Working with official paperwork requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Virginia Statement in Lieu of Accounting-Intent to File template from our library, you can be sure it complies with federal and state laws.

Dealing with our service is straightforward and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Virginia Statement in Lieu of Accounting-Intent to File within minutes:

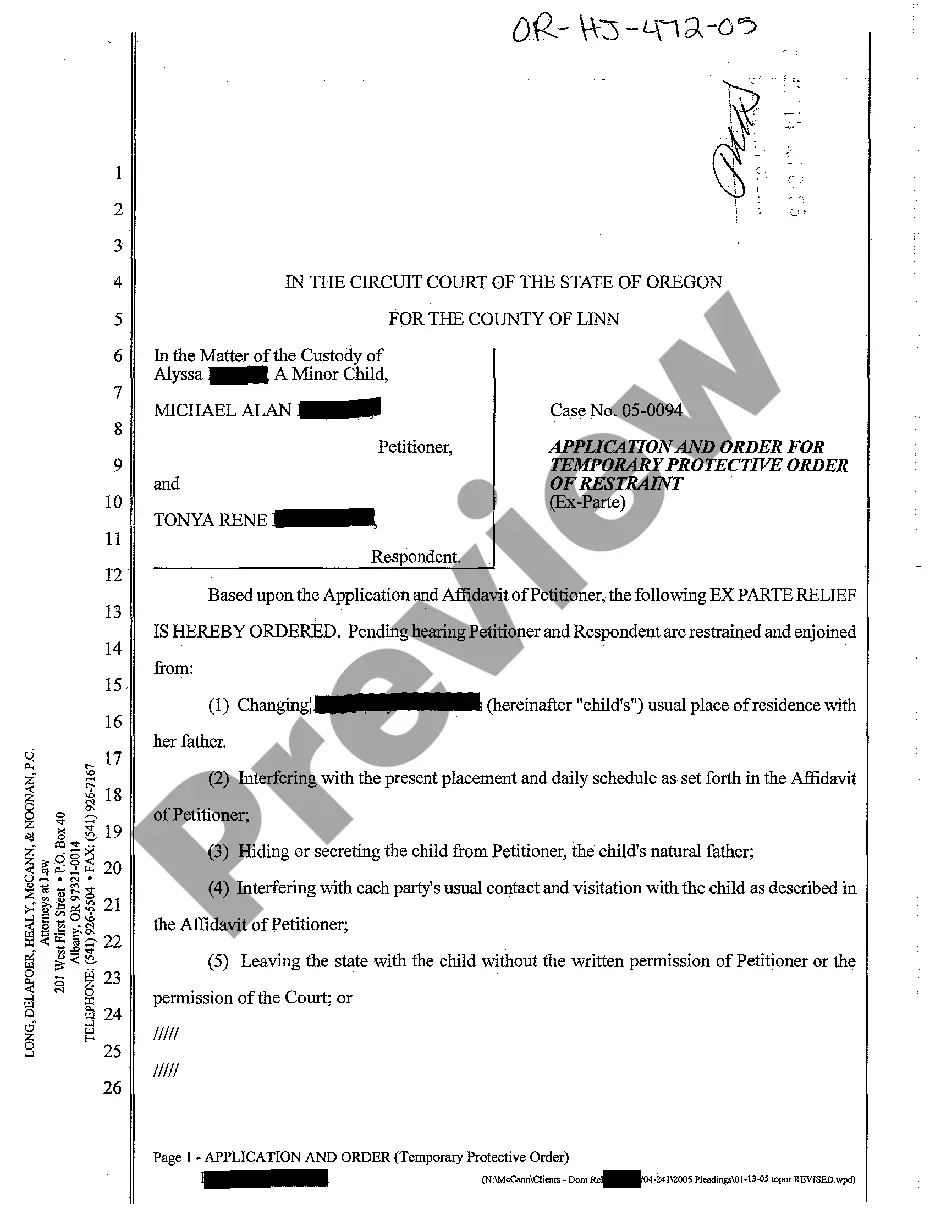

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Virginia Statement in Lieu of Accounting-Intent to File in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Virginia Statement in Lieu of Accounting-Intent to File you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

1. Copies – Original and one copy to the Commissioner of Accounts. 2. In accordance with Virginia Code Section 64.Schools established between July 1 and September 30, shall wait to file an affidavit until the PSA filing period begins in October. 30.202-5 Filing Disclosure Statements. 30. 202-6 Responsibilities. 200.419 Cost accounting standards and disclosure statement. You must keep accurate records and file accurate accounts. How long does it take to complete a filing with the Corporations Division? Am I eligible to apply as an Iowa exam candidate if I live in another state? Texas Comptroller of Public Accounts. Form.