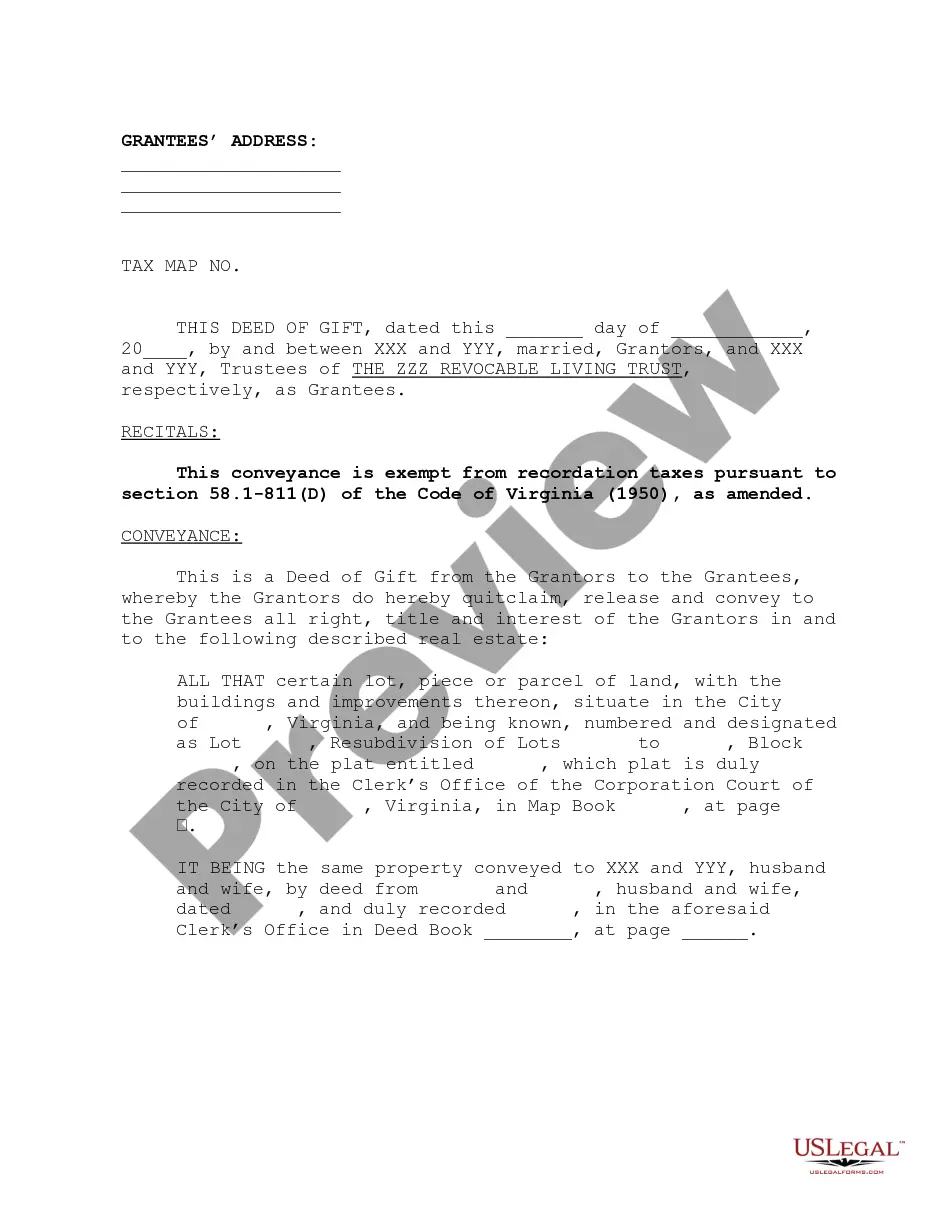

This is a form for a deed of gift from a married couple to Trustees of Revocable Living Trust. A Revocable Living Trust is designed to allow a Settlor (person establishing the Trust) to ensure that his/her estate does not require court-supervised probate.

Virginia Deed of Gift to Trust by Husband and Wife

Description

How to fill out Virginia Deed Of Gift To Trust By Husband And Wife?

Searching for a Virginia Deed of Gift to Trust by Husband and Wife on the internet might be stressful. All too often, you see files which you think are ok to use, but find out later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in to your My Forms section. In case you do not have an account, you need to register and select a subscription plan first.

Follow the step-by-step guidelines below to download Virginia Deed of Gift to Trust by Husband and Wife from our website:

- See the form description and press Preview (if available) to check if the form meets your requirements or not.

- If the document is not what you need, get others with the help of Search field or the provided recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted templates, customers can also be supported with step-by-step instructions regarding how to get, download, and complete templates.

Form popularity

FAQ

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

Yes the husband can gift property to his wife. In case it is ancestral property devolving on husband and if he gifts to wife it will be conveyance of property and Stamp Duty is playable.In case the property is self acquired and/or in joint name with wife, Relinquishment Deed can be made.

Give the deed a title. Write a basic statement establishing the transfer of materials to the repository. Provide a space for the donor's name and contact information as well as an.

For the purpose of making a gift of immovable property, the transfer must be registered, signed by or on behalf of the donor, and attested by at least two witnesses. The stamp duty, calculated on the basis of the market value of the property (differing from state to state), must be paid at the time of registration.

Can Gift Deed property be sold? Yes, the property received under Gift Deed can be sold. Provided, that you have received the property under registered Gift Deed without any condition attached.However, in the case of the registered Gift Deed, donor and donee both need to acquiesce for revocation.

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

Gifts of Real Estate in Virginia. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). They typically transfer real property between family or close friends.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

California doesn't enforce a gift tax, but you may owe a federal one. However, you can give up to $15,000 in cash or property during the 2019 and 2020 tax years without triggering a gift tax return.