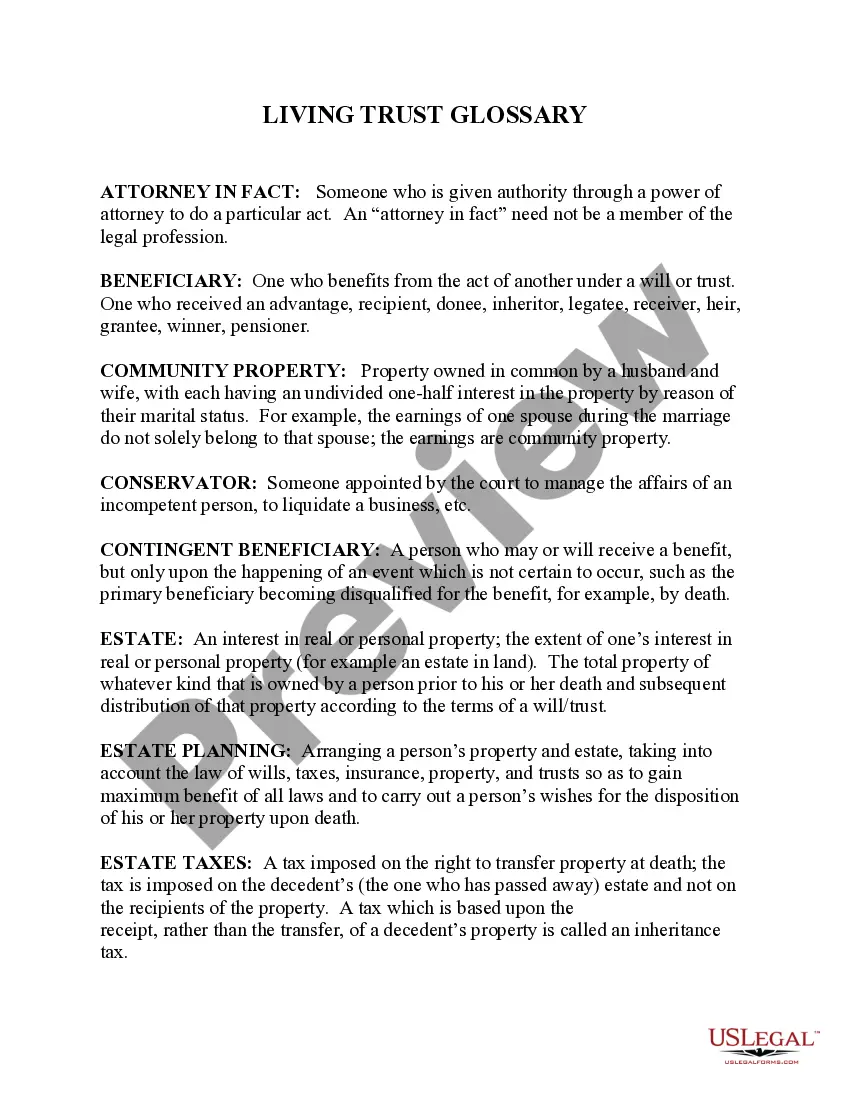

This document provides general information for a person who is a Settlor or Trustee of a trust in Virginia. The documents addresses the Revocable Living Trust. It also provides a glossary of terms.

Virginia Settlor and Trustee Instructions for Revocable Trust

Description

How to fill out Virginia Settlor And Trustee Instructions For Revocable Trust?

Searching for a Virginia Settlor and Trustee Instructions for Revocable Trust online can be stressful. All too often, you see documents that you think are alright to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Have any form you’re searching for in minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will immediately be included to the My Forms section. If you don’t have an account, you need to sign up and select a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Settlor and Trustee Instructions for Revocable Trust from our website:

- See the document description and click Preview (if available) to verify if the template meets your expectations or not.

- If the form is not what you need, find others using the Search engine or the provided recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms library. Besides professionally drafted templates, customers are also supported with step-by-step instructions regarding how to get, download, and complete forms.

