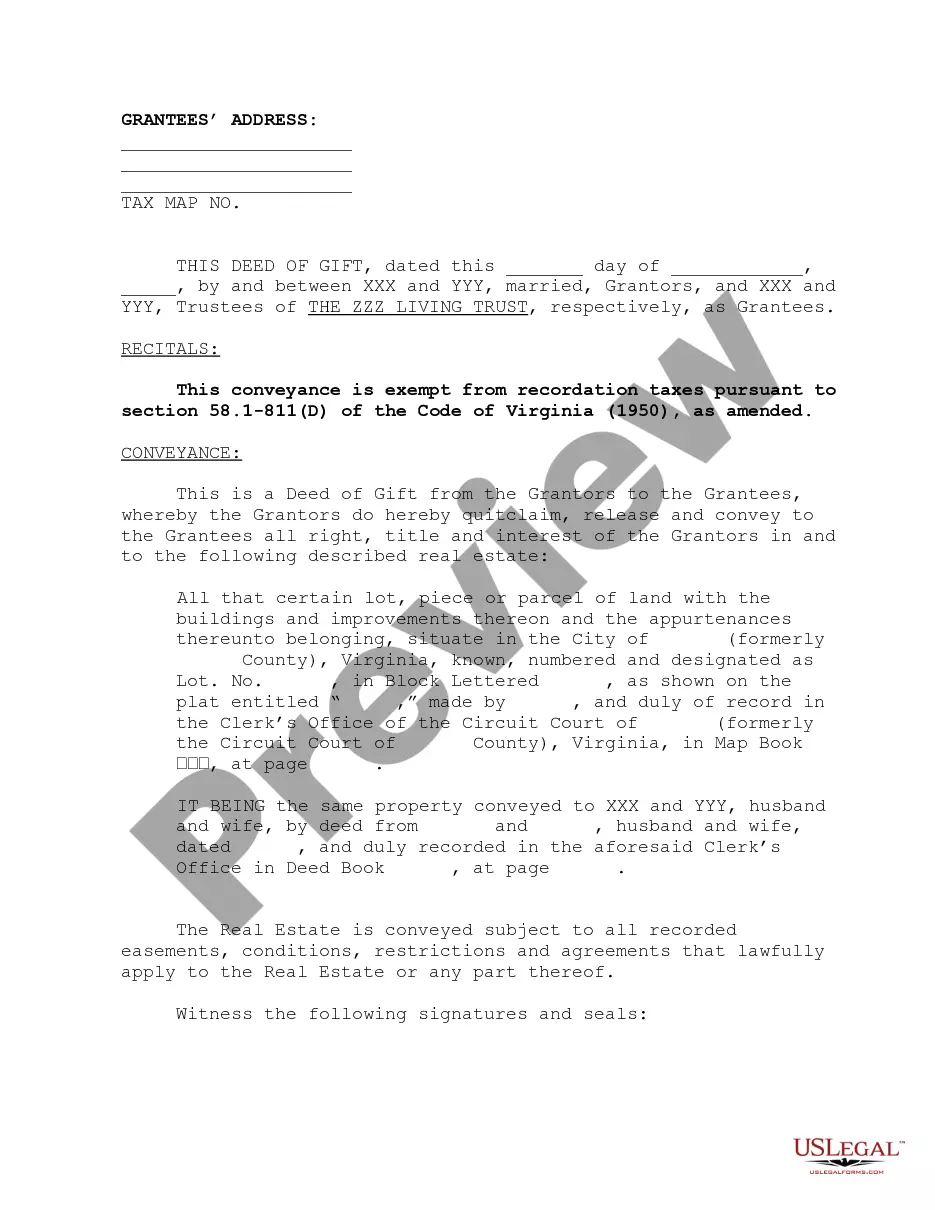

This is a form deed to convey property as a gift to an A-B Trust. An A-B trust is only revocable until the death of the first spouse, at which point it splits into two separate trusts.

Virginia Deed of Gift to Trust

Description

How to fill out Virginia Deed Of Gift To Trust?

Looking for a Virginia Deed of Gift to Trust online can be stressful. All too often, you find papers that you think are alright to use, but find out later on they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Have any document you are looking for in minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be added to your My Forms section. If you don’t have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step instructions below to download Virginia Deed of Gift to Trust from our website:

- See the form description and click Preview (if available) to check if the template suits your expectations or not.

- If the document is not what you need, find others with the help of Search field or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After getting it, you can fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted samples, customers can also be supported with step-by-step guidelines concerning how to get, download, and fill out templates.

Form popularity

FAQ

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

Give the deed a title. Write a basic statement establishing the transfer of materials to the repository. Provide a space for the donor's name and contact information as well as an.

Place and date on which the deed is to be executed. Relevant information regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property. Two witnesses to bear testimony and their signatures.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

It is however difficult to prove the same. You should have clinging evidence to show that it was against the wish of owner of through fraud, misrepresentation, coercion etc. As it is registered gift deed under sec 17 of Registration Act 1908 it becomes a valid and authentic document.

For the purpose of making a gift of immovable property, the transfer must be registered, signed by or on behalf of the donor, and attested by at least two witnesses. The stamp duty, calculated on the basis of the market value of the property (differing from state to state), must be paid at the time of registration.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

Gifts of Real Estate in Virginia. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). They typically transfer real property between family or close friends.