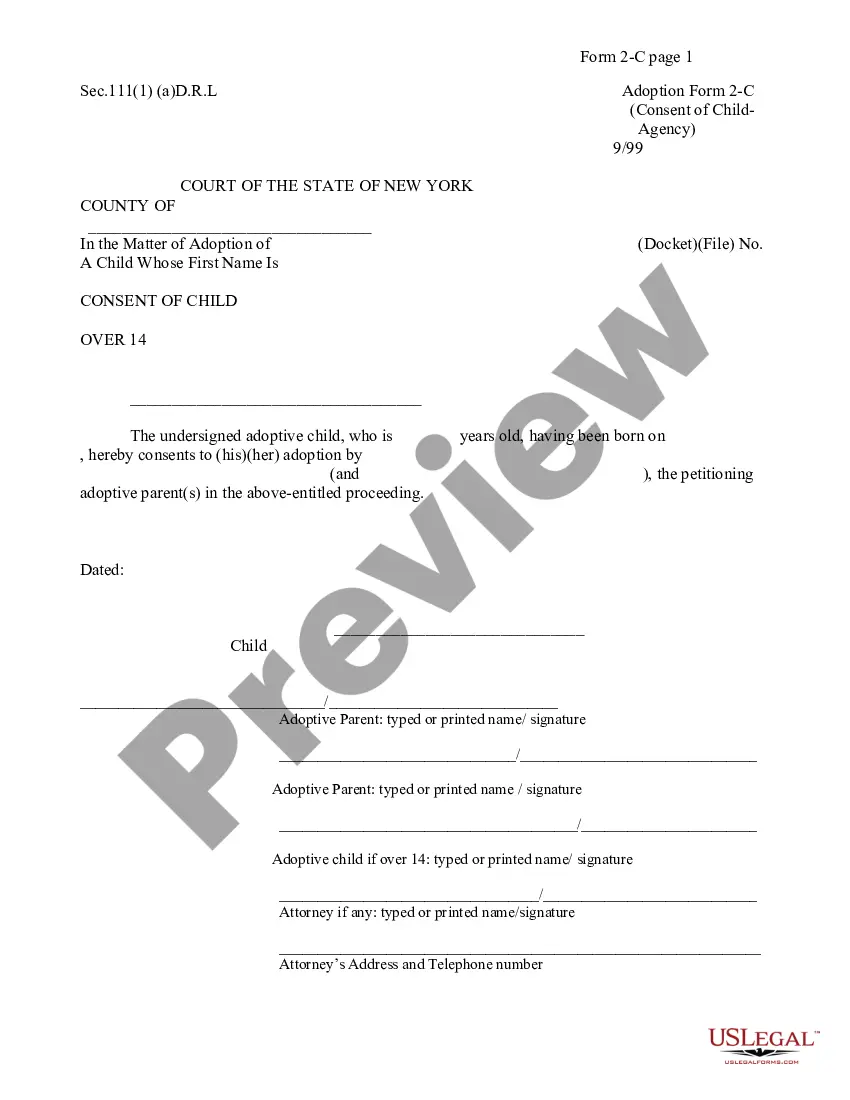

Follow the step-by-step instructions below to download Virginia Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children from our website:

- See the form description and press Preview (if available) to verify if the form meets your requirements or not.

- If the form is not what you need, find others using the Search engine or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, customers can also be supported with step-by-step guidelines concerning how to get, download, and fill out forms.

Form popularity

FAQ

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

A living trust in Virginia is an estate planning option that allows you to place your assets in trust while continuing to use and control them. The trust passes the assets to your beneficiaries after your death. A revocable living trust (inter vivos trust) offers unique control and flexibility.

Many people find that they can successfully set up their own living trust without the help of a lawyer. Making a living trust takes a more work than writing a will because a living trust requires that you take the additional step of transferring property into the trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.