Form popularity

FAQ

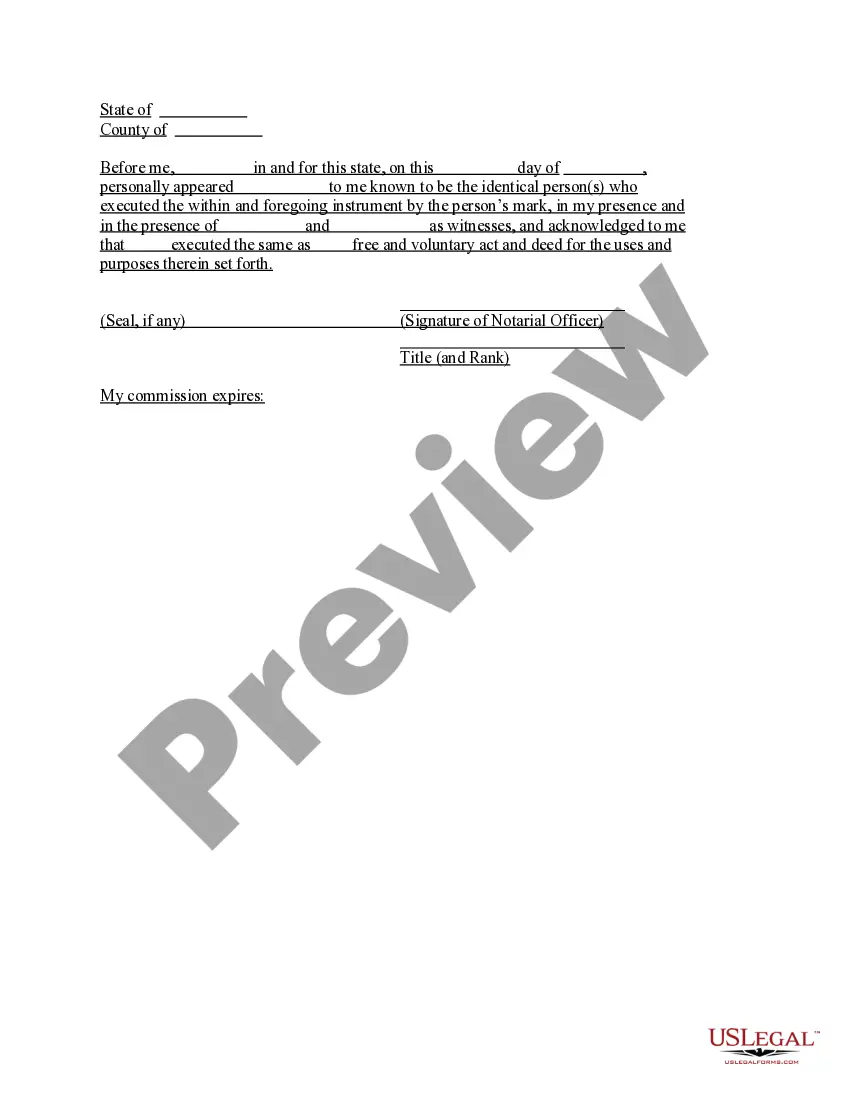

Select a type of trust. Inventory your assets and property. Choose a trustee. Put together your trust document. Visit a notary public and sign your living trust in front of them. Fund your trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Create an amendment to your trust. Type the amendment so that it specifically states the trustee that you wish to add. Indicate whether you wish to remove an existing trustee, in addition to naming a new one. Specify that the trustee you are adding is a co-trustee, rather than a successor trustee.

When there are joint Address Address Settlors, both Settlors will automatically be Trustees. The 'Trustees' shall mean the Settlor and the Additional Trustees and any other Trustees for the time being of this Trust.

The need for a lawyer to help with your estate has nothing to do with a Revocable Living Trust. If your executor could handle your estate alone, then there is no need for a lawyer even if you had no Revocable Living Trust.For example, with filing inheritance and estate tax returns or obtaining beneficiary releases.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

Establishing a trust requires serious legal help, which is not cheap. A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

The Process of Creating a Revocable Living Trust Start by taking an inventory of your assets. Then, think about who you want to inherit your assets and who you can assign as trustee. Once the document is drawn up, transfer any property you want covered into the trust.

Generally speaking, a living trust's grantor (the person who created the revocable living document) may appoint or remove trustees during their lifetime without hiring an attorney. The grantor can accomplish this by either creating an amendment to it or by revoking the original document and creating a new trust.